2025 COTI Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Currency

Introduction: COTI's Market Position and Investment Value

COTI (COTI), as a comprehensive ecosystem around the "financial blockchain", has been solving problems faced by both centralized and decentralized finance since its inception in 2019. As of 2025, COTI's market capitalization has reached $82,557,445, with a circulating supply of approximately 2,428,153,854 tokens, and a price hovering around $0.034. This asset, hailed as the "DAG-based financial solution", is playing an increasingly crucial role in optimizing financial transactions and experiences.

This article will provide a comprehensive analysis of COTI's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to offer professional price predictions and practical investment strategies for investors.

I. COTI Price History Review and Current Market Status

COTI Historical Price Evolution

- 2019: Initial launch, price reached an all-time low of $0.00556342 on November 7

- 2021: Bull market peak, price hit an all-time high of $0.668634 on September 29

- 2022-2023: Crypto winter, price declined significantly from its peak

COTI Current Market Situation

As of October 21, 2025, COTI is trading at $0.034, with a market capitalization of $82,557,231. The token has seen a 2.37% increase in the last 24 hours but remains down 35.099% over the past 30 days. COTI's current price is 94.92% below its all-time high, indicating a significant correction from its peak. The token's trading volume in the last 24 hours stands at $42,605.71, suggesting moderate market activity. With a circulating supply of 2,428,153,854 COTI out of a maximum supply of 4,910,000,000, the token has a circulating supply ratio of 49.45%.

Click to view the current COTI market price

COTI Market Sentiment Indicator

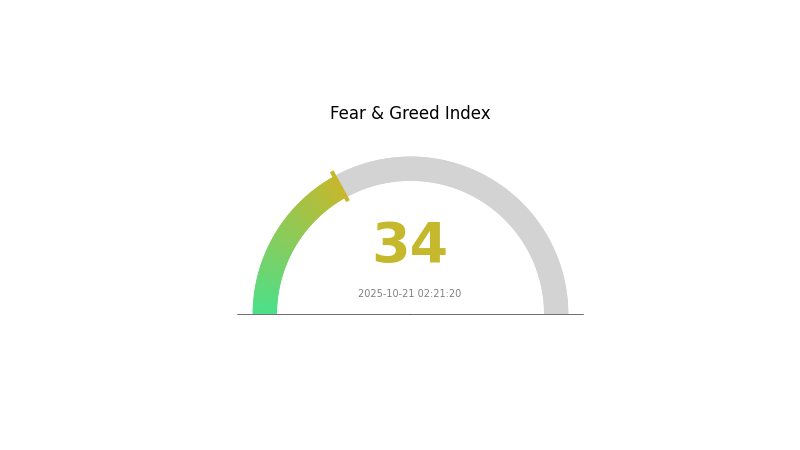

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of uncertainty, as reflected in the Fear and Greed Index standing at 34. This "Fear" sentiment suggests investors are cautious and may be hesitant to make bold moves. During such times, it's crucial to stay informed and consider long-term strategies. While fear can present buying opportunities for some, it's essential to conduct thorough research and manage risks carefully. Remember, market sentiment can shift quickly, so staying updated with reliable sources like Gate.com is key to navigating these volatile conditions.

COTI Holdings Distribution

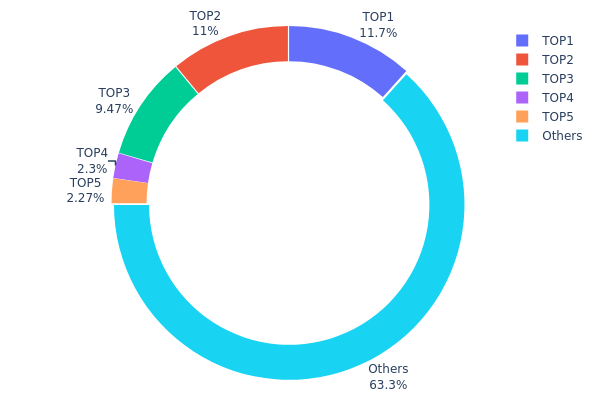

The address holdings distribution data for COTI reveals a notable concentration among top holders. The top address controls 11.65% of the total supply, with the top three addresses collectively holding 32.11% of all COTI tokens. This level of concentration suggests a relatively centralized ownership structure, which could potentially impact market dynamics.

While the top five addresses account for 36.67% of the total supply, it's worth noting that 63.33% is distributed among other addresses. This indicates a degree of wider distribution beyond the major holders. However, the substantial holdings of the top addresses could still exert significant influence on market movements and liquidity.

The current distribution pattern may contribute to increased volatility and susceptibility to large-scale trading activities. It also raises questions about the overall decentralization of COTI's ecosystem, as major holders could potentially influence governance decisions or market sentiment. Investors should consider these factors when assessing COTI's market structure and potential risks associated with concentrated ownership.

Click to view the current COTI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 318125.05K | 11.65% |

| 2 | 0x1ba5...3ba581 | 300000.00K | 10.99% |

| 3 | 0x5a52...70efcb | 258500.00K | 9.47% |

| 4 | 0xb8ff...9fd84e | 62748.80K | 2.29% |

| 5 | 0x3a13...1e4559 | 62024.29K | 2.27% |

| - | Others | 1727880.94K | 63.33% |

II. Key Factors Affecting COTI's Future Price

Market Dynamics

- Price Resistance: Breaking through the $0.06 resistance level is a key challenge for COTI.

- Trading Volume: Increasing trading volume and market attention is crucial for price growth.

Technical Development and Ecosystem Building

- Trustchain: COTI's core innovation is Trustchain, a consensus algorithm based on trust scores. Each user has a Trust Score in the network, which affects transaction verification and confirmation.

- Payment Solutions: COTI needs to prove the actual adoption rate of its payment solutions.

- Differentiation: Establishing differentiation in the competitive payment sector is essential for COTI's future success.

Macroeconomic Environment

- Market Volatility: The cryptocurrency market's volatility requires investors to adopt a forward-looking approach to predict potential price trends and position themselves strategically.

III. COTI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02006 - $0.03

- Neutral prediction: $0.03 - $0.04

- Optimistic prediction: $0.04 - $0.04964 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.03199 - $0.06143

- 2028: $0.04319 - $0.06973

- Key catalysts: Increased adoption of COTI's payment solutions, blockchain technology advancements

2029-2030 Long-term Outlook

- Base scenario: $0.06089 - $0.06819 (assuming steady market growth)

- Optimistic scenario: $0.07550 - $0.09684 (assuming strong market performance and COTI ecosystem expansion)

- Transformative scenario: Up to $0.09684 (with breakthrough innovations and widespread adoption)

- 2030-12-31: COTI $0.06819 (potential average price, reflecting significant growth from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04964 | 0.034 | 0.02006 | 0 |

| 2026 | 0.04349 | 0.04182 | 0.03764 | 22 |

| 2027 | 0.06143 | 0.04266 | 0.03199 | 25 |

| 2028 | 0.06973 | 0.05204 | 0.04319 | 52 |

| 2029 | 0.0755 | 0.06089 | 0.03775 | 78 |

| 2030 | 0.09684 | 0.06819 | 0.03478 | 100 |

IV. COTI Professional Investment Strategies and Risk Management

COTI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate COTI tokens during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

COTI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-7% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options trading: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official COTI wallet

- Security precautions: Enable 2FA, use strong passwords, regularly update software

V. COTI Potential Risks and Challenges

COTI Market Risks

- High volatility: COTI price can experience significant fluctuations

- Limited liquidity: May face challenges in large-volume trades

- Competition: Other blockchain payment solutions may gain market share

COTI Regulatory Risks

- Uncertain regulations: Cryptocurrency regulations are evolving globally

- Compliance issues: Potential challenges in adhering to new financial regulations

- Cross-border restrictions: Some countries may limit or ban COTI transactions

COTI Technical Risks

- Smart contract vulnerabilities: Potential bugs in smart contract code

- Scalability challenges: May face issues as network usage grows

- Network security: Risk of 51% attacks or other network compromises

VI. Conclusion and Action Recommendations

COTI Investment Value Assessment

COTI presents a unique value proposition in the blockchain payment sector, with potential for long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

COTI Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market

✅ Experienced investors: Consider a moderate allocation with active risk management

✅ Institutional investors: Explore strategic partnerships and large-scale adoption opportunities

COTI Trading Participation Methods

- Spot trading: Buy and sell COTI on Gate.com

- Staking: Participate in COTI staking programs for passive income

- DeFi integration: Explore COTI-based DeFi products as they become available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Coti reach $10?

Yes, COTI could potentially reach $10, but it's likely to be a long-term goal. Current projections suggest this might happen after 2030.

Does Coti coin have a future?

Yes, Coti has a promising future. Its potential for growth is supported by locked treasury funds, transaction fees, and strong adoption within the Cardano ecosystem. Market projections suggest significant upside, with some estimates reaching up to $200 billion.

Is Coti a good crypto to buy?

COTI shows potential in the Web3 space. Its innovative technology and growing adoption make it an interesting investment option for 2025. Always research before investing.

Can cro coin reach $1?

CRO is unlikely to reach $1 based on current projections. Analysts forecast a maximum value of around $0.40 by 2031, which falls short of the $1 mark.

Share

Content