2025 MSN Fiyat Tahmini: Dijital Ekonomide Merkeziyetsiz Depolamanın Geleceğinde Yol Almak

Giriş: MSN'nin Piyasa Konumu ve Yatırım Değeri

Meson Network (MSN), Web3 ekosisteminde merkeziyetsiz bant genişliği pazarı olarak kurulduğundan bu yana dikkate değer bir gelişim göstermektedir. 2025 itibarıyla, MSN'nin piyasa değeri 163.703,77 $, dolaşımda yaklaşık 17.456.150 token bulunmakta ve fiyatı 0,009378 $ civarında seyretmektedir. "Bant genişliği gelirleştirme çözümü" olarak öne çıkan bu varlık, merkeziyetsiz depolama, hesaplama ve gelişen Web3 Dapp ekosisteminde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, MSN'nin 2025-2030 dönemindeki fiyat eğilimleri; geçmiş performans, piyasa arz ve talebi, ekosistem gelişimi ile makroekonomik etkenler göz önünde bulundurularak detaylı biçimde analiz edilmekte, profesyonel fiyat tahminleri ve yatırımcılara uygulanabilir stratejiler sunulmaktadır.

I. MSN Fiyat Geçmişi ve Güncel Piyasa Durumu

MSN Tarihsel Fiyat Gelişim Süreci

- 2024: Proje lansmanı, fiyat 29 Nisan'da tüm zamanların en yüksek seviyesi olan 13,638 $'a ulaştı

- 2025: Piyasa düşüşü, fiyat 10 Eylül'de tüm zamanların en düşük seviyesi olan 0,007028 $'a geriledi

MSN Güncel Piyasa Durumu

1 Kasım 2025 itibarıyla MSN'nin fiyatı 0,009378 $ olup, bu değer tüm zamanların en yüksek seviyesinden %92,84 oranında gerilemiştir. Token, son 24 saatte %6,66, son bir haftada ise %20,08 düşüşle negatif performans göstermiştir. Mevcut piyasa değeri 163.703,77 $, dolaşımdaki MSN token adedi ise 17.456.150'dir. Son 24 saatteki işlem hacmi 23.956,55 $ ile piyasada orta düzeyde bir hareketlilik yaşanmaktadır. Tam seyreltilmiş değerleme 937.800 $ olup, projenin ilgi görmesi halinde büyüme potansiyeli taşımaktadır. Kısa vadede piyasa eğilimi düşüş yönünde olup, token üzerinde aşağı yönlü baskı bulunmaktadır.

Güncel MSN piyasa fiyatını görüntüleyin

MSN Piyasa Duyarlılık Göstergesi

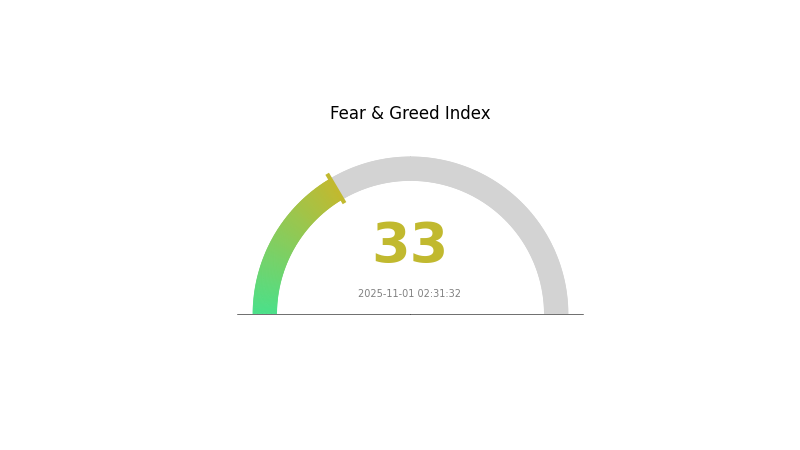

2025-11-01 Korku ve Açgözlülük Endeksi: 33 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntüleyin

Kripto piyasasında duyarlılık "Korku" bölgesinde seyretmekte ve Korku ve Açgözlülük Endeksi 33 seviyesindedir. Bu, yatırımcılar arasında temkinli bir havaya ve piyasanın düşük değerlenmiş olabileceğine işaret eder. Geçmişte korku dönemleri genellikle piyasa toparlanmalarından önce yaşanmıştır. Yine de, yatırımcıların dikkatli olması ve yatırım kararı öncesinde detaylı araştırma yapmaları önerilir. Gate.com, bu belirsiz dönemde kapsamlı piyasa verisi ve analiz araçlarıyla yatırımcılara destek sunmaktadır. Unutulmamalıdır ki, kripto piyasası yüksek volatiliteye sahip olup piyasa duyarlılığı hızla değişebilir.

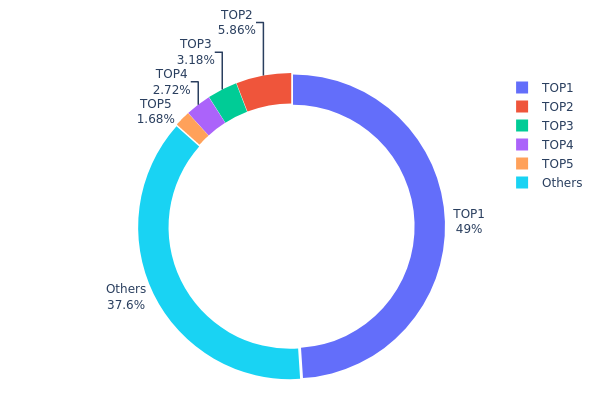

MSN Varlık Dağılımı

MSN'nin adres varlık dağılımı, son derece yoğun bir sahiplik yapısına işaret etmektedir. En büyük adres, toplam arzın %48,95’ini elinde bulundurarak MSN tokenlerinin neredeyse yarısını kontrol etmektedir. Bu seviye, piyasa dinamiklerinde etkili olabilir. Sonraki dört büyük adres, arzın toplamda %13,44’ünü elinde tutmakta olup, ilk 5 adresin sahipliği %62,39’a ulaşmaktadır.

Böylesi bir yoğunlaşma, piyasa manipülasyonu riskini ve olası fiyat dalgalanmalarını artırır. Tek bir adresin arzın yaklaşık yarısına sahip olması, büyük işlemler gerçekleşirse fiyatlarda ani değişimlere yol açabilir. Ayrıca, bu yoğunluk MSN'nin sahiplik yapısında merkeziyetsizliğin düşük olduğunu gösterir; bu durum yönetişim kararlarını ve piyasa istikrarını etkileyebilir.

Arzın %37,61’i diğer adresler arasında dağılmış olsa da, mevcut sahiplik desenleri, piyasa dayanıklılığını artırmak ve merkezileşme riskini azaltmak için daha yaygın bir dağılım gerektirmektedir. Bu yoğunlaşma seviyesi, MSN'nin fiyat hareketleri ve piyasa sağlığı üzerindeki muhtemel etkileri açısından yatırımcılar tarafından yakından takip edilmelidir.

Güncel MSN Varlık Dağılımını görüntüleyin

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdecd...beeb0e | 51.401,86K | 48,95% |

| 2 | 0x0529...c553b7 | 6.153,17K | 5,86% |

| 3 | 0x0d07...b492fe | 3.342,20K | 3,18% |

| 4 | 0x93ae...1462f8 | 2.857,14K | 2,72% |

| 5 | 0x91d4...c8debe | 1.764,23K | 1,68% |

| - | Others | 39.481,39K | 37,61% |

II. MSN'nin Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Talebi: MSN fiyatının yükselmesi doğrudan piyasa talebindeki artışa bağlıdır.

- Güncel Etki: Daha fazla yatırımcı ve kullanıcı MSN almaya başladıkça fiyat üzerinde olumlu etki görülmesi beklenir.

Kurumsal ve Büyük Sahip Dinamikleri

- Kurumların Benimsemesi: MSN'nin yatırımcılar ve kullanıcılar tarafından artan şekilde benimsenmesi fiyatın yükselmesinde ana etkendir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özellikleri: Bitcoin gibi kripto para örneklerinde olduğu gibi, MSN belli koşullarda enflasyona karşı koruma sağlayabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Kullanıcı Büyümesi: MSN'nin kullanıcı tabanının genişlemesi, gelecekteki fiyat hareketinin temel belirleyicisidir.

- Ekosistem Uygulamaları: MSN ekosisteminde uygulama ve projelerin gelişimi, talebin artmasını ve fiyatın yükselmesini destekleyebilir.

III. MSN 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00703 $ - 0,00938 $

- Tarafsız tahmin: 0,00938 $ - 0,01064 $

- İyimser tahmin: 0,01064 $ - 0,01191 $ (olumlu piyasa duyarlılığı gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Büyüme dönemi potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,01087 $ - 0,01519 $

- 2028: 0,00848 $ - 0,02064 $

- Başlıca katalizörler: Artan benimseme ve teknolojik ilerleme

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01496 $ - 0,01861 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,01861 $ - 0,02538 $ (olumlu piyasa koşulları varsayımıyla)

- Dönüştürücü senaryo: 0,02538 $ üzeri (aşırı olumlu gelişmelerde)

- 2030-12-31: MSN 0,02538 $ (iyimser projeksiyona göre potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,01191 | 0,00938 | 0,00703 | 0 |

| 2026 | 0,01554 | 0,01064 | 0,00692 | 13 |

| 2027 | 0,01519 | 0,01309 | 0,01087 | 39 |

| 2028 | 0,02064 | 0,01414 | 0,00848 | 50 |

| 2029 | 0,01861 | 0,01739 | 0,01496 | 85 |

| 2030 | 0,02538 | 0,018 | 0,0153 | 91 |

IV. MSN Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MSN Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde MSN token biriktirin

- Önemli piyasa hareketleri için fiyat uyarıları belirleyin

- Tokenleri güvenli donanım cüzdanlarında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Eğilimleri ve olası dönüş noktalarını belirlemek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım ve aşırı satım durumlarını izleyin

- Dalgalı alım-satım için ana noktalar:

- Olası trend değişiklikleri için işlem hacmini takip edin

- Risk yönetimi için zararı durdur emirleri kullanın

MSN Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %15'i

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları birden fazla kripto para ve varlık sınıfına yaymak

- Düzenli alım (Dollar-Cost Averaging): Volatilite etkisini azaltmak için düzenli küçük alımlar yapmak

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk saklama çözümü: Uzun vadeli yatırımlar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü doğrulama kullanın, özel anahtarları güvenli şekilde yedekleyin

V. MSN Potansiyel Riskler ve Zorluklar

MSN Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında büyük fiyat dalgalanmaları sıklıkla görülür

- Sınırlı likidite: Büyük işlemlerin fiyat üzerinde baskı oluşturmadan gerçekleşmesi zor olabilir

- Genel kripto piyasasıyla korelasyon: Genel piyasa duyarlılığı MSN fiyatını etkileyebilir

MSN Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Tokenin kullanımını etkileyebilecek yeni regülasyonlar gündeme gelebilir

- Sınır ötesi uyumluluk: Farklı ülkelerde değişen yasal statü

- AML/KYC gereklilikleri: Token erişimi ve alım-satım işlemlerinde değişikliklere yol açabilir

MSN Teknik Riskler

- Akıllı sözleşmede açıklar: Temel yazılımda istismar riski

- Ağ tıkanıklığı: Yoğun talep dönemlerinde ölçeklenebilirlik sorunları yaşanabilir

- Teknolojik eskime: MSN'nin daha yeni blokzincir çözümlerinin gerisinde kalma riski

VI. Sonuç ve Eylem Tavsiyeleri

MSN Yatırım Değeri Değerlendirmesi

MSN, Web3 bant genişliği pazarında yüksek riskli fakat yüksek potansiyele sahip bir yatırım alternatifidir. Uzun vadeli değer potansiyeli güçlü olmakla birlikte, kısa vadeli fiyat oynaklığı ve düzenleyici belirsizlikler ciddi riskler taşır.

MSN Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Sınırlı yatırım, eğitim ve piyasa takibine odaklanın ✅ Deneyimli yatırımcılar: Çeşitlendirilmiş portföy içinde küçük pozisyon değerlendirilebilir ✅ Kurumsal yatırımcılar: Detaylı inceleme gereklidir, stratejik yatırım fırsatı olabilir

MSN Alım-Satım Katılım Yöntemleri

- Spot işlem: MSN tokenlerini Gate.com üzerinden doğrudan alıp satma

- Staking: Ağ doğrulamasına katılarak ödül kazanma (uygunsa)

- DeFi entegrasyonu: Likidite sağlama veya getiri elde etme fırsatlarını değerlendirme (dikkatli olunmalı)

Kripto para yatırımları son derece yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre hareket etmeli, profesyonel finansal danışmanlarla görüşmelidir. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Microsoft hissesi 1000 $'a ulaşır mı?

Microsoft hissesi, yapay zeka ve bulut hizmetlerindeki güçlü büyümesiyle 1000 $ seviyesini potansiyel olarak görebilir. Şirketin piyasa liderliği ve artan gelirleri, bu hedefin önümüzdeki yıllarda ulaşılabilir olduğunu gösteriyor.

Mana 20 $'ı görür mü?

Decentraland'ın büyümesi sürerse, MANA uzun vadede 20 $ seviyesine ulaşabilir. Analistler, 2025 için 10 $ tahmin etmekte; bu da ileride 20 $'ın mümkün olmasını sağlayabilir.

Moderna hissesi için 12 aylık tahmin nedir?

Analist tahminlerine göre Moderna hissesinin 12 aylık ortalama beklentisi 206,72 $'dır; projeksiyonlar Eylül 2025 itibarıyla 100 $ ile 270 $ arasında değişmektedir.

MSN hissesinin uzun vadeli görünümü nedir?

MSN hissesinin 2025'te 0,34 $ ile 0,56 $ aralığında işlem görmesi beklenmekte olup, tahminler uzun vadede kademeli büyümeye işaret etmektedir.

2025 POKT Fiyat Tahmini: Pocket Network’in Yerel Token’ı İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 XL1 Fiyat Tahmini: Yeni Nesil Elektrikli Araç İçin Piyasa Trendleri ve Potansiyel Büyümenin Analizi

2025 NKN Fiyat Tahmini: Yeni Tür Ağ Tokeni'nin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 MOBILE Fiyat Tahmini: Gelecek Akıllı Telefon Maliyetlerini Belirleyen Piyasa Trendleri ve Teknolojik Unsurların Analizi

2025 BZZ Fiyat Tahmini: Web3 Depolama Ekosisteminde Swarm'ın Yerel Token Potansiyelini Analiz Etmek

2025 FIL Fiyat Tahmini: Filecoin'in Gelecekteki Değeri İçin Piyasa Trendleri ve Uzman Tahminlerinin Analizi

Satoshi Plus Konsensüs Mekanizmasını Anlamak

Geliştiriciler için zkSync Ekosistemine Kapsamlı Rehber

Dark Pool’ları Anlamak: Kripto Yatırımcılarına Yönelik Kapsamlı Bir Genel Bakış