2025 NVIR Fiyat Tahmini: Sanal Gerçeklik Yatırımlarının Geleceğinde Yön Bulmak

Giriş: NVIR'ın Piyasadaki Konumu ve Yatırım Potansiyeli

NvirWorld (NVIR), 2022’den bu yana yeni nesil Web3 oyun stüdyosu ve pazar yeri olarak konumlanmıştır. 2025 itibarıyla NVIR’ın piyasa değeri 144.498 dolar seviyesine ulaşmış, dolaşımdaki arzı yaklaşık 1.282.148.079 token ve fiyatı 0,0001127 dolar civarındadır. “Web3 oyun geçidi” olarak tanımlanan bu varlık, blokzincir tabanlı oyunlar ve Web3 ekosistemine kullanıcı katılımında giderek daha önemli bir rol üstlenmektedir.

Bu makalede, NVIR’ın 2025-2030 dönemindeki fiyat hareketleri ayrıntılı olarak incelenecek; geçmiş fiyat verileri, piyasa arz ve talebi, ekosistem gelişimi ile makroekonomik etkenler bir araya getirilerek profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejik öneriler sunulacaktır.

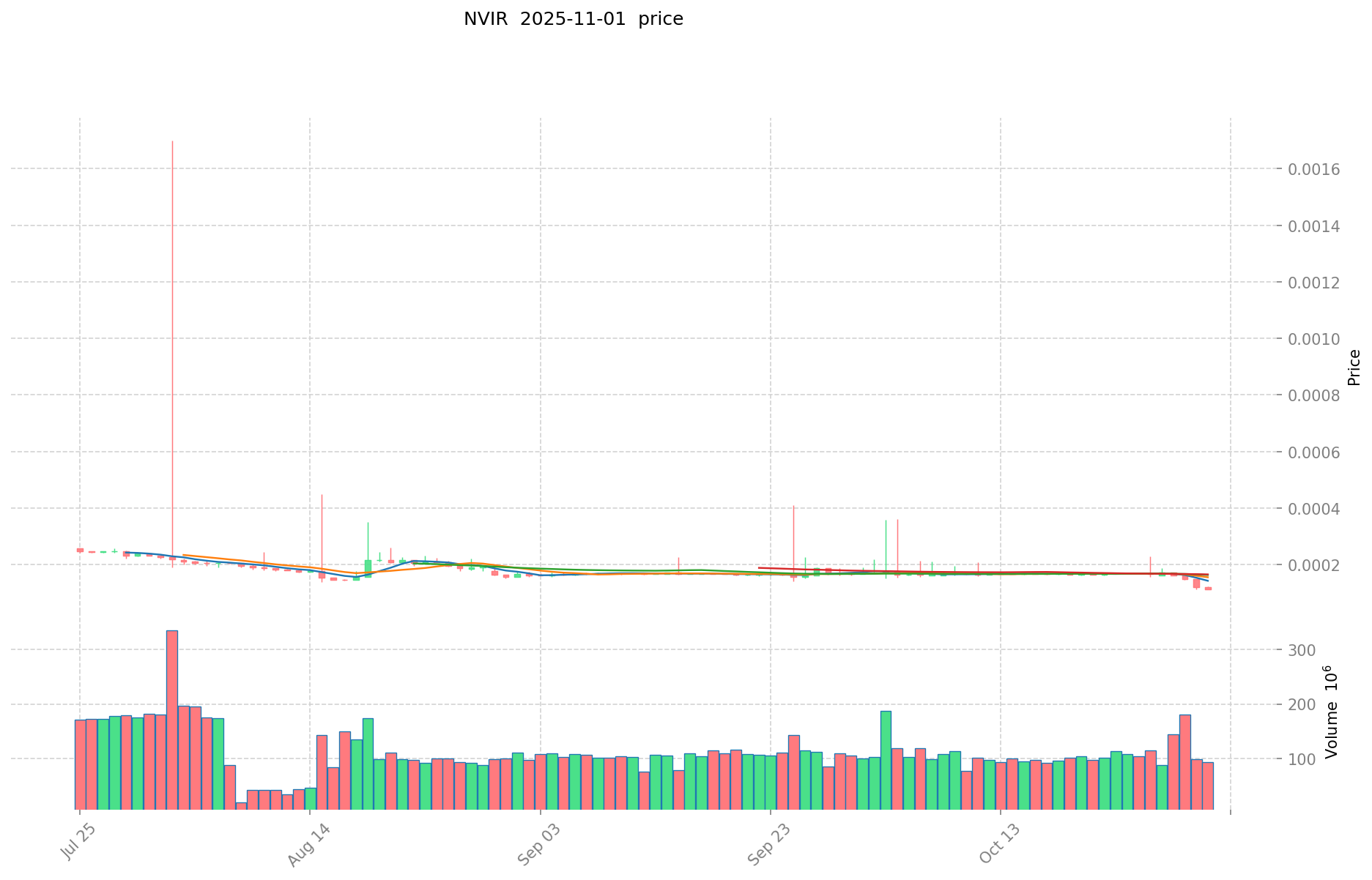

I. NVIR Fiyat Geçmişi ve Güncel Piyasa Durumu

NVIR Tarihsel Fiyat Gelişimi

- 2022: İlk çıkış, 25 Mart’ta fiyatı 1,67 dolarla zirve yaptı

- 2022: Piyasa düşüşü, 5 Nisan’da tüm zamanların en düşük seviyesi olan 0,00000305 dolara geriledi

- 2025: Süregelen piyasa zorlukları, fiyat 0,0001127 dolar civarında seyrediyor

NVIR Güncel Piyasa Durumu

1 Kasım 2025 itibarıyla NVIR, 0,0001127 dolardan işlem görüyor. Token, son bir yılda yüksek volatilite yaşadı ve değerinde %93,37 oranında düşüş gerçekleşti. Son 24 saatte NVIR’da %6,85 gerileme ile olumsuz piyasa havası devam ediyor. Token’ın piyasa değeri 144.498 dolar, dolaşımdaki arzı ise 1.282.148.079 NVIR. Son 24 saatteki işlem hacmi 11.199 dolar olup, bu rakam orta seviyede piyasa hareketliliğine işaret ediyor. Mevcut düşük fiyatına rağmen NVIR, zirve fiyatı olan 1,67 dolardan oldukça uzak ve bu durum, son yıllarda kripto para piyasasında yaşanan zorlukları yansıtıyor.

Güncel NVIR piyasa fiyatını görüntüleyin

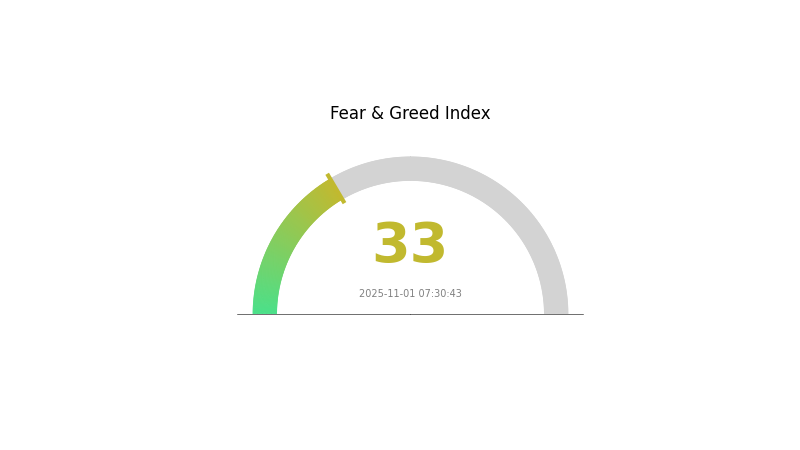

NVIR Piyasa Duyarlılık Göstergesi

2025-11-01 Korku ve Açgözlülük Endeksi: 33 (Korku)

Güncel Korku ve Açgözlülük Endeksi’ni inceleyin

Kripto piyasasında temkinli bir hava hakim. Korku ve Açgözlülük Endeksi 33 seviyesinde ve piyasa katılımcılarının korku içinde olduğunu gösteriyor. Bu, yatırımcıların çekimser ve riskten kaçınan tutumda olduğunu, karşıt görüşlü yatırımcılar için ise alım fırsatları oluşabileceğini gösteriyor. Ancak, detaylı araştırma yapmak ve riskleri dikkatli şekilde yönetmek gereklidir. Mevcut duyarlılık, piyasadaki belirsizlikleri ve son fiyat dalgalanmalarını yansıtıyor olabilir. Her zaman olduğu gibi, çeşitlendirme ve uzun vadeli stratejiyle hareket etmek volatil kripto piyasasında başarılı olmanın anahtarıdır.

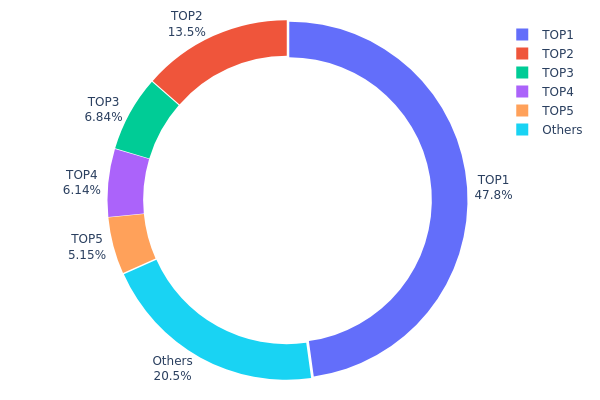

NVIR Varlık Dağılımı

NVIR’ın adres bazlı varlık dağılımı, son derece yoğun bir sahiplik yapısı olduğunu gösteriyor. En büyük adres, muhtemelen bir yakım adresi (0x0000...00dead), toplam arzın %47,80’ini elinde bulunduruyor; bu tokenler fiilen dolaşımdan çıkarılmış durumda. Sonraki dört büyük adres ise toplam arzın %31,65’ini kontrol etmekte ve bu adreslerin her birinin sahipliği %5,14 ile %13,54 arasında değişiyor.

Bu yoğunlaşma, token’in merkeziyetsizliği ve piyasa istikrarı açısından risk teşkil ediyor. NVIR tokenlerinin %79’undan fazlası yalnızca beş adreste bulunduğundan, piyasa manipülasyonu ve fiyat oynaklığı potansiyeli yüksek. Büyük adreslerden herhangi birinin satış veya transfer yapması halinde ani fiyat hareketleri yaşanabilir.

Yakım adresindeki yüksek yoğunluk, dolaşımdaki arzı azalttığı için olumlu görülse de, diğer büyük adreslerdeki yüksek varlıklar zincir üstü hareketlerin dikkatle izlenmesini gerektiriyor. Bu dağılım, NVIR’ın piyasa dinamiklerini ve likiditeyi etkileyebilir, yaygın benimsenme önünde engel oluşturabilir.

Güncel NVIR Varlık Dağılımını görüntüleyin

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 5.115.094,68K | 47,80% |

| 2 | 0x802a...d9f2c3 | 1.449.415,71K | 13,54% |

| 3 | 0x1297...216e03 | 731.875,10K | 6,83% |

| 4 | 0x09d2...678edc | 657.108,08K | 6,14% |

| 5 | 0x3335...7c5c6c | 550.983,33K | 5,14% |

| - | Diğerleri | 2.195.523,10K | 20,55% |

II. NVIR’ın Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Makroekonomik Ortam

- Para Politikası Etkisi: Büyük merkez bankalarının politikaları NVIR fiyatını etkileyebilir, küresel ekonomik koşullar ise değerlemesinde belirleyicidir.

- Enflasyona Karşı Koruma Potansiyeli: Enflasyonist ortamlarda NVIR’ın performansı fiyat hareketlerinde rol oynayabilir.

- Jeopolitik Faktörler: Uluslararası gelişmeler ve gerilimler NVIR fiyatında dalgalanmalara yol açabilir, küresel ekonomik istikrar ise yatırımcıların tutumunu belirler.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Teknolojik İlerlemeler: Sektördeki yenilikler ve gelişmeler NVIR fiyatında etkili olabilir.

- Ekosistem Uygulamaları: NVIR ile ilişkili başlıca DApp’ler ve ekosistem projeleri, değer önerisini ve benimsenmeyi artırabilir.

III. NVIR 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00007 - 0,00009 dolar

- Tarafsız tahmin: 0,00010 - 0,00012 dolar

- İyimser tahmin: 0,00013 - 0,00014 dolar (olumlu piyasa koşulları ile)

2027-2028 Görünümü

- Piyasa fazı: Büyüme potansiyeli dönemi

- Fiyat aralığı öngörüsü:

- 2027: 0,00008 - 0,00016 dolar

- 2028: 0,00014 - 0,00016 dolar

- Temel katalizörler: Artan benimsenme ve teknolojik gelişmeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00015 - 0,00020 dolar (istikrarlı piyasa büyümesi ile)

- İyimser senaryo: 0,00020 - 0,00025 dolar (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: 0,00025 - 0,00030 dolar (çığır açan yeniliklerle)

- 2030-12-31: NVIR 0,00025 dolar (olası zirve fiyatı)

| Yıl | Öngörülen En Yüksek Fiyat | Öngörülen Ortalama Fiyat | Öngörülen En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00014 | 0,00011 | 0,00007 | 0 |

| 2026 | 0,00015 | 0,00013 | 0,00008 | 11 |

| 2027 | 0,00016 | 0,00014 | 0,00008 | 21 |

| 2028 | 0,00016 | 0,00015 | 0,00014 | 32 |

| 2029 | 0,0002 | 0,00015 | 0,0001 | 34 |

| 2030 | 0,00025 | 0,00018 | 0,00012 | 57 |

IV. NVIR İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

NVIR Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli bakış açısına sahip ve risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde NVIR biriktirin

- Kısmi kar realizasyonu için fiyat hedefleri belirleyin

- Token’ları güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönünü ve olası dönüş noktalarını belirlemek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izleyin

- Dalgalı işlem için önemli noktalar:

- Destek ve direnç seviyelerini belirleyin

- Risk yönetimi için zarar-durdur emirleri kullanın

NVIR Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara dağıtın

- Zarar-durdur emirleri: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Cüzdan

- Sıcak cüzdan çözümü: Aktif alım-satım için Gate.com’un dahili cüzdanını kullanın

- Güvenlik önlemleri: İki aşamalı doğrulama etkinleştirilmeli, güçlü şifreler kullanılmalı

V. NVIR İçin Potansiyel Riskler ve Zorluklar

NVIR Piyasa Riskleri

- Yüksek volatilite: NVIR fiyatında ciddi dalgalanmalar yaşanabilir

- Sınırlı likidite: Büyük hacimli işlemlerde likidite sorunu yaşanabilir

- Rekabet: Diğer Web3 oyun platformları NVIR’ın pazar payını etkileyebilir

NVIR Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Web3 ve oyun tokenlerine yönelik denetim riski bulunuyor

- Sınır ötesi uyum: Farklı ülkelerdeki düzenlemeler benimsemeyi etkileyebilir

- Vergi sonuçları: Değişen vergilendirme kuralları NVIR işlemlerini ve varlıklarını etkileyebilir

NVIR Teknik Riskler

- Akıllı kontrat açıkları: Token’ın temel kodunda güvenlik açıkları olabilir

- Ölçeklenebilirlik sorunları: NWS platformu yoğun kullanıcı ilgisiyle sorun yaşayabilir

- Birlikte çalışabilirlik endişeleri: Diğer blokzincir ağları ve oyunlarla entegrasyon teknik zorluklar getirebilir

VI. Sonuç ve Eylem Önerileri

NVIR Yatırım Değerinin Değerlendirilmesi

NVIR, Web3 oyun sektöründe spekülatif bir yatırım fırsatı sunar. NWS platformu ile büyüme potansiyeli taşısa da, piyasa oynaklığı ve Web3 oyun sektörünün erken aşaması nedeniyle kayda değer riskler barındırır.

NVIR Yatırım Önerileri

✅ Yeni başlayanlar: Kapsamlı araştırmadan sonra küçük, keşif amaçlı pozisyonlar alın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle ortalama maliyetle alım stratejisi uygulayın ✅ Kurumsal yatırımcılar: Detaylı inceleme ile NVIR’ı çeşitlendirilmiş kripto portföyünde değerlendirin

NVIR Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com’da NVIR doğrudan satın alınabilir

- Limit emirleri: İstenilen fiyat seviyesinden alım için kullanılabilir

- DCA (Ortalama Maliyetle Alım): Zamanlama riskini azaltmak için düzenli küçük alımlar yapılabilir

Kripto para yatırımları son derece yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarını göz önünde bulundurarak temkinli kararlar almalı ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

Solana 2025’te 1.000 dolara ulaşabilir mi?

Evet, Solana 2025’te 1.000 dolara ulaştı. Güçlü kurumsal benimseme, teknolojik yenilikler ve düzenleyici zorlukların başarıyla aşılması bu başarının ana etkenlerindendir.

ICE’ın 2025’teki fiyatı ne olacak?

ICE’ın 2025’te yükseliş döneminde 0,01317 dolara ulaşması bekleniyor; fakat ivme kaybederse fiyatı 0,0001288 dolara kadar inebilir.

Pi Coin 100 dolara ulaşır mı?

Olası fakat kesin değil. Tahminler, Pi’nin 2030’da yaygın şekilde benimsenirse 500 dolara ulaşabileceğini gösteriyor. Mevcut öngörüler 100 doları doğrulamıyor.

2025’te kripto için fiyat tahmini nedir?

Bitcoin’in 2025’te 60.000 dolara, Ethereum’un 4.000 dolara ve Solana’nın 200 dolara ulaşması bekleniyor; bu tahminler güncel piyasa trendleri ve uzman öngörülerine dayanmaktadır.

2025 CELB Fiyat Tahmini: Bu Yükselen Kripto Paranın Piyasa Trendleri ve Geleceğine Dair Analiz

2025 VRA Fiyat Tahmini: Sanal Gerçeklik Varlıkları İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

2025 AIOZ Fiyat Tahmini: Web3 Ağ Tokeni'nin Büyüme Faktörleri ve Piyasa Potansiyelinin Analizi

2025 FUN Fiyat Tahmini: Dijital eğlence ekosisteminin hızla genişlediği mevcut ortamda, FUN Token’ın piyasa trendleri ve gelecekteki büyüme potansiyeli detaylı şekilde analiz ediliyor.

Adventure Gold (AGLD) İyi Bir Yatırım mı?: NFT Ekosisteminde Bu Oyun Token’ının Uzun Vadeli Potansiyeli Nasıl Değerlendirilmeli?

Sleepless AI (AI) iyi bir yatırım mı?: Gelişen yapay zeka sektöründe uzun vadeli büyüme potansiyeli ve risklerin incelenmesi

USDC ve USDT'nin Kapsamlı Karşılaştırması: Stablecoin Kılavuzu

2025 SWEAT Fiyat Tahmini: Uzman Analizi ve Gelecek Yıla Yönelik Piyasa Öngörüsü

2025 BLUE Fiyat Tahmini: Uzman Analizi ve Önümüzdeki Yıla Dair Piyasa Beklentileri

ENA Sentetik Stablecoin Protokolü’ne Kapsamlı Rehber