2025 TOK Fiyat Tahmini: Benimsenme Hızlanırken ve Piyasa Algısı İyileşirken Yükseliş Eğilimi Öne Çıkıyor

Giriş: TOK'un Piyasa Konumu ve Yatırım Potansiyeli

Solana ekosisteminde geliştirilmiş bir yapay zekâ kısa video uygulama platformu olan TOKAI (TOK), piyasaya sürüldüğü günden beri kripto para sektöründe dikkat çekici adımlar atmaktadır. 2025 yılı itibarıyla TOKAI'nin piyasa değeri $221.754 olarak kaydedilmiştir; dolaşımdaki arzı yaklaşık 780.000.000 token seviyesindedir ve fiyatı $0,0002843 civarındadır. "Piyasa odaklı yapay zekâ teknolojisi fiyatlandırması" ile bilinen bu varlık, yapay zekâ ve kısa video içerikleri alanında giderek daha önemli bir rol üstlenmektedir.

Bu makalede, TOKAI'nin 2025-2030 fiyat hareketleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı şekilde analiz edilerek yatırımcılara profesyonel fiyat tahminleri ile uygulanabilir yatırım stratejileri sunulacaktır.

I. TOK Fiyat Geçmişi ve Mevcut Piyasa Durumu

TOK Tarihsel Fiyat Gelişimi

- 2024: İlk çıkış, fiyat 23 Ağustos'ta tüm zamanların en yüksek seviyesi olan $0,0135'i gördü

- 2024: Piyasa düzeltmesi, fiyat 12 Kasım'da tüm zamanların en düşük seviyesi olan $0,0000647'ye geriledi

- 2025: Toparlanma dönemi, fiyat $0,0002 ile $0,0003 arasında dalgalanıyor

TOK Mevcut Piyasa Durumu

1 Kasım 2025 itibarıyla TOK, $0,0002843 seviyesinden işlem görüyor ve 24 saatlik işlem hacmi $9.866,91. Son 24 saatte %1,52 oranında hafif bir değer kaybı yaşadı. TOK'un piyasa değeri $221.754 olup, kripto para piyasasında 4.233. sırada yer alıyor.

Mevcut fiyat, tüm zamanların en yüksek seviyesi olan $0,0135'in oldukça altında olsa da, tüm zamanların en düşük seviyesi olan $0,0000647'nin oldukça üzerinde kalmayı başardı. Token, farklı zaman aralıklarında karmaşık bir performans sergiledi; son bir haftada %4,46 artış, son 30 günde ise %25,45 düşüş yaşadı.

TOK'un dolaşımdaki arzı 780.000.000 token olup, maksimum arzın %78'ine denk gelmektedir (maksimum arz: 1.000.000.000). Tam seyreltilmiş piyasa değeri $284.300'dür; bu da projenin daha fazla benimsenmesiyle büyüme potansiyeline işaret etmektedir.

Mevcut TOK piyasa fiyatını görüntülemek için tıklayın

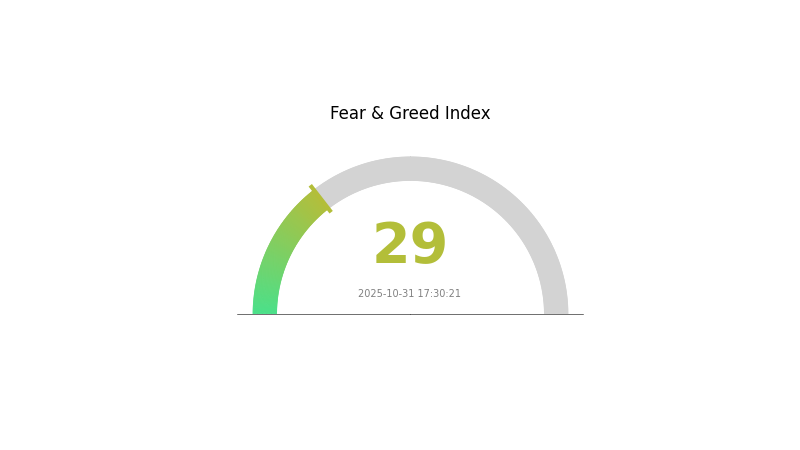

TOK Piyasa Duyarlılığı Göstergesi

31 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Mevcut Korku & Açgözlülük Endeksi'ni görüntülemek için tıklayın

Kripto para piyasası, Korku ve Açgözlülük Endeksi'nin 29 olarak gösterdiği bir korku evresiyle karşı karşıya. Yatırımcılar temkinli ve riskten kaçınan bir tutum sergiliyor. Bu duyarlılık, uzun vadeli yatırımcılar için varlıkların düşük değerde olabileceği alım fırsatları yaratabilir. Yine de yatırım kararı öncesinde detaylı araştırma yapmak ve dikkatli davranmak gereklidir. Bilgilerinizi güncel tutun ve riskleri azaltmak için portföyünüzü çeşitlendirin.

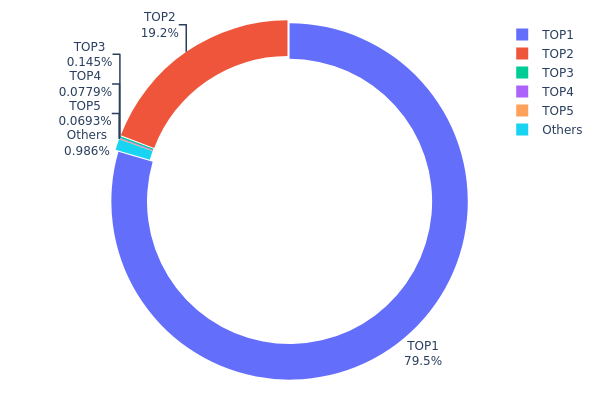

TOK Varlık Dağılımı

Adres dağılımı verileri TOK'ta son derece yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük adres toplam arzın %79,49'unu elinde bulundururken, ikinci en büyük sahip %19,23'lük paya sahip. Sadece iki adres, tüm TOK tokenlerinin %98,72'sini kontrol ediyor; bu da aşırı merkezileşmeye işaret ediyor.

Bu yoğunlaşma, piyasa istikrarı ve olası fiyat manipülasyonu konusunda endişe yaratıyor. Tokenlerin büyük kısmının az sayıda varlıkta bulunması, bu adreslerin büyük ölçekli satış veya transfer yapması halinde önemli fiyat dalgalanmalarına sebep olabilir. Ayrıca bu yapı, ekosistemin karar alma gücünün bu ana sahipler tarafından yönlendirilebileceğini gösteriyor.

Mevcut dağılım, TOK'un zincir üstü istikrarı ve piyasa dinamiklerinin çok az sayıda adresin hareketlerine bağımlı olduğunu gösteriyor. Bu yoğunlaşma, adil piyasa uygulamalarına önem veren yatırımcıları caydırabilir ve tokenin uzun vadeli sürdürülebilirliği ile benimsenmesini etkileyebilir.

Mevcut TOK Varlık Dağılımı'nı görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 619.988,29K | 79,49% |

| 2 | 8KEH9g...N5UtCa | 149.995,83K | 19,23% |

| 3 | 4jgYUd...nird2a | 1.129,55K | 0,14% |

| 4 | 8bVKpM...g1feAn | 607,63K | 0,07% |

| 5 | 4Ngyef...oDAFcu | 540,35K | 0,06% |

| - | Diğerleri | 7.688,05K | 1,01% |

II. TOK'un Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Halving: TOK'un yeni arzında periyodik azalma fiyat üzerinde etkili olabilir

- Geçmiş Eğilim: Önceki halving dönemleri genellikle fiyat artışları ile sonuçlandı

- Mevcut Etki: Bir sonraki halving ile arz enflasyonu azalacak ve fiyat artışına destek olabilir

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: Büyük kurumlar TOK'u portföylerine eklemeye başladı

- Kurumsal Benimsenme: Önde gelen şirketler TOK'u ödeme aracı olarak kabul ediyor veya bilançolarına ekliyor

- Devlet Politikaları: Büyük ekonomilerdeki regülasyonlar TOK'un benimsenmesi ve fiyatı üzerinde belirleyici olabilir

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının, özellikle ABD Merkez Bankası'nın politikaları TOK'u alternatif varlık olarak etkileyebilir

- Enflasyona Karşı Koruma: TOK'un enflasyonist dönemlerdeki performansı, alım gücünü korumak isteyen yatırımcıların ilgisini çekiyor

- Jeopolitik Faktörler: Küresel belirsizlikler ve jeopolitik riskler, TOK'a güvenli liman ilgisini artırabilir

Teknolojik Gelişmeler ve Ekosistem Büyümesi

- Lightning Network: Bu ikinci katman çözümünün gelişimi ve benimsenmesi, TOK'un ödeme işlemlerinde kullanımını artırabilir

- Taproot Güncellemesi: Gizlilik ve akıllı sözleşme özelliklerindeki iyileştirmeler, TOK'un kullanım alanlarını geliştirebilir

- Ekosistem Uygulamaları: TOK ile entegre veya üzerine kurulu DApp'lerin ve platformların sayısındaki artış, kullanım alanı ile potansiyel kullanıcı tabanını büyütüyor

III. 2025-2030 TOK Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: $0,00016 - $0,00025

- Tarafsız tahmin: $0,00025 - $0,00028

- İyimser tahmin: $0,00028 - $0,00031 (güçlü piyasa toparlanması ve artan benimsenme gerektirir)

2026-2028 Beklentisi

- Piyasa aşaması: Artan volatiliteyle potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: $0,00028 - $0,00038

- 2027: $0,00017 - $0,00049

- 2028: $0,00027 - $0,00044

- Belirleyici unsurlar: Teknolojik ilerlemeler, daha geniş piyasa benimsenmesi ve olası iş ortaklıkları

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: $0,00035 - $0,00047 (istikrarlı piyasa büyümesi ve sürekli proje gelişimi varsayılırsa)

- İyimser senaryo: $0,00047 - $0,00066 (güçlü piyasa koşulları ve önemli proje kilometre taşları gerçekleşirse)

- Dönüştürücü senaryo: $0,00066+ (çığır açan yenilikler ve ana akım benimsenme halinde)

- 2030-12-31: TOK $0,00066 (oldukça olumlu koşullarda potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00031 | 0,00028 | 0,00016 | 0 |

| 2026 | 0,00038 | 0,0003 | 0,00028 | 4 |

| 2027 | 0,00049 | 0,00034 | 0,00017 | 18 |

| 2028 | 0,00044 | 0,00042 | 0,00027 | 46 |

| 2029 | 0,00047 | 0,00043 | 0,00035 | 50 |

| 2030 | 0,00066 | 0,00045 | 0,00033 | 58 |

IV. TOK İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

TOK Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygunluk: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde TOK biriktirin

- Fiyat hedefleri belirleyip portföyünüzü periyodik olarak dengeleyin

- Tokenleri güvenli cüzdanlarda ve yedekli olarak saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüşleri tespit edin

- RSI: Aşırı alım ve aşırı satım bölgelerini izleyin

- Dalgalı al-sat için anahtar noktalar:

- Yapay zekâ sektörü haberlerini ve Solana ekosistemi gelişmelerini takip edin

- Zarar durdur emirleri ile aşağı yönlü riskleri yönetin

TOK Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla yapay zekâ ve blokzincir projesine dağıtın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü parolalar kullanın

V. TOK İçin Olası Riskler ve Zorluklar

TOK Piyasa Riskleri

- Yüksek volatilite: Kısa vadede ciddi fiyat dalgalanmaları olabilir

- Sınırlı likidite: Az sayıda borsada işlem görmesi, alım-satım süreçlerini zorlaştırabilir

- Rekabet: Diğer yapay zekâ odaklı blokzincir projeleri pazar payını etkileyebilir

TOK Regülasyon Riskleri

- Belirsiz regülasyon ortamı: Yapay zekâ ve kripto regülasyonları TOK'un faaliyetlerini etkileyebilir

- Uyum zorlukları: Veri gizliliği ve yapay zekâ yönetimiyle ilgili riskler

- Uluslararası kısıtlamalar: Küresel regülasyonlar benimsenmeyi sınırlandırabilir

TOK Teknik Riskler

- Solana ağına bağımlılık: Solana'daki sorunlar TOK'un performansını etkileyebilir

- Akıllı sözleşme açıkları: Token sözleşmesinde güvenlik açığı ya da hata riski

- Yapay zekâ teknolojisi riskleri: Sektördeki hızlı gelişmeler sık güncellemeleri gerektirebilir

VI. Sonuç ve Eylem Önerileri

TOK Yatırım Değeri Değerlendirmesi

TOK, Solana üzerinde yapay zekâ destekli kısa video alanında benzersiz bir fırsat sunuyor. Uzun vadede yapay zekâ ve blokzincir sektörlerinde büyüme potansiyeli taşısa da, piyasa volatilitesi ve regülasyon belirsizlikleri nedeniyle kısa vadede önemli riskler barındırıyor.

TOK Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Detaylı araştırma sonrası küçük ve deneme amaçlı pozisyonlar alınabilir ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle kademeli alım (dolar maliyeti ortalaması) stratejisi uygulanmalı ✅ Kurumsal yatırımcılar: Kapsamlı inceleme ile çeşitlendirilmiş bir kripto portföyünde değerlendirilebilir

TOK Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com'da doğrudan token alımı

- Staking: Proje tarafından sunulursa olası staking seçenekleri

- DeFi entegrasyonu: Solana ekosisteminde gelecekteki DeFi fırsatlarını takip edin

Kripto para yatırımları son derece risklidir; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre dikkatli karar vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

Tron $10'a ulaşabilir mi?

Oldukça iddialı olsa da; güçlü benimsenme, teknolojik ilerlemeler ve olumlu piyasa koşulları ile $10 seviyesine ulaşmak mümkün olabilir. TRON'un DApp, DeFi ve NFT odaklı yaklaşımı, talep ve fiyat artışını destekleyebilir.

Floki coin 2025'te $1'a ulaşır mı?

Hayır, Floki coin'in 2025'te $1'a ulaşması beklenmiyor. Tahminler, yıl sonunda en yüksek $0,000290 seviyesine ulaşacağını gösteriyor.

Coti $10'a ulaşabilir mi?

Evet, COTI potansiyel olarak $10'a ulaşabilir. Gizlilikteki ilerlemeler ve Ethereum Layer 2 entegrasyonu COTI için güçlü büyüme katalizörleri sunuyor. Mevcut piyasa eğilimleri, yükseliş senaryosunda bu hedefin ulaşılabilir olduğunu gösteriyor.

Solana 2025'te $1.000'a ulaşır mı?

Mevcut eğilimler ve Solana'nın potansiyeli göz önüne alındığında, 2025'te $1.000 seviyesine ulaşmak mümkün; ancak garanti değildir. Piyasa koşulları ve teknolojik ilerlemeler, Solana'nın fiyatında belirleyici rol oynayacaktır.

2025 TOK Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

ZEREBRO nedir: Dijital inovasyonu dönüştüren devrim niteliğindeki yapay zekâ platformuna kapsamlı bir rehber

QFS Kripto Açıklandı: Kuantum Finans Sistemi Dijital Varlıklar İçin Ne Anlama Geliyor

2025 TAO Fiyat Tahmini: Gelişen Kripto Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Moni nedir? Bir Rehber

2025 FET Fiyat Tahmini: Fetch.ai'nin Gelecekteki Değerini Belirleyen Boğa Eğilimleri ve Ana Etkenler

Magic Eden’i Keşfetmek: NFT Pazaryeri Genel Görünümü ve Kullanım İpuçları

Web3 işlemlerinde güvenli dijital cüzdan

Grass Airdrop'u Hakkında Eksiksiz Kılavuz: Ödül Almanın Adımları

Web3 Token Değerlemesi: Tam Kapsamlı Rehber

BGSC nedir: Kan Gazı ve Serum Kimyası Analizine Kapsamlı Bir Rehber