2025 KOII Price Prediction: Analyzing Potential Growth and Market Trends for the Web3 Token

Introduction: KOII's Market Position and Investment Value

Koii (KOII), as a decentralized computing network platform, has been making significant strides since its inception. As of 2025, Koii's market capitalization stands at $36,778, with a circulating supply of approximately 568,000,000 tokens, and a price hovering around $0.00006475. This asset, often referred to as "The People's Supercomputer," is playing an increasingly crucial role in the fields of AI, storage, and decentralized applications.

This article will provide a comprehensive analysis of Koii's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. KOII Price History Review and Current Market Status

KOII Historical Price Evolution

- 2025: Initial listing, price peaked at $0.012968 on January 13

- 2025: Market downturn, price dropped to all-time low of $0.00005318 on October 21

- 2025: Slight recovery, current price at $0.00006475 as of November 3

KOII Current Market Situation

KOII is currently trading at $0.00006475, with a 24-hour trading volume of $19,622.92. The token has experienced a slight decrease of 0.12% in the past 24 hours. KOII's market capitalization stands at $36,778, ranking it at 6170th position in the crypto market. The circulating supply is 568,000,000 KOII tokens, which represents 5.68% of the total supply of 10,000,000,000 KOII. Despite a recent 6.97% increase over the past week, KOII has seen a significant decline of 21.85% in the last 30 days and a massive 99.17% drop over the past year. The current price is 99.50% below its all-time high, indicating a challenging market environment for KOII.

Click to view the current KOII market price

KOII Market Sentiment Indicator

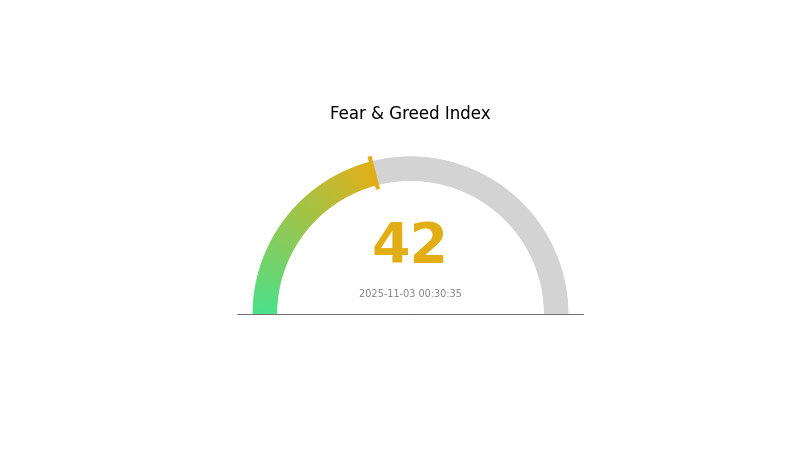

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a wave of fear, with the Fear and Greed Index registering at 42. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Traders should remain vigilant, conduct thorough research, and consider using Gate.com's advanced trading tools to navigate these uncertain waters effectively.

KOII Holdings Distribution

The address holdings distribution data for KOII is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. This lack of data could be due to various factors, such as the token being in an early stage of development, limited circulation, or issues with data collection and reporting.

Without specific address holdings information, it's challenging to assess the degree of decentralization, the potential for market manipulation, or the overall stability of KOII's on-chain structure. The absence of this data also makes it difficult to evaluate the impact on market dynamics and price volatility.

In situations where holdings distribution data is not accessible, it becomes crucial for investors and analysts to seek alternative metrics and information sources to gauge the token's market structure and potential risks. This may include analyzing trading volumes, liquidity metrics, and any available information on token allocation and vesting schedules.

Click to view the current KOII Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting KOII's Future Price

Supply Mechanism

- Historical Patterns: Past supply changes have significantly impacted KOII's price, with increased supply often leading to price decreases.

- Current Impact: Recent supply changes suggest potential price volatility in the short term.

Institutional and Whale Dynamics

- Institutional Holdings: Limited information available on major institutional holdings of KOII.

Macroeconomic Environment

- Inflation Hedging Properties: KOII's performance as an inflation hedge remains uncertain in the current economic climate.

Technological Development and Ecosystem Building

- Ecosystem Applications: KOII is developing its ecosystem, with potential for growth in decentralized applications and services.

III. KOII Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00004 - $0.00006

- Neutral forecast: $0.00006 - $0.00008

- Optimistic forecast: $0.00008 - $0.00009 (requires favorable market conditions and increased adoption)

2026-2027 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range predictions:

- 2026: $0.00005 - $0.00012

- 2027: $0.00009 - $0.00013

- Key catalysts: Project development milestones, partnerships, and broader crypto market trends

2028-2030 Long-term Outlook

- Base scenario: $0.00011 - $0.00016 (assuming steady growth and adoption)

- Optimistic scenario: $0.00016 - $0.00019 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.00019 - $0.00024 (with breakthrough innovations and mainstream acceptance)

- 2030-12-31: KOII $0.00024 (potential peak price in an extremely bullish scenario)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00009 | 0.00007 | 0.00004 | 0 |

| 2026 | 0.00012 | 0.00008 | 0.00005 | 23 |

| 2027 | 0.00013 | 0.0001 | 0.00009 | 52 |

| 2028 | 0.00017 | 0.00011 | 0.00007 | 75 |

| 2029 | 0.00019 | 0.00014 | 0.00007 | 118 |

| 2030 | 0.00024 | 0.00016 | 0.00013 | 152 |

IV. KOII Professional Investment Strategies and Risk Management

KOII Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate KOII tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure wallets with backup

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- Relative Strength Index (RSI): Measure overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to decentralized computing

- Set stop-loss orders to limit potential losses

KOII Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio

- Aggressive investors: 3-5% of portfolio

- Professional investors: 5-10% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for KOII

KOII Market Risks

- High volatility: KOII's price may experience significant fluctuations

- Limited liquidity: Low trading volume may lead to price slippage

- Competition: Other decentralized computing projects may impact KOII's market share

KOII Regulatory Risks

- Uncertain regulations: Cryptocurrency regulations may affect KOII's adoption

- Compliance issues: Potential challenges in meeting evolving regulatory requirements

- Cross-border restrictions: International regulations may limit KOII's global reach

KOII Technical Risks

- Network security: Potential vulnerabilities in the Koii network

- Scalability challenges: Issues in handling increased network load

- Smart contract bugs: Possible errors in smart contract implementation

VI. Conclusion and Action Recommendations

KOII Investment Value Assessment

KOII presents a unique value proposition in decentralized computing but faces significant short-term risks due to market volatility and regulatory uncertainties. Long-term potential exists if the project successfully scales and gains widespread adoption.

KOII Investment Recommendations

✅ Beginners: Consider small, exploratory investments after thorough research ✅ Experienced investors: Allocate a small portion of portfolio, monitor project developments closely ✅ Institutional investors: Conduct comprehensive due diligence, consider strategic partnerships

KOII Trading Participation Methods

- Spot trading: Purchase KOII tokens on Gate.com

- Dollar-cost averaging: Regularly invest small amounts to mitigate price volatility

- Staking: Participate in KOII staking programs if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will ICP reach $1000?

While ICP's potential is significant, reaching $1000 is uncertain. It depends on market conditions, adoption, and technological advancements in the Web3 space.

Can pi coin reach $100?

It's highly unlikely. Pi reaching $100 would require a market cap of $670.8 billion, far exceeding most cryptocurrencies. Such growth is improbable given Pi's current status and market conditions.

Which coin price will increase in 2025?

Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) are expected to see price increases in 2025, based on current market trends and forecasts.

Would Hamster Kombat coin reach $1?

Based on current projections, Hamster Kombat is unlikely to reach $1 in the near future. However, long-term predictions suggest potential growth, though reaching $1 remains uncertain.

Share

Content