2025 EDGE Fiyat Tahmini: Büyüme Potansiyeli Analizi ve Gelecekteki Değeri Etkileyen Piyasa Faktörleri

Giriş: EDGE’in Piyasa Konumu ve Yatırım Potansiyeli

Definitive (EDGE), zincir üstü alım-satım platformu olarak gelişmiş ticaret araçlarını herkesin erişimine açıyor ve kuruluşundan bu yana kayda değer başarılar elde etti. 2025 yılı itibarıyla EDGE’in piyasa değeri 61.258.636 ABD Doları’na, dolaşımdaki arzı yaklaşık 203.024.680 tokene, fiyatı ise 0,30173 ABD Doları civarına ulaştı. “Kitleler için gelişmiş alım-satım aracı” olarak bilinen EDGE, merkeziyetsiz finans ve çoklu zincir ticaretinde giderek daha önemli bir rol oynuyor.

Bu makalede, EDGE’in 2025’ten 2030’a kadar olan fiyat eğilimleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında detaylı biçimde incelenecek, yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir stratejiler sunulacaktır.

I. EDGE Fiyat Geçmişi ve Mevcut Piyasa Durumu

EDGE Fiyatının Tarihsel Seyri

- 2025 Nisan: EDGE, 0,02603 ABD Doları ile tüm zamanların en düşük seviyesine inerek piyasadaki varlığını başlattı

- 2025 Ağustos: Token, 0,95518 ABD Doları ile tüm zamanların en yüksek seviyesine çıkarak kısa sürede ciddi büyüme kaydetti

- 2025 Eylül: EDGE, ATH ve mevcut fiyat aralığında dalgalanarak düzeltme süreci yaşadı

EDGE Güncel Piyasa Görünümü

EDGE şu anda 0,30173 ABD Doları fiyatında işlem görüyor ve bu seviye, tüm zamanların en yüksek fiyatından %68,41 daha düşük. Token’ın 24 saatlik işlem hacmi 39.814,20 ABD Doları, piyasa değeri ise 61.258.636,72 ABD Doları. EDGE’in dolaşımdaki arzı 203.024.680,07 token olup, bu miktar toplam 1.000.000.000 token arzının %20,30’una karşılık geliyor. Token son dönemde aşağı yönlü baskı altında: Son 24 saatte %2,16, son 30 günde ise %33,1 oranında değer kaybetti. Bu kısa vadeli zorluklara rağmen EDGE’in piyasa hakimiyeti %0,0073 seviyesinde.

Güncel EDGE piyasa fiyatını görmek için tıklayın

EDGE Piyasa Duyarlılığı Göstergesi

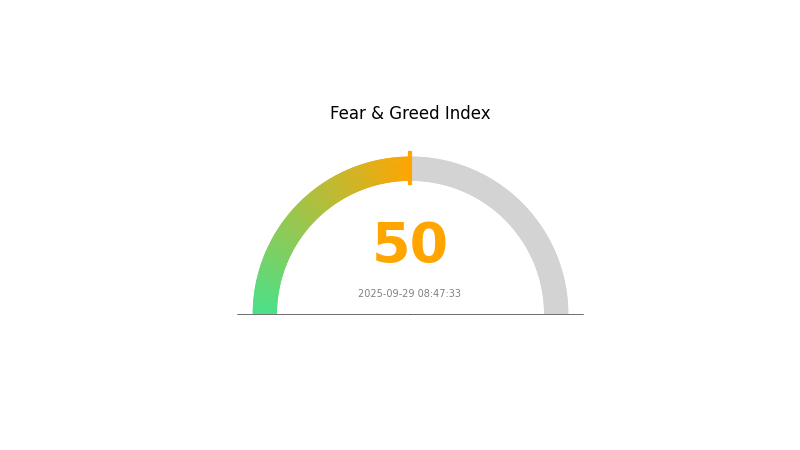

2025-09-29 Korku ve Açgözlülük Endeksi: 50 (Nötr)

Güncel Korku & Açgözlülük Endeksi'ni görmek için tıklayın

Kripto para piyasasında duyarlılık bugün dengeli ve Korku ve Açgözlülük Endeksi 50 seviyesinde, yani nötr. Bu denge, yatırımcıların aşırı korku veya açgözlülükten uzak olduğunu gösteriyor. Piyasada aşırı duyguların olmaması, genellikle temkinli yatırımcılar için fırsat sunar; irrasyonel karar riski düşer. Yatırımcılar, strateji ve portföylerini gözden geçirmek için uygun bir zaman bulabilir; ancak piyasa koşulları hızla değişebilir.

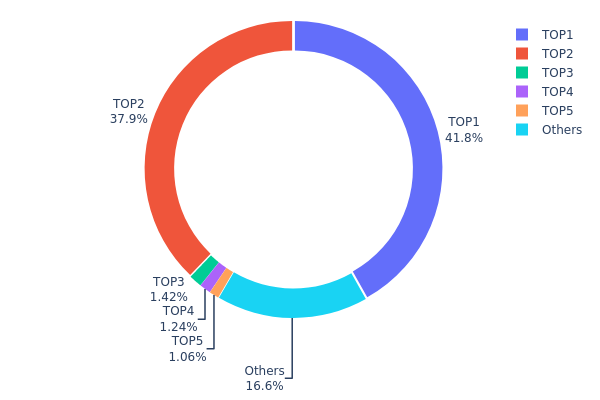

EDGE Varlık Dağılımı

EDGE adres dağılımı verileri, sahiplikte aşırı yoğunlaşmanın olduğunu gösteriyor. En büyük iki adres, toplam arzın %79,69’unu elinde tutuyor; payları sırasıyla %41,84 ve %37,85. Bu yoğunlaşma, merkezileşme ve olası piyasa manipülasyonuna dair riskleri gündeme getiriyor.

Üçüncü ve beşinci en büyük adresler, toplam arzın her biri %1-1,5’ini elinde tutarken, kalan adresler toplamda %16,61’lik paya sahip. Dağılımdaki bu bariz dengesizlik, EDGE sahipleri arasında ciddi bir güç farkına ve piyasa dinamikleri ile fiyat oynaklığında potansiyel etkiye işaret ediyor. Böyle konsantre bir yapı, büyük çaplı satışlar veya birikimlerde fiyat dalgalanmasını ve piyasa istikrarsızlığını artırabilir.

Genel bakışta, bu dağılım EDGE ekosisteminde düşük merkeziyetsizlik düzeyine işaret eder. Tokenların az sayıda adreste toplanması, projenin dayanıklılığını ve yönetim gücünü zayıflatabilir; çünkü kararlar az sayıda büyük sahip tarafından yönlendirilebilir.

Güncel EDGE Varlık Dağılımı'nı incelemek için tıklayın

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf6ba...aef071 | 418.446,10K | 41,84% |

| 2 | 0x421a...be36da | 378.529,22K | 37,85% |

| 3 | 0x85bc...48e1e3 | 14.166,87K | 1,41% |

| 4 | 0xb5e9...c663af | 12.402,43K | 1,24% |

| 5 | 0xdefe...c68bde | 10.588,26K | 1,05% |

| - | Diğerleri | 165.867,12K | 16,61% |

II. EDGE’in Gelecek Fiyatını Etkileyecek Temel Unsurlar

Piyasa Duyarlılığı ve Topluluk Faaliyetleri

- Haberler ve Duyurular: EDGE fiyatı üzerinde haberler ve topluluk beklentisi belirleyici etkiye sahip.

- Tarihsel Model: Fiyat grafikleri, piyasa duyarlılığının izlenmesi açısından teknik analizde kritik rol oynar.

- Güncel Etki: HODLer’lar uzun vadeli temellere odaklanırken, kısa vadeli yatırımcılar anlık piyasa algısından etkilenir.

Teknolojik Gelişim ve Ekosistem Genişlemesi

- Yapay Zeka Entegrasyonu: EDGE’in geleceğinde, araçlara, telefonlara ve bilgisayarlara entegre AI çipleri gibi AI uygulamalarının yaygınlaşması bekleniyor.

- Büyüme Potansiyeli: Morgan Stanley’e göre, bu tür AI yarı iletkenleri 2023-2027 döneminde hızlı büyüme gösterecek.

III. EDGE 2025-2030 Fiyat Öngörüleri

2025 Beklentisi

- Temkinli tahmin: 0,17499 - 0,25000 ABD Doları

- Nötr tahmin: 0,25000 - 0,30171 ABD Doları

- İyimser tahmin: 0,30171 - 0,36507 ABD Doları (pozitif piyasa algısı ve aktif kullanım ile)

2027-2028 Beklentisi

- Piyasa aşaması: Yüksek volatilite ile büyüme dönemi olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,20318 - 0,5737 ABD Doları

- 2028: 0,30135 - 0,51035 ABD Doları

- Temel katalizörler: Teknolojik yenilikler, geniş ölçekli benimsenme, olumlu regülasyon

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,49820 - 0,62026 ABD Doları (istikrarlı büyüme ve benimsenme ile)

- İyimser senaryo: 0,62026 - 0,81874 ABD Doları (güçlü performans ve yaygın kullanım ile)

- Dönüştürücü senaryo: 0,81874 - 1,00000 ABD Doları (çığır açan yenilik ve kitlesel benimsenme ile)

- 2030-12-31: EDGE 0,62026 ABD Doları (%105 artış, 2025’e göre)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,36507 | 0,30171 | 0,17499 | 0 |

| 2026 | 0,46341 | 0,33339 | 0,29338 | 10 |

| 2027 | 0,5737 | 0,3984 | 0,20318 | 32 |

| 2028 | 0,51035 | 0,48605 | 0,30135 | 61 |

| 2029 | 0,74232 | 0,4982 | 0,31387 | 65 |

| 2030 | 0,81874 | 0,62026 | 0,33494 | 105 |

IV. EDGE Yatırım Stratejileri ve Risk Yönetimi

EDGE Yatırım Stratejisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Yüksek risk toleranslı uzun vadeli yatırımcılar için

- Uygulama önerileri:

- Piyasa düşüşlerinde EDGE token biriktirin

- Uzun vadeli fiyat hedefleri belirleyin

- Token’ları güvenli soğuk cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç seviyelerini belirlemek için

- RSI: Aşırı alım/aşırı satım noktalarını tespit etmek için

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Trend dönüşleri için işlem hacmini takip edin

- Risk yönetimi için zarar-durdur emri kullanın

EDGE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü EDGE’de

- Agresif yatırımcılar: Kripto portföyünün %5-10’u EDGE’de

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i EDGE’de

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımı birden fazla kripto varlığa dağıtın

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için otomatik satış emri kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate web3 cüzdan önerisi

- Soğuk saklama: Donanım cüzdanı ile uzun vadeli saklama

- Güvenlik önlemleri: İki faktörlü doğrulama ve güçlü şifre kullanımı mutlaka sağlanmalı

V. EDGE için Olası Riskler ve Zorluklar

EDGE Piyasa Riskleri

- Yüksek volatilite: Kısa sürede ciddi fiyat dalgalanmaları

- Düşük likidite: Büyük işlemlerde likidite sıkıntısı

- Piyasa algısı: Genel kripto piyasası eğilimlerine duyarlılık

EDGE Regülasyon Riskleri

- Belirsiz mevzuat: DeFi platformlarını etkileyebilecek yeni yasalar

- Sınır ötesi uyumluluk: Uluslararası regülasyonlara uyum zorlukları

- Vergi etkisi: DeFi işlemlerinin değişen vergi uygulamaları

EDGE Teknik Riskler

- Akıllı sözleşme açıkları: Platform kodunda istismar riski

- Ağ tıkanıklığı: Yoğun trafik dönemlerinde işlem gecikmeleri

- İnteroperabilite sorunları: Diğer blockchain ağlarıyla bağlantı güçlükleri

VI. Sonuç ve Öneriler

EDGE Yatırım Potansiyeli Değerlendirmesi

EDGE, DeFi alanında yüksek risk ile yüksek getiri potansiyeli sunuyor. Uzun vadeli değerini gelişmiş alım-satım araçları ve çoklu zincir desteğinden alıyor; kısa vadeli dalgalanma ve regülasyon belirsizliği ise ciddi risk oluşturuyor.

EDGE Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, platformu tanıyın ✅ Deneyimli yatırımcılar: DeFi portföyünde EDGE’e yer ayırın ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın, büyük pozisyonlar için OTC seçeneklerini değerlendirin

EDGE Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com ve desteklenen borsalarda işlem imkanı

- DeFi likidite sağlama: Definitive platformunda likidite havuzlarına katılım

- Staking: Proje sunuyorsa staking fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk içerir ve bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Kaybetmeyi göze alamayacağınız tutarları asla yatırmayın.

SSS

Hangi kripto para 1000x potansiyeline sahip?

Bitcoin Hyper ($HYPER), mevcut piyasa trendleri ve büyüme beklentilerine göre 2025-09-29 itibarıyla 1000x artış potansiyeline sahip olarak öngörülmektedir.

En yüksek fiyat beklentisi hangi kripto parada?

2025’te en yüksek fiyat beklentisi Bitcoin (BTC)’de olup, hemen ardından Ethereum (ETH) gelmektedir. Tahminler, güncel piyasa trendleri ve uzman analizlerine dayanmaktadır.

2025’te 1 Bitcoin’in değeri ne olacak?

Analistlere göre, 2025’te 1 Bitcoin’in değeri ETF yatırımları ve kurumsal benimsenme ile 125.000 ila 200.000 ABD Doları arasında olabilir.

Definitive EDGE için fiyat tahmini nedir?

EDGE’in 2025’te 0,048463 ile 0,070655 ABD Doları arasında işlem görmesi, 2030’da ise 0,070655 ABD Doları seviyesine ulaşma potansiyeli öngörülmektedir.

2025 EUL Fiyat Tahmini: DeFi Ekosisteminde Euler Finance Token’a Yönelik Piyasa Analizi ve Gelecek Trendleri

2025 BENQI Fiyat Tahmini: DeFi Protokolü İçin Piyasa Trendleri ve Gelecek Değerleme Analizi

2025 ASTER Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 OMG Fiyat Tahmini: Gelişen Kripto Ekosisteminde Token'ın Piyasa Trendleri ve Gelecek Potansiyelinin Değerlendirilmesi

2025 MORPHO Fiyat Tahmini: DeFi Tokenı için Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 TOKEN Fiyat Tahmini: Piyasa Eğilimleri ve Yaklaşan Boğa Sezonunda Büyüme Potansiyelinin İncelenmesi

AvengerDAO, Haftalık BNB Chain Güvenlik Raporunu Sunar