2025 JUP Fiyat Tahmini: Değişen Kripto Piyasasında Jupiter'ın Potansiyelinin Analizi

Giriş: JUP'un Piyasadaki Konumu ve Yatırım Potansiyeli

Jupiter (JUP), Solana blockchain üzerinde lider DeFi dApp olarak, kuruluşundan bu yana Solana'nın ana likidite altyapısını oluşturmuştur. 2025 yılı itibarıyla Jupiter'in piyasa değeri 1.150.556.258 $'a ulaşırken, dolaşımdaki arzı yaklaşık 3.165.216.666 token ve fiyatı ise 0,3635 $ seviyesinde bulunmaktadır. "Solana'nın Likidite Gücü" olarak bilinen bu varlık, Solana ekosisteminde merkeziyetsiz finans ve likidite sağlama alanında giderek daha kritik bir rol üstlenmektedir.

Bu makalede, Jupiter'in 2025-2030 dönemindeki fiyat trendleri; tarihsel hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar bir arada değerlendirilerek yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. JUP Fiyat Geçmişi ve Güncel Piyasa Durumu

JUP Tarihsel Fiyat Seyri

- 2024: JUP, 31 Ocak'ta 2,2 $ ile tüm zamanların en yüksek seviyesine ulaşarak dönüm noktası yaşadı

- 2025: Piyasa ayı eğilimine girdi, JUP fiyatı ciddi biçimde geriledi

- 2025: JUP, 10 Ekim'de 0,1097 $ ile en düşük seviyesini gördü ve büyük bir piyasa düzeltmesi yaşandı

JUP Güncel Piyasa Durumu

16 Ekim 2025 tarihinde JUP, 0,3635 $ seviyesinden işlem görmektedir ve piyasa değeri 1.150.556.258 $’dır. Son 24 saatte %3,06, son bir haftada ise %18,35 oranında değer kaybetmiştir. Mevcut fiyat, zirvesinden %83,48 düşüş ve dip seviyesinden %231,36 yükseliş göstermektedir. Dolaşımdaki arz 3.165.216.666,64 token olup, maksimum 10 milyar token arzının %31,65’ini oluşturmaktadır. Tam seyreltilmiş değerleme 3.635.000.000 $'dır. JUP'un piyasa hakimiyeti şu anda %0,063 ile genel kripto piyasasında küçük bir paya sahiptir. Piyasa eğilimi, fiyatın farklı zaman dilimlerinde negatif seyretmesiyle ayı yönündedir.

Güncel JUP piyasa fiyatını görüntüleyin

JUP Piyasa Duyarlılık Göstergesi

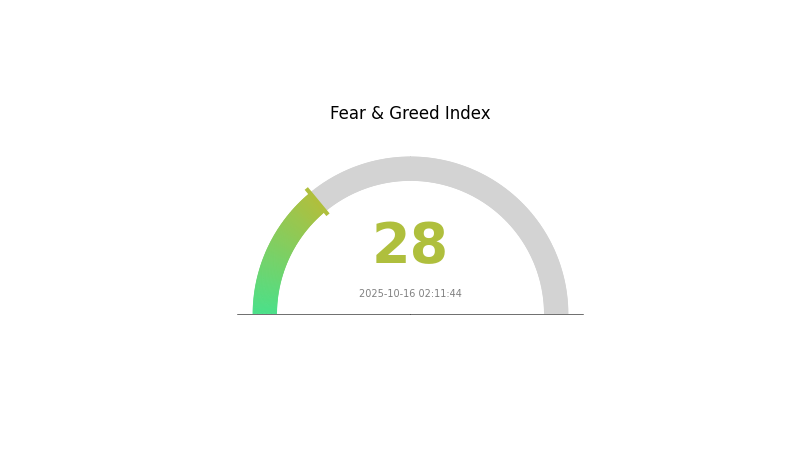

16 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntüleyin

Kripto piyasasında duyarlılık endeksi 28 seviyesinde ve korku hakim. Bu durum, yatırımcıların temkinli hareket ettiğini ve kararsızlık yaşadığını gösteriyor; uzun vadeli dijital varlıklara inananlar için alım fırsatı sunabilir. Ancak kripto piyasasında duyarlılık çok hızlı değişebilir. Yatırımcılar dikkatli olmalı, detaylı araştırma yapmalı ve belirsiz ortamda riskleri azaltmak için portföylerini çeşitlendirmelidir.

JUP Varlık Dağılımı

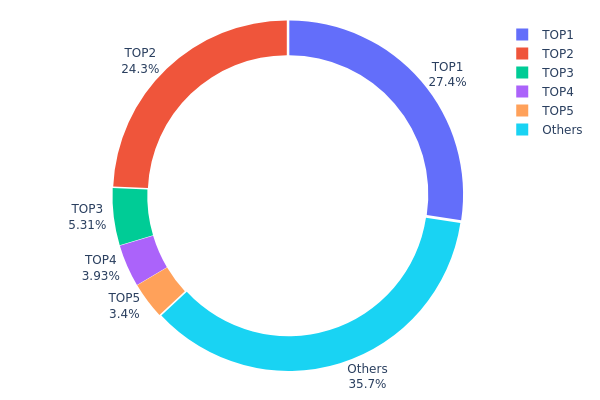

Adres bazlı varlık dağılımı verileri, JUP token sahipliğinde yoğunlaşma olduğunu gösteriyor. En büyük iki adres toplam arzın %51,65’ini elinde bulunduruyor; sırasıyla %27,37 ve %24,28 paya sahipler. Bu yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı açısından risk taşıyor.

İlk 5 adres JUP token’larının %64,28’ini kontrol ederken, kalan %35,72’lik kısım diğer sahipler arasında dağılmış durumda. Bu dengesizlik, merkeziyetsizliğin düşük olduğunu ve token'ın piyasa yapısı ile istikrarını etkileyebileceğini gösteriyor.

Büyük sahiplerin ani satış veya yeni alım kararları fiyat oynaklığını artırabilir. Ayrıca az sayıda varlık sahibinin JUP ekosistemi üzerindeki etkisi, yönetişim ve piyasa duyarlılığını şekillendirebilir.

Güncel JUP Varlık Dağılımını inceleyin

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 61aq58...s5xHXV | 1.916.033,33K | 27,37% |

| 2 | EXJHiM...7yHm6T | 1.700.000,00K | 24,28% |

| 3 | FVhQ3Q...iKfekf | 371.492,92K | 5,30% |

| 4 | BmEyv8...CSF1j2 | 275.127,62K | 3,93% |

| 5 | Any5gL...37T7iz | 238.131,85K | 3,40% |

| - | Diğerleri | 2.498.225,28K | 35,72% |

II. JUP'un Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Airdrop Etkinlikleri: Piyasaya yeni token girişi, satış baskısı oluşturup fiyatı aşağı çekebilir.

- Mevcut Etki: Son airdrop’lar fiyat dalgalanmasına ve piyasa belirsizliğine yol açtı.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Jupiter DeFi araçlarının daha fazla benimsenmesi JUP fiyatını olumlu etkileyebilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: JUP, enflasyona karşı koruma arayan yatırımcıların ilgisiyle yönlenebilir.

- Jeopolitik Unsurlar: Küresel tedarik zinciri değişiklikleri ve jeopolitik gerilimler Solana ekosistemini ve JUP’u dolaylı olarak etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Solana Ağ Geliştirmeleri: Solana ağındaki yükseltmeler, JUP’un uzun vadeli fiyat potansiyelini destekleyebilir.

- Ekosistem Uygulamaları: Jupiter, Solana’daki en büyük DEX toplayıcısıdır; en iyi işlem oranları ve dolar-maliyet ortalaması ile zincirler arası köprü gibi yenilikçi özellikler sunar.

III. 2025-2030 İçin JUP Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,20845 $ - 0,3657 $

- Tarafsız tahmin: 0,3657 $ - 0,40000 $

- İyimser tahmin: 0,40000 $ - 0,42421 $ (güçlü piyasa ivmesi gerektirir)

2027 Orta Vadeli Görünüm

- Piyasa fazı beklentisi: Benimsenmenin artmasıyla büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2026: 0,37126 $ - 0,55294 $

- 2027: 0,36494 $ - 0,50238 $

- Temel katalizörler: Kullanım alanlarının ve ekosistemin gelişimi

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,48817 $ - 0,59049 $ (istikrarlı piyasa büyümesi ile)

- İyimser senaryo: 0,59049 $ - 0,67906 $ (yaygın benimsenme ile)

- Dönüştürücü senaryo: 0,67906 $ - 0,75000 $ (teknolojik atılımlar ile)

- 31 Aralık 2030: JUP 0,67906 $ (mevcut tahminlere göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,42421 | 0,3657 | 0,20845 | 0 |

| 2026 | 0,55294 | 0,39496 | 0,37126 | 8 |

| 2027 | 0,50238 | 0,47395 | 0,36494 | 30 |

| 2028 | 0,56627 | 0,48817 | 0,26361 | 34 |

| 2029 | 0,65375 | 0,52722 | 0,45868 | 45 |

| 2030 | 0,67906 | 0,59049 | 0,30115 | 62 |

IV. JUP İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

JUP Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde JUP token biriktirin

- Fiyat hedefleri koyun, portföyünüzü düzenli aralıklarla gözden geçirin

- Token’larınızı güvenli, gözetim dışı cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve giriş/çıkış noktalarını tespit için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım ve aşırı satım durumlarını belirler

- Dalgalı işlemde dikkat edilmesi gerekenler:

- Solana ekosistem gelişmelerini yakından izleyin

- Zarar durdur emirleriyle riskinizi yönetin

JUP Risk Yönetimi Yapısı

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü oranında

- Agresif yatırımcılar: Kripto portföyünün %5-10’u oranında

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Birden fazla DeFi projesine yatırım yapın

- Zarar durdur emirleri: Dalgalı piyasada kayıpları sınırlandırın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulamayı etkinleştirin, benzersiz şifreler kullanın

V. JUP İçin Potansiyel Riskler ve Zorluklar

JUP Piyasa Riskleri

- Volatilite: Kripto piyasalarında aşırı fiyat dalgalanmaları sıkça görülür

- Rekabet: Solana ve diğer blokzincirlerdeki yeni DeFi projeleri

- Piyasa duyarlılığı: Genel piyasa trendlerine karşı hassasiyet

JUP Regülasyon Riskleri

- Regülasyon belirsizliği: DeFi alanında düzenlemelerin artma olasılığı

- Uyum sorunları: DEX’lere karşı olası düzenleyici işlemler

- Sınır ötesi kısıtlar: Farklı ülkelerde değişen hukuki statü

JUP Teknik Riskleri

- Akıllı kontrat açıkları: Sömürü veya yazılım hatası ihtimali

- Ölçeklenebilirlik sorunları: Solana ağının performansına bağlılık

- Birlikte çalışabilirlik eksikliği: Sınırlı zincirler arası işlevsellik

VI. Sonuç ve Eylem Önerileri

JUP Yatırım Değeri Analizi

Jupiter (JUP), Solana DeFi ekosisteminde yüksek risk ve yüksek potansiyele sahip bir yatırım sunar. Güçlü piyasa konumu ve kullanıcı tabanı uzun vadeli değer sağlarken, kısa vadeli oynaklık ve regülasyon belirsizliği önemli riskler doğurur.

JUP Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarla başlayın, DeFi temellerini öğrenin ✅ Deneyimli yatırımcılar: JUP’u çeşitlendirilmiş bir DeFi portföyüne dahil edin ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, OTC işlemleri değerlendirin

JUP Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden JUP token alın ve tutun

- Kazanç çiftçiliği: Jupiter platformunda likidite havuzlarına katılın

- Staking: Pasif gelir için varsa stake seçeneklerini değerlendirin

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk toleranslarına göre dikkatlice vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

JUP Coin iyi bir yatırım mı?

JUP Coin, Solana’nın büyümesiyle yüksek getiri potansiyeli sunar. Derin likiditesi ve optimize swap özellikleriyle 2025’te yükseliş eğilimi göstermektedir; ancak başarı Solana ekosistemi ve JUP’un kullanım alanı gelişimine bağlıdır.

Jupiter 5 $’a ulaşabilir mi?

Jupiter teorik olarak 5 $’a ulaşabilir; fakat 2025 sonunda bu olası görünmemektedir. Tahminler ortalama işlem fiyatının 4,29 $ civarında olacağını, uzun vadeli projeksiyonlarda ise olası bir düşüş yaşanabileceğini göstermektedir.

JUP en fazla ne kadar yükselebilir?

Mevcut piyasa analizlerine göre Jupiter (JUP), Ekim 2025’te 0,41 $ ile zirveye ulaşabilir; ay ortalaması ise 0,38 $ civarında olabilir.

Jupiter coin için 2030 tahmini nedir?

Mevcut trendlere göre Jupiter coin, artan benimsenme ve ekosistem büyümesiyle 2030’da 5-7 $ aralığına ulaşabilir.

2025 RAY Fiyat Tahmini: Önümüzdeki Yıllarda RAY Token’ın Büyüme Dinamikleri ve Piyasa Potansiyelinin Değerlendirilmesi

2025 RAY Fiyat Tahmini: Gelişen DeFi Ekosisteminde Bu Katman-1 Protokolü Yeni Zirvelere Ulaşabilir mi?

2025 KMNO Fiyat Tahmini: Piyasa Eğilimleri, Ana Etkenler ve Yatırım Perspektifi

2025 JTO Fiyat Tahmini: Jito Network Token DeFi Ekosisteminde Yeni Zirvelere Yükselir mi?

2025 RAY Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

HLN ve SOL: Kripto Para Arenasında Devlerin Mücadelesi

ORBR Nedir: Gerçek Zamanlı İş Yanıt Sistemlerini Optimize Etmek İçin Kapsamlı Bir Rehber

WAVES Nedir: Dalga Teknolojisi ve Modern Toplumdaki Uygulamaları Hakkında Kapsamlı Bir Rehber

USELESS Nedir: Modern Hayatta Hiçbir Amaca Hizmet Etmeyen Şeyleri Anlamak İçin Kapsamlı Bir Rehber

CVAULTCORE nedir: Gelişmiş güvenli veri depolama ve yönetim çözümleri üzerine kapsamlı bir rehber

2025 USELESS Fiyat Tahmini: Memecoin Yeni Zirvelere Ulaşacak mı, Yoksa Piyasa Düzeltmesiyle mi Karşılaşacak?