2025 REKTCOIN Fiyat Tahmini: Kripto Vahşi Batısı’nda Dalgalanmayı Yönetmek

Giriş: REKTCOIN’in Piyasadaki Konumu ve Yatırım Potansiyeli

REKTCOIN (REKTCOIN), meme temelli ve topluluk odaklı bir ekosistem olarak kuruluşundan bu yana sanat, kültür ve tüketici ürünlerini bünyesinde birleştirmiştir. 2025 yılı itibarıyla REKTCOIN’in piyasa değeri $182.684.632,5’e ulaşırken, dolaşımdaki arz yaklaşık 420.690.000.000.000 ve fiyatı $0,00000043425 civarında seyretmektedir. “Meme tabanlı ekosistem” kimliğiyle bu varlık, dijital dünyaya hâkim, kültürel olarak ilgili kripto yatırımcılarını ve koleksiyonerleri hedefleyen kritik bir rol üstlenmektedir.

Bu makalede REKTCOIN’in 2025’ten 2030’a kadar olan fiyat dinamikleri; geçmiş fiyat hareketleri, arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortamla birlikte ayrıntılı olarak ele alınıp, yatırımcılara profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulacaktır.

I. REKTCOIN Fiyat Geçmişi ve Güncel Piyasa Durumu

REKTCOIN Tarihsel Fiyat Seyri

- 2025 (Mart): REKTCOIN, $0,00000003102 ile tüm zamanların en düşük seviyesine ulaştı

- 2025 (Ağustos): Proje, $0,00000145207 ile tüm zamanların en yüksek değerini gördü

- 2025 (Ekim): Fiyat $0,00000043425 civarında istikrar kazandı; yıl boyunca yüksek volatilite gözlendi

REKTCOIN Güncel Piyasa Görünümü

19 Ekim 2025 tarihi itibarıyla REKTCOIN, $0,00000043425 seviyesinden işlem görmektedir. Son 24 saatte token %1,29 değer kaybederken, işlem hacmi $31.883,66 olarak gerçekleşmiştir. REKTCOIN’in piyasa değeri şu anda $182.684.632,50 olup, kripto para piyasasında 288’inci sıradadır.

Token farklı zaman dilimlerinde dalgalı bir performans sergilemiştir. Son bir saatte %0,33 artış sağlasa da, haftalık bazda %15,58 ve aylık bazda %47,19 oranında düşüş göstermiştir. Yıllık bazda ise REKTCOIN %266,44’lük güçlü bir büyüme kaydetmiştir.

Mevcut fiyat, 8 Ağustos 2025’te görülen $0,00000145207’lik tüm zamanların zirvesine göre önemli ölçüde düşük olup, piyasa koşulları iyileşirse toparlanma potansiyeli taşımaktadır. Dolaşımdaki arz, toplam ve maksimum arz ile örtüşmekte olup, 420.690.000.000.000 REKTCOIN tokenı bulunmaktadır.

Mevcut REKTCOIN piyasa fiyatını görüntülemek için tıklayın

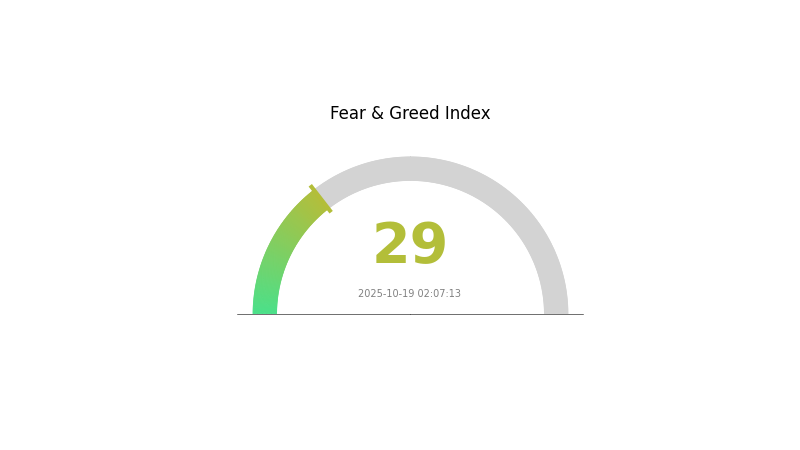

REKTCOIN Piyasa Duyarlılık Göstergesi

19 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Mevcut Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda korku modunda; Korku ve Açgözlülük Endeksi 29 seviyesinde. Bu, yatırımcılar arasında temkinli bir tutuma işaret ederken, karşıt strateji izleyenler için alım fırsatı doğurabilir. Ancak yatırım kararı almadan önce kapsamlı araştırma yapmak ve çok yönlü değerlendirme önemlidir. Kripto piyasalarında duyarlılık hızla değişebilir; Gate.com gibi platformlarda güncel kalın, bilinçli ve temkinli işlem yapın.

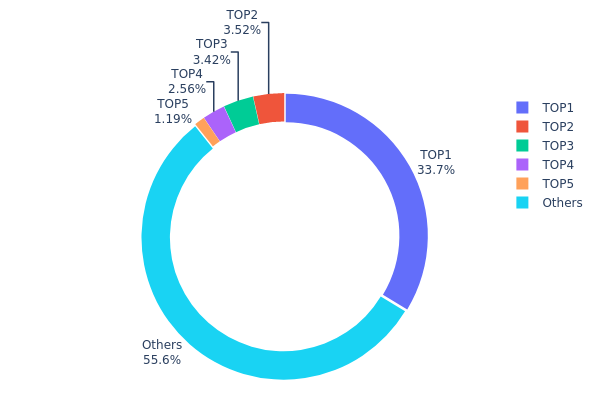

REKTCOIN Varlık Dağılımı

REKTCOIN için adres bazlı varlık dağılımı, görece yoğunlaşmış bir sahiplik yapısını göstermektedir. En büyük adres, toplam arzın %33,67’sini elinde tutmakta ve bu da merkezileşme riskini gündeme getirmektedir. Sonraki dört büyük adres, toplamda arzın %10,67’sini; kalan %55,66 ise diğer adresler arasında dağılmaktadır.

Varlıkların birkaç adreste yoğunlaşması, piyasa hareketlerini etkileyebilir. Arzın üçte birinden fazlasını kontrol eden ana adres, fiyat ve likidite üzerinde ciddi bir etkiye sahip olabilir. Bu yoğunlaşma, büyük sahiplerin satış ya da transfer yapması halinde piyasa manipülasyonu ve ani fiyat dalgalanmaları riskini artırmaktadır.

Yine de, diğer adresler arasında dağılım belirli bir merkeziyetsizliğe işaret etmektedir. Ancak genel yapı, REKTCOIN ekosisteminin istikrarı ve adil işleyişi için dikkatli olunması gerektiğini göstermekte; piyasa, birkaç büyük sahibin hareketlerine karşı hassas bir durumda olabilir.

Mevcut REKTCOIN Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0x424d...2f7c98 | 141.654.008.699,09K | 33,67% |

| 2 | 0xbbbb...eeffcb | 14.802.817.530,07K | 3,51% |

| 3 | 0x7130...ad0d96 | 14.397.456.892,88K | 3,42% |

| 4 | 0x2b30...dedfca | 10.771.530.508,25K | 2,56% |

| 5 | 0x9fc4...fa6d46 | 5.000.000.000,00K | 1,18% |

| - | Diğerleri | 234.064.186.369,71K | 55,66% |

II. REKTCOIN’in Gelecek Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Deflasyonist Model: REKTCOIN, zaman içinde toplam arzı azaltmak amacıyla token yakma mekanizması uygular.

- Geçmiş Eğilim: Önceki token yakımları genellikle kısa vadeli fiyat artışlarına yol açmıştır.

- Mevcut Etki: Yaklaşan token yakımı fiyat üzerinde yukarı yönlü baskı oluşturabilir; etkisi piyasa koşullarına bağlıdır.

Kurumsal ve Whale Dinamikleri

- Kurumsal Varlıklar: Bazı kripto yatırım şirketleri yakın zamanda REKTCOIN pozisyonlarını artırmıştır.

- Kurumsal Benimseme: Birkaç e-ticaret platformu ödemelerde REKTCOIN entegrasyonunu araştırmaktadır.

Makroekonomik Ortam

- Parasal Politika Etkisi: Merkez bankalarının gevşek para politikasına geçişi, REKTCOIN gibi kripto varlıklara olan risk iştahını artırabilir.

- Enflasyona Karşı Koruma: REKTCOIN’in enflasyon oranlarıyla belirli bir korelasyon göstermesi, koruma arayan yatırımcıları cezbetmektedir.

Teknolojik Gelişim ve Ekosistem Oluşturma

- Layer 2 Ölçeklendirme: REKTCOIN, işlem hızını artırmak ve maliyetleri azaltmak için Layer 2 çözümü geliştiriyor.

- Ekosistem Uygulamaları: REKTCOIN ağı üzerinde çeşitli DeFi protokolleri ve NFT pazar yerleri inşa edilmektedir.

III. 2025-2030 REKTCOIN Fiyat Tahminleri

2025 Öngörüsü

- Temkinli tahmin: $0,95 - $1,05

- Tarafsız tahmin: $1,00 - $1,10

- İyimser tahmin: $1,10 - $1,20 (güçlü piyasa duyarlılığı ve artan benimseme ile)

2027-2028 Öngörüsü

- Piyasa evresi: Yüksek volatilite ile potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: $1,20 - $1,40

- 2028: $1,80 - $2,10

- Kritik katalizörler: Teknolojik ilerlemeler, DeFi uygulamalarında yaygın kullanım

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: $2,70 - $3,20 (istikrarlı büyüme ve benimseme ile)

- İyimser senaryo: $3,20 - $3,70 (olumlu düzenleme ve kurumsal ilgi ile)

- Dönüştürücü senaryo: $3,70 - $4,25 (çığır açan kullanım alanları ve ana akım benimsenmeyle)

- 2030-12-31: REKTCOIN $4,25 (dönemin en yüksek potansiyel değeri)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 11 |

| 2027 | 0 | 0 | 0 | 22 |

| 2028 | 0 | 0 | 0 | 51 |

| 2029 | 0 | 0 | 0 | 55 |

| 2030 | 0 | 0 | 0 | 70 |

IV. REKTCOIN Profesyonel Yatırım Stratejileri ve Risk Yönetimi

REKTCOIN Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Hitap edilenler: Meme tabanlı ekosistemlere ilgi duyan kripto yatırımcıları ve koleksiyonerler

- Operasyon önerileri:

- Piyasadaki geri çekilmelerde REKTCOIN biriktirin

- Proje gelişmelerini ve topluluk aktivitelerini düzenli takip edin

- Token’ları Gate Web3 cüzdanında güvenli şekilde saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası giriş/çıkış noktalarını tespit edin

- RSI: Aşırı alım/aşırı satım durumlarını takip edin

- Dalgalı işlemde kritik noktalar:

- Kazanç hedefleri ve zarar durdur seviyeleri belirleyin

- Sosyal medya duyarlılığı ve proje duyurularını izleyin

REKTCOIN Risk Yönetimi Yapısı

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3 arasında

- Agresif yatırımcılar: %5-10 arasında

- Profesyonel yatırımcılar: %10-15 arasında

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara dağıtın

- Zarar durdur emirleri: Olası kayıpları sınırlandırın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk saklama: Uzun vadeli varlıklar için donanım cüzdanı

- Güvenlik önlemleri: İki adımlı doğrulama aktif edin, güçlü şifreler kullanın

V. REKTCOIN için Potansiyel Riskler ve Zorluklar

REKTCOIN Piyasa Riskleri

- Yüksek volatilite: Meme tabanlı token’larda aşırı fiyat dalgalanması görülür

- Piyasa duyarlılığı: Yatırımcı davranışındaki ani değişimlere açık

- Rekabet: Diğer meme coin’ler REKTCOIN’in pazar payını etkileyebilir

REKTCOIN Düzenleyici Riskler

- Belirsiz mevzuat: Meme coin’lerde daha sıkı denetim olasılığı

- Vergi etkisi: Gelişen vergi düzenlemeleri REKTCOIN işlemlerini etkileyebilir

- Platform kısıtlamaları: Listeden çıkarılma veya işlem sınırları riski

REKTCOIN Teknik Riskler

- Akıllı kontrat açıkları: Sömürü ve hata olasılığı

- Ağ tıkanıklığı: Yoğun dönemlerde yüksek ücret ve yavaş işlemler

- Cüzdan güvenliği: Saklama sırasında siber saldırı veya kullanıcı hatası riski

VI. Sonuç ve Eylem Önerileri

REKTCOIN Yatırım Değeri Analizi

REKTCOIN, meme coin ekosisteminde yüksek risk-yüksek getiri fırsatı sunar. Ciddi kazanç potansiyeli mevcut; ancak yatırımcıların aşırı volatilite ve düzenleyici belirsizliklere karşı hazırlıklı olmaları gerekir.

REKTCOIN Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyünüzün çok küçük bir kısmını ayırın, öğrenmeye odaklanın

✅ Deneyimli yatırımcılar: Kısa vadeli işlem fırsatlarını değerlendirin, sıkı risk yönetimini sürdürün

✅ Kurumsal yatırımcılar: Temkinli yaklaşın, kapsamlı analiz ve inceleme yapın

REKTCOIN İşlem Katılım Yöntemleri

- Spot piyasada işlem: Gate.com spot piyasasında REKTCOIN alıp satın

- Limit emirleri: Belirli giriş ve çıkış fiyatlarıyla riskinizi yönetin

- DCA stratejisi: Uzun vadeli birikim için maliyet ortalaması yöntemi uygulayın

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlardan görüş almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

Sıkça Sorulan Sorular

2030’da REKT kripto için fiyat tahmini nedir?

Mevcut piyasa trendleri ve olası büyüme kapsamında, REKT kripto 2030’da token başına $50-$100 seviyelerine ulaşabilir ve bugünkü değerine göre önemli bir artış gösterebilir.

REKT coin’in güncel değeri nedir?

Ekim 2025 itibarıyla REKT coin, yaklaşık $0,15 seviyesinden işlem görmektedir; piyasa değeri yaklaşık $15 milyon, günlük işlem hacmi ise $2 milyon civarındadır.

Rekt, çok para kaybetmek için kullanılan bir kripto argosu mu?

Evet, ‘rekt’ kripto dünyasında çok para kaybetmek anlamında kullanılan yaygın bir argo olup; genellikle hatalı işlem kararları veya piyasa çöküşleriyle ilişkilendirilir.

XRP $100’a ulaşır mı?

Kısa vadede pek olası değil; ancak XRP, yaygın benimseme ve olumlu düzenleyici gelişmelerle uzun vadede $100’a çıkabilir. Bunun için ciddi piyasa büyümesi ve kullanım alanlarının artması gerekmektedir.

2025 SPX Fiyat Tahmini: S&P 500’ü Yeni Zirvelere Taşıyabilecek Temel Faktörler

2025 PUFF Fiyat Tahmini: Kripto Para Yatırımcılarına Yönelik Stratejik Piyasa Analizi ve Öngörü

2025 GOHOME Fiyat Tahmini: Küresel Gayrimenkul Yatırım Trendlerine Yönelik Piyasa Analizi ve Gelecek Öngörüsü

2025 GIGGLE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 HAPPY Fiyat Tahmini: Dijital Varlık Piyasa Trendlerinin ve Gelecek Perspektiflerinin Analizi

2025 SPX Fiyat Tahmini: Boğa Koşusu mu, Ayı Piyasası mı? Uzmanlar S&P 500'ün Geleceğine Dair Görüşlerini Paylaşıyor

Monad (MON) iyi bir yatırım mı?: Performans, Risk Faktörleri ve Piyasa Potansiyelinin Kapsamlı Analizi

ZBCN ve XTZ: Özellikler, performans ve yatırım potansiyelinin kapsamlı bir karşılaştırması

ZK ve VET: Sıfır Bilgi Kanıtları ile Vechain’in Kurumsal Blockchain Çözümlerinin Karşılaştırılması

Undeads Games (UDS) iyi bir yatırım mı?: Risk, potansiyel getiriler ve piyasa uygunluğu üzerine kapsamlı bir analiz

BUILDon (B) iyi bir yatırım mı?: Performans, riskler ve geleceğe yönelik beklentilerin kapsamlı bir analizi