2025 JST Fiyat Tahmini: Just Token’ın Potansiyel Büyümesi ve Piyasa Trendlerinin Analizi

Giriş: JST'nin Piyasa Konumu ve Yatırım Değeri

Just (JST), merkeziyetsiz finans ekosisteminin önde gelen aktörlerinden biri olarak 2020 yılındaki lansmanından bu yana önemli bir gelişim göstermiştir. 2025 yılı itibarıyla JST’nin piyasa değeri 309.474.000 dolara ulaşmış, dolaşımdaki arzı yaklaşık 9.900.000.000 token seviyesine çıkmış ve fiyatı 0,03126 dolar civarında seyretmektedir. “Adil yönetim tokenı” olarak da anılan bu varlık, TRON ağı üzerinde stabilcoin kredilendirmesi ve topluluk yönetimi süreçlerinde giderek daha stratejik bir rol üstlenmektedir.

Bu makalede, 2025-2030 yılları arasında JST’nin fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında profesyonel fiyat tahminleri ve yatırımcılar için pratik stratejilerle kapsamlı şekilde analiz edilmektedir.

I. JST Fiyat Geçmişi ve Güncel Piyasa Durumu

JST Tarihsel Fiyat Gelişim Seyri

- 2020: JST piyasaya sürüldü, fiyatı 0,002 dolardan başladı

- 2021: 5 Nisan’da tüm zamanların en yüksek seviyesi olan 0,193254 dolara ulaştı

- 2022-2024: Piyasa döngüleri yaşandı, fiyat 0,03-0,05 dolar aralığında dalgalandı

JST Güncel Piyasa Görünümü

18 Ekim 2025 itibarıyla JST, 0,03126 dolardan işlem görüyor. Son 24 saatte %0,44’lük hafif bir düşüş yaşanırken, işlem hacmi 237.459,64 dolar oldu. JST’nin piyasa değeri 309.474.000 dolar ile kripto piyasasında 214. sırada yer alıyor. Mevcut fiyatı, zirvesinin %83,81 altında, en düşük seviyesinin ise %556,34 üzerinde bulunuyor. Son bir saate bakıldığında %0,26’lık artış, son bir haftada ise %4,03’lük yükseliş mevcut; ancak 30 günlük performansta %5,76’lık bir düşüş söz konusu.

Güncel JST piyasa fiyatını görmek için tıklayın

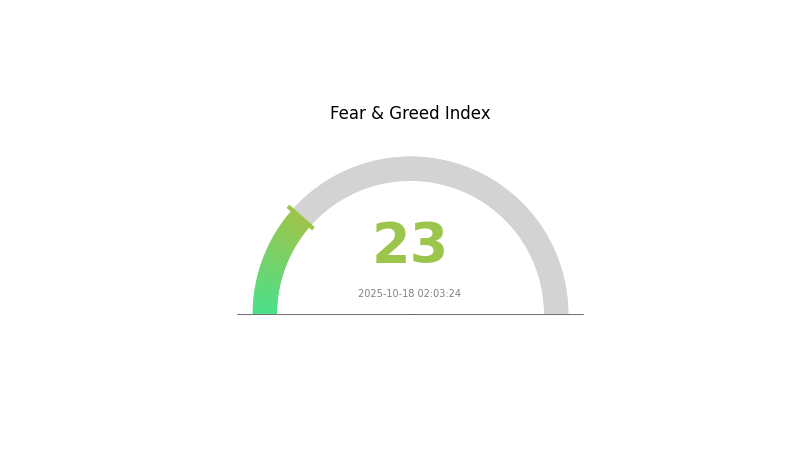

JST Piyasa Duyarlılığı Göstergesi

18 Ekim 2025 Korku ve Açgözlülük Endeksi: 23 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda aşırı korku yaşanıyor; Korku ve Açgözlülük Endeksi 23’e kadar geriledi. Bu düzeydeki olumsuz hava, genellikle karşıt yatırımcılar için alım fırsatı olarak görülür. Ancak yatırım kararı almadan önce temkinli olmak ve detaylı araştırma yapmak gerekir. Piyasa duyarlılığının hızla değişebileceğini unutmayın; bugün dip gibi görünen fiyat, yarın daha da düşebilir. Bilgilenmeye devam edin, portföyünüzü çeşitlendirin ve belirsiz dönemlerde maliyet ortalaması stratejisini göz önünde bulundurun.

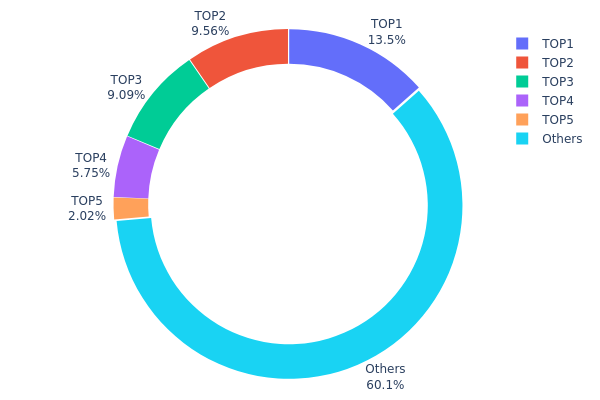

JST Varlık Dağılımı

Adres bazlı varlık dağılımı, JST token’larında kayda değer bir yoğunlaşma olduğunu gösteriyor. İlk beş adres, toplam arzın %39,86’sını elinde bulunduruyor ve en büyük sahip toplam tokenların %13,45’ine sahip. Bu yoğunluk, görece merkezi bir dağılıma işaret ederek piyasa dinamiklerini etkileyebilir.

Böyle bir sahiplik yapısı, fiyat oynaklığını ve büyük hareketlere duyarlılığı artırabilir. Üst düzey sahipler, arz üzerinde önemli etki yaratıp likidite ile fiyat istikrarını şekillendirebilir. Yine de tokenların %60,14’ünün diğer adreslerde olması, piyasa katılımının genişliğini gösteriyor.

Bu dağılım modeli, belirli bir merkeziyetsizlik seviyesine işaret etmekle birlikte, üst adreslerdeki yüksek oranlı birikimler dikkatle izlenmelidir. Mevcut yapı, token’ın zincir üzerindeki istikrarını etkileyebilir ve JST token tabanlı bir oylama sistemi uygularsa yönetim kararlarını da etkileyebilir. Yatırımcılar, büyük sahiplerin hareketlerini piyasa üzerindeki olası etkiler açısından izlemelidir.

Güncel JST Varlık Dağılımı için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | TPyjyZ...kgNan5 | 1.332.133,32K | 13,45% |

| 2 | TDw3sd...7L4x2p | 946.802,33K | 9,56% |

| 3 | TXk9Ln...9M4ZD6 | 900.011,82K | 9,09% |

| 4 | TASUAU...F4NKot | 568.985,48K | 5,74% |

| 5 | TSFUtq...WuT6h9 | 200.000,01K | 2,02% |

| - | Diğerleri | 5.952.067,04K | 60,14% |

II. JST’nin Gelecek Fiyatını Etkileyecek Temel Faktörler

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özellikleri: JST, belirli ekonomik koşullarda enflasyona karşı bir varlık olarak işlev görebilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Ekosistem Uygulamaları: JUST (JST), temel olarak TRON ekosisteminde kullanılmakta olup, TRON ağı üzerinde çeşitli DeFi uygulamalarını ve hizmetlerini desteklemektedir.

III. 2025-2030 JST Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,01814 - 0,02500 dolar

- Nötr tahmin: 0,02500 - 0,03127 dolar

- İyimser tahmin: 0,03127 - 0,03659 dolar (olumlu piyasa duyarlılığı ve proje gelişmeleriyle)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan oynaklık ile potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,01843 - 0,04938 dolar

- 2028: 0,03913 - 0,04839 dolar

- Ana tetikleyiciler: Proje yükseltmeleri, ortaklıklar ve genel kripto piyasa trendleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,04524 - 0,05496 dolar (istikrarlı proje gelişimi ve piyasa adaptasyonu halinde)

- İyimser senaryo: 0,05496 - 0,06469 dolar (ekosistemde ciddi büyüme ve ortaklıklarla)

- Dönüştürücü senaryo: 0,06469+ dolar (oldukça olumlu piyasa koşulları ve çığır açıcı yeniliklerle)

- 31 Aralık 2030: JST 0,05716 dolar (istikrarlı büyümeyle potansiyel yıl sonu hedefi)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,03659 | 0,03127 | 0,01814 | 0 |

| 2026 | 0,03562 | 0,03393 | 0,0285 | 8 |

| 2027 | 0,04938 | 0,03478 | 0,01843 | 11 |

| 2028 | 0,04839 | 0,04208 | 0,03913 | 34 |

| 2029 | 0,06469 | 0,04524 | 0,02352 | 44 |

| 2030 | 0,05716 | 0,05496 | 0,04012 | 75 |

IV. JST Profesyonel Yatırım Stratejisi ve Risk Yönetimi

JST Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun: İstikrarlı büyüme hedefleyen temkinli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde JST biriktirin

- Uzun vadeli fiyat hedefi belirleyip sadık kalın

- JST’yi güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını belirlemek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım ya da aşırı satım koşullarını tespit etmek için faydalıdır

- Dalgalı al-sat için dikkat edilmesi gerekenler:

- JST'nin TRX ve USDJ fiyatlarıyla korelasyonunu izleyin

- TRON ekosistemindeki gelişmeleri takip edin

JST Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-8’i

- Profesyonel yatırımcı: Kripto portföyünün %10-15’i

(2) Riskten Korunma Stratejileri

- Diversifikasyon: Yatırımları farklı DeFi projeleri arasında dağıtmak

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için kullanılır

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli varlıklar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama aktif edin, güçlü şifreler kullanın

V. JST’ye Yönelik Potansiyel Riskler ve Zorluklar

JST Piyasa Riskleri

- Yüksek oynaklık: JST fiyatı ciddi dalgalanmalar gösterebilir

- Korelasyon riski: TRON ekosisteminin performansına yüksek bağımlılık

- Likidite riski: Yüksek hacimli işlemlerde likidite kısıtı yaşanabilir

JST Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Daha sıkı DeFi düzenlemeleri gelebilir

- Sınır ötesi uyum: Farklı ülkelerin regülasyonlarına uyumda zorluklar

- Stablecoin incelemesi: USDJ gibi stablecoin’lere yönelik artan denetim

JST Teknik Riskleri

- Akıllı sözleşme açıkları: JST platformunda istismar riski

- Ölçeklenebilirlik sorunları: TRON blokzincirinde ağ tıkanıklığı meydana gelebilir

- Oracle hataları: Fiyat verisi doğruluğu ile ilgili riskler

VI. Sonuç ve Eylem Önerileri

JST Yatırım Değeri Değerlendirmesi

JST, TRON ekosisteminin gücüyle DeFi alanında öne çıkan fırsatlardan biri. Büyüme potansiyeli taşısa da yatırımcılar, kripto piyasasındaki yüksek dalgalanma ve düzenleyici belirsizliklere karşı dikkatli olmalıdır.

JST Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, JST ekosistemini öğrenmeye öncelik verin

✅ Deneyimli yatırımcılar: JST’yi, diğer DeFi varlıklarıyla birlikte dengeli olarak değerlendirin

✅ Kurumsal yatırımcılar: JST’yi çeşitlendirilmiş bir DeFi portföyünde inceleyin, kapsamlı araştırma yapın

JST Alım Satıma Katılım Yöntemleri

- Spot işlemler: JST’yi Gate.com’da alıp satın

- Staking: JST stake programlarına katılarak pasif gelir elde edin

- DeFi kullanımı: JST’yi JUST ağında borç verme ve alma işlemlerinde değerlendirin

Kripto para yatırımları çok yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

2030 için JST fiyat tahmini nedir?

Piyasa eğilimleri ve potansiyel büyümeye göre JST, 2030’da 0,50-1 dolar aralığına ulaşabilir. Bu, JUST ağının yaygın benimsenmesi ve hizmetlerine olan talebin artmasıyla mümkün olur.

Jupiter 5 dolara ulaşabilir mi?

Evet, Jupiter uygun piyasa koşulları ve proje gelişmeleriyle gelecekte 5 dolara çıkabilir. Ancak fiyat tahminleri spekülatiftir ve garanti edilemez.

Injective Protocol 100 dolara ulaşabilir mi?

Evet, Injective Protocol yenilikçi teknolojisi ve DeFi’de artan benimsenmesiyle uzun vadede 100 dolara ulaşabilir.

JST kripto nedir?

JST, TRON blokzincirindeki merkeziyetsiz borç verme platformu JUST ağının yerel tokenıdır. Ekosistemde yönetim, staking ve teminat olarak kullanılır.

2025 CRV Fiyat Tahmini: Piyasa Trendleri, Benimsenme Göstergeleri ve Curve DAO Token Değerini Belirleyen Ana Etkenlerin Analizi

2025 JST Fiyat Tahmini: JUST Token’ın Gelecekteki Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 LUNA Fiyat Tahmini: İyileşme Sonrası Dönemde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 USDD Fiyat Tahmini: Gelecek Trendler, Piyasa Dinamikleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 RESOLV Fiyat Tahmini: Piyasa trendleri ve gelecekteki değerleme potansiyelinin analizi

ENA ile CRO: İki Önde Gelen Genomik Veri Deposu Arasında Karşılaştırmalı Bir Analiz

Jupiter Airdrop’unuzu Talep Etmeye Başlamak İçin Temel Rehber

Bitcoin'un Alternatif Kripto Paralar Üzerindeki Etkisi

Sahte kripto para sitelerini tespit etme: Dolandırıcılıklara karşı korunma yöntemleri

CGPT Nedir: Yapay Zeka Tabanlı Konuşma Teknolojisini Anlamak için Kapsamlı Bir Rehber

MOCA Nedir: Montreal Bilişsel Değerlendirme Üzerine Kapsamlı Bir Rehber