2025 SHOE Price Prediction: Navigating Market Trends and Economic Factors for Footwear Industry Forecasts

Introduction: SHOE's Market Position and Investment Value

ShoeFy (SHOE) has emerged as an innovative decentralized platform combining NFTs and FTs since its inception in 2021. As of 2025, SHOE's market cap has reached $14,515.53, with a circulating supply of approximately 13,013,746.88 tokens and a price hovering around $0.0011154. This asset, hailed as a "futuristic NFT project," is playing an increasingly crucial role in maximizing returns through cutting-edge DeFi tools.

This article will provide a comprehensive analysis of SHOE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SHOE Price History Review and Current Market Status

SHOE Historical Price Evolution

- 2021: Project launch, price reached all-time high of $0.856973 on October 19

- 2025: Market downturn, price hit all-time low of $0.00065215 on March 24

- 2025: Gradual recovery, current price at $0.0011154 as of November 3

SHOE Current Market Situation

SHOE is currently trading at $0.0011154, with a 24-hour trading volume of $9,550.59. The token has seen a slight increase of 0.87% in the past 24 hours. However, it shows negative trends over longer periods, with a 6.34% decrease in the past week and a 4.61% decline over the last 30 days. The current market cap stands at $14,515.53, ranking SHOE at 7026th position in the overall cryptocurrency market. With a circulating supply of 13,013,746.88 SHOE and a total supply of 100,000,000 tokens, the project has a market dominance of 0.0000029%.

Click to view the current SHOE market price

SHOE Market Sentiment Indicator

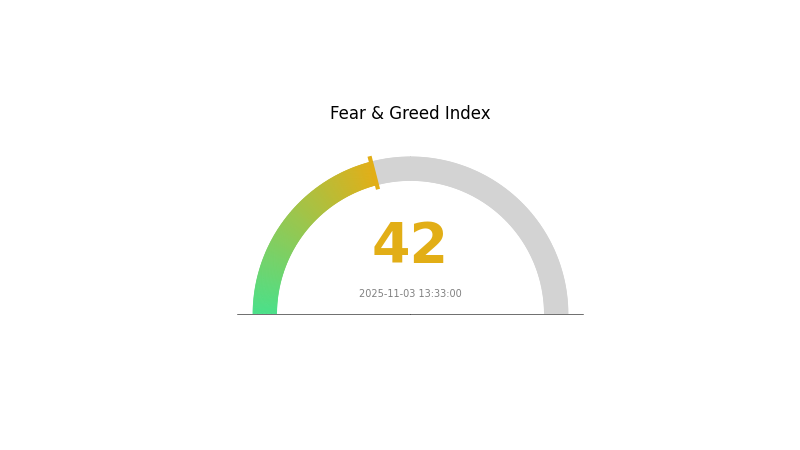

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone with a reading of 42. This indicates a cautious approach among investors, potentially signaling undervalued market conditions. Historically, fear periods have presented buying opportunities for long-term investors. However, it's crucial to conduct thorough research and consider your risk tolerance before making investment decisions. Stay informed about market trends and utilize tools like Gate.com's market data to make well-informed choices in this volatile market environment.

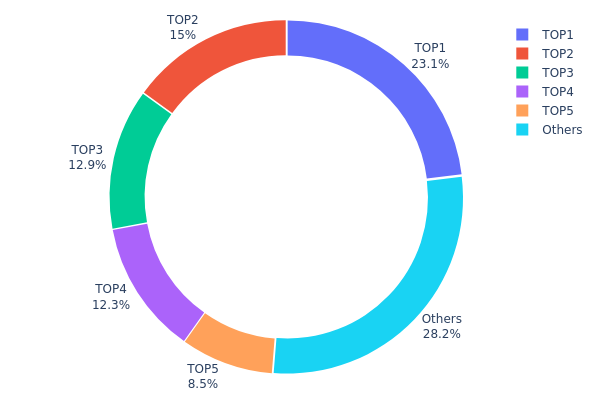

SHOE Holdings Distribution

The address holdings distribution data for SHOE reveals a notably concentrated ownership structure. The top 5 addresses collectively hold 71.74% of the total supply, with the largest single address controlling 23.05%. This high concentration level raises concerns about potential market manipulation and price volatility.

The presence of a burn address (0x0000...00dead) holding 15% of the supply effectively reduces circulating tokens, which could impact liquidity. The concentrated distribution among a few large holders suggests a significant imbalance in token ownership, potentially affecting the project's decentralization efforts and market dynamics. This structure may lead to increased price sensitivity to large transactions and could pose risks to smaller investors due to the outsized influence of major holders.

Overall, the current SHOE token distribution indicates a relatively centralized ecosystem, which may impact its stability and susceptibility to whale movements. Investors should consider these factors when assessing the token's long-term prospects and potential market behavior.

Click to view the current SHOE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf5db...ee2fc2 | 23052.18K | 23.05% |

| 2 | 0x0000...00dead | 15008.25K | 15.00% |

| 3 | 0x0d07...b492fe | 12929.39K | 12.92% |

| 4 | 0x1c7f...20b151 | 12278.79K | 12.27% |

| 5 | 0xb195...4983f8 | 8501.53K | 8.50% |

| - | Others | 28229.87K | 28.26% |

II. Key Factors Affecting SHOE's Future Price

Supply Mechanism

- Market Saturation: As the brand's sales volume increases and market share reaches a certain level, SHOE may naturally experience slowing sales growth and potential customer churn risk.

- Historical Pattern: HOKA's sales growth has slowed from over 50% to around 11% currently.

- Current Impact: The slowdown in growth is partly due to the brand reaching a certain stage of development, as well as increased market competition and reduced brand mystique.

Institutional and Whale Dynamics

- Corporate Adoption: Popular running brands like HOKA and On Running have gained significant traction in the Chinese market, targeting the high-end segment with shoes priced between 1000-2000 yuan.

Macroeconomic Environment

- Monetary Policy Impact: Deckers Brands management has factored in potential impacts from tariffs and cautious consumer behavior due to macroeconomic pressures in the US.

- Geopolitical Factors: Exchange rate fluctuations have impacted some brands' profitability in certain quarters.

Technological Development and Ecosystem Building

- Product Innovation: Brands are competing on technological advancements, with major players like Nike, Adidas, and domestic brands investing heavily in midsole technologies and carbon plate running shoes.

- Ecosystem Applications: The running ecosystem is expanding rapidly in China, with growth in marathon events, trail running, and running-related social media content.

III. SHOE Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00099 - $0.00112

- Neutral forecast: $0.00112 - $0.00115

- Optimistic forecast: $0.00115 - $0.00118 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range predictions:

- 2027: $0.00084 - $0.00152

- 2028: $0.00095 - $0.00195

- Key catalysts: Increasing adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00166 - $0.00173 (assuming steady market growth)

- Optimistic scenario: $0.00180 - $0.00195 (with strong ecosystem development)

- Transformative scenario: $0.00195 - $0.00204 (with breakthrough innovations and mass adoption)

- 2030-12-31: SHOE $0.00204 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00118 | 0.00112 | 0.00099 | 0 |

| 2026 | 0.00125 | 0.00115 | 0.00062 | 3 |

| 2027 | 0.00152 | 0.0012 | 0.00084 | 7 |

| 2028 | 0.00195 | 0.00136 | 0.00095 | 22 |

| 2029 | 0.0018 | 0.00166 | 0.00099 | 48 |

| 2030 | 0.00204 | 0.00173 | 0.00163 | 55 |

IV. Professional Investment Strategies and Risk Management for SHOE

SHOE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operational advice:

- Accumulate SHOE tokens during market dips

- Participate in staking and farming programs offered by ShoeFy

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor ShoeFy project developments and NFT market trends

SHOE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Balance SHOE holdings with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for SHOE

SHOE Market Risks

- High volatility: SHOE price may experience significant fluctuations

- Limited liquidity: Low trading volume may lead to slippage and difficulty executing large orders

- NFT market dependency: Performance tied to overall NFT market trends

SHOE Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on NFTs and DeFi projects

- Cross-border compliance: Varying regulations across jurisdictions may impact global adoption

- Tax implications: Evolving tax laws may affect SHOE holders and NFT transactions

SHOE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the ShoeFy platform

- Scalability challenges: Ethereum network congestion may impact platform performance

- Interoperability issues: Compatibility with other blockchain networks and NFT standards

VI. Conclusion and Action Recommendations

SHOE Investment Value Assessment

SHOE presents an innovative approach to NFTs and DeFi, offering potential long-term value for investors interested in the convergence of these technologies. However, the project faces short-term risks due to market volatility, regulatory uncertainties, and technical challenges inherent in the crypto space.

SHOE Investment Recommendations

✅ Beginners: Start with small positions and focus on education about NFTs and DeFi ✅ Experienced investors: Consider allocating a portion of their crypto portfolio to SHOE as part of a diversified strategy ✅ Institutional investors: Conduct thorough due diligence on ShoeFy's technology and market position before considering substantial investments

SHOE Trading Participation Methods

- Spot trading: Purchase SHOE tokens on Gate.com

- Staking: Participate in ShoeFy's staking programs for passive income

- NFT interactions: Engage with the ShoeFy platform to explore NFT functionalities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Are shoe prices going up?

Yes, shoe prices are rising. Recent data shows a 1.4% increase in August, the highest in 17 months. Most consumers have noticed higher prices and expect further increases in the coming months.

How to tell if a shoe will go up in value?

Check rarity, brand reputation, and demand trends. Limited editions and sought-after designs often appreciate. Monitor resale markets and release hype for potential value increase indicators.

Why are shoes so expensive in 2025?

Shoes are expensive in 2025 due to new tariffs, supply chain disruptions, and increased production costs. These factors have driven up prices significantly.

Will Nike go up in 2025?

Yes, Nike is likely to go up in 2025. They plan to raise prices on sneakers and apparel by up to $10 starting June 1, 2025, which could boost their revenue and stock price.

Share

Content