2025 OSMO Fiyat Tahmini: Osmosis Network’ün yerel token’ı için büyüme potansiyeli ve piyasa trendleri analizi

Giriş: OSMO'nun Piyasa Konumu ve Yatırım Değeri

Cosmos SDK ile geliştirilen ileri düzey AMM protokolü Osmosis (OSMO), 2021'den bu yana kayda değer bir gelişim göstermiştir. 2025 itibarıyla Osmosis'in piyasa değeri $91.754.522,88 olarak kaydedilmiş, dolaşımdaki arz yaklaşık 748.405.570 tokena ulaşmış ve fiyatı $0,1226 civarında seyretmektedir. Sıklıkla "özelleştirilebilir AMM'lerin yönetim tokenı" olarak anılan OSMO, merkeziyetsiz finans ve özel AMM protokol geliştirme alanında gitgide daha önemli bir yere sahip olmaktadır.

Bu makalede, Osmosis'in 2025-2030 dönemindeki fiyat hareketlerinin profesyonel analizi sunulacak; geçmiş fiyat verileri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik göstergeler dikkate alınarak yatırımcılara uzman fiyat öngörüleri ve pratik yatırım stratejileri aktarılacaktır.

I. OSMO Fiyat Geçmişi ve Güncel Piyasa Durumu

OSMO Tarihsel Fiyat Seyri

- 2022: Tüm zamanların en yüksek seviyesi, 4 Mart'ta fiyat $11,25 ile zirve yaptı

- 2023-2024: Piyasa gerilemesi, fiyat ciddi ölçüde düştü

- 2025: Yeni dip seviyesi, 11 Ekim'de fiyat $0,108039'a indi

OSMO Güncel Piyasa Görünümü

21 Ekim 2025 itibarıyla OSMO, $0,1226 fiyatıyla işlem görmektedir ve 24 saatlik işlem hacmi $34.184,40'tır. Token, son 24 saatte %0,24 oranında hafif bir yükseliş göstermiştir. Ancak OSMO, daha uzun süreli periyotlarda ciddi kayıplar yaşamıştır; son bir haftada %9,69, son bir ayda %23,06 değer kaybetmiştir. Yıl başından bu yana performansı ise %77,91 oranında düşüş göstermektedir.

OSMO'nun piyasa değeri şu anda $91.754.522,88 olup kripto para piyasasında 427. sıradadır. Dolaşımdaki arz 748.405.570 OSMO'dur ve bu, maksimum arzın %74,84'üne karşılık gelir (maksimum arz: 1.000.000.000 token). Tam seyreltilmiş piyasa değeri ise $122.600.000 düzeyindedir.

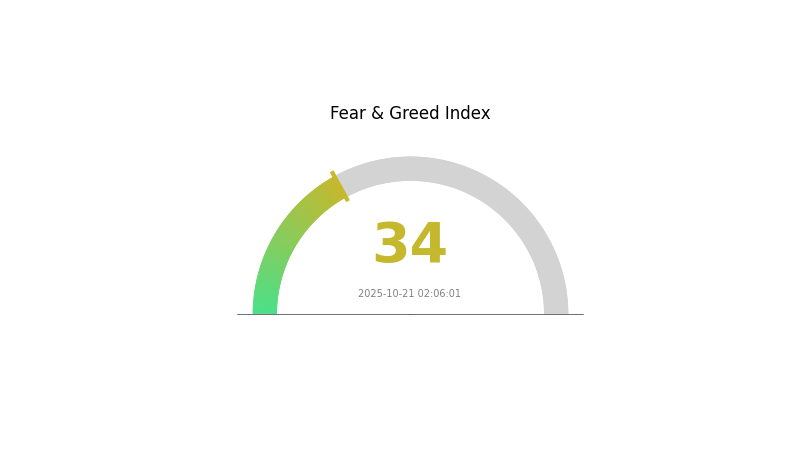

Mevcut fiyat, tüm zamanların zirvesinin oldukça altında olup orta ve uzun vadede düşüş eğilimi göstermektedir. OSMO için piyasa duyarlılığı temkinli; genel kripto piyasası korku ve açgözlülük endeksinde "Korku" seviyesi 34 olarak izlenmektedir.

Güncel OSMO piyasa fiyatını görmek için tıklayın

OSMO Piyasa Duyarlılık Göstergesi

21 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda korku ortamında; Korku ve Açgözlülük Endeksi 34 olarak ölçülmektedir. Bu, yatırımcıların temkinli davrandığını ve "düşüşten alım" fırsatları doğabileceğini gösteriyor. Ancak, piyasa hareketleri öncesinde dikkatli olmak ve detaylı analiz yapmak önemlidir. Piyasa duyarlılığı hızlı değişebilir; kripto sektörüyle ilgili güncel gelişmeleri yakından takip etmek gereklidir.

OSMO Varlık Dağılımı

OSMO adres varlık dağılım grafiği benzersiz bir tablo sunuyor. Veriler, hiçbir adresin yüksek miktarda tokena sahip olmadığını gösteriyor. Bu sıra dışı dağılım, OSMO tokenlarının ağda son derece merkeziyetsiz şekilde yayıldığını ortaya koyuyor.

En büyük adreslerde büyük token sahiplerinin (balinaların) olmaması, daha adil bir kullanıcı dağılımı anlamına gelmektedir. Bu yüksek merkeziyetsizlik seviyesi, piyasa manipülasyon riskini azaltabilir ve fiyatların daha istikrarlı hareket etmesini sağlayabilir. Ayrıca, topluluk odaklı ve hiçbir kuruluşun ağı kontrol etmediği bir ekosistemi yansıtıyor olabilir.

Bununla birlikte, bu dağılım OSMO'nun benimsenme düzeyi ve kullanımına dair soru işaretleri uyandırıyor. Büyük sahiplerin yokluğu, ekosistemin henüz erken aşamada ve kullanıcı kazanımı sürecinde olabileceğini düşündürüyor. Proje geliştikçe, dağılımın nasıl evrildiğini ve piyasa yapısına etkisini izlemek önemlidir.

Güncel OSMO varlık dağılımını görüntülemek için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|

II. OSMO'nun Gelecek Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Geçmiş eğilimler: Arzdaki değişimler geçmişte OSMO fiyatını etkilemiş, artan arz genellikle fiyat baskısı yaratmıştır.

- Mevcut etkiler: Mevcut arz dinamiklerinin OSMO fiyatını etkilemeye devam etmesi bekleniyor; arz talebin önüne geçerse aşağı yönlü baskı görülebilir.

Makroekonomik Ortam

- Parasal politika etkisi: Merkez bankası politikaları ve küresel ekonomik durumlar, genel kripto piyasası ile beraber OSMO fiyatını da etkileyecektir.

- Jeopolitik faktörler: Uluslararası gerilim ve jeopolitik riskler, hem genel kripto piyasasını hem de OSMO'yu etkileyebilir.

Teknolojik Gelişim ve Ekosistem Yapılanması

- Çapraz zincir yenilikleri: Osmosis'in çapraz zincir işlemler ve likidite sağlama konusundaki inovasyonları, OSMO fiyatını olumlu yönde etkileyebilir.

- Ekosistem uygulamaları: Osmosis ekosistemi içindeki DApp ve projelerin gelişimi, OSMO talebini artırıp fiyatı yukarı çekebilir.

III. 2025-2030 Dönemi OSMO Fiyat Tahmini

2025 Öngörüsü

- Temkinli tahmin: $0,10971 - $0,1219

- Nötr tahmin: $0,1219 - $0,1347

- İyimser tahmin: $0,1347 - $0,1475 (pozitif piyasa duyarlılığı ve artan benimseme ile)

2027-2028 Öngörüsü

- Piyasa aşaması beklentisi: Yükselen volatilite ile potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: $0,1298 - $0,18584

- 2028: $0,08667 - $0,21

- Başlıca katalizörler: Ekosistem genişlemesi, teknolojik yenilikler ve genel piyasa trendleri

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: $0,18834 - $0,2034 (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: $0,21847 - $0,28477 (kuvvetli piyasa performansı ve artan kullanım ile)

- Dönüştürücü senaryo: $0,28477 - $0,30 (büyük ortaklıklar veya teknolojik sıçramalar ile)

- 2030-12-31: OSMO $0,28477 (iyimser projeksiyonun potansiyel zirvesi)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1475 | 0.1219 | 0.10971 | 0 |

| 2026 | 0.16029 | 0.1347 | 0.07947 | 9 |

| 2027 | 0.18584 | 0.1475 | 0.1298 | 20 |

| 2028 | 0.21 | 0.16667 | 0.08667 | 35 |

| 2029 | 0.21847 | 0.18834 | 0.16009 | 53 |

| 2030 | 0.28477 | 0.2034 | 0.14238 | 65 |

IV. OSMO'da Profesyonel Yatırım Stratejileri ve Risk Yönetimi

OSMO Yatırım Metodu

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: DeFi ve AMM protokollerine inanan uzun vadeli yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde OSMO biriktirin

- Tokenları stake ederek ödül kazanın

- Ek güvenlik için kendi cüzdanınızda saklayın (non-custodial)

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktası belirleme için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım ve satım durumlarını takip edin

- Dalgalı işlemler için anahtar noktalar:

- Osmosis ekosistemindeki gelişmelere ve güncellemelere odaklanın

- DeFi piyasasındaki genel duyarlılığı izleyin

OSMO Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Portföyün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: OSMO'yu diğer kripto ve geleneksel varlıklarla dengeleyin

- Stop-loss emirleri: Potansiyel kayıpları sınırlamak için uygun seviyeler belirleyin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifre ve düzenli yazılım güncellemesi

V. OSMO İçin Potansiyel Riskler ve Zorluklar

OSMO Piyasa Riskleri

- Oynaklık: Kripto piyasasında yüksek fiyat dalgalanmaları

- Rekabet: DeFi alanında artan AMM protokolü sayısı

- Likidite: Piyasa stresinde likidite sorunları yaşanabilir

OSMO Düzenleyici Riskler

- Düzenleyici belirsizlik: DeFi ve kripto alanında değişen global düzenlemeler

- Uyum sorunları: Gelecekteki regülasyonlara uyumda olası zorluklar

- Coğrafi kısıtlamalar: Bazı bölgelerde OSMO kullanımına getirilebilecek kısıtlamalar

OSMO Teknik Riskler

- Akıllı sözleşme açıkları: Protokolde istismar veya hata riski

- Ölçeklenebilirlik: Yüksek işlem hacmini yönetmede zorluklar

- Birlikte çalışabilirlik: Zincirler arası entegrasyonda güçlükler

VI. Sonuç ve Eylem Önerileri

OSMO Yatırım Değeri Analizi

OSMO, AMM ve DeFi alanında uzun vadeli büyüme potansiyeliyle öne çıkmaktadır. Kısa vadeli fiyat oynaklığı ve düzenleyici belirsizlikler ise yatırımcılar tarafından dikkate alınmalıdır.

OSMO Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük yatırımlarla başlayın, DeFi ve AMM protokolleri hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Stake ve aktif al-sat arasında dengeli stratejiler uygulayın ✅ Kurumsal yatırımcılar: Detaylı analiz ve due diligence ile OSMO'yu çeşitlendirilmiş DeFi portföyüne dahil edin

OSMO Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com'da OSMO alın ve satın

- Stake etme: Osmosis resmi platformunda OSMO stake edin

- Likidite sağlama: Osmosis'te likidite havuzlarına katılarak ek ödül kazanın

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk profillerine göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alamayacağınızdan fazla yatırım yapmayın.

SSS

2025 için Osmo fiyat tahmini nedir?

Algoritmik analizlere göre Osmo fiyatı, 18 Kasım 2025'te $0,1229 seviyesine ulaşabilir.

Osmo iyi bir coin mi?

OSMO, Cosmos ekosisteminde önemli bir DeFi varlığı olarak öne çıkmaktadır. Yenilikçi özellikleri ve artan kullanımı, merkeziyetsiz borsalara güvenen yatırımcılar için potansiyel sunmaktadır.

2030 için Osmo fiyat tahmini nedir?

Geçmiş verilerin analizine göre Osmo'nun 2030 yılı fiyat tahmini yaklaşık $13,38'dir. Bu, kripto para için uzun vadeli büyüme potansiyelini göstermektedir.

Hamster Kombat coin $1'a ulaşır mı?

Mevcut tahminlere göre Hamster Kombat'ın $1 seviyesine ulaşması çok düşük olasılıktadır. Coinin bu fiyatı görmesi için %228.000'in üzerinde sıra dışı bir yükselişe ihtiyacı vardır.

2025 OSMO Fiyat Tahmini: Osmosis Protocolü’nün yerel token’ı için büyüme dinamikleri ve piyasa potansiyeli analizi

Osmosis (OSMO) iyi bir yatırım mı?: DeFi protokolü tokeninin potansiyeli ve risklerinin incelenmesi

2025 OSMO Fiyat Tahmini: Cosmos Ekosistem Token’ı Yeni Zirvelere Ulaşabilir mi?

2025 OSMO Fiyat Tahmini: Osmosis Yıl Sonunda 5 Doları Aşacak mı?

Avalanche (AVAX) 2025 Fiyat Analizi ve Piyasa Trendleri

SEI Staking Analizi: %60-70 Arasında Arz Kilitli ve Fiyat Etkisi

Kârı Açığa Çıkarmak: Flash Loan Fırsatlarını Değerlendirmenin Yolları

Cheems Meme Coin'i İncelemek: Benzersizliğini Ortaya Çıkaran Unsurlar Nelerdir?