2025 SUN Fiyat Tahmini: Dijital Varlıkta Potansiyel Büyüme ve Piyasa Trendlerinin Analizi

Giriş: SUN'un Piyasadaki Konumu ve Yatırım Potansiyeli

SUN (SUN), TRON ağı üzerinde stabil coin takası, token madenciliği ve otonom yönetişim alanlarında öncü entegre bir platform olarak 2021'deki lansmanından itibaren kayda değer bir gelişim sergiledi. 2025 yılı itibarıyla SUN'un piyasa değeri 449.549.028 $ seviyesine ulaşırken, dolaşımdaki toplam arzı yaklaşık 19.170.534.274 token ve fiyatı ise 0,02345 $ civarında seyrediyor. "TRON üzerindeki DeFi Güç Merkezi" olarak anılan bu varlık, merkeziyetsiz finans ve topluluk tabanlı yönetişimde giderek daha kritik bir konum edinmiştir.

Bu makale; SUN'un 2025-2030 arasındaki fiyat hareketlerini, tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörlerle bütünleşik şekilde analiz ederek yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunacaktır.

I. SUN Fiyat Geçmişi ve Güncel Piyasa Durumu

SUN'un Tarihsel Fiyat Seyri

- 2020: SUN piyasaya sürüldü; 11 Eylül'de tüm zamanların en yüksek seviyesi olan 66,45 $'a ulaştı

- 2021: 26 Mayıs'ta token bölünmesi gerçekleşti, 1 SUNOLD = 1.000 SUN

- 2022: Ayı piyasasında, 14 Kasım'da tüm zamanların en düşük seviyesi olan 0,00462303 $'a geriledi

SUN'un Mevcut Piyasa Görünümü

17 Ekim 2025 itibarıyla SUN, 0,02345 $ seviyesinde işlem görüyor ve piyasa değeriyle 170. sırada yer alıyor. Token, son 24 saatte %2 düşüş yaşarken işlem hacmi 400.349 $ oldu. SUN'un piyasa değeri 449.549.028 $ ile toplam kripto piyasasının %0,011'ini oluşturuyor. Dolaşımdaki arz 19.170.534.274 SUN olup toplam arzın %96,33'üne karşılık gelmektedir. Son bir yılda, SUN kısa vadeli dalgalanmalara rağmen %24,9 oranında değer artışıyla dayanıklılığını gösterdi.

Güncel SUN piyasa fiyatını buradan takip edebilirsiniz

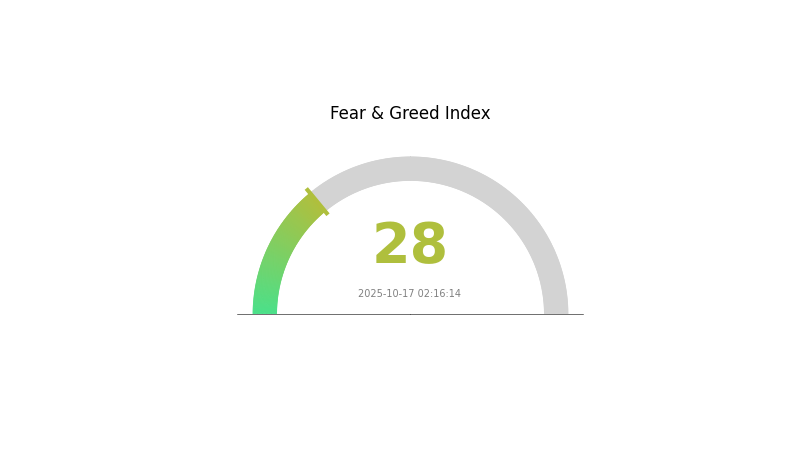

SUN Piyasa Duyarlılık Endeksi

17 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku ve Açgözlülük Endeksini görüntüleyin

Kripto piyasasında bugün temkinli bir hava hakim. Korku ve Açgözlülük Endeksi 28 seviyesinde ve "Korku" bölgesinde. Bu, yatırımcıların daha ihtiyatlı ve riskten kaçınan bir tutum benimsediğini gösteriyor. Böyle dönemlerde bazı yatırımcılar, "Başkaları açgözlüyken kork, başkaları korkuyorken açgözlü ol" stratejisiyle bunu alım fırsatı olarak değerlendirebilir. Ancak, yatırım kararı öncesinde detaylı araştırma yapılması ve kişisel risk toleransının dikkate alınması şarttır.

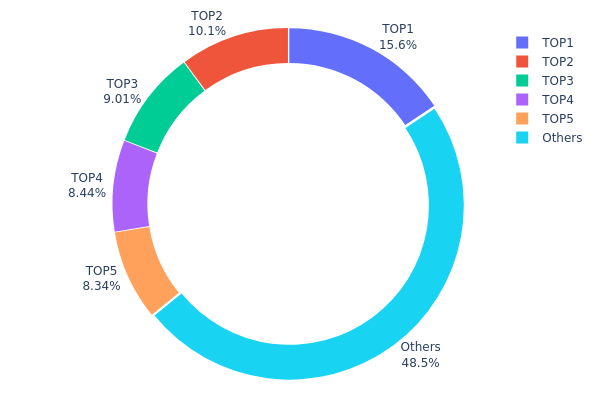

SUN Varlık Dağılımı

SUN tokenlarının adresler bazındaki dağılımı, toplam arzın büyük bir bölümünün az sayıda adreste toplandığını ortaya koyuyor. İlk 5 adres, toplam arzın %51,5'ini elinde tutarken en büyük tek adresin payı %15,63. Bu yoğunlaşma, sahiplikte görece merkezileşmeye işaret ediyor ve hem piyasa hem de yönetişim üzerinde etkili olabiliyor.

Böylesi bir yoğun dağılım, fiyat oynaklığına ve büyük yatırımcıların tetikleyebileceği ani piyasa hareketlerine karşı hassasiyeti artırabilir. Az sayıda büyük adresin varlığı, olası piyasa manipülasyonu ya da koordineli işlemlerle fiyat ve likidite üzerinde belirleyici olabilir. Öte yandan, arzın %48,5'i de diğer adresler arasında dağılmış durumda; bu da SUN ekosistemine daha geniş yatırımcı katılımı olduğunu gösteriyor.

Söz konusu dağılım, hem büyük kurumsal ve erken dönem yatırımcıları hem de daha çeşitli küçük yatırımcı tabanını içeren bir piyasa yapısına işaret ediyor. Bu yapı, büyük paydaşların bağlılığı ile belli ölçüde istikrar sağlarken; büyük adreslerdeki değişimlerin yakından izlenmesi, piyasanın gidişatı veya SUN'un temel dinamiklerindeki değişimler için öncü gösterge olabilir.

Güncel SUN Varlık Dağılımı detaylarına ulaşmak için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | TScVwV...NbzmUL | 3.111.713,86K | 15,63% |

| 2 | TT2T17...EWkU9N | 2.009.954,75K | 10,09% |

| 3 | TXomXp...amFX9t | 1.793.482,38K | 9,01% |

| 4 | TWadTq...hue7uE | 1.679.832,85K | 8,44% |

| 5 | TQiXPT...MLrxnM | 1.659.259,31K | 8,33% |

| - | Others | 9.646.486,85K | 48,5% |

II. SUN’un Gelecekteki Fiyatına Etki Eden Temel Faktörler

Arz Mekanizması

- Kalıcı Geri Alım Programı: Justin Sun, SUN için kalıcı geri alım anlaşması duyurdu. Bu adım, zamanla dolaşımdaki arzı azaltabilir.

- Güncel Etki: Geri alım programı haberi, piyasa duyarlılığında ani bir yükseliş sağlayarak, tek bir günde %22'nin üzerinde fiyat artışı yarattı.

Kurumsal ve Büyük Yatırımcı Davranışları

- Piyasa Duyarlılığı: Gate.com’un duyarlılık endeksi şu an SUN’u "nötr" olarak gösteriyor; bu da son dönemdeki yüksek fiyat oynaklığının ardından temkinli bir kısa vade beklentisine işaret ediyor.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: SUN, diğer birçok kripto varlık gibi, enflasyonist ortamda yatırımcılar için koruma aracı olarak değerlendirilebilir.

- Jeopolitik Faktörler: Uluslararası ticaret anlaşmaları ve gümrük tarifesi görüşmeleri, SUN dahil tüm kripto piyasasını dolaylı olarak etkileyebilir.

Teknik Gelişmeler ve Ekosistem İnşası

- Ekosistem Uygulamaları: SUN ağı içerisinde DApp’lerin ve ekosistem projelerinin büyümesi, gelecekteki fiyat eğrisinde belirleyici olabilir.

III. 2025-2030 SUN Fiyat Tahmini

2025 Öngörüsü

- Ihtiyatlı tahmin: 0,01595 $ - 0,02345 $

- Nötr tahmin: 0,02345 $ - 0,02509 $

- İyimser tahmin: 0,02509 $ - 0,03000 $ (pozitif piyasa sentimenti ve artan kullanım şartıyla)

2027-2028 Öngörüsü

- Piyasa evresi: Artan dalgalanma ile birlikte büyüme potansiyeli

- Fiyat tahmini:

- 2027: 0,01464 $ - 0,02984 $

- 2028: 0,01479 $ - 0,04321 $

- Önemli katalizörler: Teknolojik inovasyonlar, kripto varlıkların yaygınlaşması ve elverişli regülasyon ortamı

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,03610 $ - 0,04423 $ (istikrarlı büyüme ve adaptasyon varsayımıyla)

- İyimser senaryo: 0,05235 $ - 0,06015 $ (güçlü piyasa performansı ve artan kullanım ile)

- Dönüştürücü senaryo: 0,06500 $ - 0,07500 $ (çığır açan yenilikler ve kitlesel benimseme ile)

- 31 Aralık 2030: SUN 0,06015 $ (yıl içinde potansiyel tepe fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,02509 | 0,02345 | 0,01595 | 0 |

| 2026 | 0,03204 | 0,02427 | 0,01869 | 3 |

| 2027 | 0,02984 | 0,02815 | 0,01464 | 19 |

| 2028 | 0,04321 | 0,029 | 0,01479 | 23 |

| 2029 | 0,05235 | 0,0361 | 0,03358 | 53 |

| 2030 | 0,06015 | 0,04423 | 0,02875 | 88 |

IV. SUN için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SUN Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli değer yatırımcıları

- İşlem önerileri:

- Piyasa düşüşlerinde SUN biriktirin

- Ek getiri için SUN staking yapın

- Donanım cüzdanında güvenle saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamalarla trend takibi

- RSI: Alım-satım noktalarını aşırı alım/aşırı satım seviyeleriyle belirleyin

- Dalgalı işlemlerde dikkat edilmesi gerekenler:

- Kayıpları sınırlamak için kesin zarar-durdur emirleri kullanın

- Belirlenen direnç seviyelerinde kâr alın

SUN Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Korumacı yatırımcılar: Kripto portföyünün %1-3’ü

- Aggresif yatırımcılar: %5-10 arası

- Profesyoneller: Portföyün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları birden fazla DeFi projesine yaymak

- Stabilcoin kullanımı: Yüksek volatilite dönemlerinde kısmen stabilcoin’e geçiş

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 wallet

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanına aktarım

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifre kullanımı

V. SUN için Olası Riskler ve Zorluklar

SUN Piyasa Riskleri

- Yüksek fiyat oynaklığı

- Likidite riski: Büyük hacimli işlemlerde zorluk

- Rekabet: Yeni DeFi platformları SUN’un pazar payını tehdit edebilir

SUN Regülasyon Riskleri

- Bilinmez regülasyon ortamı: DeFi için daha sıkı düzenlemeler olası

- Sınır ötesi uyumluluk: Farklı ülkelerde değişen yasal durum

- Vergisel etkiler: DeFi işlemleri ve getirileri için sürekli gelişen vergi mevzuatı

SUN Teknik Riskleri

- Akıllı sözleşme açıkları: Sömürü veya hack riski

- Ölçeklenebilirlik sorunları: Yüksek talep dönemlerinde ağ tıkanıklığı

- Birlikte çalışabilirlik: Diğer blok zincirleriyle entegrasyon zorlukları

VI. Sonuç ve Eylem Önerileri

SUN Yatırım Potansiyeli Değerlendirmesi

SUN, büyüyen DeFi sektöründe önemli potansiyel sunar; ancak, yüksek oynaklık ve düzenleyici belirsizlikler ciddi riskler barındırır. Uzun vadeli değeri, platformun gelişimi ve kullanıcı tabanının büyümesine bağlıdır.

SUN Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük ve yönetilebilir yatırımlarla başlayın, platformu öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Stake ve alım-satımı dengeleyen bir yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın, SUN’u çeşitlendirilmiş bir DeFi portföyünde değerlendirin

SUN İşlem Yöntemleri

- Spot alım-satım: Gate.com üzerinde SUN token alıp satmak

- Staking: SUN'un staking programlarıyla pasif gelir elde etmek

- Likidite sağlama: Ek getiri için likidite havuzlarına katkı yapmak

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kararlarını kendi risk toleranslarına göre vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

SSS

2025 için güneş tahmini nedir?

Astrolojik öngörülere göre 2025’te güneş, pek çok burç için önemli kariyer fırsatları ve olumlu aşk gelişmeleri getirebilir. Detaylı öngörüler burca göre değişir.

2030’da Sun kripto için fiyat tahmini nedir?

Teknik analizlere göre, 2030 yılında Sun kripto için fiyat tahmini 0,018083 $ seviyesindedir. Bu, uzun vadede büyüme potansiyeline işaret etmektedir.

2025 için Sol fiyat tahmini nedir?

Güncel eğilimler ve uzman tahminleriyle, Solana (SOL) 2025’te yaklaşık 482 $ seviyesine ulaşabilir. Bu, blockchain alanında artan benimsenme ve teknolojik yeniliklerin etkisidir.

Sun hisse senedi için fiyat tahmini nedir?

2030 yılına dek SUN hisse senedinin 0,03186 $ seviyesine ulaşması bekleniyor. 2025-2029 için öngörüler bulunmamaktadır.

2025 JST Fiyat Tahmini: JUST Token’ın Gelecekteki Piyasa Trendleri ve Büyüme Potansiyeli Analizi

STRIKE ve TRX: Evde Antrenmanlar İçin Hangi Direnç Antrenman Sistemi Daha İyi Sonuçlar Sağlar?

Just (JST) iyi bir yatırım mı?: Bu yükselen kriptoparanın potansiyeli ve riskleri üzerine bir analiz

SUN (SUN) iyi bir yatırım mı?: Bu kripto paranın güncel piyasadaki potansiyelini ve risklerini analiz etmek

LEMD ve TRX: İki Popüler Temel Güçlendirme Sisteminin Etkinliği Karşılaştırılıyor

JackPool (JFI) iyi bir yatırım mı?: Bu yükselen kripto paranın potansiyeli ve riskleri üzerine ayrıntılı analiz

ZOO Token Satın Alma Rehberi: Listeleme Bilgileri, Fiyat Tahmini ve Satın Alma Süreçleri

VANRY nedir: Bu Yenilikçi Dijital Platformu Anlamak İçin Kapsamlı Bir Rehber

LAT nedir: Latissimus Dorsi Kası ve Antrenman Yöntemleri Hakkında Kapsamlı Bir Rehber

NFT Hazine Avcılığına Yeni Başlayanlar İçin Rehber: Fırsatları Belirleme ve Alım-Satım Platformlarını Anlamak

2025 BAS Fiyat Tahmini: Uzman Analizi ve Önümüzdeki Yıl İçin Piyasa Beklentileri