2025 O4DX Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: O4DX'nin Piyasa Konumu ve Yatırım Potansiyeli

OrangeDX (O4DX), birinci nesil Bitcoin DEFI Merkezi olarak, kuruluşundan bu yana BRC20 ekosistemlerine yenilikçi bir yaklaşım sunmaktadır. 2025 itibarıyla OrangeDX'in piyasa değeri 102.100 $'a ulaşmıştır; dolaşımdaki arz yaklaşık 50.000.000 token olup, fiyatı 0,002042 $ civarında seyretmektedir. “Bitcoin Protokol platformu” olarak tanımlanan bu varlık, BRC20 ve EVM tokenlarının köprülenmesi, takası, alım-satımı ve piyasaya sürülmesinde giderek daha stratejik bir rol üstlenmektedir.

Bu makalede, OrangeDX'in 2025-2030 dönemindeki fiyat hareketleri; tarihsel trendler, piyasa arz-talep yapısı, ekosistem gelişimi ve makroekonomik koşullar kapsamında analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. O4DX Fiyat Geçmişi ve Güncel Piyasa Durumu

O4DX Tarihsel Fiyat Seyri

- 2024: Mart ayında ilk çıkış, fiyatı 2,8 $ ile zirve yaptı

- 2025: Piyasa gerilemesiyle Temmuz'da fiyat tüm zamanların en düşüğü olan 0,001328 $'a indi

O4DX Güncel Piyasa Görünümü

2 Kasım 2025 itibarıyla O4DX, 0,002042 $ seviyesinden işlem görmektedir ve 24 saatlik işlem hacmi 9.857,76 $'dır. Token son 24 saatte %0,69 değer kazanmıştır. Ancak, uzun vadede kayda değer düşüşler yaşanmış; son 30 günde %31,38, son bir yılda ise %90,38 oranında gerilemiştir.

O4DX'in mevcut piyasa değeri 102.100 $ olup, kripto para piyasasında 5042. sıradadır. Dolaşımdaki arz 50.000.000 O4DX olup, toplam 100.000.000 tokenın %50'sini oluşturmaktadır.

Son 24 saatlik yükselişe rağmen, O4DX genel olarak düşüş trendinde seyretmiş; haftalık, aylık ve yıllık periyotlarda ciddi kayıplar yaşamıştır. Token, 26 Mart 2024'te görülen 2,8 $'lık tüm zamanların en yüksek seviyesinin %99,93 altında işlem görmektedir.

Güncel O4DX piyasa fiyatı için tıklayın

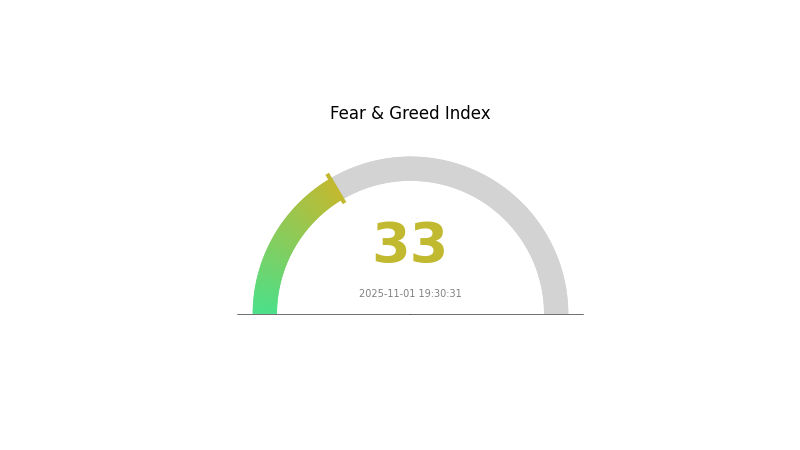

O4DX Piyasa Duyarlılığı Göstergesi

2025-11-01 Korku ve Açgözlülük Endeksi: 33 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda korku döneminde; Korku ve Açgözlülük Endeksi 33 seviyesinde bulunuyor. Bu tablo, yatırımcıların temkinli davrandığını ve güvenli varlıklara yöneldiğini gösteriyor. Böyle bir duyarlılık genellikle fiyatların düşük olduğu ve alım fırsatlarının doğabileceği bir ortam yaratır. Ancak, yatırım kararı almadan önce mutlaka detaylı araştırma yapmalı ve risk profilinizi gözetmelisiniz. Unutmayın, piyasa duyarlılığı hızla değişebilir ve geçmiş performans gelecek için garanti teşkil etmez. Gate.com'da bilinçli ve sorumlu işlem yapın.

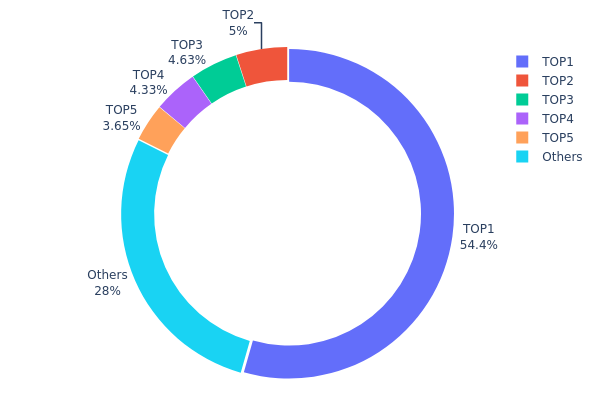

O4DX Varlık Dağılımı

Adres bazında varlık dağılımı, O4DX tokenlarının cüzdanlar arasında nasıl yoğunlaştığını gösterir. Analizler, en büyük adresin toplam arzın %54,42'sini bulundurduğunu ortaya koyuyor. Bu kadar yüksek bir yoğunlaşma, potansiyel piyasa manipülasyonu ve fiyat oynaklığı açısından önemli bir risk oluşturuyor.

İlk beş adres, toplam O4DX arzının %72,02'sini kontrol ediyor; bu da son derece merkezi bir dağılıma işaret ediyor. Bu yoğunlaşma, büyük sahiplerin alım-satım işlemleriyle token fiyatını ciddi biçimde etkileme gücüne sahip olduğunu gösteriyor. Kalan %27,98 ise diğer adresler arasında dağılmış durumda ve küçük yatırımcılar arasında dolaşımın sınırlı olduğunu gösteriyor.

Bu yoğunlaşma yapısı, O4DX'nin blokzincir üzerindeki merkeziyetsizliğinin düşük olduğunu ortaya koyuyor ve daha yaygın bir dağıtım arayan yatırımcılar için risk teşkil ediyor. Mevcut dağılım, piyasada dalgalanmayı artırabilir ve büyük sahiplerin başlatacağı fiyat hareketlerine karşı duyarlılığı yükseltebilir.

Güncel O4DX Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 54.427,54K | 54,42% |

| 2 | 0x1ece...52b72d | 5.000,00K | 5,00% |

| 3 | 0x0529...c553b7 | 4.632,70K | 4,63% |

| 4 | 0x11d7...03d947 | 4.325,08K | 4,32% |

| 5 | 0xf219...ec425e | 3.654,74K | 3,65% |

| - | Diğerleri | 27.959,92K | 27,98% |

II. O4DX'nin Gelecekteki Fiyatına Etki Eden Temel Unsurlar

Arz Mekanizması

- Piyasa Duyarlılığı: O4DX'nin fiyatı, piyasa genelindeki duyarlılık ve yatırımcı güveninden doğrudan etkilenir.

Makroekonomik Ortam

- Para Politikası Etkisi: Küresel para politikası değişimleri O4DX fiyatında dalgalanmalara yol açabilir.

- Jeopolitik Faktörler: Uluslararası politik gelişmeler O4DX'nin değerini etkileyebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Teknolojik İnovasyon: O4DX'nin teknolojisinde yaşanacak gelişmeler fiyat üzerinde doğrudan etkili olabilir.

- Düzenleyici Çerçeve: Ülkelerdeki düzenleyici politikaların gelişimi, O4DX'nin benimsenmesini ve fiyatını etkileyebilir.

III. O4DX 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00187 $ – 0,00200 $

- Tarafsız tahmin: 0,00200 $ – 0,00210 $

- İyimser tahmin: 0,00210 $ – 0,00216 $ (pozitif piyasa duyarlılığı gerektirir)

2027-2028 Görünümü

- Piyasa evresi: Büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,00171 $ – 0,00273 $

- 2028: 0,00238 $ – 0,00310 $

- Öne çıkan katalizörler: Artan benimsenme ve teknolojik ilerlemeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00280 $ – 0,00346 $ (istikrarlı piyasa büyümesi)

- İyimser senaryo: 0,00346 $ – 0,00412 $ (güçlü yükseliş trendi)

- Dönüştürücü senaryo: 0,00412 $ – 0,00439 $ (çığır açıcı yenilikler)

- 2030-12-31: O4DX 0,00439 $ (potansiyel zirve fiyat)

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00216 | 0,00204 | 0,00187 | 0 |

| 2026 | 0,00245 | 0,0021 | 0,00122 | 2 |

| 2027 | 0,00273 | 0,00227 | 0,00171 | 11 |

| 2028 | 0,0031 | 0,0025 | 0,00238 | 22 |

| 2029 | 0,00412 | 0,0028 | 0,00263 | 37 |

| 2030 | 0,00439 | 0,00346 | 0,00253 | 69 |

IV. O4DX Profesyonel Yatırım Stratejileri ve Risk Yönetimi

O4DX Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk toleransına sahip ve Bitcoin DEFI ekosistemine güvenen yatırımcılar

- Operasyon önerileri:

- Piyasa geri çekilmelerinde O4DX biriktirin

- Kısmi kar alımı için fiyat hedefleri belirleyin

- Tokenleri güvenli cüzdanlarda, tercihen donanım cüzdanlarında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve muhtemel dönüş noktalarını belirlemede kullanılır

- RSI: Aşırı alım/aşırı satım seviyelerini izleyin

- Dalgalı ticaret için önemli noktalar:

- Açık giriş-çıkış seviyeleri belirleyin

- Risk yönetimi için zarar durdur emirleri kullanın

O4DX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Portföyün %5-10'u

- Profesyoneller: %15'e kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara yaymak

- Stablecoin kullanımı: Yüksek oynaklıkta varlıkların bir kısmını stablecoin'e çevirmek

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifre kullanımı ve yazılım güncelleme

V. O4DX için Muhtemel Riskler ve Zorluklar

O4DX Piyasa Riskleri

- Yüksek oynaklık: O4DX fiyatında ani ve büyük dalgalanmalar olabilir

- Sınırlı likidite: Büyük hacimli işlemlerde fiyat etkisi oluşabilir

- Bitcoin korelasyonu: Performansı, Bitcoin fiyatındaki hareketlere bağlı olabilir

O4DX Düzenleyici Riskler

- Belirsiz mevzuat: BRC20 tokenları için yeni düzenleme ihtimali

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen yasal statü

- AML/KYC gereklilikleri: Artan uyum talepleri benimsenmeyi etkileyebilir

O4DX Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda hata veya sömürü riski

- Ölçeklenebilirlik sorunları: Bitcoin blokzincirinde ağ tıkanıklığı

- Uyumluluk engelleri: Diğer blokzincirlerle entegrasyonda zorluklar

VI. Sonuç ve Eylem Önerileri

O4DX Yatırım Potansiyeli Değerlendirmesi

O4DX, Bitcoin'deki büyüyen BRC20 ekosistemine erişim sunarken, büyüme şansı ile birlikte kısa vadeli yüksek oynaklık ve düzenleyici belirsizlikler barındırıyor.

O4DX Yatırım Önerileri

✅ Yeni başlayanlar: Küçük hacimli pozisyonlarla başlayın, BRC20 tokenları konusunda bilgi edinin ✅ Deneyimli yatırımcılar: Kripto portföyünün bir kısmını çeşitlendirme amacıyla O4DX'e ayırabilir ✅ Kurumsal yatırımcılar: Kapsamlı durum tespiti yaparak O4DX'i Bitcoin ekosistemi yatırımlarına dahil etmeyi göz önünde bulundurmalı

O4DX Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com ve diğer destekleyen borsalarda işlem yapılabilir

- DeFi platformları: BRC20 tokenlarını destekleyen merkeziyetsiz borsaları inceleyin

- OTC piyasaları: Büyük hacimli işlemlerde piyasa etkisini azaltmak için

Kripto para yatırımları çok yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarını göz önünde bulundurarak dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

SSS

Hangi kripto para 1000 kat artacak öngörülüyor?

Blast'ın, Layer-2 adaptasyonu ve güçlü DeFi entegrasyonları sayesinde Ekim 2025'te 1000 kat artması bekleniyor.

XRP 2025'te 100 $'a ulaşır mı?

XRP'nin mevcut fiyatı yaklaşık 2,66 $'dır; 2025'te 100 $ seviyesine ulaşması mümkün olsa da oldukça spekülatiftir. Kurumsal benimsenme ve olumlu piyasa koşulları önemli büyüme getirebilir, ancak bu ölçüde bir artış garanti değildir.

STMX 1 dolara ulaşır mı?

Mevcut tahminlere göre, STMX'in Kasım 2025'e kadar 1 $'a ulaşması beklenmiyor. Tahminler, Mart 2025'te en fazla 0,006576 $ seviyesine ulaşabileceğini gösteriyor; bu değer 1 $'ın oldukça altında kalıyor.

Orchid OXT iyi bir yatırım mı?

Evet, Orchid (OXT) gelecek vadeden bir yatırım olarak öne çıkıyor. Analistlere göre 2025'te 1,52 $ seviyesine ulaşma potansiyeli bulunuyor; bu da güçlü büyüme ve uzun vadeli karlılık sağlayabilir.

OrangeDX (O4DX) yatırım için uygun mu?: Bu yükselen kripto paranın potansiyeli ve risklerine dair analiz

Bitcoin Staking Rehberi 2025: Yüksek Getiri Nasıl Güvence Altına Alınır

2025 Yılında En İyi Bitcoin Staking Yöntemleri: Getiri Karşılaştırması ve Güvenlik Stratejileri

Zincir Üzerinde BTC Staking: 2025'te Bitcoin Yatırımcıları için Bir Rehber

Bitcoin Ve AUD

2025 BTC on-chain staking: Getiri, platform karşılaştırması ve Risk Yönetimi

Soğuk cüzdan işlemlerinde işlem ücreti ödenmesi gerekiyor mu? Ayrıntılı inceleme

Sadece 1 $ ile Mikro İşlemeye Başlamak: Yeni Başlayanlar İçin Kılavuz

READY Hakkında: Mükemmellik ve Gelişim için Çerçeveyi Anlamaya Yönelik Kapsamlı Bir Rehber

Kripto para dünyasında replay saldırılarını anlamak

UNCX nedir: Uniswap Konsantre Likiditesi ve Merkeziyetsiz Finans Yeniliğine Kapsamlı Bir Rehber