2025 GAS Price Prediction: Navigating the Future of Cryptocurrency Transaction Costs

Introduction: GAS's Market Position and Investment Value

Gas (GAS), as the fuel token of the NEO blockchain, has played a crucial role since its inception in 2017. As of 2025, GAS has reached a market capitalization of $166,444,285, with a circulating supply of approximately 65,093,580 tokens, and a price hovering around $2.557. This asset, known as the "fuel of the smart economy," is playing an increasingly vital role in powering smart contracts and resource management on the NEO network.

This article will provide a comprehensive analysis of GAS's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. GAS Price History Review and Current Market Status

GAS Historical Price Evolution

- 2018: All-time high reached, price peaked at $91.94 on January 15

- 2020: Market downturn, price hit all-time low of $0.621309 on March 13

- 2022-2025: Gradual recovery and stabilization, price fluctuating between $2 and $5

GAS Current Market Situation

As of October 19, 2025, GAS is trading at $2.557, with a market capitalization of $166,444,285. The token has experienced a slight decline of 1.12% in the past 24 hours, but shows a positive 5.75% growth over the past week. However, longer-term performance indicates a downward trend, with a 23.97% decrease over the last 30 days and a significant 42.30% drop in the past year.

The current price is well below its all-time high, suggesting potential room for growth if market conditions improve. The circulating supply of 65,093,580.54 GAS represents 65.09% of the fully diluted market cap, indicating a relatively high token distribution.

Trading volume in the last 24 hours stands at $32,528.74, reflecting moderate market activity. The token's market dominance is currently at 0.0043%, positioning it as a niche player in the broader cryptocurrency ecosystem.

Click to view the current GAS market price

GAS Market Sentiment Indicator

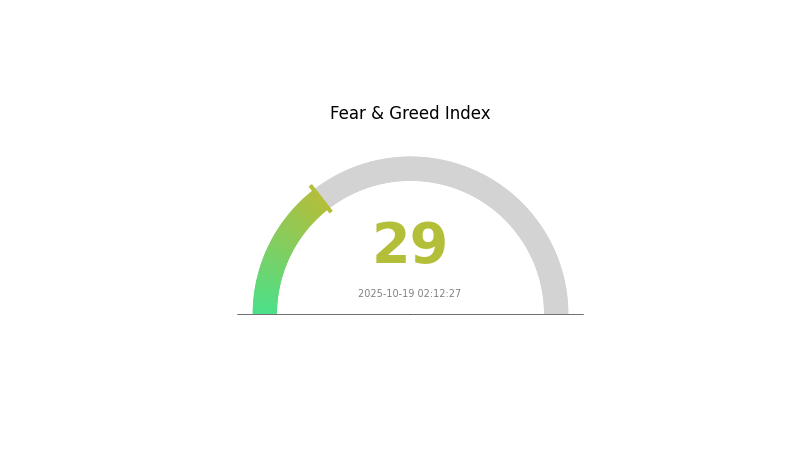

2025-10-19 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 29. This indicates a cautious atmosphere among investors, potentially creating buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. As always, conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed and trade wisely on Gate.com.

GAS Holdings Distribution

The address holdings distribution data for GAS reveals important insights into the token's current market structure. This metric provides a snapshot of how GAS tokens are distributed among different addresses, offering valuable information about ownership concentration and potential market dynamics.

Analysis of the provided data suggests that GAS currently exhibits a relatively decentralized ownership structure. The absence of any single address holding a significant percentage of the total supply indicates a diverse distribution of tokens among market participants. This distribution pattern is generally considered favorable for market stability and resilience against potential price manipulation attempts.

The current address distribution suggests a healthy market structure for GAS, with a reduced risk of sudden large-scale sell-offs that could negatively impact price stability. This decentralized ownership pattern also aligns well with the principles of blockchain technology, potentially contributing to stronger on-chain governance and overall ecosystem stability for the GAS network.

Click to view the current GAS holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting GAS Future Price

Supply Mechanism

- Fixed Supply: GAS has a fixed total supply of 100 million tokens.

- Historical Pattern: The fixed supply has historically contributed to price stability.

- Current Impact: The limited supply may lead to increased scarcity and potentially higher prices as demand grows.

Technical Development and Ecosystem Building

- NEO 3.0 Upgrade: The upgrade to NEO 3.0 has improved network performance and functionality, potentially increasing GAS utility and value.

- Ecosystem Applications: The NEO ecosystem continues to expand with various DApps and projects utilizing GAS for transaction fees and smart contract execution.

III. GAS Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $1.50 - $2.00

- Neutral forecast: $2.00 - $3.00

- Optimistic forecast: $3.00 - $3.68 (requires strong NEO ecosystem growth)

2027-2028 Outlook

- Market phase expectation: Potential consolidation and growth phase

- Price range prediction:

- 2027: $1.78 - $3.70

- 2028: $2.00 - $4.82

- Key catalysts: NEO network upgrades, increased dApp adoption

2029-2030 Long-term Outlook

- Base scenario: $3.60 - $4.40 (assuming steady NEO ecosystem expansion)

- Optimistic scenario: $4.40 - $5.50 (with accelerated adoption and partnerships)

- Transformative scenario: $5.50 - $6.34 (with major institutional adoption and technological breakthroughs)

- 2030-12-31: GAS $4.40 (72% growth from 2025 average)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 3.68208 | 2.557 | 1.50863 | 0 |

| 2026 | 3.74345 | 3.11954 | 2.40205 | 22 |

| 2027 | 3.70601 | 3.43149 | 1.78438 | 34 |

| 2028 | 4.81782 | 3.56875 | 1.9985 | 39 |

| 2029 | 4.61261 | 4.19329 | 3.60623 | 63 |

| 2030 | 6.34025 | 4.40295 | 3.83057 | 72 |

IV. Professional Investment Strategies and Risk Management for GAS

GAS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and NEO ecosystem supporters

- Operation suggestions:

- Accumulate GAS during market dips

- Hold for at least 2-3 years to capture potential growth

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

GAS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance GAS with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official NEO wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GAS

GAS Market Risks

- High volatility: Significant price fluctuations

- Limited liquidity: Potential difficulty in executing large trades

- Correlation with NEO: Performance tied to NEO ecosystem growth

GAS Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of crypto assets

GAS Technical Risks

- Smart contract vulnerabilities: Potential exploits in NEO ecosystem

- Network congestion: Possible delays during high-traffic periods

- Technological obsolescence: Competition from newer blockchain platforms

VI. Conclusion and Action Recommendations

GAS Investment Value Assessment

GAS presents a speculative investment opportunity tied to the success of the NEO ecosystem. While it offers potential for growth, it carries significant risks due to market volatility and regulatory uncertainties.

GAS Investment Recommendations

✅ Beginners: Limit exposure, focus on education and small, diversified positions ✅ Experienced investors: Consider GAS as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and implement robust risk management

GAS Trading Participation Methods

- Spot trading: Buy and sell GAS on Gate.com

- Staking: Participate in NEO staking to earn GAS rewards

- DeFi: Explore decentralized finance options within the NEO ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is gas expected to go up or down?

Gas prices are expected to go up due to increasing network activity and demand for blockchain transactions in the coming years.

What are the predictions for gas prices?

Gas prices are expected to fluctuate between 30-50 Gwei for standard transactions, with potential spikes during network congestion periods. Lower fees are anticipated due to ongoing Ethereum scaling solutions.

How much would gas be in 2025?

Gas prices in 2025 are projected to be around 30-50 Gwei on average, with potential spikes to 100 Gwei during high network congestion periods.

What will gasoline prices be in 2030?

Gasoline prices in 2030 are projected to reach $5-$6 per gallon in the US, due to increased demand, limited supply, and stricter environmental regulations.

Share

Content