2025 TPTPrice Prediction: Market Analysis and Forecast for Token Value Growth in the Coming Bull Cycle

Introduction: TPT's Market Position and Investment Value

Token Pocket (TPT), as the utility token of the TokenPocket ecosystem, has achieved significant growth since its inception in 2018. As of 2025, TPT's market capitalization has reached $61,085,912, with a circulating supply of approximately 3,466,457,399 tokens, and a price hovering around $0.017622. This asset, often referred to as the "TP ecosystem connector," is playing an increasingly crucial role in various payment scenarios and as proof of membership benefits within the TokenPocket ecosystem.

This article will provide a comprehensive analysis of TPT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering professional price predictions and practical investment strategies for investors.

I. TPT Price History Review and Current Market Status

TPT Historical Price Evolution

- 2020: TPT launched, price reached an all-time low of $0.00012901 on March 28

- 2021: Bull market peak, TPT hit an all-time high of $0.14558 on May 14

- 2025: Ongoing recovery, price currently at $0.017622 as of September 29

TPT Current Market Situation

As of September 29, 2025, TPT is trading at $0.017622. The token has shown positive momentum across various timeframes, with a 2.96% increase in the last 24 hours and an 11.26% gain over the past 30 days. The most significant growth is observed in the yearly performance, with TPT surging by 256.65% compared to the previous year.

TPT's market capitalization stands at $61,085,912, ranking it 621st in the cryptocurrency market. The token's circulating supply is 3,466,457,399 TPT, which represents 58.75% of its maximum supply of 5,900,000,000 TPT.

The trading volume in the last 24 hours is $18,175.70, indicating moderate market activity. The current price is significantly below the all-time high of $0.14558, suggesting potential room for growth if market conditions improve.

Click to view the current TPT market price

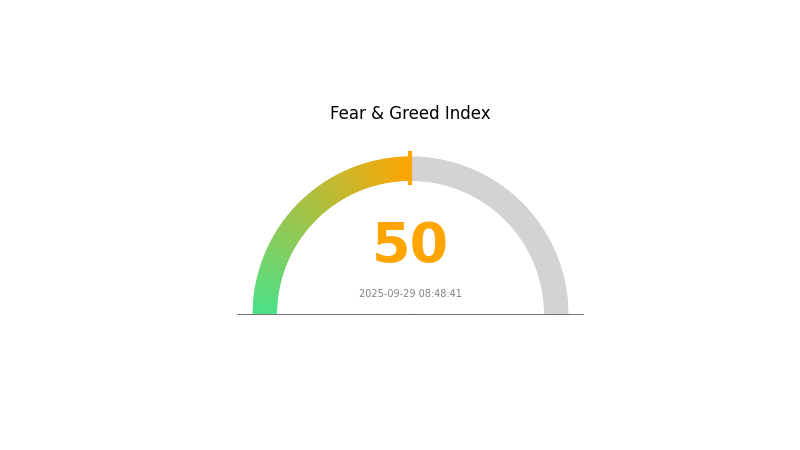

TPT Market Sentiment Indicator

2025-09-29 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains neutral today, with the Fear and Greed Index standing at 50. This balanced state suggests that investors are neither overly pessimistic nor excessively optimistic about the market's current conditions. Such equilibrium often indicates a period of stability, where market participants are cautiously assessing various factors before making significant moves. Traders and investors should remain vigilant, as this neutral sentiment could potentially shift in either direction based on upcoming news, regulatory developments, or technological advancements in the crypto space.

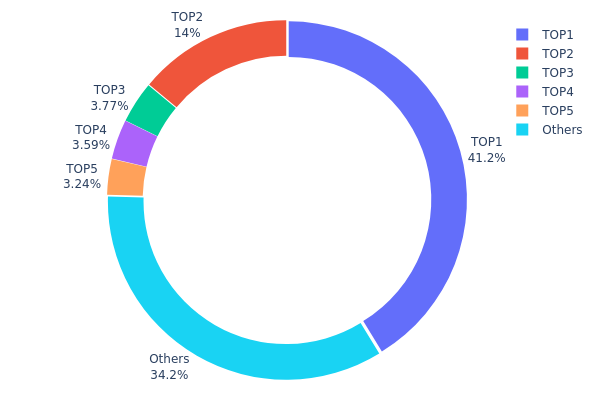

TPT Holdings Distribution

The address holdings distribution data for TPT reveals a highly concentrated ownership structure. The top address holds a significant 41.24% of the total supply, while the top 5 addresses collectively control 65.78% of TPT tokens. This concentration level raises concerns about potential market manipulation and centralization risks.

Such a concentrated distribution could lead to increased price volatility and susceptibility to large-scale sell-offs. The dominant position of the top holder, in particular, poses a significant risk to market stability if they decide to liquidate their holdings. Furthermore, this concentration may undermine the project's claims of decentralization and could potentially impact governance decisions if TPT employs a token-based voting system.

While the remaining 34.22% distributed among other addresses provides some level of diversification, the overall token distribution suggests a need for improved decentralization efforts to enhance market resilience and reduce manipulation risks.

Click to view the current TPT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...000001 | 2433542.60K | 41.24% |

| 2 | 0xd675...dd6852 | 823975.54K | 13.96% |

| 3 | 0x61b9...09b81e | 222435.68K | 3.77% |

| 4 | 0x99cf...baf4df | 211587.62K | 3.58% |

| 5 | 0x6a54...5f6256 | 190934.76K | 3.23% |

| - | Others | 2017523.79K | 34.22% |

II. Key Factors Affecting TPT's Future Price

Supply Mechanism

- Historical Pattern: Past supply changes have significantly impacted TPT's price. For example, negative news about TP wallet in January caused TPT price to drop to a one-year low of about 0.0063 yuan on January 19.

Institutional and Whale Dynamics

- Enterprise Adoption: Some enterprises have started adopting TPT, which could potentially influence its future price.

Macroeconomic Environment

- Geopolitical Factors: The US-China trade war and other global supply chain restructuring factors may indirectly affect TPT's price.

Technological Development and Ecosystem Building

- Ecosystem Applications: TPT is part of the EOS ecosystem, and developments in this ecosystem could impact its price.

The future price trend of TPT is influenced by market demand, technological innovation, and competition. Recent market volatility has been high, suggesting potential for significant price fluctuations. Technological advancements and market expansion may potentially boost future prices.

III. TPT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01339 - $0.01762

- Neutral prediction: $0.01762 - $0.01833

- Optimistic prediction: $0.01833 - $0.01903 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01744 - $0.03309

- 2028: $0.0183 - $0.03937

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.0265 - $0.03841 (assuming steady market growth)

- Optimistic scenario: $0.03841 - $0.04328 (assuming strong market performance)

- Transformative scenario: $0.04328+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: TPT $0.03956 (potential peak before year-end adjustment)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01903 | 0.01762 | 0.01339 | 0 |

| 2026 | 0.02639 | 0.01833 | 0.01155 | 4 |

| 2027 | 0.03309 | 0.02236 | 0.01744 | 26 |

| 2028 | 0.03937 | 0.02772 | 0.0183 | 57 |

| 2029 | 0.04328 | 0.03355 | 0.0265 | 90 |

| 2030 | 0.03956 | 0.03841 | 0.02881 | 117 |

IV. TPT Professional Investment Strategies and Risk Management

TPT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and TokenPocket ecosystem believers

- Operation suggestions:

- Accumulate TPT during market dips

- Hold for at least 1-2 years to benefit from potential ecosystem growth

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor TokenPocket ecosystem developments and updates

- Set stop-loss orders to limit potential losses

TPT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Plans

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, keep private keys offline

V. Potential Risks and Challenges for TPT

TPT Market Risks

- Volatility: Cryptocurrency market fluctuations may impact TPT price

- Competition: Other wallet providers may challenge TokenPocket's market share

- Liquidity: Limited trading volume may affect price stability

TPT Regulatory Risks

- Global regulations: Changes in crypto regulations may impact TPT usage

- KYC/AML requirements: Increased compliance measures could affect adoption

- Tax implications: Evolving tax laws may impact TPT holders

TPT Technical Risks

- Smart contract vulnerabilities: Potential bugs in the token contract

- Blockchain congestion: Network issues on BSC could affect transactions

- Wallet security: Risks associated with hot wallet storage

VI. Conclusion and Action Recommendations

TPT Investment Value Assessment

TPT offers potential long-term value as the utility token for the TokenPocket ecosystem. However, short-term price volatility and regulatory uncertainties pose risks.

TPT Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the TokenPocket ecosystem ✅ Experienced investors: Consider a balanced approach, allocating based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence, consider TPT as part of a diversified crypto portfolio

TPT Trading Participation Methods

- Spot trading: Buy and sell TPT on Gate.com

- Staking: Participate in TPT staking programs if available

- DeFi integration: Explore DeFi opportunities within the TokenPocket ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the tap price prediction for 2025?

Based on current market trends, the Tap price prediction for 2025 is €0.00, with a projected 5% price change.

What is the polka dot price prediction for 2025?

Based on current forecasts, Polkadot (DOT) price in 2025 is expected to range between $4.01 and $13.90, with potential for significant price fluctuations throughout the year.

What is the stock price forecast for Topps Tiles?

Analysts project an average 12-month price target of 53.333 for Topps Tiles, with estimates ranging from 40 to 70.

What is the paws token price prediction 2025?

The PAWS token price is predicted to reach $0.00001416 by October 2025, based on current technical analysis.

Share

Content