2025 PBTC35A Price Prediction: Analyzing Market Trends and Factors Influencing Bitcoin's Future Value

Introduction: PBTC35A's Market Position and Investment Value

PBTC35A (PBTC35A), as a decentralized standard computing power protocol, has been playing an increasingly crucial role in the Bitcoin mining ecosystem since its inception. As of 2025, PBTC35A's market capitalization has reached $169,041.99, with a circulating supply of approximately 214,601.99998208 tokens, and a price hovering around $0.7877. This asset, known as the "Bitcoin mining power token," is playing an increasingly critical role in providing accessible and standardized Bitcoin mining power to investors.

This article will comprehensively analyze PBTC35A's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide professional price predictions and practical investment strategies for investors.

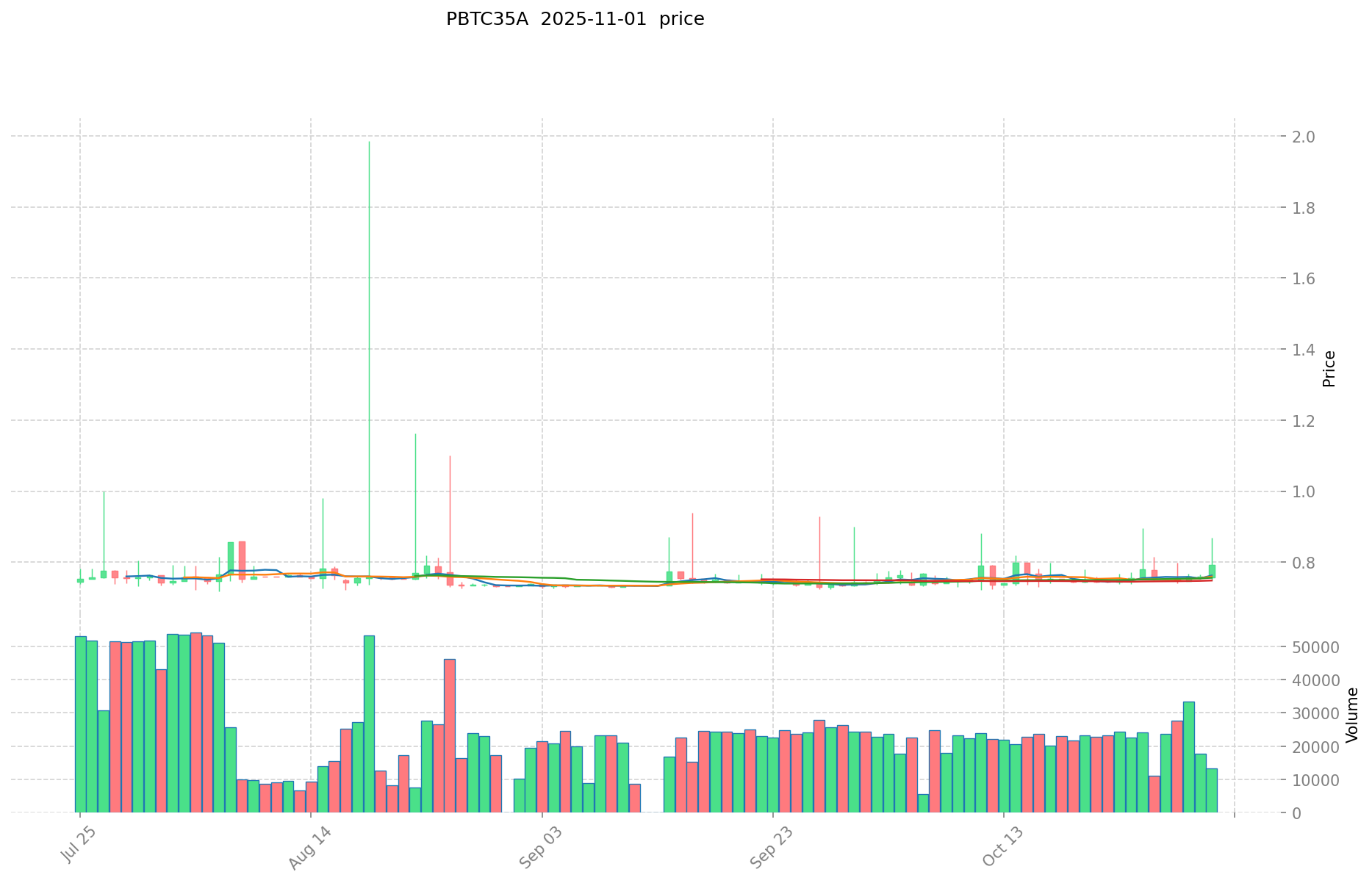

I. PBTC35A Price History Review and Current Market Status

PBTC35A Historical Price Evolution

- 2021: All-time high reached, price peaked at $216.53 on January 14

- 2024: Significant market downturn, price dropped to all-time low of $0.478614 on December 22

- 2025: Market recovery phase, price fluctuating between $0.7487 and $0.8684 in the past 24 hours

PBTC35A Current Market Situation

As of November 1, 2025, PBTC35A is trading at $0.7877, showing a 3.54% increase in the last 24 hours. The token has a market capitalization of $169,041.99, ranking it at 4531 in the cryptocurrency market. The trading volume in the past 24 hours stands at $10,522.59. PBTC35A has seen positive growth in various timeframes, with a 4.15% increase over the past week and a 4.68% gain in the last 30 days. However, it's worth noting that the token has experienced an 18.33% decrease in value over the past year. The current price is significantly lower than its all-time high, indicating potential room for growth if market conditions improve.

Click to view the current PBTC35A market price

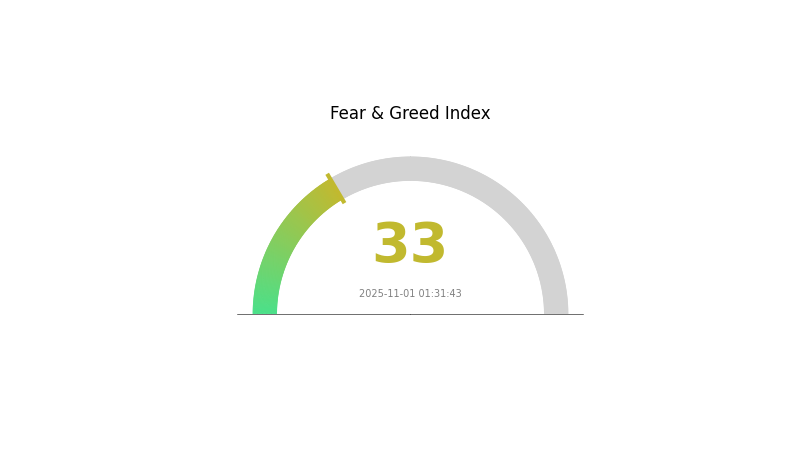

PBTC35A Market Sentiment Indicator

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 33. This suggests that investors are cautious and uncertainty prevails in the market. During such times, it's crucial for traders to remain vigilant and consider their risk management strategies carefully. However, periods of fear can also present potential buying opportunities for long-term investors who believe in the fundamentals of cryptocurrencies. As always, it's advisable to conduct thorough research and consult with financial experts before making any investment decisions.

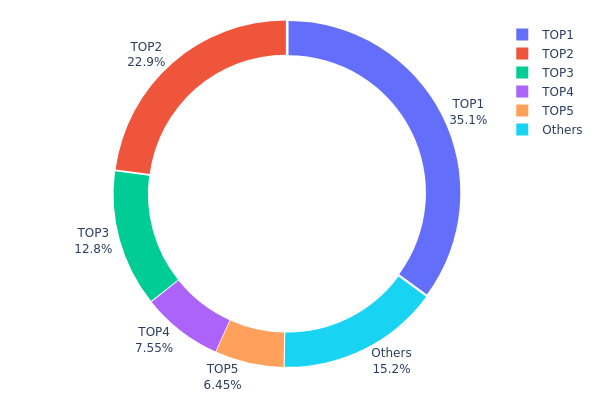

PBTC35A Holdings Distribution

The address holdings distribution data for PBTC35A reveals a significant concentration among a few top addresses. The top address holds 35.09% of the total supply, while the top five addresses collectively control 84.79% of PBTC35A tokens. This high concentration suggests a centralized ownership structure, which could potentially impact market dynamics.

Such a concentrated distribution raises concerns about market manipulation and price volatility. The top holders have substantial influence over the token's supply, potentially allowing them to exert significant pressure on price movements. This centralization also indicates a lower degree of decentralization within the PBTC35A ecosystem, which may affect its overall stability and resilience to market shocks.

However, it's worth noting that 15.21% of the supply is distributed among other addresses, indicating some level of broader participation. While this distribution pattern reflects a current imbalance in token ownership, it also highlights the importance of monitoring these metrics for potential shifts in market structure and liquidity dynamics over time.

Click to view the current PBTC35A Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5b1e...fce73b | 75.31K | 35.09% |

| 2 | 0xd641...ee2778 | 49.12K | 22.88% |

| 3 | 0x5cba...949efd | 27.54K | 12.83% |

| 4 | 0x0d07...b492fe | 16.20K | 7.55% |

| 5 | 0xc75a...70edbb | 13.83K | 6.44% |

| - | Others | 32.60K | 15.21% |

II. Key Factors Influencing PBTC35A's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and their expectations are likely to influence PBTC35A's price, as they affect overall market sentiment and investment flows.

- Inflation Hedging Properties: PBTC35A's performance in inflationary environments may be a significant factor, as investors often look to cryptocurrencies as potential hedges against inflation.

- Geopolitical Factors: International political situations and tensions can impact PBTC35A's price, as global uncertainties often affect the broader cryptocurrency market.

Technical Development and Ecosystem Building

- Market Sentiment: The overall sentiment in the cryptocurrency market plays a crucial role in PBTC35A's price movements, reflecting investor confidence and speculative behavior.

- Regulatory Changes: Policy and regulatory developments in various countries can significantly impact PBTC35A's adoption and price volatility.

- Technological Advancements: Ongoing innovations and improvements in the underlying technology of PBTC35A and related cryptocurrencies can influence its value proposition and market perception.

III. PBTC35A Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.76407 - $0.7877

- Neutral forecast: $0.7877 - $0.96099

- Optimistic forecast: $0.96099 - $1.10168 (requires strong market momentum)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range predictions:

- 2027: $0.54341 - $1.11645

- 2028: $0.71552 - $1.53626

- Key catalysts: Broader crypto market trends, institutional adoption, and regulatory developments

2029-2030 Long-term Outlook

- Base scenario: $1.29425 - $1.32013 (assuming steady market growth)

- Optimistic scenario: $1.34602 - $1.78218 (assuming favorable market conditions)

- Transformative scenario: $1.78218 - $2.00 (assuming extremely positive market dynamics)

- 2030-12-31: PBTC35A $1.78218 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.96099 | 0.7877 | 0.76407 | 0 |

| 2026 | 1.10168 | 0.87435 | 0.49838 | 11 |

| 2027 | 1.11645 | 0.98801 | 0.54341 | 25 |

| 2028 | 1.53626 | 1.05223 | 0.71552 | 33 |

| 2029 | 1.34602 | 1.29425 | 0.97068 | 64 |

| 2030 | 1.78218 | 1.32013 | 1.20132 | 67 |

IV. PBTC35A Professional Investment Strategies and Risk Management

PBTC35A Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors seeking exposure to Bitcoin mining

- Operation suggestions:

- Accumulate PBTC35A during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Swing trading key points:

- Set stop-loss orders to limit downside risk

- Take partial profits during significant price surges

PBTC35A Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Options contracts: Use put options to protect against downside

- Diversification: Balance PBTC35A with other crypto assets

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, backup private keys

V. Potential Risks and Challenges for PBTC35A

PBTC35A Market Risks

- Bitcoin price volatility: PBTC35A value closely tied to BTC price fluctuations

- Mining difficulty adjustments: Can impact profitability of underlying mining operations

- Liquidity risk: Limited trading volume may lead to slippage

PBTC35A Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter crypto regulations

- Tax implications: Evolving tax treatment of mining-related tokens

- Environmental concerns: Increased scrutiny on energy consumption of Bitcoin mining

PBTC35A Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Centralization risks: Dependence on Poolin for mining operations

- Network congestion: High Ethereum gas fees during peak times

VI. Conclusion and Action Recommendations

PBTC35A Investment Value Assessment

PBTC35A offers unique exposure to Bitcoin mining, but carries significant risks due to market volatility, regulatory uncertainty, and technical complexities. Long-term potential exists, but investors should be prepared for high short-term volatility.

PBTC35A Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of portfolio, focus on education

✅ Experienced investors: Consider 3-5% allocation, actively manage position

✅ Institutional investors: Explore as part of a diversified crypto mining strategy

PBTC35A Participation Methods

- Spot trading: Buy and hold PBTC35A on Gate.com

- Liquidity provision: Provide liquidity on decentralized exchanges

- DeFi integration: Explore yield farming opportunities with PBTC35A

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will POL reach 1$?

POL may reach $1 by 2035, based on current projections and market trends. However, cryptocurrency prices are highly volatile and unpredictable.

Will pi coin reach $100?

Based on current projections, Pi coin could potentially reach $100 or even $500 by 2030 if it achieves widespread adoption and real-world use cases.

Would hamster kombat coin reach $1?

Hamster Kombat coin has potential to reach $1 by 2028, driven by blockchain gaming adoption and market trends.

How much will $1 Bitcoin be worth in 2025?

Based on current trends and expert predictions, $1 Bitcoin could be worth between $50,000 to $100,000 by 2025. However, cryptocurrency markets are highly volatile and unpredictable.

Share

Content