2025 DEXE Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: DEXE'nin Piyasa Konumu ve Yatırım Potansiyeli

DeXe (DEXE), merkeziyetsiz ve otonom bir kripto para portföy platformu olarak, 2020'deki kuruluşundan bu yana kayda değer ilerlemeler kaydetti. 2025 yılı itibarıyla DEXE'nin piyasa değeri $405.094.176,75 seviyesine ulaştı; dolaşımdaki arz yaklaşık 57.103.774,56 token ve fiyatı $7,094 civarında seyrediyor. "DeFi portföy yönetimi çözümü" olarak bilinen bu varlık, merkeziyetsiz finans ve varlık yönetimi alanında giderek daha önemli bir rol üstleniyor.

Bu makalede, DEXE'nin 2025-2030 yılları arasındaki fiyat hareketleri kapsamlı şekilde analiz edilecek; tarihsel fiyat eğilimleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler birlikte değerlendirilerek yatırımcılara profesyonel fiyat tahminleri ve uygulamaya yönelik yatırım stratejileri sunulacaktır.

I. DEXE Fiyat Geçmişi ve Mevcut Piyasa Durumu

DEXE Tarihsel Fiyat Seyri

- 2020: Lansman, fiyat $0,5 seviyesinden başladı

- 2021: 8 Mart'ta $32,38 ile tüm zamanların en yüksek seviyesine ulaştı

- 2022-2025: Piyasa döngülerinde fiyat $32,38 ile $0,671563 arasında dalgalandı

DEXE Güncel Piyasa Durumu

17 Ekim 2025 itibarıyla DEXE, $7,094 seviyesinden işlem görüyor. Son 24 saatte token %6,05 artış gösterdi ve işlem hacmi $311.187,39 oldu. DEXE'nin piyasa değeri $405.094.176,75 ile kripto para piyasasında 179. sırada yer alıyor. Dolaşımdaki arz 57.103.774,56 DEXE olup, toplam arzın %57,71'ini oluşturuyor (toplam arz: 96.504.599,33 DEXE). Token, zaman aralıklarına göre karma bir performans sergiledi; son 1 saatte %1,94 düşüş, son 7 günde %36,87 azalma, ancak son 30 günde %0,41 artış yaşadı. Güncel fiyatı, tüm zamanların en yüksek seviyesinin %78,09 altında ve en düşük seviyesinin %956,25 üzerinde bulunuyor.

Güncel DEXE piyasa fiyatını görüntüleyin

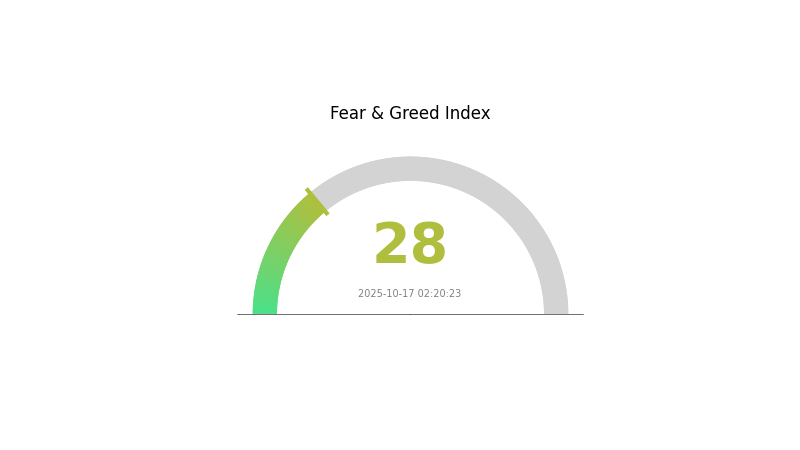

DEXE Piyasa Duyarlılığı Göstergesi

2025-10-17 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim; duyarlılık endeksi 28 seviyesinde. Bu, yatırımcıların temkinli davrandığını gösteriyor. Böyle dönemlerde dikkatli hareket etmek, yatırım öncesinde detaylı araştırma yapmak kritik öneme sahiptir. Korku ortamı bazıları için alım fırsatı sunabilir; ancak mutlaka risk profilinizi ve uzun vadeli stratejinizi değerlendirin. Piyasa duyarlılığının hızla değişebileceğini unutmayın, güncel bilgiyle hareket etmek belirsiz ortamda başarı için gereklidir.

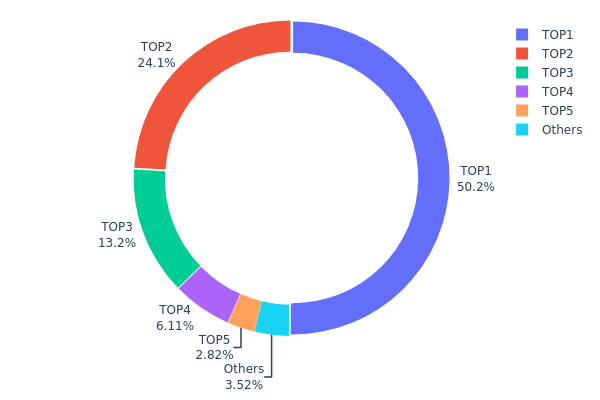

DEXE Varlık Dağılımı

DEXE'nin adres bazlı varlık dağılımı, son derece yoğunlaşmış bir sahiplik yapısı gösteriyor. En büyük adres toplam arzın %50,24’ünü elinde tutarken, ikinci ve üçüncü en büyük adresler sırasıyla %24,06 ve %13,23 paya sahip. İlk üç adres DEXE tokenlerinin %87,53’ünü kontrol ediyor; bu da aşırı merkeziyetçi bir dağılım anlamına geliyor.

Böyle yüksek yoğunlaşma, piyasa istikrarı ve olası fiyat manipülasyonu risklerini gündeme getiriyor. Tokenlerin büyük bir kısmının az sayıda adreste toplanması, ani satışlarda ciddi fiyat oynaklığına yol açabilir. Ayrıca bu merkeziyet, projenin merkeziyetsizlik iddiasını zayıflatabilir ve DEXE token tabanlı oylama mekanizmasında yönetişim kararlarını etkileyebilir.

Mevcut dağılım, DEXE için zincir üstü merkeziyetsizliğin oldukça düşük olduğunu gösteriyor. Bu yoğunlaşma, piyasa manipülasyonu ve ekosistem içi güç dengesizliği riskleri nedeniyle bazı yatırımcıları caydırabilir. Bununla birlikte, büyük payların kilitli veya önemli yatırımcıların projeye olan güvenini yansıtıyor olması da mümkündür.

Güncel DEXE Varlık Dağılımı için tıklayın

| En Yüksek | Adres | Bakiyedeki Miktar | Bakiyedeki (%) |

|---|---|---|---|

| 1 | 0xb562...7c0f0b | 48.491,38K | 50,24% |

| 2 | 0x3ee1...8fa585 | 23.226,36K | 24,06% |

| 3 | 0xde4e...c2cbd6 | 12.770,95K | 13,23% |

| 4 | 0xbe8c...71b7b2 | 5.895,27K | 6,10% |

| 5 | 0xf977...41acec | 2.720,84K | 2,81% |

| - | Diğerleri | 3.399,79K | 3,56% |

II. DEXE'nin Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- DeXe Protocol DAO: DAO'nun önerileri ve yönetişim mekanizmaları, DEXE'nin arzı ve fiyatında kilit rol oynar.

- Mevcut Etki: Token sahiplerinin hazineden çektiği token oranı, yönetişim tokenının fiyatını doğrudan etkiler.

Kurumsal ve Whale Dinamikleri

- Kurumsal Benimseme: DEXE'nin tanınmış kurumlarca benimsenmesi, fiyatında güçlü etki yaratabilir.

- Ulusal Politikalar: Kripto ve blockchain teknolojisine ilişkin devlet politikaları, DEXE'nin fiyatını etkileyebilir.

Makroekonomik Ortam

- Enflasyon Koruma Özelliği: DEXE'nin enflasyonist dönemlerdeki performansı, fiyatına yansıyabilir.

- Jeopolitik Faktörler: Uluslararası gelişmeler, DEXE'nin fiyat hareketlerini etkileyebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Ekosistem Uygulamaları: DeXe ağında ana DApp’ler ve ekosistem projeleri geliştikçe, DEXE fiyatında artış görülebilir.

III. 2025-2030 DEXE Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: $4,26 - $7,11

- Tarafsız tahmin: $7,11 - $8,71

- İyimser tahmin: $8,71 - $10,31 (sürekli piyasa büyümesi ve benimseme ile)

2027-2028 Görünümü

- Piyasa aşaması: Konsolidasyon sonrası kademeli büyüme bekleniyor

- Fiyat aralığı tahmini:

- 2027: $7,37 - $14,17

- 2028: $10,57 - $15,79

- Ana katalizörler: Ekosistem genişlemesi, teknolojik güncellemeler, genel piyasa trendleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: $13,83 - $15,63 (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: $17,43 - $21,42 (güçlü piyasa performansı ve artan kullanım ile)

- Dönüştürücü senaryo: $21,42+ (kitlesel benimseme ve büyük ortaklıklar durumunda)

- 2030-12-31: DEXE $15,63 (mevcut projeksiyonlara göre ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 10,30515 | 7,107 | 4,2642 | 0 |

| 2026 | 10,44729 | 8,70608 | 8,09665 | 22 |

| 2027 | 14,17349 | 9,57668 | 7,37405 | 34 |

| 2028 | 15,79386 | 11,87509 | 10,56883 | 67 |

| 2029 | 17,43144 | 13,83448 | 7,33227 | 95 |

| 2030 | 21,41715 | 15,63296 | 13,91333 | 120 |

IV. DEXE Profesyonel Yatırım Stratejileri ve Risk Yönetimi

DEXE Yatırım Stratejisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde DEXE token biriktirin

- En az 1-2 yıl boyunca elde tutarak dalgalanmalara karşı pozisyon alın

- Token’ları donanım cüzdanında güvenli saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemek için

- RSI: Aşırı alım veya aşırı satım durumlarını izlemek için

- Swing trading için ipuçları:

- Nokta atışı giriş ve çıkış seviyeleri belirleyin

- Düşüş riskini sınırlamak için stop-loss emirleri kullanın

DEXE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcı: Portföyün %1-3’ü

- Agresif yatırımcı: Portföyün %5-10’u

- Profesyonel yatırımcı: Portföyün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Birden fazla kripto para arasında dağıtım

- Stop-loss emirleri: Potansiyel zararları sınırlandırma

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı: Resmi DEXE cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama kullanın, özel anahtarları çevrimdışı saklayın

V. DEXE için Potansiyel Riskler ve Zorluklar

DEXE Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasalarında sert fiyat dalgalanmaları

- Likidite riski: Düşük işlem hacmi pozisyon almayı zorlaştırabilir

- Rekabetçi ortam: Diğer DeFi projeleri pazar payı kazanabilir

DEXE Düzenleyici Riskleri

- Belirsiz yasal ortam: DeFi projeleri için daha sıkı düzenlemeler gelebilir

- Uyum zorlukları: Farklı ülkelerde değişen yasal gereklilikler

- Vergi belirsizliği: Birçok ülkede DeFi işlemlerinin vergisel statüsü net değil

DEXE Teknik Riskleri

- Akıllı kontrat açıkları: Protokolde hata veya istismar riski

- Ölçeklenebilirlik sorunları: Ağ tıkanıklığı performansı olumsuz etkileyebilir

- Uyumluluk zorlukları: Diğer blokzincirlerle entegrasyon güçlükleri

VI. Sonuç ve Eylem Tavsiyeleri

DEXE Yatırım Değeri Analizi

DEXE, DeFi yönetişim tokenı olarak uzun vadede potansiyel sunarken, kısa vadede piyasa oynaklığı ve düzenleyici belirsizlikler nedeniyle risk barındırıyor.

DEXE Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kapsamlı araştırma sonrası küçük ve uzun vadeli pozisyonları değerlendirin

✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi uygulayın

✅ Kurumsal yatırımcılar: DEXE’yi çeşitlendirilmiş kripto portföyünde değerlendirin

DEXE İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com borsasında DEXE token satın alın

- DeFi katılımı: Protokol yönetişiminde DEXE token stake edin

- Likidite madenciliği: DEXE ekosisteminde likidite sağlama fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre karar vermeli ve profesyonel finansal danışmanlarla görüşmelidir. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

SSS

DEXE için 2025 tahmini nedir?

Teknik analizlere göre, DeXe'nin Kasım 2025'te $7,62 seviyesine ulaşması bekleniyor; analiz tarihi: 17 Ekim 2025.

DEXE için tüm zamanların en yüksek fiyatı nedir?

DeXe'nin tüm zamanların en yüksek fiyatı $33,58 olup, 8 Mart 2021'de bu zirveye ulaşmıştır. Bu fiyat, DeXe tarafından bugüne kadar elde edilen en yüksek değeri göstermektedir.

DEXE coin nedir?

DeXe, dijital varlık yönetimini merkeziyetsiz araçlarla sağlayan bir kripto para projesidir. Varlık yönetimini otomasyonla kolaylaştırmayı ve DeFi süreçlerini sadeleştirmeye odaklanır.

2030'da XRP için fiyat tahmini nedir?

Uzun vadeli piyasa trendlerine göre, XRP'nin fiyatı 2030'da $17,00 ile $26,50 arasında olabilir ve potansiyel ortalama fiyat $19,75'tir.

HTX DAO (HTX) iyi bir yatırım mı?: Bu merkeziyetsiz borsa token’inin potansiyelini ve risklerini analiz etmek

DAO Maker (DAO) iyi bir yatırım mı?: Mevcut kripto piyasasında potansiyel ve riskler üzerine değerlendirme

Stella (ALPHA) Yatırım İçin Uygun mu?: Güncel Kripto Piyasasında Olası Getiri ve Risklerin Değerlendirilmesi

Dorayaki (DORA) Yatırıma Değer mi?: Kripto Para Piyasasında Potansiyelinin Değerlendirilmesi

AladdinDAO (ALD) Yatırım İçin Uygun mu?: Bu DeFi Protokol Token'ının Güncel Piyasadaki Potansiyeli ve Risklerinin Analizi

2025 BUSY Fiyat Tahmini: Dijital varlık için piyasa trendleri ve potansiyel büyüme faktörlerinin analizi

Cardano'yu Keşfetmek: Gelecek Perspektifleri ve Yatırım Potansiyeli

CLORE ve UNI: İki Önde Gelen Merkeziyetsiz Hesaplama Platformunun Detaylı Karşılaştırması

Moonbag Stratejisini Keşfetmek: Web3’te Kripto Yatırım Taktikleri İçin Profesyonel Bir Rehber

Kripto para piyasasında Top Form token hakkında en güncel gelişmeler ve uzman analizleri

USD ile USDT alımında zahmetsizce kullanabileceğiniz yeni yöntemleri keşfedin