2025 MPLX Fiyat Tahmini: Orta Akım Enerji Devi İçin Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

Giriş: MPLX’in Piyasa Konumu ve Yatırım Değeri

Metaplex (MPLX), Solana blokzincirinde dijital varlık oluşturma ve kullanımı için açık kaynaklı bir protokol olarak, kurulduğu günden bu yana önde gelen platformlarla önemli ölçüde entegre olmuştur. 2025 yılı itibarıyla Metaplex’in piyasa değeri 129.965.837 $’a ulaşırken, dolaşımdaki arzı yaklaşık 586.541.374 token ve fiyatı 0,22158 $ seviyesinde seyretmektedir. “NFT altyapı omurgası” olarak bilinen bu varlık, Web3 varlıklarının gelişimi ve yaygınlaşmasında giderek daha önemli bir rol üstlenmektedir.

Bu yazıda, Metaplex’in 2025-2030 dönemi fiyat dinamikleri; geçmiş eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar ışığında kapsamlı şekilde değerlendirilecek, yatırımcılara profesyonel fiyat tahminleri ile uygulamaya yönelik yatırım stratejileri sunulacaktır.

I. MPLX Fiyat Geçmişi ve Güncel Piyasa Durumu

MPLX Tarihsel Fiyat Seyri

- 2022: MPLX, 20 Eylül’de 0,896784 $ ile tüm zamanların rekor seviyesine ulaşarak önemli bir başarıya imza attı

- 2023: Piyasa düşüşe geçti, MPLX 12 Mayıs’ta 0,02528374 $ ile dibe vurdu

- 2025: MPLX toparlanma işaretleri gösteriyor; ancak hâlâ tarihi zirvesinin altında

MPLX’in Güncel Piyasa Durumu

20 Ekim 2025 itibarıyla MPLX, 0,22158 $ seviyesinden fiyatlanıyor ve son 24 saatte %4,83 yükseldi. Token’ın piyasa değeri 129.965.837,65 $ olup, küresel kripto sıralamasında 359’uncu sıradadır. Son dönemdeki yükselişe rağmen, MPLX son 30 günde %22,64 ve son bir yılda %47,43 değer kaybetti. Şu anki fiyat, zirvesinin %75,29 altında, en düşük seviyesinin ise %776,75 üzerinde yer alıyor. 1.000.000.000 toplam arzın 586.541.374’ü dolaşımda ve dolaşımdaki oran %58,65. VIX endeksinin 29 değeri, piyasada yatırımcıların korku halinde olduğunu gösteriyor.

Güncel MPLX piyasa fiyatını görmek için tıklayın

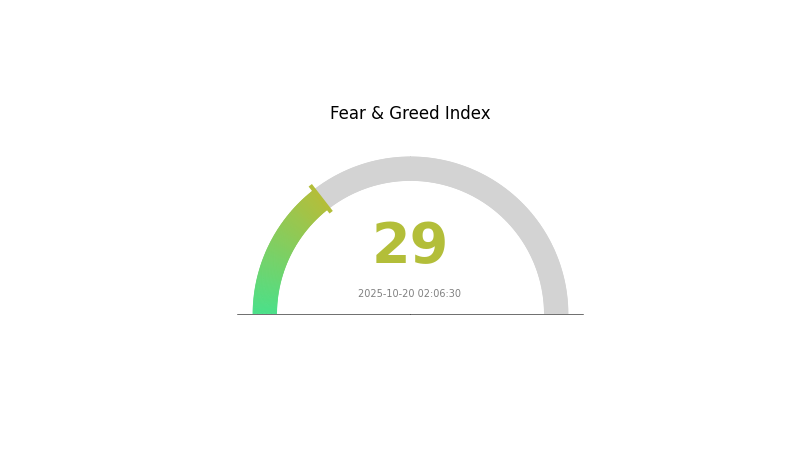

MPLX Piyasa Duyarlılık Göstergesi

2025-10-20 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında duyarlılık “Korku” bölgesinde kalırken endeks 29 seviyesinde. Bu durum, son dönemdeki piyasa belirsizliği veya düzenleyici gelişmeler nedeniyle yatırımcıların temkinli olduğunu işaret eder. Böyle zamanlarda, deneyimli yatırımcılar “diğerleri korkarken cesur ol” yaklaşımıyla düşük fiyatlardan toplama fırsatı görebilir. Ancak, bu yüksek oynaklık ortamında detaylı araştırma ve titiz risk yönetimi kritik önemdedir.

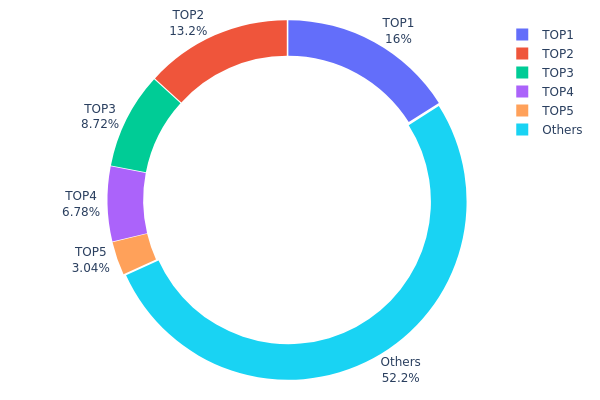

MPLX Varlık Dağılımı

MPLX’in adres bazlı varlık dağılımı, token sahipliğinde orta derecede bir yoğunlaşmaya işaret ediyor. En büyük ilk 5 adres, toplam arzın %47,77’sini elinde tutarken; en büyük sahip tek başına %16 paya sahip. Bu oran, az sayıda büyük yatırımcının fiyat üzerinde ciddi etkiye sahip olabileceğini gösteriyor.

Bu dağılım, aşırı merkeziyetsiz olmasa da fiyat dalgalanması ve manipülasyon riskine zemin hazırlayabilir. Büyük sahipler, yüksek hacimli işlemlerle likidite ve fiyatlarda belirleyici rol oynayabilir. Ancak, tokenların %52’sinden fazlası diğer adreslerde bulunuyor ve bu da merkeziyetsizliği güçlendirerek yoğunlaşma riskini kısmen azaltıyor.

Bu yapı, önemli paydaşlar ile geniş bir küçük yatırımcı tabanının bir arada bulunduğu, gelişen bir piyasa tablosu ortaya koyuyor. Orta düzeyde zincir üstü istikrar sunan bu ortamda, piyasada dayanıklılığı artırmak ve olası manipülasyon risklerini azaltmak için çeşitlendirme gerekliliği öne çıkıyor.

Güncel MPLX varlık dağılımını görmek için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | BHkk3R...4E254k | 160.000,02K | 16,00% |

| 2 | 3uNC2h...NF7zEi | 132.445,32K | 13,24% |

| 3 | E7Hzc1...nU53gK | 87.212,40K | 8,72% |

| 4 | 61pA3e...zEJoWD | 67.800,00K | 6,78% |

| 5 | 6v3sne...1CxM6P | 30.365,04K | 3,03% |

| - | Diğerleri | 522.159,70K | 52,23% |

II. MPLX’in Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Makroekonomik Ortam

- Enflasyona Karşı Koruma: MPLX, kripto para olarak enflasyona karşı koruma işlevi görebilir. Ancak, bu tür ortamlardaki performansı, çeşitli piyasa koşullarına ve faktörlere bağlıdır.

Teknik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: Ayrıntılar verilmemekle birlikte, MPLX üzerinde çeşitli merkeziyetsiz uygulamalar (DApp) ve ekosistem projeleri bulunması muhtemeldir. Bu uygulamalar, MPLX’in kullanım alanı ve benimsenmesini artırarak fiyat üzerinde etkili olabilir.

III. 2025-2030 MPLX Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,12608 $ - 0,20000 $

- Tarafsız tahmin: 0,20000 $ - 0,24000 $

- İyimser tahmin: 0,24000 $ - 0,24994 $ (olumlu piyasa duyarlılığı ve proje gelişmeleri durumunda)

2027-2028 Görünümü

- Piyasa fazı: Benimsemenin artmasıyla büyüme dönemi olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,19437 $ - 0,32307 $

- 2028: 0,22843 $ - 0,33679 $

- Başlıca katalizörler: Proje kilometre taşları, genel kripto trendleri ve potansiyel ortaklıklar

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,31483 $ - 0,37150 $ (istikrarlı piyasa büyümesi ve proje gelişimi varsayımıyla)

- İyimser senaryo: 0,37150 $ - 0,42817 $ (önemli proje başarıları ve piyasa genişlemesi halinde)

- Dönüştürücü senaryo: 0,42817 $ - 0,47180 $ (oldukça elverişli piyasa koşulları ve çığır açan yeniliklerle)

- 2030-12-31: MPLX 0,47180 $ (iyimser projeksiyona göre olası zirve fiyat)

| 年份 | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,24994 | 0,22119 | 0,12608 | 0 |

| 2026 | 0,28975 | 0,23557 | 0,18139 | 6 |

| 2027 | 0,32307 | 0,26266 | 0,19437 | 18 |

| 2028 | 0,33679 | 0,29286 | 0,22843 | 32 |

| 2029 | 0,42817 | 0,31483 | 0,20779 | 42 |

| 2030 | 0,4718 | 0,3715 | 0,2489 | 67 |

IV. MPLX Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MPLX Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde MPLX biriktirin

- Fiyat hedefleri belirleyin, portföyü düzenli olarak yeniden dengeleyin

- MPLX’i güvenli, saklayıcı olmayan cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend belirleme ve destek/direnç seviyeleri için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım durumlarını tespit etmede yardımcı olur

- Dalgalı al-sat için önemli noktalar:

- Solana ekosistemindeki gelişmeleri yakından takip edin

- Sıkı zarar-durdur ve kâr-al seviyeleri belirleyin

MPLX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklarına yaymak

- Opsiyon stratejileri: Düşüş riskine karşı satım opsiyonlarıyla korunmak

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama çözümü: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: Çok faktörlü kimlik doğrulama, düzenli güvenlik denetimleri uygulayın

V. MPLX İçin Potansiyel Riskler ve Zorluklar

MPLX Piyasa Riskleri

- Yüksek oynaklık: MPLX fiyatı ciddi dalgalanmalar gösterebilir

- Solana ile korelasyon: MPLX performansı Solana ekosistemiyle yakından bağlantılıdır

- Rekabet: Yeni NFT protokolleri, Metaplex’in pazar konumunu zorlayabilir

MPLX Düzenleyici Riskleri

- Belirsiz düzenleyici ortam: NFT ve dijital varlıklar için daha sıkı düzenleme olasılığı

- Sınır ötesi uyumluluk: Farklı bölgelerdeki değişken düzenlemeler benimsemeyi etkileyebilir

- Vergilendirme etkileri: Gelişen vergi mevzuatı, MPLX sahipleri ve NFT üreticilerini etkileyebilir

MPLX Teknik Riskleri

- Akıllı sözleşme açıkları: Metaplex protokolünde olası güvenlik zaafları

- Ölçeklenebilirlik sorunları: Solana ağındaki yoğunluk, Metaplex performansını etkileyebilir

- İş birliği sorunları: Sınırlı zincirler arası işlevsellik, büyümenin önünde engel olabilir

VI. Sonuç ve Eylem Önerileri

MPLX Yatırım Değeri Değerlendirmesi

MPLX, Solana’nın NFT ekosisteminin temel altyapısı olarak uzun vadede potansiyel sunar; ancak kısa vadede volatilite ve rekabet baskılarıyla karşı karşıyadır. Token’ın değeri, Solana’daki NFT büyümesi ve yaygınlaşmasıyla doğrudan ilişkilidir.

MPLX Yatırım Önerileri

✅ Yeni başlayanlar: Portföy çeşitliliği için küçük, uzun vadeli pozisyonlar değerlendirin

✅ Deneyimli yatırımcılar: Ortalama maliyetle alım yapın, Solana ekosistemini aktif izleyin

✅ Kurumsal yatırımcılar: MPLX’i geniş çaplı NFT ve Web3 yatırımlarınızda analiz edin

MPLX Alım-Satım Katılım Yöntemleri

- Spot alım-satım: MPLX’i Gate.com gibi güvenilir borsalarda alıp tutmak

- Staking: Uygunsa MPLX staking programlarına katılmak

- NFT oluşturma: Solana’da NFT üretmek ve satmak için Metaplex araçlarını kullanmak

Kripto para yatırımları yüksek risk taşır ve bu makale yatırım tavsiyesi niteliği taşımaz. Yatırım kararlarınızı kendi risk toleransınıza göre verin ve profesyonel finans danışmanlarına danışın. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

MPLX alınmalı mı, satılmalı mı, tutulmalı mı?

Mevcut piyasa koşulları ve potansiyel büyüme göz önüne alındığında, MPLX alım yönünde değerlendirilmektedir. Güçlü performansı ve pozitif görünümüyle 2025 için cazip bir yatırım fırsatı sunmaktadır.

MPLX temettüsü sürdürülebilir mi?

Evet, MPLX’in temettüsü sürdürülebilir görünmektedir. Şirket, sürekli temettü artışı ve orta akım operasyonlarından sağlam nakit akışı ile güçlü bir sicile sahiptir.

2025 için MPLX fiyat hedefi nedir?

Piyasa analizine göre MPLX’in 2025’te fiyat hedefi, Web3 sektöründeki potansiyel büyümeye paralel olarak token başına yaklaşık 45 $ ile 50 $ aralığında öngörülmektedir.

MPLX yatırımı yapmanın riskleri nelerdir?

MPLX yatırımı; piyasa volatilitesi, düzenleyici belirsizlik ve likidite riskleri taşır. Kripto piyasasındaki öngörülemezlik ve MPLX’in performansı, fiyatlarda önemli dalgalanmalara ve kayıplara yol açabilir.

GigaChad Meme Coin: Ernest Khalimov'un Web3 Fitness Topluluğu Üzerindeki Etkisi

2025 PENGU Fiyat Tahmini: Dijital varlık için piyasa trendleri ile potansiyel büyüme faktörlerinin kapsamlı analizi

Pakistan'daki NFT düzenlemelerine ilişkin en güncel gelişmeler ve küresel perspektifler

2025 A47 Fiyat Tahmini: Yatırımcılara Yönelik Kapsamlı Piyasa Analizi ve Gelecek Trendleri

2025 RARE Fiyat Tahmini: Büyüme Potansiyeli ve Token Değerini Etkileyen Piyasa Faktörlerinin Analizi

2025 LIKE Fiyat Tahmini: Sosyal Token’ın Piyasa Trendleri ve Büyüme Potansiyeli Analizi

TREE Nedir: Ağaç Veri Yapılarını ve Gerçek Hayattaki Uygulamalarını Anlama Rehberi

Blum Lansman Takvimi Detayları