2025 LRC Fiyat Tahmini: Loopring’in Token’ı DeFi Ekosisteminde Yeni Zirvelere Ulaşacak mı?

Giriş: LRC'nin Piyasa Konumu ve Yatırım Değeri

Loopring (LRC), ERC20 ve akıllı sözleşmeler üzerine kurulu açık çoklu token işlem protokolü olarak, 2017’deki başlangıcından bu yana önemli gelişmeler göstermiştir. 2025 yılı itibarıyla Loopring’in piyasa değeri 96.253.570 $’a ulaşırken, dolaşımdaki arzı yaklaşık 1.245.991.468 token seviyesindedir ve fiyatı 0,07006 $ civarında seyretmektedir. Sıklıkla “sıfır riskli token takas modeli” olarak anılan bu varlık, merkeziyetsiz borsa uygulamalarında giderek daha önemli bir rol üstlenmektedir.

Bu makalede, 2025-2030 döneminde Loopring’in fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler dikkate alınarak kapsamlı şekilde analiz edilecek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. LRC Fiyat Geçmişi ve Güncel Piyasa Durumu

LRC Tarihsel Fiyat Gelişimi

- 2017: İlk çıkış, fiyat yaklaşık 0,05 $ civarında seyretti

- 2018: Ayı piyasası dönemi, fiyat 0,02 $ seviyesine geriledi

- 2021: Boğa piyasası zirvesi, LRC tüm zamanların en yüksek seviyesi olan 3,75 $’a ulaştı

LRC Güncel Piyasa Durumu

LRC’nin mevcut işlem fiyatı 0,07006 $ olup, 24 saatlik işlem hacmi 235.174,55 $’dır. Token, son 24 saatte %2,25 yükselmiş; ancak son 30 günde %24,75, son bir yılda ise %48,5 değer kaybetmiştir. LRC’nin piyasa değeri 87.294.162 $ seviyesinde ve kripto paralar arasında 439. sıradadır. Güncel fiyat, 10 Kasım 2021’de görülen 3,75 $’lık zirvenin oldukça altındadır.

Güncel LRC piyasa fiyatını görüntülemek için tıklayın

LRC Piyasa Duyarlılığı Endeksi

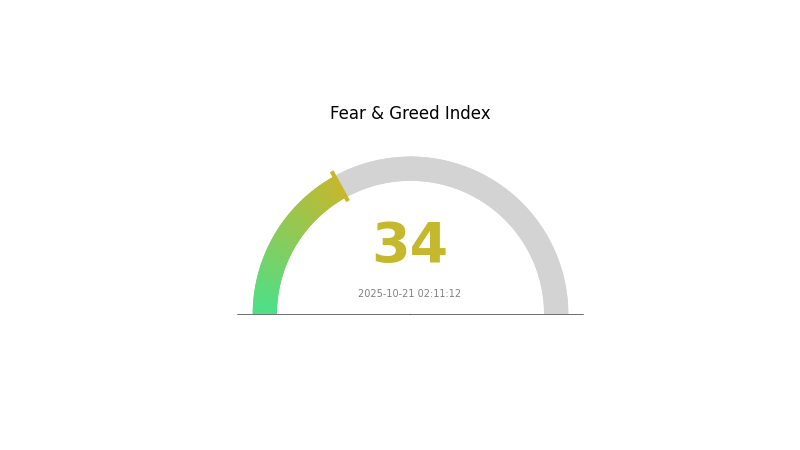

2025-10-21 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında duyarlılık temkinli seyrediyor; Korku ve Açgözlülük Endeksi’nin 34’te kalması, piyasada korkunun hakim olduğunu gösteriyor. Bu durum, yatırımcıların temkinli davranıp fırsat kolladıklarına işaret eder. Korku ortamı, birikim için uygun bir zaman olabilir; ancak kapsamlı araştırma yapıp, risk toleransınızı göz önünde bulundurmanız önemlidir. Piyasa duyarlılığının hızla değişebileceğini unutmayın; güncel kalarak uzun vadeli yatırım stratejinize sadık kalın.

LRC Dağılımı

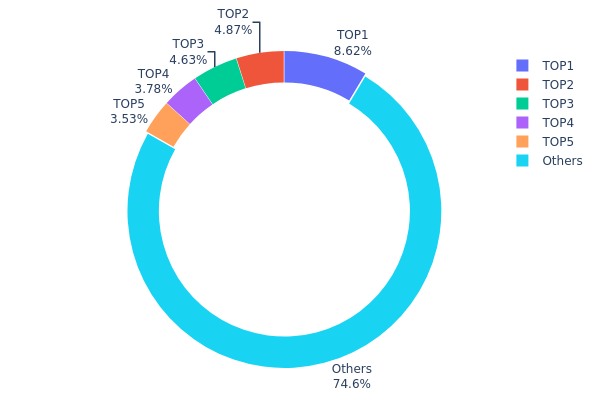

LRC’nin adres bazlı dağılım verileri, üst sıralardaki sahipler arasında orta düzeyde bir yoğunlaşma olduğunu gösteriyor. En büyük 5 adres toplam arzın %25,4’ünü elinde tutarken, en büyük adresin payı %8,62’dir. Bu yapı, göreceli dengeli bir sahiplik dağılımı sunmakla birlikte, üst segmentte halen belirgin bir yoğunlaşma mevcuttur.

En büyük sahipler önemli etkiye sahip olsa da, LRC tokenlarının %74,6’sının diğer adresler arasında dağılmış olması, merkeziyetsizliğin makul seviyede olduğunu gösterir. Bu yapı, tek bir varlığın piyasayı domine etmesini engelleyerek istikrarı artırabilir. Yine de, üst düzey sahiplerin eşgüdümlü hareketleri fiyatları etkileyebilir. Genel dağılım, büyük yatırımcılar ile geniş çapta küçük yatırımcının birlikte var olduğu, uzun vadede LRC ekosistemini daha dirençli kılan bir yapı sunmaktadır.

Güncel LRC Dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Tutan Miktar | Tutan (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 118.431,90K | 8,62% |

| 2 | 0x5a52...70efcb | 66.895,04K | 4,86% |

| 3 | 0x76ec...78fbd3 | 63.625,17K | 4,63% |

| 4 | 0x674b...66bd3f | 51.867,61K | 3,77% |

| 5 | 0xc368...816880 | 48.475,79K | 3,52% |

| - | Diğerleri | 1.024.577,90K | 74,6% |

II. LRC’nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Mevcut Etki: Arz-talep dengesi fiyat oluşumunda belirleyicidir. Yüksek arz, talep yaratmayı zorlaştırabilir.

Kurumsal ve Whale Dinamikleri

- Kurumsal Yatırımlar: 2025’te ADA’ya yönelen kurumsal fonlar 73 milyon $’a ulaşırken, toplam saklama varlıkları 900 milyon $’ı geçti.

Makroekonomik Ortam

- Para Politikası Etkisi: Analistlere göre, ABD Merkez Bankası eylülde faiz indirimi yaparsa ADA 3 $’a ulaşabilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Katman 2 Ölçeklenebilirlik: Loopring’in zincir teknolojisi ve katman 2 ölçekleme alanındaki yenilikleri, kripto piyasasında özgün fırsatlar sunar.

- Ekosistem Uygulamaları: Loopring, merkeziyetsiz borsa sektöründe rekabete karşı sürekli yenilik ve tanıtım yapmalıdır.

III. LRC 2025-2030 Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,06228 $ - 0,06998 $

- Tarafsız tahmin: 0,06998 $ - 0,08293 $

- İyimser tahmin: 0,08293 $ - 0,09587 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Benimsenmenin artışıyla büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,08757 $ - 0,1214 $

- 2028: 0,10604 $ - 0,15243 $

- Temel katalizörler: DeFi kullanım alanlarının genişlemesi, teknolojik gelişmeler ve pazar toparlanması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,13144 $ - 0,16102 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,16102 $ - 0,19059 $ (güçlü ekosistem gelişimiyle)

- Dönüştürücü senaryo: 0,19059 $ - 0,20000 $ (yaygın benimseme ve büyük ortaklıklarla)

- 2030-12-31: LRC 0,17551 $ (yıl sonu konsolidasyon öncesi olası zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,09587 | 0,06998 | 0,06228 | 0 |

| 2026 | 0,1161 | 0,08293 | 0,07049 | 17 |

| 2027 | 0,1214 | 0,09951 | 0,08757 | 41 |

| 2028 | 0,15243 | 0,11046 | 0,10604 | 57 |

| 2029 | 0,19059 | 0,13144 | 0,07492 | 86 |

| 2030 | 0,17551 | 0,16102 | 0,10305 | 128 |

IV. LRC Profesyonel Yatırım Stratejileri ve Risk Yönetimi

LRC Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Yüksek risk toleranslı uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde LRC biriktirin

- Fiyat hedefleri belirleyip portföyünüzü düzenli aralıklarla dengeleyin

- LRC’lerinizi güvenli donanım cüzdanlarında saklayın

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Eğilim ve potansiyel giriş/çıkış noktalarını belirlemek için

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izlemek için

- Salınım ticareti için önemli noktalar:

- Risk yönetimi için kesin stop-loss emirleri kullanın

- Kârı önceden belirlenmiş seviyelerde alın

LRC Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları birden fazla kripto varlığına yaymak

- Stop-loss emirleri: Olası kayıpları sınırlamak için

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü parolalar kullanımı

V. LRC İçin Potansiyel Riskler ve Zorluklar

LRC Piyasa Riskleri

- Yüksek oynaklık: LRC fiyatı önemli dalgalanmalara maruz kalabilir

- Rekabet: Diğer Katman 2 çözümleri pazar payı kazanabilir

- Piyasa duyarlılığı: Genel kripto piyasa eğilimleri LRC fiyatını etkileyebilir

LRC Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Kripto düzenlemelerindeki değişiklikler LRC’yi etkileyebilir

- Sınır ötesi uyum: Farklı ülkelerde değişen regülasyonlar

- Menkul kıymet olarak sınıflandırılma olasılığı: İşlem ve benimsemeyi etkileyebilir

LRC Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü veya hata riski

- Ölçeklenebilirlik sorunları: Ağ kullanımı arttıkça yeni sorunlar çıkabilir

- Ethereum’a bağımlılık: LRC’nin başarısı Ethereum’daki gelişmelere bağlıdır

VI. Sonuç ve Eylem Önerileri

LRC Yatırım Değeri Değerlendirmesi

LRC, Ethereum için Katman 2 ölçeklenebilirlik çözümü olarak uzun vadede potansiyel sunarken; piyasa oynaklığı ve ölçekleme alanındaki rekabet nedeniyle kısa vadede risklerle karşı karşıya kalmaktadır.

LRC Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, Katman 2 teknolojilerine odaklanarak bilgi edinin

✅ Deneyimli yatırımcılar: LRC’yi çeşitlendirilmiş kripto portföyünüzde değerlendirin

✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın, projeyi yakından takip edin

LRC Alım-Satım Katılım Yöntemleri

- Spot işlemler: LRC’yi Gate.com gibi güvenilir borsalarda alıp tutmak

- DeFi katılımı: Loopring’in merkeziyetsiz borsasında likidite sağlamak

- Staking: Varsa Staking programlarına katılıp ödül kazanmak

Kripto para yatırımları yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlara danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

LRC ne kadar yükselebilir?

LRC, 2025 sonuna kadar 0,066 $ seviyesine ulaşabilir. Uzun vadeli projeksiyonlar, mevcut piyasa eğilimlerine dayanarak büyüme potansiyeline işaret etmektedir.

LRC için 2030 fiyat tahmini nedir?

İstatistiksel modellere göre, LRC’nin 2030 ortasında yaklaşık 0,014 $’a ve yıl sonunda 0,011 $’a ulaşması beklenmektedir.

Luna tekrar 1 $’a ulaşır mı?

Luna’nın yakın zamanda yeniden 1 $’a çıkması pek olası değil. Piyasa koşulları ve yatırımcı güveni önemli engellerdir. Ancak, kripto piyasaları öngörülemezdir.

LRC neden yükseliyor?

LRC, Binance’in teminat oranını düşürerek LRC’ye karşı borçlanmayı kolaylaştırmasıyla artan likidite sayesinde yükseliyor. Bu da talebin ve fiyatın artmasına neden oldu.

2025 FUEL Fiyat Tahmini: Piyasa Trendlerinin Stratejik Analizi ve Yatırımcılar İçin Gelecek Perspektifi

2025 yılında Ethereum topluluğu ne kadar aktif: Sosyal medya, geliştirici katkıları ve DApp ekosisteminin analizi

Monad (MON) nedir ve yüksek performanslı blockchain’i nasıl çalışır?

TAIKO nedir: Tüm dünyada izleyicileri kendine hayran bırakan kadim Japon davul sanatı

Base L2'yi Anlamak: Etkin Bir Katman 2 Ölçekleme Çözümü Açıklandı

Ethereum Fusaka Yükseltmesi: ETH Fiyatındaki Etkisi ve Kripto Piyasası Görünümü

Kripto Paralar ve Web3’te Algoritmik Alım Satımın Nihai Rehberi

ZK Sync Airdrop’ındaki Payınızı Nasıl Talep Edeceğiniz: Kapsamlı Bir Rehber

USD Coin Stablecoin'in Avantajları ve Kullanım Alanları Üzerine İnceleme

Token-Küratörlü Bilgi Grafikleriyle TRUST Başlatma Rehberi