2025 FOREX Price Prediction: Emerging Markets and Digital Currencies Reshape Global Exchange Rates

Introduction: FOREX's Market Position and Investment Value

FOREX (FOREX), as a decentralized multi-currency stablecoin protocol, has made significant strides since its inception. As of 2025, FOREX's market capitalization has reached $114,514.92, with a circulating supply of approximately 114,172,402 tokens, and a price hovering around $0.001003. This asset, known as the "DeFi FX protocol," is playing an increasingly crucial role in creating and exchanging multi-currency stablecoins.

This article will comprehensively analyze FOREX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. FOREX Price History Review and Current Market Status

FOREX Historical Price Evolution Trajectory

- 2021: ATH reached, price peaked at $0.985949

- 2024: Market downturn, price hit all-time low of $0.00023641

- 2025: Recovery phase, price rebounded to $0.001003

FOREX Current Market Situation

FOREX is currently trading at $0.001003, showing a slight decline of 0.04% in the past 24 hours. The token has experienced significant volatility over the past year, with a 79.75% increase in price. However, it has seen a 7.46% decrease over the last 30 days. The market capitalization stands at $114,514.92, with a circulating supply of 114,172,402 FOREX tokens. The fully diluted valuation is $421,260, and the current price represents 27.18% of the all-time high. Trading volume in the last 24 hours reached $9,479.99.

Click to view the current FOREX market price

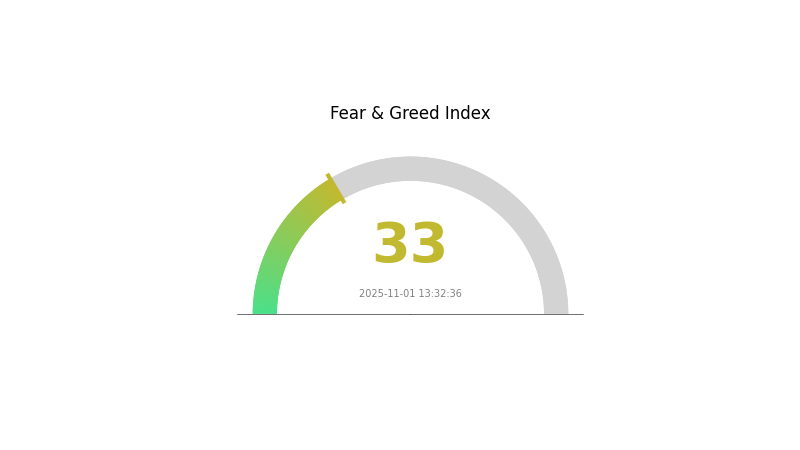

FOREX Market Sentiment Indicator

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with a reading of 33 on the Fear and Greed Index. This indicates a cautious atmosphere among investors, potentially signaling undervalued market conditions. Historically, extreme fear has often presented buying opportunities for savvy traders. However, it's crucial to conduct thorough research and exercise prudence in your investment decisions. Keep an eye on market trends and stay informed about the latest developments in the crypto space to navigate these uncertain times effectively.

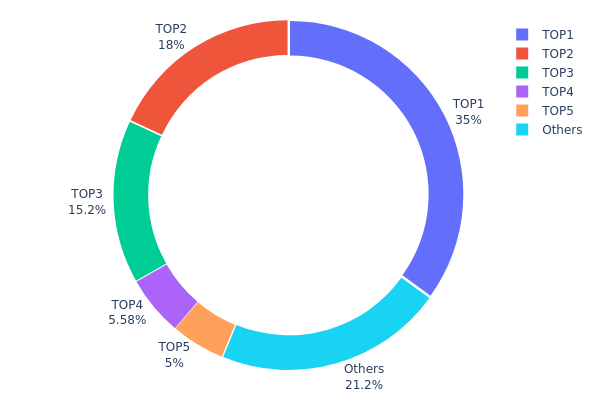

FOREX Holdings Distribution

The address holdings distribution data for FOREX reveals a significant concentration of tokens among a few top addresses. The top address holds 34.95% of the total supply, while the top five addresses collectively control 78.73% of FOREX tokens. This high concentration suggests a centralized ownership structure, which could have implications for market dynamics and token governance.

Such a concentrated distribution raises concerns about potential market manipulation and price volatility. Large holders, often referred to as "whales," have the capacity to significantly influence token prices through substantial buy or sell orders. Moreover, this centralization may impact the decision-making process in the FOREX ecosystem, potentially compromising its decentralization ethos.

From a market perspective, this distribution pattern indicates a relatively low level of token dispersion among smaller holders. While this concentration might provide some stability in the short term, it could also pose risks to the long-term sustainability and adoption of the FOREX token. Encouraging a more diverse distribution of tokens across a broader base of holders could enhance market resilience and promote a more decentralized ecosystem.

Click to view the current FOREX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3e45...7208ec | 146800.00K | 34.95% |

| 2 | 0x8c21...9173e9 | 75754.00K | 18.03% |

| 3 | 0xa112...3aad8b | 63778.16K | 15.18% |

| 4 | 0x0d07...b492fe | 23420.98K | 5.57% |

| 5 | 0xadcf...6c5680 | 21000.00K | 5.00% |

| - | Others | 89246.86K | 21.27% |

II. Key Factors Influencing Future FOREX Prices

Supply Mechanism

- Supply and Demand: The primary driver of forex price trends is the supply and demand relationship. For example, if demand for the US dollar increases, its price will rise unless supply also increases proportionally.

- Historical Pattern: Changes in currency supply have historically had significant impacts on exchange rates.

- Current Impact: Central banks can alter currency supply levels, which typically leads to currency depreciation when increased.

Institutional and Major Player Dynamics

- Institutional Holdings: Major financial institutions' currency holdings can influence market trends.

- National Policies: Government policies at the national level can significantly impact currency values.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly interest rate decisions, are crucial in shaping currency values.

- Inflation Hedging Properties: Currencies often react to inflationary pressures in their respective economies.

- Geopolitical Factors: International political events and conflicts can cause significant forex market volatility.

Technical Development and Ecosystem Building

- Economic Data: Key economic indicators such as inflation data, GDP, production reports, retail data, and employment figures play a vital role in currency valuation.

- Market Sentiment: Overall investor sentiment and market psychology can drive currency trends, sometimes independently of economic fundamentals.

III. FOREX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00091 - $0.00100

- Neutral prediction: $0.00100 - $0.00110

- Optimistic prediction: $0.00110 - $0.00118 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.00094 - $0.00129

- 2027: $0.00067 - $0.00169

- Key catalysts: Increased adoption and market sentiment improvement

2028-2030 Long-term Outlook

- Base scenario: $0.00144 - $0.00190 (assuming steady market growth)

- Optimistic scenario: $0.00190 - $0.00277 (assuming strong bullish trends)

- Transformative scenario: $0.00277+ (extremely favorable market conditions)

- 2030-12-31: FOREX $0.00277 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00118 | 0.001 | 0.00091 | 0 |

| 2026 | 0.00129 | 0.00109 | 0.00094 | 9 |

| 2027 | 0.00169 | 0.00119 | 0.00067 | 18 |

| 2028 | 0.00212 | 0.00144 | 0.00137 | 43 |

| 2029 | 0.00201 | 0.00178 | 0.00164 | 77 |

| 2030 | 0.00277 | 0.0019 | 0.00112 | 89 |

IV. FOREX Professional Investment Strategies and Risk Management

FOREX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate FOREX tokens during market dips

- Participate in the Handle.fi ecosystem to earn additional rewards

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Handle.fi ecosystem developments for potential price catalysts

FOREX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi protocols

- Use of stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, secure private keys, and regularly update software

V. Potential Risks and Challenges for FOREX

FOREX Market Risks

- High volatility: FOREX price may experience significant fluctuations

- Liquidity risk: Limited trading volume may affect ease of buying or selling

- Correlation risk: Performance may be tied to overall DeFi market conditions

FOREX Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting DeFi projects

- Cross-border compliance: Challenges in adhering to varying international regulations

- Tax implications: Evolving tax treatment of DeFi tokens and activities

FOREX Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the Handle.fi protocol

- Scalability issues: Possible network congestion on Ethereum affecting transaction speed

- Oracle failures: Risks associated with price feed inaccuracies for multi-currency stablecoins

VI. Conclusion and Action Recommendations

FOREX Investment Value Assessment

FOREX presents a unique opportunity in the DeFi forex market but carries significant risks due to its low market cap and limited adoption. Long-term potential exists if Handle.fi gains traction, but short-term volatility and technical risks should be carefully considered.

FOREX Investment Recommendations

✅ Beginners: Limit exposure to a small percentage of portfolio, focus on learning the Handle.fi ecosystem ✅ Experienced investors: Consider allocating as part of a diversified DeFi portfolio, actively monitor project developments ✅ Institutional investors: Conduct thorough due diligence on the Handle.fi protocol before considering significant positions

FOREX Trading Participation Methods

- Spot trading: Available on Gate.com for direct FOREX token purchases

- DeFi interactions: Participate in Handle.fi protocol to mint and trade fxTokens

- Yield farming: Explore potential liquidity provision opportunities within the Handle.fi ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is forex worth it in 2025?

Yes, forex remains profitable in 2025. Market volatility offers opportunities for skilled traders. Advanced tech and AI enhance trading strategies, increasing potential returns.

How to tell if forex will go up or down?

Analyze price charts: rising prices show green/blue, falling prices show red. Use technical indicators to confirm trends.

How much can you make with $1000 in forex per day?

With $1000 in forex, you can potentially make $20 to $50 per day using aggressive strategies. Higher returns are possible with increased risk and favorable market conditions.

How to predict forex prices?

Analyze market trends, economic indicators, and use technical tools like charts and patterns. Machine learning models can also help forecast currency movements.

Share

Content