2025 SAGA Fiyat Tahmini: Gelişen Blockchain Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Giriş: SAGA'nın Piyasadaki Yeri ve Yatırım Potansiyeli

Saga (SAGA), ölçeklenebilir blokzincir altyapısı sunan Layer 1 protokolü olarak, kuruluşundan itibaren kayda değer bir büyüme gösterdi. 2025 yılı itibarıyla Saga'nın piyasa değeri yaklaşık $61.854.553 olup, yaklaşık 295.107.602 adet dolaşımdaki token ile fiyatı yaklaşık $0,2096. "Chainlet Creator" olarak anılan bu token, merkeziyetsiz uygulamalar ve blokzincir tabanlı oyunların gelişiminde giderek daha önemli bir rol üstleniyor.

Bu makalede, Saga'nın 2025-2030 dönemindeki fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik unsurlar ışığında kapsamlı şekilde analiz edilerek, profesyonel fiyat tahminleri ve yatırımcılara yönelik pratik stratejiler sunulacaktır.

I. SAGA Fiyat Geçmişi İncelemesi ve Güncel Piyasa Durumu

SAGA Fiyatının Tarihsel Seyri

- 2024: SAGA, 9 Nisan 2024'te $7,8609 ile tüm zamanların en yüksek seviyesine ulaşarak proje için kritik bir dönüm noktası yaşadı.

- 2025: Piyasa düşüşe geçti ve SAGA fiyatı 17 Nisan 2025'te $0,1835 ile tüm zamanların en düşük seviyesine indi.

SAGA Güncel Piyasa Görünümü

29 Eylül 2025 itibarıyla SAGA, $0,2096 seviyesinden işlem görüyor ve son 24 saatte %3,65 yükseldi. Mevcut fiyat, tüm zamanların en yüksek seviyesine göre ciddi bir düşüş gösteriyor ve son bir yılda %-91,11 oranında geriledi. SAGA'nın piyasa değeri $61.854.553 olup, kripto para piyasasında 615. sırada yer alıyor.

Kısa vadede token karmaşık bir performans sergiledi; son bir saatte %0,1 yükselirken, son bir haftada %-5,45 geriledi. 30 günlük trend ise %-15,84 ile devam eden ayı baskısına işaret ediyor.

SAGA'nın son 24 saatteki işlem hacmi $198.283 olarak kaydedildi; bu, orta düzeyde piyasa aktivitesine işaret ediyor. Dolaşımdaki 295.107.602 SAGA tokenı toplam arzın %29,51'ini oluşturuyor (toplam arz: 1.077.906.781).

Güncel SAGA piyasa fiyatını görmek için tıklayın

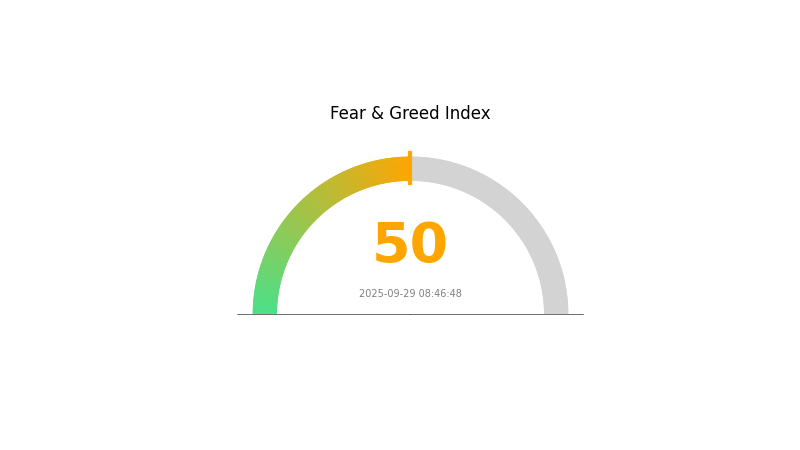

SAGA Piyasa Duyarlılığı Göstergesi

29 Eylül 2025 Korku ve Açgözlülük Endeksi: 50 ile piyasada nötr bir duyarlılık hakim

Güncel Korku ve Açgözlülük Endeksini görmek için tıklayın

Kripto piyasa duyarlılığı şu anda dengede; Korku ve Açgözlülük Endeksi 50 ile piyasada nötr bir duyarlılık hakim. Yatırımcılar aşırı endişeli ya da aşırı açgözlü değil. Bu denge, genellikle temkinli yatırım kararları için fırsatlar sunar. Piyasa stabil görünse de, dikkatli olmak ve yatırım öncesi detaylı araştırma yapmak gerekir. Her zaman olduğu gibi, portföyü çeşitlendirmek ve riskleri etkin şekilde yönetmek, kripto piyasasında başarılı olmak için temel stratejilerdir.

SAGA Varlık Dağılımı

SAGA’nın adres bazlı varlık dağılımı, büyük sahiplerde yoğunlaşma olmadığını gösteriyor. Bu dağılım, projenin istikrarı ve adil yapısı açısından olumlu bir merkeziyetsizlik göstergesidir.

Toplam arzın büyük bir kısmını elinde bulunduran baskın adreslerin olmaması, tek bir kişinin SAGA token üzerinde orantısız etki sahibi olmadığı anlamına gelir. Merkeziyetsiz yapı, piyasa manipülasyonu veya büyük sahiplerin ani satışları nedeniyle oluşabilecek fiyat dalgalanmalarını azaltır. Aynı zamanda daha geniş ve çeşitli bir kullanıcı kitlesine işaret ederek, SAGA piyasasını daha dayanıklı ve sürdürülebilir kılar.

Genel adres dağılımı, SAGA için sağlıklı bir merkeziyetsizlik seviyesini yansıtıyor. Bu özellik, merkeziyetçilik risklerinden endişe eden yatırımcılar için tokenın cazibesini artırabilir ve piyasada daha organik bir fiyat oluşumunu destekler.

Güncel SAGA varlık dağılımını incelemek için tıklayın

| En Büyükler | Adres | Varlık Adedi | Varlık (%) |

|---|

II. SAGA'nın Gelecekteki Fiyatını Etkileyecek Ana Faktörler

Arz Mekanizması

- Mevcut Etki: SAGA'nın gelecekteki değeri, proje gelişmeleri ve piyasa koşulları gibi unsurlara bağlı olarak belirsiz ve spekülatif bir yapıya sahiptir.

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Varlıklar: Yatırımcılar, riskli varlıklara yatırım yaparken temkinli davranıyor; Orta Doğu'daki jeopolitik riskler ve faiz oranı belirsizlikleri bu tutumu etkiliyor.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Son iki yılda yaşanan enflasyon, varlık değerlerini ve yatırımcı güvenini etkiledi.

- Jeopolitik Unsurlar: Orta Doğu'daki süregelen çatışmalar, piyasa risklerini ve yatırımcı duyarlılığını etkiliyor.

Teknolojik Gelişim ve Ekosistem Oluşturma

- Sonsuz Yatay Ölçeklenebilirlik: SAGA'nın temelinde, uygulamaların maksimum performans ve hızına esnek biçimde ölçeklenmesini sağlayan paralel uygulama zinciri örnekleri (Chainlet) yer alıyor.

- Ekosistem Uygulamaları: SAGA, ölçeklenebilir mimarisiyle blokzincir ekosisteminin sınırsız potansiyelini karşılamayı amaçlıyor.

III. SAGA 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: $0,15323 - $0,20

- Nötr tahmin: $0,20 - $0,23

- İyimser tahmin: $0,23 - $0,25398 (olumlu piyasa duyarlılığı ve proje gelişmeleri ile)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan benimsenmeyle büyüme aşaması

- Fiyat aralığı tahmini:

- 2027: $0,26278 - $0,33497

- 2028: $0,24949 - $0,46468

- Temel katalizörler: Teknolojik ilerlemeler, iş birlikleri ve piyasa genişlemesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: $0,38827 - $0,43292 (istikrarlı piyasa büyümesi ve proje ilerlemesi varsayımıyla)

- İyimser senaryo: $0,43292 - $0,47758 (hızlanan benimsenme ve olumlu piyasa şartları ile)

- Dönüştürücü senaryo: $0,47758 - $0,4892 (çığır açan yenilikler ve kitlesel kabul ile)

- 2030-12-31: SAGA $0,4892 (iyimser projeksiyona göre potansiyel zirve fiyat)

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,25398 | 0,2099 | 0,15323 | 0 |

| 2026 | 0,34559 | 0,23194 | 0,12757 | 10 |

| 2027 | 0,33497 | 0,28876 | 0,26278 | 37 |

| 2028 | 0,46468 | 0,31187 | 0,24949 | 48 |

| 2029 | 0,47758 | 0,38827 | 0,37662 | 85 |

| 2030 | 0,4892 | 0,43292 | 0,22945 | 106 |

IV. SAGA Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SAGA Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli bakış açısına sahip ve risk toleransı yüksek yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde SAGA token biriktirin

- Fiyat hedefleri belirleyerek önceden saptanan seviyelerde kısmi kar alın

- Tokenlarınızı güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını tespit edin

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım durumunu ölçün

- Swing trading için ana noktalar:

- SAGA'nın büyük kripto paralarla korelasyonunu takip edin

- Potansiyel zararları sınırlamak için stop-loss emirleri kullanın

SAGA Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: %5-10'u

- Profesyonel yatırımcılar: %15'e kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla Layer 1 protokolüne yatırım yaparak riskleri azaltın

- Stop-loss emirleri: Potansiyel kayıpları sınırlandırın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı: Ledger veya Trezor gibi

- Yazılım cüzdanı seçeneği: Gate Web3 Wallet ve resmi SAGA cüzdanı (mevcutsa)

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifre kullanımı

V. SAGA Olası Riskler ve Zorluklar

SAGA Piyasa Riskleri

- Yüksek oynaklık: SAGA'nın fiyatı büyük dalgalanmalara açık

- Rekabet: Yeni Layer 1 protokolleri SAGA'nın piyasa pozisyonunu zorlayabilir

- Piyasa duyarlılığı: Genel kripto piyasasındaki duyarlılık değişimleri SAGA'nın değerini etkileyebilir

SAGA Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Küresel regülasyonlardaki değişiklikler SAGA'nın gelişimini etkileyebilir

- Uyum gereklilikleri: SAGA'nın yeni düzenleyici standartlara uyum sağlaması gerekebilir

- Jeopolitik gelişmeler: Uluslararası gerilimler SAGA'nın benimsenme oranını ve kullanımını etkileyebilir

SAGA Teknik Riskler

- Akıllı sözleşme açıkları: SAGA protokolünde istismar riski

- Ölçeklenebilirlik sorunları: Kullanım arttıkça ağ tıkanıklığı riski

- Birlikte çalışabilirlik: Diğer blokzincirlerle entegrasyonda zorluklar

VI. Sonuç ve Eylem Önerileri

SAGA Yatırım Değerinin Değerlendirilmesi

SAGA, yenilikçi Chainlet teknolojisi ve büyüyen ekosistemiyle Layer 1 blokzincir alanında güçlü bir yatırım potansiyeli sunuyor. Ancak yatırımcıların, yüksek oynaklık ve potansiyel teknik/düzenleyici riskleri göz önünde bulundurması gerekir.

SAGA Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonla başlayın, teknolojiye odaklanarak öğrenin

✅ Deneyimli yatırımcılar: Orta ölçekli dağılımı değerlendirin, proje gelişimini yakından izleyin

✅ Kurumsal yatırımcılar: Derinlemesine analiz yapın, staking ve node işletimini değerlendirin

SAGA Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden SAGA token satın alın

- Staking: SAGA'nın staking programında pasif gelir elde edin (varsa)

- Node işletimi: Ağda doğrulayıcı node çalıştırarak destek olun (ileri düzey kullanıcılar için)

Kripto para yatırımlarının yüksek risk içerdiğini unutmayın; bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırımcılar, kendi risk profillerine göre dikkatli hareket etmeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

Saga ne kadar yükselebilir?

Saga’nın fiyatının 2025’te $0,41923 seviyesine ulaşması öngörülüyor; bu, mevcut seviyeye göre önemli bir artış anlamına gelir. Tahmin, Eylül 2025 piyasa analizlerine dayanıyor.

Saga'nın fiyat hedefi nedir?

3 analistin projeksiyonuna göre Saga için ortalama 12 aylık fiyat hedefi $196,67 olup, tahminler $120 ile $285 arasında değişmektedir.

Saga'nın geleceği nasıl?

Saga'nın geleceği, çoklu zincir ekosisteminin gelişmesi, yeni projeler ve artan erişimle oldukça parlak görünüyor. Geliştirici verimliliği ve sürdürülebilir teşviklere odaklanması, önümüzdeki yıllarda güçlü büyüme potansiyelini destekliyor.

Saga coin yatırım yapılır mı?

2025 itibarıyla Saga coin, $0,2615 fiyatı ve $71,23M piyasa değeriyle dikkat çekiyor. Son dönemdeki dalgalanmalara rağmen yenilikçi blokzincir teknolojileri sayesinde kripto ekosisteminde izlenmesi gereken bir varlık olarak konumlanıyor.

2025 APT Fiyat Tahmini: Aptos Token’ı Yeni Zirvelere Taşıyabilecek Temel Dinamikler

2025 KAS Fiyat Öngörüsü: Kaspa'nın Gelecekteki Değerini Etkileyen Başlıca Faktörlerin Derinlemesine Analizi

2025 MOVE Fiyat Tahmini: Gelişen kripto para ekosisteminde büyüme faktörleri ve piyasa trendlerinin analizi

Kaspa (KAS) iyi bir yatırım mı?: Yüksek işlem kapasitesine sahip bu blockchain projesinin potansiyelini analiz etmek

FOXY ve APT: Kurumsal güvenlik ortamlarında modern tehdit tespit sistemlerinin karşılaştırılması

LOFI ve APT: Siber Güvenlik Tehdit İstihbaratına Farklı Yaklaşımların Analizi

Dijital cüzdanınızı Polygon Network ile entegre etme: Adım adım rehber