2025 ILV Fiyat Tahmini: Yükseliş Trendleri ve Illuvium'un Gelecekteki Değerini Belirleyen Temel Etkenler

Giriş: ILV’nin Piyasa Konumu ve Yatırım Değeri

Illuvium (ILV), Ethereum ağı üzerinde öncü GameFi projelerinden biri olarak 2021’den bu yana önemli mesafe katetmiştir. 2025 yılı itibarıyla Illuvium’un piyasa değeri 105.911.377 $’a ulaşmış, dolaşımdaki arzı yaklaşık 9.482.619 token ve fiyatı 11,169 $ seviyelerine yerleşmiştir. “NFT Oyun İnovatörü” olarak anılan bu varlık, blokzincir oyunları ile merkeziyetsiz finansın kesişiminde giderek daha merkezi bir rol üstlenmektedir.

Bu makalede, Illuvium’un 2025-2030 dönemine ait fiyat eğilimleri; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkiler ışığında kapsamlı şekilde analiz edilerek, profesyonel fiyat öngörüleri ve yatırımcılara yönelik etkin stratejiler sunulacaktır.

I. ILV Fiyat Geçmişi ve Güncel Piyasa Durumu

ILV Fiyat Geçmişinin Evrimi

- 2021: ILV, 30 Kasım 2021’de genel kripto yükselişiyle 1.911,26 $’lık en yüksek seviyesine ulaştı.

- 2022-2024: Kripto kışı ile birlikte genel piyasayla paralel olarak ciddi bir düşüş yaşadı.

- 2025: ILV, 11 Ekim 2025’te 8,33 $ ile tüm zamanların en düşük seviyesini gördü ve zirveden büyük bir gerileme yaşadı.

ILV Güncel Piyasa Görünümü

20 Ekim 2025 itibarıyla ILV, son dip seviyesinden bir miktar toparlanarak 11,169 $ seviyesinden işlem görüyor. Son 24 saatte %0,91’lik hafif bir artışla pozitif bir ivme yakaladı. Ancak genel trend hâlâ düşüş yönünde olup, haftalık bazda %11,21, aylık bazda ise %23,71 oranında gerileme dikkat çekiyor.

Mevcut piyasa değeri 105.911.377 $ seviyesinde olan ILV, kripto piyasasında 393. sırada bulunuyor. 24 saatlik işlem hacmi ise 87.608 $ ile orta düzey aktiviteye işaret ediyor.

Son yükselişe rağmen ILV, geçen yıla göre %69,78 değer kaybederek kripto piyasasındaki zorlukların sürdüğünü gösteriyor. Dolaşımdaki 9.482.619 ILV, toplam arzın %94,82’sini oluşturuyor ve bu da yüksek token dağılımına işaret ediyor.

Güncel ILV piyasa fiyatını görüntülemek için tıklayın

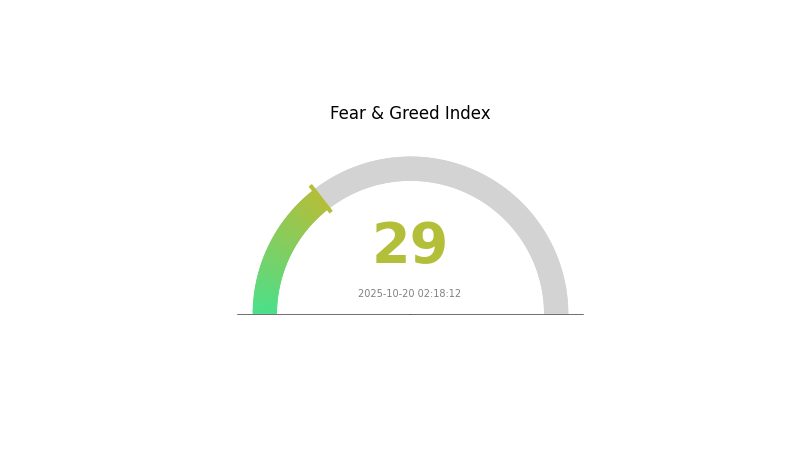

ILV Piyasa Duyarlılığı Göstergesi

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto para piyasası şu anda korku evresinde; endeks 29 seviyesinde. Bu, yatırımcıların temkinli davrandığını ve büyük hamlelerden kaçındığını gösteriyor. Böyle zamanlarda, kısa vadeli dalgalanmalara kapılarak ani kararlar almaktan kaçınmak gerekir. Deneyimli yatırımcılar, “diğerleri korkarken açgözlü ol” yaklaşımıyla bu tip dönemleri fırsat olarak değerlendirir. Ancak, yatırım yapmadan önce kapsamlı araştırma yapmak ve risk profilinizi dikkate almak her zaman büyük önem taşır.

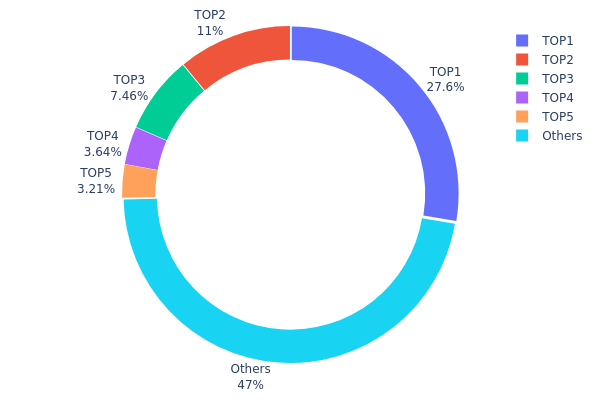

ILV Varlık Dağılımı

ILV adres dağılımı, tokenlerin önemli bir kısmının az sayıda üst düzey adreste toplandığını gösteriyor. En büyük adres toplam arzın %27,64’ünü elinde bulundururken, ilk 5 adres toplamda %52,94’lük bir paya sahip. Bu yoğunlaşma, merkezi bir sahiplik yapısına ve potansiyel piyasa etkilerine işaret eder.

Böyle bir dağılım, piyasa manipülasyonu ve volatilite risklerini artırır. Arzın dörtte birinden fazlasını kontrol eden en büyük sahip, token fiyatında ciddi dalgalanmalara neden olabilir. Bu merkezileşme, büyük oyuncuların alım veya satış kararlarıyla piyasa hareketliliğini artırabilir.

Piyasa yapısı açısından, bu dağılım ILV’de merkeziyetsizliğin düşük olduğuna işaret eder. Tokenlerin neredeyse yarısı yalnızca beş adreste tutuluyor; bu durum zincir üstü istikrarı ve piyasa sağlamlığını zedeleyebilir. Ayrıca, ILV’nin yönetişiminde ve karar alma süreçlerinde de az sayıda büyük yatırımcının etkisi belirleyici olabilir.

Güncel ILV Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x6bd2...57adc6 | 2.510,50K | 27,64% |

| 2 | 0xf977...41acec | 1.000,00K | 11,01% |

| 3 | 0x7f5f...34291d | 677,35K | 7,45% |

| 4 | 0x9df6...da8811 | 330,87K | 3,64% |

| 5 | 0x6a09...ac0eda | 291,05K | 3,20% |

| - | Diğerleri | 4.271,17K | 47,06% |

II. ILV’nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Teknik Gelişim ve Ekosistem Oluşumu

-

Illuvium: Zero: Illuvium ekosisteminde, oyuncuların oyun oynayarak ve kaynak yönetimiyle ILV kazanabildiği mobil oyun.

-

Ekosistem Uygulamaları: Illuvium projesi, Illuvium: Arena ve Illuvium: Overworld gibi çeşitli oyunlar ve uygulamalarla ekosistemin gelişimine ve ILV’ye olan talebe katkı sağlar.

III. 2025-2030 Dönemi ILV Fiyat Tahminleri

2025 Öngörüsü

- Temkinli tahmin: 10,50 $ - 11,00 $

- Tarafsız tahmin: 11,00 $ - 11,50 $

- İyimser tahmin: 11,50 $ - 12,29 $ (blokzincir oyun sektöründeki büyüme devam ederse)

2027-2028 Öngörüsü

- Piyasa aşaması beklentisi: Konsolidasyon sonrası büyüme fazı

- Fiyat aralığı tahminleri:

- 2027: 10,18 $ - 14,00 $

- 2028: 11,89 $ - 19,38 $

- Kilit katalizörler: Illuvium ekosisteminin genişlemesi, blokzincir oyunlarının yaygınlaşması

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 16,37 $ - 19,07 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 19,07 $ - 21,77 $ (blokzincir oyunlarının hızlı benimsenmesi ile)

- Transformasyon senaryosu: 21,77 $ - 22,31 $ (Illuvium’un lider bir blokzincir oyun platformu olması durumunda)

- 31 Aralık 2030: ILV 22,31 $ (iyimser projeksiyonla potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 12,2892 | 11,172 | 10,50168 | 0 |

| 2026 | 13,7248 | 11,7306 | 7,39028 | 5 |

| 2027 | 14,00047 | 12,7277 | 10,18216 | 13 |

| 2028 | 19,37792 | 13,36409 | 11,89404 | 19 |

| 2029 | 21,77344 | 16,37101 | 9,98631 | 46 |

| 2030 | 22,3145 | 19,07222 | 17,54644 | 70 |

IV. ILV için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ILV Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli yatırımcılar ve GameFi tutkunları

- İşlem önerileri:

- Piyasa düşüşlerinde ILV biriktirin

- Illuvium ekosisteminde aktif olun

- Token’ları güvenli, gözetimsiz cüzdanlarda saklayın

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönü ve olası dönüşleri takip edin

- RSI: Aşırı alım/aşırı satım bölgelerini belirleyin

- Dalgalı işlem için ana noktalar:

- Sıkı zarar durdur emirleri koyun

- Belirlenen direnç seviyelerinde kar alın

ILV Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı farklı GameFi projelerine dağıtın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Web3 cüzdan önerisi: Gate web3 cüzdan

- Donanım cüzdanı: Uzun vadeli soğuk depolama için kullanın

- Güvenlik önlemleri: İki faktörlü doğrulama açın, güçlü şifreler kullanın

V. ILV için Potansiyel Riskler ve Zorluklar

ILV Piyasa Riskleri

- Yüksek volatilite: GameFi token’larında sert fiyat dalgalanmaları yaşanabilir

- Rekabet: Blokzincir oyun projelerinde artan rekabet

- Piyasa duyarlılığı: Genel kripto piyasa eğilimlerinden etkilenme

ILV Düzenleyici Riskler

- Belirsiz düzenleyici ortam: GameFi projelerine yönelik artan denetim ihtimali

- Sınır ötesi sınırlamalar: Ülkeden ülkeye değişen regülasyonlar

- Vergilendirme etkileri: Kripto oyun kazançlarına yönelik yeni vergi düzenlemeleri

ILV Teknik Riskler

- Akıllı sözleşme açıkları: İstismar veya hata riski

- Ölçeklenebilirlik sorunları: Ethereum ağındaki tıkanıklık oyun deneyimini etkileyebilir

- Siber güvenlik tehditleri: Illuvium platformuna yönelik saldırı riski

VI. Sonuç ve Eylem Önerileri

ILV Yatırım Değeri Analizi

ILV, GameFi sektöründe uzun vadeli büyüme potansiyeli sunarken, kısa vadede volatilite ve artan rekabet baskılarıyla karşı karşıyadır.

ILV Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp, Illuvium ekosistemini öğrenmeye odaklanmalı

✅ Deneyimli yatırımcılar: Maliyet ortalaması ve yönetişimde aktif katılım düşünülmeli

✅ Kurumsal yatırımcılar: Kapsamlı durum tespiti yapmalı ve stratejik ortaklıkları gözden geçirmeli

ILV İşlem Katılım Yöntemleri

- Spot işlem: Gate.com ve önde gelen borsalarda mevcut

- Staking: Illuvium getiri programlarına katılım

- NFT işlemleri: Illuvium NFT pazarında oyun içi varlık alım-satımı

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını yatırmayınız.

Sıkça Sorulan Sorular

Illuvium 2025’te kaç dolar olabilir?

Piyasa eğilimleri ve proje gelişimine göre, Illuvium (ILV) 2025’te yenilikçi oyun ekosistemi ve artan kullanıcı tabanı sayesinde 150-200 $ aralığına ulaşabilir.

Illuvium 1.000 $’ı görebilir mi?

Evet, Illuvium yenilikçi oyun yapısı ve blokzincir oyun sektöründeki popülaritesiyle 2025’te 1.000 $ seviyesine ulaşabilir.

Illuvium hâlâ iyi bir yatırım mı?

Evet, Illuvium 2025 yılında da umut vadeden bir yatırım olarak öne çıkıyor. Yenilikçi oyun deneyimi ve güçlü topluluk, sektördeki büyümeye ivme kazandırıyor.

ICE 2025’te ne kadar olur?

Piyasa trendleri ve uzman tahminlerine göre, ILV (Illuvium) fiyatı artan benimseme ve ekosistem büyümesiyle 2025’te yaklaşık 150-200 $ seviyelerine ulaşabilir.

ABYS nedir: Sualtı keşiflerini kökten değiştiren yenilikçi Yapay Zekâ sistemi

P2E vs Oyna ve Kazan: Kripto Oyunlarında Ödülleri Maksimize Etmek 2025

YGG'nin Geleceği Ne Olacak: 2025'te Yield Guild Games Temellerinin Kapsamlı Analizi

P2E kripto varlıkları oyun konsepti

GameFi (GAFI) Yatırım İçin Uygun mu?: 2023 Yılında Blockchain Oyun Tokenlarının Potansiyeli ve Risklerinin Analizi

2025 HMSTR Fiyat Tahmini: Hamster Token’ın Büyüme Dinamikleri ve Piyasa Potansiyeli Analizi

UNI Nedir: Uniswap’ın Yönetişim Token’ı ve Merkeziyetsiz Finansta Rolü Hakkında Kapsamlı Bir Rehber

WLFI nedir: Kablosuz Yerel Alan Ağı Frekans Entegrasyonuna Kapsamlı Bir Rehber

CRO Nedir: İşletme Büyümesini Artırmaya Yönelik Dönüşüm Oranı Optimizasyonu Hakkında Kapsamlı Rehber

PYUSD Nedir: PayPal’ın USD Stablecoin’ine Kapsamlı Bir Rehber

TON Nedir: The Open Network ve Devrim Yaratan Blockchain Teknolojisine Dair Kapsamlı Bir Rehber