2025 NFT Price Prediction: The Rise of Digital Collectibles in a Post-Pandemic Economy

Introduction: NFT's Market Position and Investment Value

APENFT (NFT), as a foundation dedicated to NFT-izing and blockchaining top global artworks, has made significant strides since its inception in 2021. As of 2025, APENFT's market capitalization has reached $411,487,921, with a circulating supply of approximately 990,105,682,877,398 tokens, and a price hovering around $0.0000004156. This asset, often referred to as the "digital art tokenization pioneer," is playing an increasingly crucial role in the fields of art, collectibles, and digital asset ownership.

This article will comprehensively analyze APENFT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. NFT Price History Review and Current Market Status

NFT Historical Price Evolution

- 2021: APENFT foundation officially established, price reached all-time high of $0.00000753

- 2023: Market downturn, price dropped to all-time low of $0.000000298737

- 2025: Market recovery, price stabilized around $0.0000004156

NFT Current Market Situation

As of October 17, 2025, APENFT (NFT) is trading at $0.0000004156, with a 24-hour trading volume of $19,480.79. The token has experienced a slight decrease of 0.55% in the past 24 hours. APENFT currently ranks 177th in the cryptocurrency market with a market capitalization of $411,487,921.80. The circulating supply stands at 990,105,682,877,398 NFT tokens, which is 99.01% of the total supply of 999,990,000,000,000 tokens. Over the past week, NFT has seen a decline of 3.69%, while its 30-day performance shows a decrease of 6.02%. However, looking at the yearly performance, NFT has shown a slight increase of 0.19%.

Click to view the current NFT market price

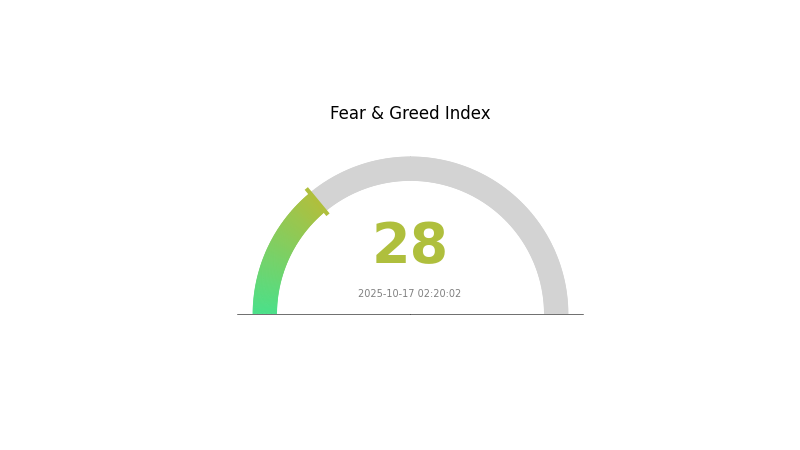

NFT Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The NFT market sentiment remains cautious, with the Fear and Greed Index at 28, indicating a state of fear. This suggests investors are hesitant and risk-averse. During such periods, some see opportunities for strategic acquisitions, while others prefer to wait for clearer market signals. It's crucial to conduct thorough research and consider your risk tolerance before making investment decisions. Remember, market sentiment can shift rapidly, so staying informed is key.

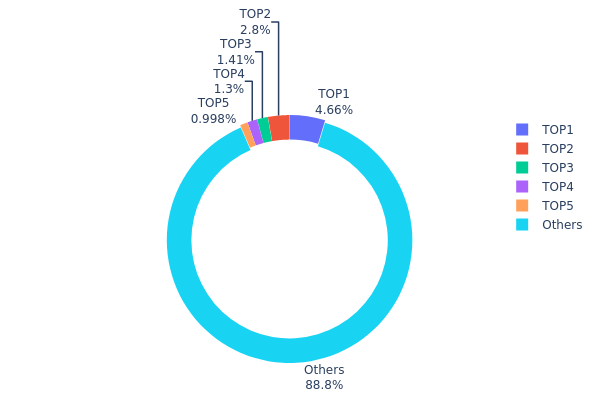

NFT Holdings Distribution

The address holdings distribution data provides insights into the concentration of NFT ownership within the market. Analysis of the provided data reveals a relatively decentralized distribution, with the top 5 addresses collectively holding 11.13% of the total supply. The largest single address holds 4.65% of the tokens, while the majority (88.87%) is distributed among numerous other addresses.

This distribution pattern suggests a moderate level of decentralization, which is generally positive for market stability. The absence of extreme concentration reduces the risk of market manipulation by a single large holder. However, the presence of addresses holding over 1% each still indicates some level of whale activity that could potentially influence market dynamics.

Overall, the current holdings distribution reflects a reasonably healthy market structure with a good balance between larger stakeholders and broader community participation. This distribution supports market liquidity and potentially reduces volatility, as no single entity has overwhelming control over the token supply.

Click to view the current NFT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | TPyjyZ...kgNan5 | 46598986588.07K | 4.65% |

| 2 | TAA7Uj...RfK8QA | 28036478575.09K | 2.80% |

| 3 | TM3sTV...rKDt7b | 14086222012.69K | 1.40% |

| 4 | TP1V18...gHtWHZ | 12964759828.61K | 1.29% |

| 5 | TUjx6w...3WmJTZ | 9975516375.70K | 0.99% |

| - | Others | 888328036619.84K | 88.87% |

II. Key Factors Affecting Future NFT Prices

Supply Mechanism

- Limited Edition Releases: NFT projects often use limited supply to create scarcity and drive demand.

- Historical Pattern: Previous supply changes have significantly impacted NFT prices, with rarer collections generally commanding higher values.

- Current Impact: The trend of "one-to-many" releases for digital collectibles may dilute the non-fungible nature of NFTs, potentially affecting their perceived value.

Institutional and Whale Dynamics

- Institutional Holdings: Major investment firms like Andreessen Horowitz (a16z) have invested over $600 million in NFT infrastructure and platforms.

- Corporate Adoption: Walmart and other major retailers are now selling NFT-linked physical products, broadening the market reach.

- National Policies: Some countries are developing regulatory frameworks for NFTs, which could impact market dynamics.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and interest rate changes can affect investment flows into NFT markets.

- Inflation Hedge Properties: Some investors view certain NFT collections as potential stores of value during inflationary periods.

- Geopolitical Factors: Global economic uncertainties may influence the perception of NFTs as alternative assets.

Technological Development and Ecosystem Building

- Blockchain Upgrades: Improvements in underlying blockchain technology can enhance NFT functionality and reduce transaction costs.

- Layer 2 Solutions: The development of scaling solutions may increase NFT adoption by improving transaction speed and reducing fees.

- Ecosystem Applications: The growth of NFT-based games, virtual worlds, and decentralized finance (DeFi) integrations expands use cases and potential value.

III. NFT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1,000 - $1,500

- Neutral prediction: $1,500 - $2,000

- Optimistic prediction: $2,000 - $2,500 (requires sustained market growth and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential consolidation and growth phase

- Price range forecast:

- 2027: $2,300 - $3,200

- 2028: $3,500 - $4,800

- Key catalysts: Mainstream adoption, improved infrastructure, and integration with real-world assets

2029-2030 Long-term Outlook

- Base scenario: $5,000 - $7,000 (assuming steady market growth and technological advancements)

- Optimistic scenario: $7,000 - $9,000 (with widespread institutional adoption and regulatory clarity)

- Transformative scenario: $9,000 - $12,000 (with revolutionary use cases and global acceptance)

- 2030-12-31: NFT $8,750 (75% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 8 |

| 2027 | 0 | 0 | 0 | 14 |

| 2028 | 0 | 0 | 0 | 37 |

| 2029 | 0 | 0 | 0 | 50 |

| 2030 | 0 | 0 | 0 | 75 |

IV. Professional NFT Investment Strategies and Risk Management

NFT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operational suggestions:

- Research and invest in NFTs with strong fundamentals and community support

- Diversify across different NFT categories and projects

- Store NFTs securely in a hardware wallet or trusted custodial solution

(2) Active Trading Strategy

- Technical analysis tools:

- Volume indicators: Monitor trading activity and liquidity

- Moving averages: Identify trends and potential entry/exit points

- Key points for swing trading:

- Set clear profit targets and stop-loss levels

- Stay informed about project developments and market sentiment

NFT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5% of portfolio

- Moderate investors: 5-10% of portfolio

- Aggressive investors: 10-20% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple NFT projects and categories

- Dollar-cost averaging: Gradually build positions over time to reduce timing risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use strong passwords, enable two-factor authentication, and be cautious of phishing attempts

V. Potential Risks and Challenges of NFTs

NFT Market Risks

- Volatility: Extreme price fluctuations can lead to significant losses

- Liquidity risk: Some NFTs may be difficult to sell quickly without impacting price

- Market manipulation: Wash trading and artificial price inflation

NFT Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny and restrictions

- Tax implications: Evolving tax treatment of NFT transactions

- Copyright and intellectual property issues: Disputes over ownership and rights

NFT Technical Risks

- Smart contract vulnerabilities: Potential for hacks or exploits

- Blockchain scalability: Network congestion and high gas fees

- Interoperability challenges: Limited cross-chain functionality

VI. Conclusion and Action Recommendations

NFT Investment Value Assessment

NFTs offer potential for high returns but come with significant risks. Long-term value lies in unique digital ownership and community engagement, while short-term risks include market volatility and regulatory uncertainty.

NFT Investment Recommendations

✅ Beginners: Start with small investments in established NFT projects, focus on education ✅ Experienced investors: Diversify across NFT categories, actively manage positions ✅ Institutional investors: Develop comprehensive NFT strategy, consider creating own NFTs

NFT Participation Methods

- Purchase on NFT marketplaces: Buy and sell NFTs on platforms like Gate.com

- Create and mint NFTs: Develop original digital content and tokenize as NFTs

- Participate in NFT-based games and metaverse projects: Engage with interactive NFT ecosystems

Cryptocurrency investments are extremely risky. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

How much is NFT worth in 2025?

In 2025, the NFT market is estimated to be worth around $200 billion, with continued growth in digital art, gaming, and collectibles sectors.

What will be the value of NFT in 2030?

The NFT market is projected to reach $232 billion by 2030, with a CAGR of over 50%. This forecast indicates substantial growth and increasing value for NFTs.

How much is $1.00 NFT worth in dollars?

As of October 17, 2025, $1.00 NFT is worth approximately $0.0000004198 in dollars. NFT prices can fluctuate rapidly in the crypto market.

Are NFTs worth it in 2025?

Yes, NFTs are worth it in 2025. They've evolved into functional digital assets with real utility in gaming, real estate, and music. Investing in NFTs with genuine use cases shows strong potential for returns.

Share

Content