2025 PYTH Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Oracle Network Token

Introduction: PYTH's Market Position and Investment Value

Pyth Network (PYTH), as a leading oracle for publishing financial market data to multiple blockchains, has made significant strides since its inception. As of 2025, PYTH's market capitalization has reached $687,525,477, with a circulating supply of approximately 5,749,983,085 tokens, and a price hovering around $0.11957. This asset, often referred to as the "financial data oracle," is playing an increasingly crucial role in providing real-time market data across various blockchain networks.

This article will comprehensively analyze PYTH's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. PYTH Price History Review and Current Market Status

PYTH Historical Price Evolution

- 2024: ATH reached on March 16, price peaked at $1.1552

- 2025: Market downturn, price dropped to ATL of $0.04747 on October 10

PYTH Current Market Situation

As of October 16, 2025, PYTH is trading at $0.11957, experiencing a 2.89% decrease in the last 24 hours. The token's market cap stands at $687,525,477, ranking 121st in the overall cryptocurrency market. PYTH has seen significant volatility recently, with a 26.54% decline over the past week and a 25.61% drop in the last 30 days. The current price represents a 65.62% decrease from a year ago, indicating a bearish trend in the medium term.

PYTH's trading volume in the last 24 hours is $3,824,384, suggesting moderate market activity. The circulating supply is 5,749,983,085 PYTH tokens, which is 57.5% of the total supply of 10 billion tokens. The fully diluted market cap is $1,195,700,000.

The token is currently trading at about 10.35% of its all-time high, showing significant potential for recovery if market conditions improve. However, the overall market sentiment appears cautious, with the fear and greed index indicating a "Fear" level of 28.

Click to view the current PYTH market price

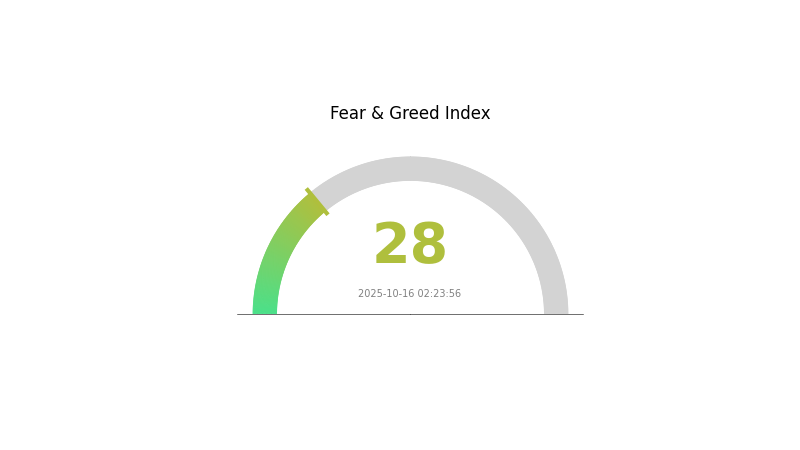

PYTH Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 28, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. However, it's crucial to remember that market sentiment can shift rapidly. While fear may present potential entry points for long-term investors, it's essential to conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed and trade responsibly on Gate.com.

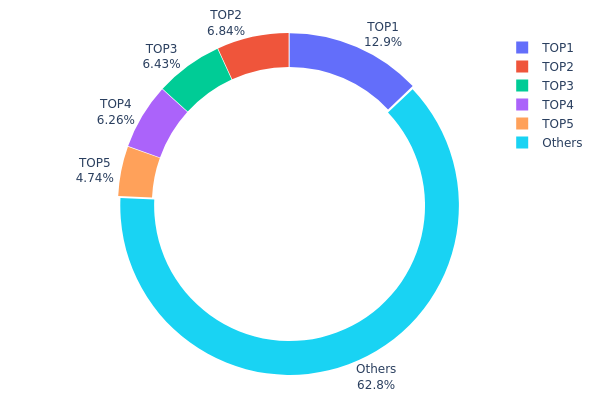

PYTH Holdings Distribution

The address holdings distribution chart for PYTH reveals a moderately concentrated ownership structure. The top address holds 12.94% of the total supply, while the top 5 addresses collectively control 37.2% of PYTH tokens. This concentration level suggests a significant influence from major holders, but it's not extreme enough to indicate centralized control.

The distribution pattern indicates a balance between large stakeholders and a diverse base of smaller holders. With 62.8% of tokens held by addresses outside the top 5, there's still substantial distribution among the broader community. This structure may contribute to market stability by preventing excessive volatility from single-actor movements, while still allowing for potential price responsiveness to major holder actions.

Overall, PYTH's current address distribution reflects a moderate level of decentralization. While there are influential large holders, the substantial portion held by smaller addresses suggests a reasonably healthy on-chain structure, potentially supporting long-term stability and organic market dynamics.

Click to view the current PYTH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5WumPY...Q85qfY | 1294475.65K | 12.94% |

| 2 | 5cz3Jz...q5BxCw | 684291.67K | 6.84% |

| 3 | Ffz4sG...Ycjc2Q | 642740.00K | 6.42% |

| 4 | E294ht...X7WJGM | 626287.17K | 6.26% |

| 5 | 9WzDXw...YtAWWM | 474213.47K | 4.74% |

| - | Others | 6277975.14K | 62.8% |

II. Core Factors Affecting PYTH's Future Price

Supply Mechanism

- Token Unlock: A significant token unlock event is scheduled for May 2025, with 2.13 billion PYTH tokens (58% of the circulating supply at that time) being released.

- Historical Pattern: Previous token unlocks have led to price volatility, with initial downward pressure followed by potential rebounds.

- Current Impact: The upcoming unlock may create short-term selling pressure, potentially causing a price drop similar to the 21% decline observed in a previous unlock event.

Institutional and Whale Dynamics

- Institutional Holdings: Following collaborations with government entities, whale wallet holdings increased by 14.5%, indicating an accumulation trend.

- Corporate Adoption: Pyth Network has expanded its services to include institutional-grade data subscriptions, targeting the $50 billion market data industry.

- Government Policies: Collaboration with the U.S. Department of Commerce has enhanced Pyth's credibility as a trusted data provider.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and their effects on the broader cryptocurrency market will likely influence PYTH's price.

- Inflation Hedge Properties: PYTH's performance as a potential hedge against inflation in the evolving economic landscape remains to be seen.

- Geopolitical Factors: Global regulatory developments and policies regarding cryptocurrencies and blockchain technology may impact Pyth Network's operations and growth.

Technological Development and Ecosystem Building

- Institutional Data Expansion: Pyth Network's second phase roadmap includes launching institutional-grade data subscription services, expanding from DeFi to traditional finance.

- Cross-Chain Integration: Pyth has expanded to over 45 blockchains, actively receiving real-time market data to power various DeFi ecosystems.

- Ecosystem Applications: Pyth's high-speed, low-latency data feeds are crucial for DeFi applications, particularly in derivatives markets where it holds a 60% market share.

III. PYTH Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.11104 - $0.1194

- Neutral forecast: $0.1194 - $0.13

- Optimistic forecast: $0.13 - $0.13373 (requires strong market momentum)

2026-2027 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2026: $0.06708 - $0.14302

- 2027: $0.11862 - $0.1604

- Key catalysts: Expanding use cases in DeFi and oracle services

2028-2030 Long-term Outlook

- Base scenario: $0.14760 - $0.18941 (assuming steady market growth)

- Optimistic scenario: $0.18941 - $0.24624 (assuming widespread adoption)

- Transformative scenario: Above $0.24624 (extreme favorable market conditions)

- 2030-12-31: PYTH $0.24624 (potential peak based on provided data)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.13373 | 0.1194 | 0.11104 | 0 |

| 2026 | 0.14302 | 0.12656 | 0.06708 | 5 |

| 2027 | 0.1604 | 0.13479 | 0.11862 | 12 |

| 2028 | 0.20811 | 0.1476 | 0.13726 | 23 |

| 2029 | 0.20097 | 0.17785 | 0.14406 | 48 |

| 2030 | 0.24624 | 0.18941 | 0.17805 | 58 |

IV. PYTH Professional Investment Strategies and Risk Management

PYTH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate PYTH during market dips

- Set price targets and take partial profits

- Store in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs for trend identification

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Identify support and resistance levels

- Use stop-loss orders to limit downside risk

PYTH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and regularly update software

V. Potential Risks and Challenges for PYTH

PYTH Market Risks

- High volatility: Significant price swings common in crypto markets

- Competition: Other oracle projects may gain market share

- Market sentiment: Susceptible to broader crypto market trends

PYTH Regulatory Risks

- Unclear regulations: Potential for restrictive policies in some jurisdictions

- Compliance challenges: Adapting to evolving regulatory landscapes

- Cross-border operations: Navigating different regulatory frameworks

PYTH Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Performance issues during high-demand periods

- Oracle manipulation: Risk of inaccurate data affecting dependent protocols

VI. Conclusion and Action Recommendations

PYTH Investment Value Assessment

PYTH offers long-term potential as a crucial infrastructure for DeFi and blockchain applications. However, short-term volatility and regulatory uncertainties pose significant risks.

PYTH Investment Recommendations

✅ Beginners: Start with small positions, focus on education and risk management ✅ Experienced investors: Consider dollar-cost averaging and set clear profit targets ✅ Institutional investors: Conduct thorough due diligence and implement robust risk management strategies

PYTH Trading Participation Methods

- Spot trading: Buy and hold PYTH tokens on Gate.com

- Staking: Participate in staking programs for passive income

- DeFi integration: Utilize PYTH in supported DeFi protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does PYTH crypto have a future?

Yes, PYTH crypto has a promising future. Its unique oracle services and growing demand in the decentralized finance sector position it for potential long-term growth and adoption in the Web3 ecosystem.

What is the price prediction for Pyth Network in 2050?

Based on technical analysis, Pyth Network's price in 2050 is projected to range between $0.1612 and $3.25, with potential for significant growth.

What is the purpose of PYTH coin?

PYTH coin is used for governance in the Pyth Network, allowing token holders to vote on and direct the network's development and future.

What are the risks of investing in PYTH coin?

Key risks include high volatility, limited track record, and potential liquidity issues. Market sentiment can cause rapid price swings.

Share

Content