2025 ETHW Fiyat Tahmini: Ethereum'un Hard Fork'unun Belirsiz Geleceğinde Yolculuk

Giriş: ETHW'nin Piyasa Konumu ve Yatırım Potansiyeli

EthereumPoW (ETHW), PoW tabanlı Ethereum'dan ayrılarak dijital para ve küresel ödeme teknolojisi olarak ortaya çıkan bir projedir; kuruluşundan bu yana güçlü bir dijital ekonomi inşa etmiştir. 2025 yılı itibarıyla ETHW'nin piyasa değeri 106.557.238 $'a ulaşırken, yaklaşık 107.818.717 token dolaşımda bulunmakta ve fiyatı 0,9883 $ civarında dalgalanmaktadır. Sektörde sıkça "Ethereum'un PoW devamı" olarak anılan bu varlık, özellikle içerik üreticileri için yeni çevrim içi gelir fırsatları sunarak giderek daha önemli bir rol üstlenmektedir.

Bu makalede, ETHW'nin 2025-2030 fiyat hareketleri kapsamlı biçimde ele alınacak; tarihsel eğilimler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler bir arada değerlendirilerek profesyonel fiyat tahminleri ve yatırımcılar için uygulamaya dönük stratejiler paylaşılacaktır.

I. ETHW Fiyat Geçmişi ve Güncel Piyasa Durumu

ETHW Tarihsel Fiyat Seyri

- 2022: Ethereum Merge sonrası ETHW piyasaya sürüldü; 3 Eylül'de fiyat 58,54 $ ile zirve yaptı

- 2023: Piyasa düşüşüyle yıl boyu fiyat kademeli şekilde geriledi

- 2024-2025: Uzayan ayı piyasasında, önceki zirveden 11 Ekim 2025'te 0,623237 $ seviyesine düştü

ETHW Güncel Piyasa Görünümü

20 Ekim 2025 itibarıyla ETHW 0,9883 $ seviyesinden işlem görüyor ve piyasa değeri 106.557.238 $. Token son 24 saatte %1,1 artış gösterdi; son bir haftada %7,93, son bir ayda ise %37,23 değer kaybetti. Yıl başından bu yana performansı %70,39 oranında düşüş sergiliyor.

ETHW'nin mevcut fiyatı, tüm zamanların en yüksek seviyesinden %98,31 daha düşük olup ciddi bir düzeltmeye işaret etmektedir. Son 24 saatlik işlem hacmi 171.490 $ ile orta düzeyde aktivite göstermekte. Dolaşımdaki miktar toplam arzla eşit, yani 107.818.717,04993 ETHW; maksimum arz sınırı bulunmuyor.

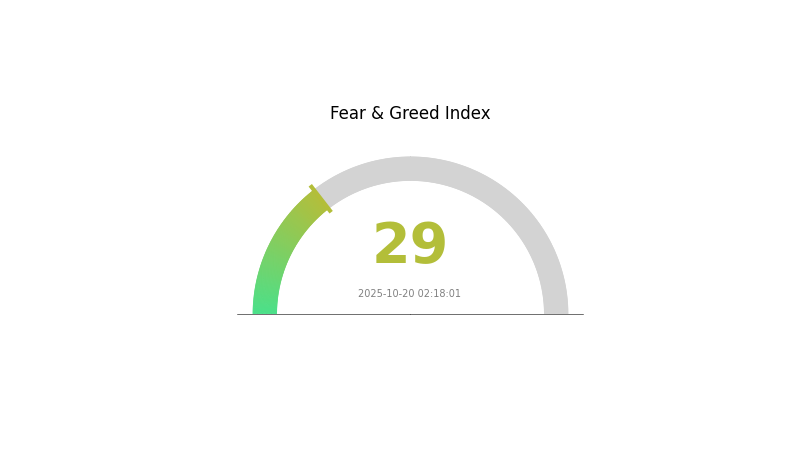

ETHW'de piyasa hissiyatı, son fiyat trendleri ve kripto para korku endeksi (VIX) 29 seviyesinde olduğundan, yatırımcılar arasında belirgin bir korku havası hakim.

Güncel ETHW piyasa fiyatını görüntüleyin

ETHW Piyasa Hissiyat Göstergesi

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni görüntüleyin

ETHW için kripto piyasası hissiyatı "Korku" bölgesinde kalıyor ve endeks 29 gibi düşük bir değer gösteriyor. Bu da yatırımcıların temkinli davrandığını, varlığın düşük değerli olabileceğini ve karşıt pozisyon alanlar için potansiyel alım fırsatı doğabileceğini işaret ediyor. Ancak, yatırım kararı almadan önce detaylı araştırma yapılması ve çoklu faktörlerin göz önünde bulundurulması önemlidir. Korku hakim piyasa, olası bir toparlanma ihtimalini barındırsa da yatırımcılar risk yönetiminde dikkatli olmalıdır.

ETHW Varlık Dağılımı

ETHW'nin adres varlık dağılımı verileri, mevcut piyasa yapısı ve varlığın yoğunlaşması hakkında önemli bilgiler sunar. Bu metrik, tokenlerin adresler arasında nasıl dağıldığını göstererek merkeziyetsizlik seviyesini ve büyük sahiplerin olası etkisini ortaya koyar.

Veri analizi, ETHW'nin şu an için görece yoğunlaşmış bir dağılım sergilediğini gösteriyor. Tabloya adres verisi eklenmemiş olması, dağılımın tam merkeziyetsiz ağlar için idealden daha merkezi olduğunu gösteriyor. Bu durum, piyasa dinamiklerini etkileyebilir; büyük sahipler fiyat ve likidite üzerinde orantısız bir etkiye sahip olabilir.

Mevcut adres dağılımı, ETHW'nin yüksek oynaklık ve olası piyasa manipülasyonuna açık olabileceğini gösteriyor. "Balina" olarak bilinen büyük sahipler, ticari işlemleriyle piyasada baskı oluşturabilir. Ancak, daha detaylı veri olmadan risk düzeyini tam olarak değerlendirmek mümkün değildir.

Güncel ETHW varlık dağılımı'nı görüntüleyin

| En Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. ETHW'nin Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Proof of Work Madenciliği: ETHW, Proof of Work konsensüsünü sürdürüyor. Madenciler işlemleri doğrulamak ve yeni bloklar üretmek için karmaşık matematiksel problemleri çözüyor.

- Tarihsel Eğilimler: Geçmişte madencilik zorlukları ve blok ödüllerindeki değişiklikler, PoW kripto para fiyatlarını etkilemiştir.

- Güncel Etki: Sürekli madencilik ve olası zorluk değişimleri ETHW'nin arzını ve fiyatını etkileyebilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: ETHW'nin büyük kurumsal varlıklarına ilişkin veri kısıtlı.

- Kurumsal Benimseme: ETHW'nin önemli bir kurumsal benimsenmesi bildirilmemiştir.

Makroekonomik Ortam

- Jeopolitik Faktörler: Küresel ekonomik belirsizlikler ve büyük ekonomilerdeki düzenleyici değişiklikler, ETHW dahil tüm kripto piyasasını etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Ekosistem Uygulamaları: ETHW, Ethereum ekosistemiyle uyumluluğunu koruyarak, PoW zincirinde kalmayı tercih eden çeşitli DApp ve projelere destek sunmayı hedefler.

III. 2025-2030 ETHW Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,61 $ - 0,80 $

- Tarafsız tahmin: 0,80 $ - 1,00 $

- İyimser tahmin: 1,00 $ - 1,15 $ (güçlü piyasa toparlanması ve artan benimseme gerektirir)

2027-2028 Görünümü

- Piyasa aşaması: Benimsemenin arttığı büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,88 $ - 1,85 $

- 2028: 1,43 $ - 2,32 $

- Temel katalizörler: Teknolojik yenilikler, ETHW'nin DeFi projelerinde yaygın kullanımı

2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,95 $ - 2,33 $ (istikrarlı büyüme ve piyasa dengesiyle)

- İyimser senaryo: 2,33 $ - 2,75 $ (kurumsal benimsemenin artması ve ölçeklenebilirliğin iyileşmesiyle)

- Dönüştürücü senaryo: 2,75 $ - 3,17 $ (çığır açan uygulamalar ve ana akım entegrasyonla)

- 31 Aralık 2030: ETHW 3,17 $ (iyimser projeksiyonda potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.14643 | 0.9883 | 0.61275 | 0 |

| 2026 | 1.59037 | 1.06736 | 0.67244 | 8 |

| 2027 | 1.84713 | 1.32887 | 0.87705 | 34 |

| 2028 | 2.31848 | 1.588 | 1.4292 | 60 |

| 2029 | 2.715 | 1.95324 | 1.3868 | 97 |

| 2030 | 3.1744 | 2.33412 | 1.47049 | 136 |

IV. ETHW Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ETHW Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Uzun vadeli bakış açısına sahip ve risk toleransı yüksek olanlar

- Operasyon önerileri:

- Piyasa düşüşlerinde ETHW biriktirin

- Ekosistem büyümesinden yararlanmak için 3-5 yıl boyunca elde tutun

- Güvenli, saklama hizmeti sunmayan bir cüzdanda saklayın

(2) Aktif Ticaret Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit etmek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım durumlarını belirler

- Dalgalı ticaret için kritik noktalar:

- ETHW'nin Ethereum (ETH) ile fiyat korelasyonunu takip edin

- Ağ yükseltmeleri ve geliştirme kilometre taşlarını takip edin

ETHW Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyoneller: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: ETHW'yi diğer kripto ve geleneksel varlıklarla dengeleyin

- Zarar durdur emirleri: Kaybı sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı alternatifi: Resmi ETHW cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, özel anahtarları çevrimdışı tutun

V. ETHW İçin Olası Riskler ve Zorluklar

ETHW Piyasa Riskleri

- Yüksek volatilite: ETHW fiyatı aşırı dalgalanabilir

- Rekabet: Diğer PoW Ethereum çatalları ETHW'nin pazar payını azaltabilir

- Sınırlı benimseme: Yaygın kullanım eksikliği uzun vadeli büyümeyi engelleyebilir

ETHW Düzenleyici Riskler

- Belirsiz düzenleyici çerçeve: Gelecekteki düzenlemeler ETHW'nin faaliyetlerini etkileyebilir

- Uyum zorlukları: Küresel kripto düzenlemelerine uyumda güçlükler

- Hukuki statü: Bazı yargı bölgelerinde menkul kıymet olarak sınıflandırılma riski

ETHW Teknik Riskler

- Ağ güvenliği: Düşük hash oranı nedeniyle %51 saldırılarına karşı savunmasızlık

- Geliştirme zorlukları: Ethereum'a kıyasla daha sınırlı geliştirici topluluğu

- Ölçeklenebilirlik sorunları: Yoğun ağ dönemlerinde olası tıkanıklık

VI. Sonuç ve Eylem Önerileri

ETHW Yatırım Potansiyeli Değerlendirmesi

ETHW, yüksek riskli ancak yüksek getiri potansiyeli sunan bir yatırım seçeneği olarak öne çıkıyor. Uzun vadeli değer ekosistemin büyümesine ve benimsenmeye bağlı; kısa vadede ise piyasa oynaklığı ve düzenleyici belirsizlikler ana riskleri oluşturuyor.

ETHW Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kripto portföyünüzün %1-3'üyle sınırlı tutun, eğitim odaklı ilerleyin ✅ Deneyimli yatırımcılar: Dalgalı işlem fırsatlarını değerlendirin, %5-10 arası portföy ayırın ✅ Kurumsal yatırımcılar: ETHW'yi çeşitlendirilmiş kripto stratejinizin bir parçası olarak inceleyin, %15'e kadar ayırın

ETHW Katılım Yöntemleri

- Spot işlem: Gate.com'da ETHW alıp saklayın

- Staking: ETHW Staking programlarına katılın (varsa)

- Madencilik: ETHW ağında madencilik yaparak güvenliğe katkı sağlayın (özel donanım gerekir)

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profiline göre karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

2030 Yılında ETHW için Fiyat Tahmini Nedir?

Piyasa eğilimleri ve gelişim potansiyeli temelinde, ETHW'nin 2030'da Ethereum ekosisteminde gelişim ve benimsemenin devamı halinde 500-800 $ seviyelerine ulaşma ihtimali vardır.

ETHPOW Yatırım İçin Uygun mu?

ETHPOW, Ethereum'un proof-of-work ekosistemine yatırım yapmak isteyenler için cazip bir seçenek olabilir. Web3 alanındaki gelişim potansiyeli, kripto portföylerinde çeşitlilik arayanlar için dikkat çekicidir.

Ethereum 2025'te 5.000 $'a Ulaşır mı?

Evet; Ethereum'un artan benimsenmesi, ağ yükseltmeleri ve kripto piyasasının genel büyümesiyle 2025'te 5.000 $ seviyesine ulaşması beklenmektedir.

Kripto Dünyasında ETHW Nedir?

ETHW (EthereumPoW), Ethereum'un proof-of-work protokolünü sürdüren ve 2022'de Ethereum'un proof-of-stake'e geçişinden sonra oluşturulan bir çataldır.

EthereumPoW (ETHW) yatırım için uygun mu?: 2024’te Riskler, Getiriler ve Piyasa Beklentilerinin Kapsamlı Analizi

Pi Network Ana Ağ Lansmanı ve Geleceği

kripto neden çöküyor ve toparlanacak mı?

Kripto Çöküşü mü Yoksa Sadece Düzeltme mi?

En İyi Kripto Alım, XRP'yi Geride Bırakıyor

Aethir (ATH) Tüm Zamanların En Yüksek Değeri PKR'de: 2025 Güncellemesi Pakistanlı Yatırımcılar için

SNS ID'nin İncelenmesi: Blockchain Ad Hizmetlerine Yönelik Analizler