2025 ICX Price Prediction: Will ICON's Native Token Reach New Heights in the Crypto Market?

Introduction: ICX's Market Position and Investment Value

ICON (ICX), as a decentralized network connecting various independent societies through blockchain, has achieved significant milestones since its inception in 2017. As of 2025, ICON's market capitalization stands at $97,630,865, with a circulating supply of approximately 1,078,317,484 tokens, and a price hovering around $0.09054. This asset, often referred to as the "Korean Ethereum," is playing an increasingly crucial role in connecting various sectors including banking, securities, insurance, healthcare, education, and e-commerce in South Korea.

This article will provide a comprehensive analysis of ICON's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ICX Price History Review and Current Market Status

ICX Historical Price Evolution

- 2018: All-time high of $13.16 reached on January 9th, marking the peak of the bull market

- 2020: COVID-19 pandemic impact, price dropped significantly but showed resilience

- 2021: Bull market resurgence, ICX price experienced notable gains

- 2022-2023: Crypto winter set in, price declined substantially from previous highs

ICX Current Market Situation

As of October 21, 2025, ICX is trading at $0.09054, with a 24-hour trading volume of $12,110.89. The current price represents a 0.83% increase in the last 24 hours, but a significant 29.84% decrease over the past 30 days. ICX's market capitalization stands at $97,630,865, ranking it 418th in the global cryptocurrency market.

The token is currently 99.31% down from its all-time high of $13.16, recorded on January 9, 2018. However, it's trading 33.64% above its all-time low of $0.06775, which occurred recently on October 11, 2025. The circulating supply of ICX is 1,078,317,484.269334 tokens, with a total supply of 1,093,424,782.021544.

Despite recent price declines, ICX maintains a market presence with a dominance of 0.0025% in the overall crypto market. The fully diluted valuation stands at $98,998,679.76, indicating potential for growth if market conditions improve.

Click to view the current ICX market price

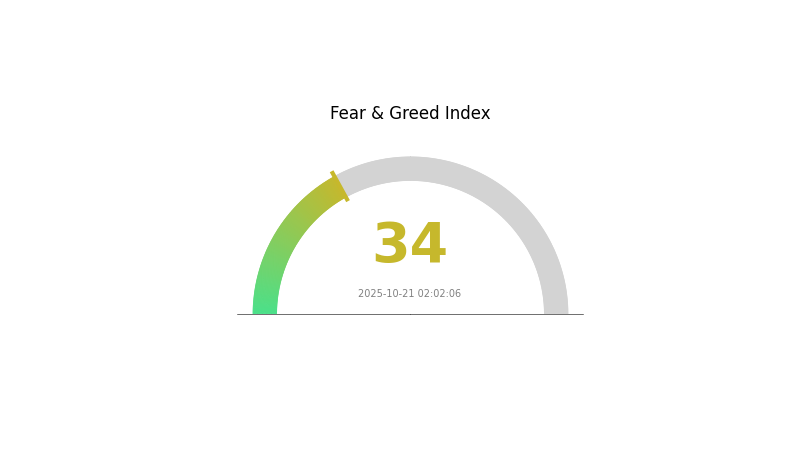

ICX Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index at 34. This suggests investors are cautious and potentially skeptical about market conditions. During such periods, some view it as an opportunity to accumulate assets at lower prices, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions.

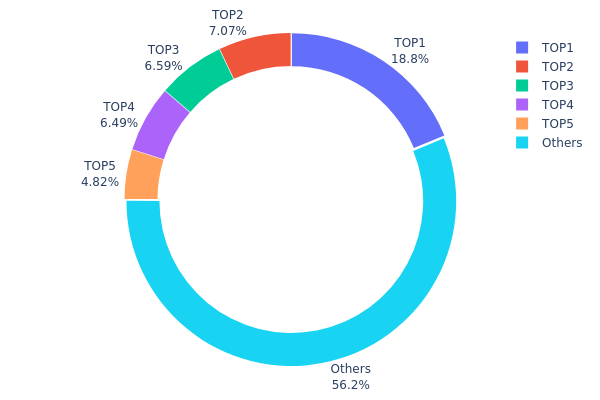

ICX Holdings Distribution

The address holdings distribution data for ICX reveals a moderate level of concentration among top holders. The top address holds 18.78% of the total supply, with the next four largest addresses collectively holding an additional 24.96%. This indicates that approximately 43.74% of ICX tokens are controlled by just five addresses, while the remaining 56.26% is distributed among other holders.

This concentration pattern suggests a relatively centralized ownership structure, which could potentially impact market dynamics. The presence of large holders may introduce volatility risks, as significant sell-offs or accumulations by these addresses could sway market prices. However, the fact that over half of the supply is distributed among smaller holders provides some balance and reduces the risk of market manipulation by any single entity.

The current distribution reflects a market structure that is not fully decentralized but maintains a degree of diversity in ownership. This balance between major stakeholders and a broader holder base could contribute to a relatively stable on-chain structure, though vigilance is warranted regarding potential movements by the largest addresses.

Click to view the current ICX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | hx49b1...cc6d1b | 202560.45K | 18.78% |

| 2 | hx3000...000000 | 76236.02K | 7.06% |

| 3 | cx43e2...e606e0 | 71063.27K | 6.59% |

| 4 | hx9f0c...b540f5 | 70000.00K | 6.49% |

| 5 | hx7442...d55016 | 52014.53K | 4.82% |

| - | Others | 606442.09K | 56.26% |

II. Key Factors Affecting ICX's Future Price

Technical Development and Ecosystem Building

-

Blockchain Infrastructure: ICON is developing a scientific, robust, and secure blockchain infrastructure aimed at attracting institutional and government investors.

-

Research-Driven Approach: The development of ICON is guided by peer-reviewed research methodologies, enhancing its credibility and potential for adoption.

-

Ecosystem Applications: As a "mother of all public chains," ICON aims to connect various blockchain ecosystems, which could significantly impact its utility and value.

Macroeconomic Environment

-

Monetary Policy Impact: Analyst predictions suggest that if the Federal Reserve implements rate cuts in September, ICX could potentially reach $3.

-

Inflation Hedging Properties: As a cryptocurrency, ICX may be viewed as a potential hedge against inflation, affecting its demand in various economic scenarios.

Institutional and Major Holder Dynamics

- Institutional Holdings: By 2025, institutional inflows into ICX are expected to reach $73 million, with total custodial holdings exceeding $900 million.

III. ICX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.08115 - $0.09017

- Neutral prediction: $0.09017 - $0.09468

- Optimistic prediction: $0.09468 - $0.09919 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.07741 - $0.12513

- 2028: $0.06935 - $0.14101

- Key catalysts: Increased adoption, technological advancements, market recovery

2030 Long-term Outlook

- Base scenario: $0.09382 - $0.14433 (assuming steady market growth)

- Optimistic scenario: $0.14433 - $0.1631 (assuming strong ecosystem development)

- Transformative scenario: Above $0.1631 (exceptional market conditions and widespread adoption)

- 2030-12-31: ICX $0.1631 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09919 | 0.09017 | 0.08115 | 0 |

| 2026 | 0.1174 | 0.09468 | 0.08142 | 4 |

| 2027 | 0.12513 | 0.10604 | 0.07741 | 17 |

| 2028 | 0.14101 | 0.11558 | 0.06935 | 27 |

| 2029 | 0.16037 | 0.1283 | 0.08724 | 41 |

| 2030 | 0.1631 | 0.14433 | 0.09382 | 59 |

IV. Professional ICX Investment Strategies and Risk Management

ICX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate ICX during market dips

- Set price targets for partial profit-taking

- Store ICX in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Use stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

ICX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official ICON wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ICX

ICX Market Risks

- High volatility: Sudden price fluctuations can lead to significant losses

- Competition: Other blockchain platforms may outperform ICON

- Market sentiment: Negative news can quickly impact ICX price

ICX Regulatory Risks

- Regulatory uncertainty: Changing government policies may affect ICX adoption

- Cross-border restrictions: International regulations may limit ICX's use cases

- Tax implications: Unclear or changing tax laws for cryptocurrency transactions

ICX Technical Risks

- Network vulnerabilities: Potential security breaches or hacks

- Scalability issues: Challenges in handling increased transaction volume

- Development delays: Slow progress in implementing planned upgrades

VI. Conclusion and Action Recommendations

ICX Investment Value Assessment

ICX presents a high-risk, high-reward investment opportunity. Its long-term value proposition lies in its potential to connect various blockchain ecosystems, particularly in South Korea. However, short-term price volatility and regulatory uncertainties pose significant risks.

ICX Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and consider ICX as part of a diversified crypto portfolio

ICX Trading Participation Methods

- Spot trading: Buy and sell ICX on Gate.com

- Staking: Participate in ICON's staking program for passive income

- DApp ecosystem: Explore ICON's decentralized applications for additional utility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of ICX?

ICX is projected to reach $0.08984 by December 2025, based on market predictions. The coin shows potential for growth, but its long-term future remains uncertain beyond these projections.

Could ICP reach 1000?

Yes, ICP has the potential to reach $1,000 in the future. While it hasn't hit this milestone yet, its innovative technology and growing ecosystem make it a promising long-term investment.

What is the all time high for ICX coin?

The all-time high for ICX coin is $13.16, reached on January 9, 2018.

What is the price prediction for LCX in 2025?

Based on current market analysis, the LCX price is predicted to reach $0.16 by November 2025, with a projected 5% price change.

Share

Content