2025 LDO Fiyat Tahmini: DeFi'nin Hızla Benimsenmesi ve Ethereum Stake Oranlarında Artış ile Güçlü İyimserlik

Giriş: LDO’nun Piyasa Konumu ve Yatırım Potansiyeli

Lido DAO Token (LDO), 2020’deki kuruluşundan bu yana Ethereum için merkeziyetsiz staking çözümlerinin öncüsü olarak likit staking ekosisteminde önemli bir rol üstlenmiştir. 2025 itibarıyla LDO’nun piyasa değeri 825.379.877 $, dolaşımdaki arzı yaklaşık 895.788.884 token ve fiyatı 0,9214 $ civarındadır. “ETH 2.0’ın likidite sağlayıcısı” olarak bilinen LDO, merkeziyetsiz finans (DeFi) ekosisteminde giderek daha stratejik bir konuma sahiptir.

Bu makalede, LDO’nun 2025-2030 dönemi fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik faktörler temelinde analiz edilerek, profesyonel tahminler ve yatırımcılar için uygulamaya yönelik stratejiler sunulacaktır.

I. LDO Fiyat Geçmişi ve Güncel Piyasa Durumu

LDO Tarihsel Fiyat Gelişimi

- 2021: LDO, 20 Ağustos’ta 7,3 $ ile rekor seviyeye ulaşarak önemli bir dönüm noktası kaydetti.

- 2022: Piyasada yaşanan düşüşle birlikte LDO, 19 Haziran’da 0,40615 $ ile taban seviyeye indi.

- 2025: Piyasa toparlanma işaretleri gösteriyor, LDO şu anda 0,9214 $’dan işlem görüyor.

LDO Güncel Piyasa Görünümü

16 Ekim 2025 tarihinde LDO, 0,9214 $ seviyesinde işlem görmekte ve piyasa değeri 825.379.877 $’dır. Son 24 saatte %5,7 oranında değer kaybeden token, kısa vadeli oynaklık sergilemiştir. Son bir haftada %22,91’lik ciddi bir düşüş yaşanmış olup orta vadede ayı trendi gözlenmektedir. 30 günlük ve 1 yıllık fiyat değişimi sırasıyla -%21,65 ve -%19,42 olup, uzun dönemde genel bir aşağı trendi göstermektedir. Son düşüşlere rağmen LDO, taban seviyesinin oldukça üzerinde seyrederek piyasada direnç göstermektedir. Dolaşımdaki miktar 895.788.883 LDO olup, toplam 1 milyar arzın %89,58’ine denk gelmektedir.

Güncel LDO piyasa fiyatını görmek için tıklayın

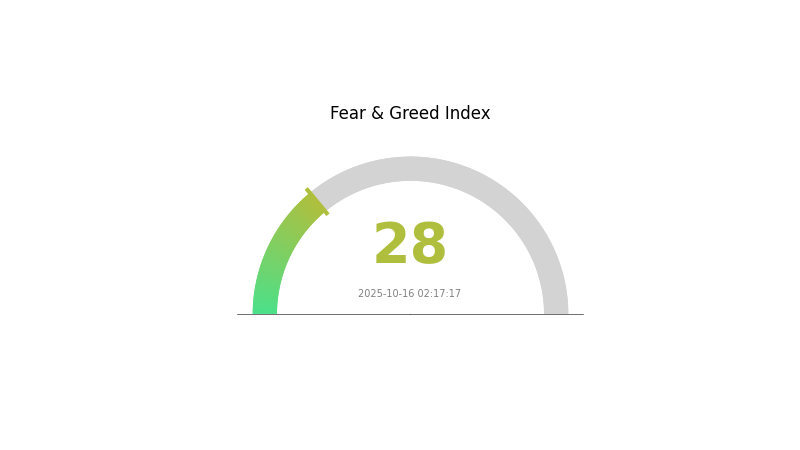

LDO Piyasa Duyarlılığı Göstergesi

2025-10-16 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

LDO için piyasa duyarlılığı şu anda “Korku” bölgesindedir ve skor 28’dir. Yatırımcılar temkinli davranırken, bazıları bu dönemi “başkaları açgözlü iken korkak, başkaları korkak iken açgözlü ol” stratejisiyle bir alım fırsatı olarak değerlendirebilir. Ancak kripto piyasasının oynak yapısı nedeniyle yatırım kararı öncesi detaylı araştırma yapmak ve çeşitli faktörleri dikkate almak büyük önem taşır.

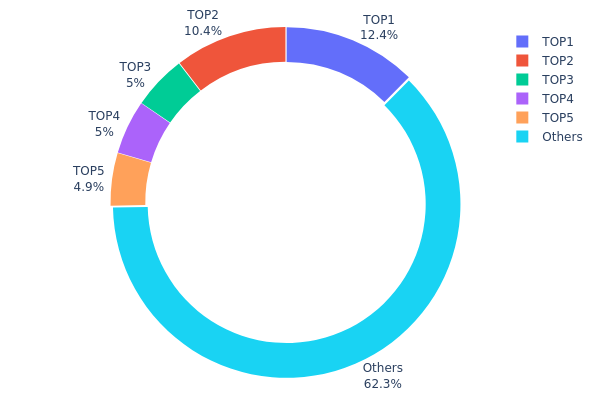

LDO Varlık Dağılımı

Adres bazlı varlık dağılım verileri, LDO tokenlarının yoğunlaşma derecesine dair önemli bilgiler sunar. Verilere göre, en büyük adres toplam arzın %12,41’ini, ikinci adres %10,42’sini, üçüncü ve dördüncü adresler %5’ini, beşinci adres ise %4,90’ını elinde bulundurmaktadır.

Bu dağılım, ilk beş adresin toplam LDO arzının %37,73’ünü kontrol ettiği orta düzeyde bir yoğunlaşmaya işaret eder. Bu durum dikkat çekici olmakla birlikte blokzincir projeleri için olağan bir yapı olup, büyük sahiplerin önemli işlemler yapması halinde piyasa ve fiyat dinamiklerini etkileyebilecek potansiyel taşır.

Kalan %62,27’lik arzın diğer adresler arasında dağılması, üst düzey sahipler dışında makul bir merkeziyetsizlik sağlamaktadır. Bu geniş dağılım piyasa istikrarı ve manipülasyona karşı direnç açısından avantaj sunar. Ancak yatırımcılar ve analistler büyük varlıkları izlemeye devam etmelidir; zira önemli değişiklikler LDO’nun piyasa yapısı ve fiyat oynaklığını etkileyebilir.

Güncel LDO Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 124.133,33K | 12,41% |

| 2 | 0x3e40...6e9c8c | 104.211,12K | 10,42% |

| 3 | 0x695c...917740 | 50.000,00K | 5,00% |

| 4 | 0x9457...72168b | 50.000,00K | 5,00% |

| 5 | 0xad4f...8b42da | 49.000,00K | 4,90% |

| - | Diğerleri | 622.655,56K | 62,27% |

II. LDO’nun Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Staking Ödülleri: Staking ödüllerinin dağıtım şekli, LDO’nun değer teklifini ve piyasa talebini doğrudan etkiler.

- Tarihsel Eğilim: Geçmişte staking ödüllerindeki artış LDO fiyatında yükselişle pozitif korelasyon göstermiştir.

- Güncel Etki: Ethereum 2.0 staking talebindeki artış beklentisi, Lido hizmetlerinin benimsenmesini artırabilir ve LDO değerini destekleyebilir.

Kurumsal ve “Whale” Dinamikleri

- Kurumsal Varlıklar: Büyük DeFi ve kripto yatırım şirketleri LDO’ya artan ilgi göstererek kurumsal benimsenmeye işaret etmektedir.

- Kurumsal Benimseme: Ethereum tabanlı şirketler staking çözümlerinde Lido’yu tercih edebilir ve LDO’ya talep yaratabilir.

- Ulusal Politikalar: Büyük ekonomilerde staking hizmetleriyle ilgili düzenleyici netlik, Lido’nun operasyonel alanını ve LDO’nun piyasa performansını doğrudan etkileyebilir.

Makroekonomik Çevre

- Para Politikası Etkisi: Merkez bankası politikaları ve kripto piyasalarını etkileyen kararlar, LDO fiyatını genel piyasa duyarlılığı üzerinden etkileyebilir.

- Enflasyona Karşı Koruma: LDO’nun Ethereum staking ile bağlantısı, onu potansiyel bir enflasyon koruma aracı olarak öne çıkarabilir.

- Jeopolitik Faktörler: Küresel ekonomik belirsizlikler, merkeziyetsiz finans çözümlerine ilgiyi artırabilir ve LDO’ya fayda sağlayabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Ethereum 2.0 İlerlemesi: Ethereum güncellemeleri ve Proof-of-Stake geçişi, Lido’nun temel iş modelini ve LDO’nun değerini doğrudan etkiler.

- Çoklu Zincir Genişlemesi: Lido’nun diğer blokzincirlere açılması, kullanıcı tabanını çeşitlendirip LDO’nun işlevselliğini artırabilir.

- Ekosistem Uygulamaları: Lido’nun likit staking çözümlerini kullanan DeFi protokollerinin büyümesi LDO talebini yükseltebilir.

III. 2025-2030 LDO Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,51 $ - 0,70 $

- Tarafsız tahmin: 0,70 $ - 0,92 $

- İyimser tahmin: 0,92 $ - 1,20 $ (piyasa toparlanması ve Ethereum staking talebinin güçlenmesiyle)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Benimsenmenin artmasıyla potansiyel büyüme dönemi

- Fiyat aralığı tahminleri:

- 2027: 0,82 $ - 1,59 $

- 2028: 1,17 $ - 2,05 $

- Başlıca katalizörler: Ethereum ekosisteminin genişlemesi, staking çözümlerinin gelişimi ve DeFi entegrasyonunun artması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,75 $ - 1,98 $ (Ethereum kullanımının istikrarlı şekilde büyüdüğü varsayımıyla)

- İyimser senaryo: 1,98 $ - 2,20 $ (önemli Ethereum güncellemeleri ve piyasa liderliği ile)

- Transformasyon senaryosu: 2,20 $ ve üzeri (kurumsal benimsenmenin kitlesel şekilde gerçekleşmesi gibi olumlu ekstrem koşullar)

- 2030-12-31: LDO 1,98 $ (projeksiyon ortalama fiyatı, 2025’e göre belirgin büyüme)

| Yıl | En Yüksek Tahmini Fiyat | Ortalama Tahmini Fiyat | En Düşük Tahmini Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 1,20481 | 0,9197 | 0,51503 | 0 |

| 2026 | 1,52965 | 1,06225 | 0,70109 | 15 |

| 2027 | 1,59402 | 1,29595 | 0,81645 | 41 |

| 2028 | 2,05188 | 1,44498 | 1,17044 | 57 |

| 2029 | 2,20302 | 1,74843 | 0,97912 | 90 |

| 2030 | 2,05475 | 1,97573 | 1,77815 | 115 |

IV. LDO için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

LDO Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Ethereum staking ekosistemine maruz kalmak isteyenler

- Uygulama önerileri:

- Piyasa gerilemelerinde LDO biriktirin

- En az 1-2 yıl tutarak potansiyel büyümeyi hedefleyin

- Tokenları güvenli, saklama hakkı sizde olan bir cüzdanda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamaları trend tespiti için kullanın

- RSI: Aşırı alım ve aşırı satım bölgelerini takip edin

- Al-sat için temel noktalar:

- Açık giriş ve çıkış noktaları belirleyin

- Risk yönetimi için zararı durdur emirleri kullanın

LDO Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Portföyün %1-3’ü

- Saldırgan yatırımcılar: %5-10 arası

- Profesyoneller: Maksimum %15

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara dağıtın

- Opsiyonlar: Satım opsiyonları ile aşağı risklere karşı koruma sağlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan için öneri: Gate Web3 Cüzdan

- Soğuk saklama: Donanım cüzdan ile uzun süreli saklama

- Güvenlik tedbirleri: 2FA kullanın, güçlü şifreler oluşturun, özel anahtarları yedekleyin

V. LDO için Potansiyel Riskler ve Zorluklar

LDO Piyasa Riskleri

- Oynaklık: Kripto piyasasında sık görülen ani fiyat dalgalanmaları

- Likidite: Yüksek hacimli işlemlerde yaşanabilecek zorluklar

- Rekabet: Rakip likit staking protokollerinin artışı

LDO Düzenleyici Riskler

- Belirsiz regülasyonlar: Olumsuz düzenleyici müdahale riski

- Uyum sorunları: DeFi projelerinde değişen hukuki çerçeve

- Vergi sonuçları: Staking ödüllerinin vergilendirilmesinde belirsizlik

LDO Teknik Riskler

- Akıllı kontrat açıkları: Sömürü veya hata riski

- Ethereum güncellemeleri: Başarılı Ethereum geçişlerine bağlılık

- Merkezileşme endişeleri: Lido yönetimine olan bağımlılık

VI. Sonuç ve Eylem Önerileri

LDO Yatırım Değeri Değerlendirmesi

LDO, Ethereum staking ekosistemine erişim açısından eşsiz bir fırsat sunmaktadır. Uzun vadeli potansiyeli Ethereum’un başarısı ve DeFi büyümesiyle bağlantılıdır. Kısa vadede ise piyasa oynaklığı ve regülasyon belirsizlikleri öne çıkmaktadır.

LDO Yatırım Önerileri

✅ Yeni başlayanlar: Kripto portföyünüzde küçük bir pay ayırabilirsiniz

✅ Deneyimli yatırımcılar: Maliyet ortalaması stratejisi uygulayın

✅ Kurumsal yatırımcılar: LDO’yu geniş DeFi portföyünün parçası olarak değerlendirin

LDO Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com’da LDO alın ve tutun

- Staking: Lido’nun likit staking protokolüne katılım

- Kazanç çiftçiliği: LDO tabanlı likidite fırsatlarını değerlendirin

Kripto para yatırımları yüksek risk taşır; bu makale yatırım tavsiyesi içermez. Yatırımcılar kararlarını kendi risk profillerine göre vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

Sıkça Sorulan Sorular

2030’da LDO tokenı için fiyat tahmini nedir?

Mevcut piyasa analizine göre LDO tokenının 2030’da ortalama 44,69 $’a ulaşması, fiyat aralığının ise 43,05 $ ile 48,09 $ arasında olması bekleniyor.

LDO alınacak iyi bir coin mi?

LDO, Lido ekosistemine ilgi duyanlar için makul bir alım fırsatı olabilir. Yönetim tokenı olarak değeri, Lido’nun DeFi’deki büyümesi ve benimsenmesiyle doğrudan bağlantılıdır.

LDOS hissesi için fiyat tahmini nedir?

LDOS hissesinin 2025’te 131-165 $, 2030’da ise 200-258 $ aralığında olması bekleniyor. Yarın için tahmini fiyatı ise 137,34 $’dır.

En yüksek fiyat tahmini hangi kripto para için?

2025 yılı için en yüksek fiyat tahmini Bitcoin (BTC) için; ardından Ethereum (ETH) ve Solana (SOL) gelmektedir.

Modern Elektronikte LDO Nedir: Low-Dropout Regülatörlerinin İşlevi ve Önemi

2025 LDO Fiyat Tahmini: Lido DAO Token’ın Büyüme Potansiyeli ve Piyasa Trendleri Analizi

ZRX Token Dağılımı, 0x Protocol'ün likiditesi üzerinde nasıl bir etki yaratır?

2025'te ETH Staking: Zincir Üstü Seçenekler ve En İyi Platformlar

Staking Nedir: Kripto Varlıklarda Pasif Gelir için Başlangıç Rehberi

Wall Street Pepe'ye Yatırım: Satın Alma Rehberi, Lansman Zamanlaması ve Fiyat Bilgileri

Hawk Tuah Coin'i Zahmetsizce Satın Alma Rehberi

HBAR tokenomisi nedir: Hedera’da token dağıtımı, enflasyon modeli ve yakım mekanizması nasıl işler?

Trump Token'larını çevrimiçi ortamda güvenli bir şekilde satın alma yöntemleri

Makroekonomik politikalar kripto para fiyatlarını nasıl etkiler: Fed faiz oranları, enflasyon verileri ve hisse senedi piyasasıyla olan korelasyonun detaylı açıklaması