2025 FIL Price Prediction: Analyzing Market Trends and Potential Growth Factors for Filecoin

Introduction: FIL's Market Position and Investment Value

Filecoin (FIL), as a decentralized storage network, has achieved significant milestones since its inception in 2020. As of 2025, Filecoin's market capitalization has reached $3.16 billion, with a circulating supply of approximately 698,801,001 tokens, and a price hovering around $1.613. This asset, often referred to as the "Web3 storage solution," is playing an increasingly crucial role in decentralized data storage and distribution.

This article will provide a comprehensive analysis of Filecoin's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. FIL Price History Review and Current Market Status

FIL Historical Price Evolution

- 2020: FIL launched in October, initial price around $26.73

- 2021: Bull market peak, FIL reached all-time high of $236.84 on April 1st

- 2022-2023: Crypto winter, price declined significantly

- 2025: FIL hit a new low of $0.848008 on October 11th

FIL Current Market Situation

As of October 16, 2025, FIL is trading at $1.613, ranking 93rd by market capitalization. The 24-hour trading volume stands at $2,527,048, with a market cap of $1,127,166,014. FIL has experienced a 3.12% decrease in the last 24 hours and a substantial 31.2% drop over the past week. The current price represents a 99.32% decline from its all-time high and a 90.19% increase from its recent all-time low. The circulating supply is 698,801,001 FIL, which is 35.67% of the total supply. The fully diluted market cap is $3,159,683,580.

Click to view the current FIL market price

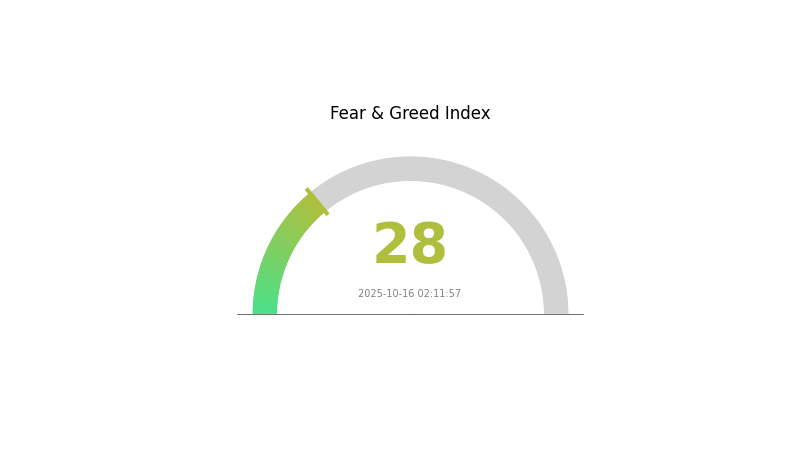

FIL Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for FIL remains cautious, with the Fear and Greed Index at 28, indicating a state of fear. This suggests that investors are currently wary and hesitant in their approach to FIL. Such market conditions often present potential buying opportunities for long-term investors, as assets may be undervalued. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on market trends and stay informed to navigate these uncertain times effectively.

FIL Holdings Distribution

The address holdings distribution data for FIL reveals an interesting pattern in the token's ownership structure. This metric provides insights into the concentration of FIL holdings across different addresses on the network.

Based on the available data, it appears that the FIL token distribution is relatively decentralized, with no single address holding an overwhelmingly large percentage of the total supply. This distribution suggests a healthy level of decentralization in the Filecoin network, which is generally considered positive for the ecosystem's stability and resilience.

The current address distribution pattern indicates a reduced risk of market manipulation by large holders, as no single entity seems to have disproportionate control over the token supply. This distribution may contribute to more organic price movements and potentially lower volatility in the FIL market. However, it's important to note that on-chain data doesn't always reflect the complete picture, as some addresses may belong to exchanges or represent multiple users.

Click to view the current FIL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing FIL's Future Price

Supply Mechanism

- Daily Release: FIL's supply increases daily, with a limited total supply but continuously growing circulating supply.

- Historical Pattern: The continuous increase in circulating supply has historically put downward pressure on FIL's price.

- Current Impact: The daily release of 280,000 FIL tokens is expected to continue impacting market supply and demand balance.

Institutional and Whale Dynamics

- National Policies: Regulatory developments and cryptocurrency policies in various countries significantly influence FIL's price. Stricter regulations may lead to decreased investor confidence, while supportive policies could have a positive impact.

Macroeconomic Environment

- Monetary Policy Impact: Inflation rates and interest rates set by major central banks are expected to influence FIL's price.

- Inflation Hedge Properties: FIL's performance in inflationary environments may affect its attractiveness as a potential hedge.

- Geopolitical Factors: International market trends, including Bitcoin's performance, regulatory developments, and broader economic factors, can cause volatility and impact investor sentiment towards FIL.

Technological Development and Ecosystem Building

- Network Usage: The Filecoin network's storage capacity has exceeded 80EB (equivalent to 80 billion GB), indicating steady growth in real demand.

- Ecosystem Applications: The development progress of the decentralized storage market and the ecosystem built on Filecoin are driving factors for FIL's future price.

III. FIL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.35 - $1.60

- Neutral prediction: $1.60 - $2.00

- Optimistic prediction: $2.00 - $2.29 (requires favorable market conditions and increased adoption)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2026: $1.54 - $2.82

- 2027: $2.12 - $3.29

- Key catalysts: Technological advancements in the Filecoin network, expanding use cases, and overall crypto market sentiment

2030 Long-term Outlook

- Base scenario: $2.80 - $3.20 (assuming steady network growth and adoption)

- Optimistic scenario: $3.20 - $3.80 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $3.80+ (under extremely favorable conditions and breakthrough use cases)

- 2030-12-31: FIL $3.80 (potential peak, subject to market dynamics)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.29472 | 1.616 | 1.35744 | 0 |

| 2026 | 2.81572 | 1.95536 | 1.54473 | 21 |

| 2027 | 3.29204 | 2.38554 | 2.12313 | 47 |

| 2028 | 3.43494 | 2.83879 | 1.47617 | 75 |

| 2029 | 3.26234 | 3.13686 | 2.85455 | 94 |

| 2030 | 3.80753 | 3.1996 | 2.81565 | 98 |

IV. FIL Professional Investment Strategies and Risk Management

FIL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in decentralized storage

- Operational advice:

- Accumulate FIL during market dips

- Stake FIL to earn additional rewards

- Consider running a Filecoin storage node for passive income

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- RSI (Relative Strength Index): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor IPFS adoption rates and network storage growth

- Keep track of major Filecoin network upgrades and their impact on token value

FIL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets and traditional markets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys, and regularly update software

V. Potential Risks and Challenges for FIL

FIL Market Risks

- Volatility: High price fluctuations common in the crypto market

- Competition: Emerging decentralized storage solutions may impact FIL's market share

- Adoption: Slow enterprise adoption of decentralized storage could limit growth

FIL Regulatory Risks

- Global regulations: Changing cryptocurrency regulations may affect FIL's operations

- Data privacy concerns: Stricter data protection laws could impact the Filecoin network

- Securities classification: Potential for FIL to be classified as a security in some jurisdictions

FIL Technical Risks

- Network scalability: Challenges in scaling the Filecoin network to meet growing demand

- Smart contract vulnerabilities: Potential for exploits in the Filecoin protocol

- Storage provider reliability: Risk of data loss or unavailability due to node failures

VI. Conclusion and Action Recommendations

FIL Investment Value Assessment

Filecoin presents a unique value proposition in the decentralized storage space with long-term potential. However, short-term volatility and adoption challenges pose significant risks.

FIL Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a balanced approach with both holding and trading strategies ✅ Institutional investors: Explore running Filecoin storage nodes and strategic partnerships

FIL Trading Participation Methods

- Spot trading: Buy and sell FIL on Gate.com

- Staking: Participate in FIL staking programs for passive income

- Storage provision: Run a Filecoin storage node to earn rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Filecoin reach $100?

Yes, Filecoin could potentially reach $100. This would require significant market growth, increased adoption of decentralized storage, and favorable crypto market conditions.

Is Filecoin a good investment?

Yes, Filecoin is a promising investment. Its decentralized storage solution is gaining adoption, and as of 2025, it shows strong long-term growth potential in the web3 ecosystem.

What is the future of FIL coin?

FIL coin is projected to reach $2.58 by October 2025, showing a modest increase. The future outlook appears neutral, based on current market trends and technical analysis.

Can Filecoin reach $1000 today?

No, Filecoin is unlikely to reach $1000 today. Given current market conditions and projections, such a dramatic price increase in a single day is highly improbable for FIL.

Share

Content