2025 COOKIE Fiyat Tahmini: Dijital Cookie Ekonomisi için Piyasa Analizi ve Gelecek Perspektifi

Giriş: COOKIE'nin Piyasadaki Konumu ve Yatırım Değeri

Cookie DAO (COOKIE), hem yapay zekâ hem de insanlar için en büyük AI Agents endeksi ve veri katmanı olarak, kripto dünyasında ilk AI Agents endeksini oluşturarak sektöre öncülük etmiştir. 2025 yılı itibarıyla COOKIE'nin piyasa değeri 64.582.118 $ seviyesine ulaşmış, dolaşımdaki arzı yaklaşık 613.140.781 token ve fiyatı 0,10533 $ civarındadır. "AI Agents Endeksinin Öncüsü" olarak bilinen bu varlık, AI ajanları piyasasında gerçek zamanlı analitik sağlama konusunda giderek daha önemli bir rol üstleniyor.

Bu makalede, COOKIE'nin 2025-2030 dönemindeki fiyat trendleri kapsamlı biçimde analiz edilecek; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler bir arada değerlendirilerek yatırımcılara profesyonel fiyat tahminleri ve etkili yatırım stratejileri sunulacaktır.

I. COOKIE Fiyat Geçmişi ve Güncel Piyasa Durumu

COOKIE Tarihsel Fiyat Değişimi

- 2024: Proje başlatıldı, fiyat 0,028 $ seviyesinden işlem gördü

- 2025 Ocak: Tüm zamanların en yüksek değeri olan 0,8468 $'a ulaşıldı

- 2025 Eylül: Fiyat düzeltmesiyle 0,10533 $ seviyesine geriledi

COOKIE Güncel Piyasa Durumu

COOKIE şu anda 0,10533 $ seviyesinden alınıp satılıyor ve 24 saatlik işlem hacmi 319.876,59 $ olarak gerçekleşti. Token son 24 saatte %2,76 değer kazandı. Piyasa değeri ise 64.582.118,57 $ ile kripto para piyasasında 597. sırada bulunuyor. Dolaşımdaki arz 613.140.781,97 COOKIE token olup toplam arzın (999.929.030 COOKIE) %61,31'ini oluşturuyor. Token son bir saatte %0,36'lık kısa vadeli pozitif ivme sergiledi; ancak orta vadede, son bir haftada %7,77 ve son 30 günde %17,96 düşüş gösterdi. Buna rağmen, COOKIE son bir yılda %313,58 gibi kayda değer bir uzun vadeli büyüme gerçekleştirdi.

Güncel COOKIE piyasa fiyatını görmek için tıklayın

İstenen formatta çıktı aşağıdadır:

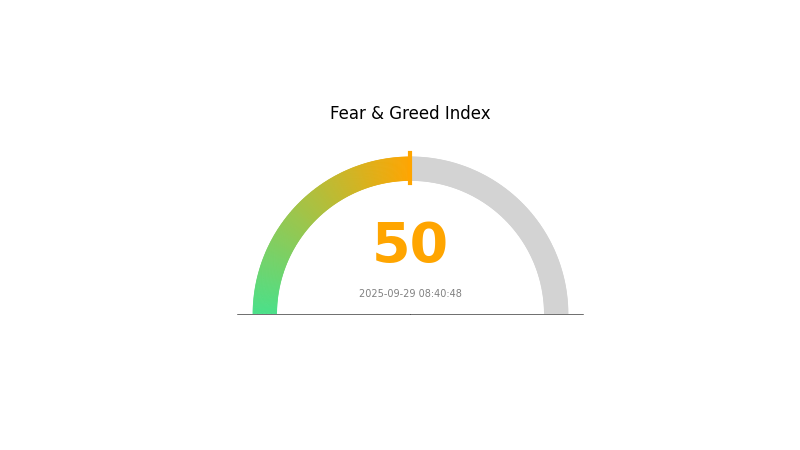

COOKIE Piyasa Duyarlılık Göstergesi

2025-09-29 Korku ve Açgözlülük Endeksi: 50 (Nötr)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında duyarlılık dengeli seyrediyor. Korku ve Açgözlülük Endeksi'nin 50 olması, piyasada nötr bir görünüm olduğunu gösteriyor. Yatırımcılar piyasanın yönüne dair aşırı iyimser veya karamsar değil. Bazı yatırımcılar bunu istikrar göstergesi olarak görürken, bazıları ise olası bir dönüm noktası olarak değerlendirebilir. Her zaman olduğu gibi, volatil kripto piyasasında yatırım kararı almadan önce kapsamlı araştırma yapmalısınız. Farklı parametreleri göz önünde bulundurun.

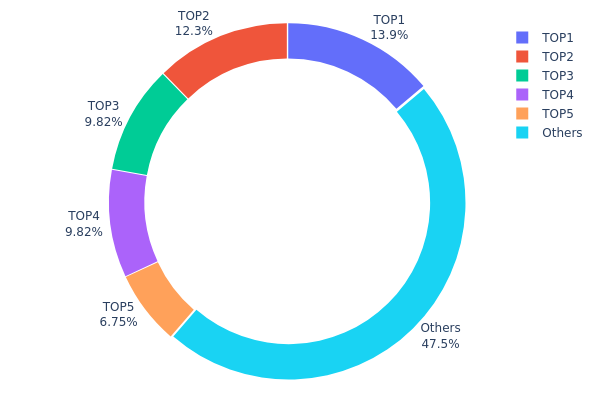

COOKIE Varlık Dağılımı

COOKIE adres varlık dağılımı verileri, görece yoğunlaşmış bir sahiplik yapısını gösteriyor. İlk 5 adres toplam arzın %52,52'sini elinde tutuyor; en büyük sahip ise tüm tokenların %13,86'sını barındırıyor. Bu yoğunlaşma, COOKIE'nin dağılımında orta düzeyde bir merkezileşmeye işaret ediyor.

Böyle bir yoğunlaşma piyasada dalgalanmalara sebep olabilir. Büyük sahiplerin elindeki varlıklar, yüklü satışlarda fiyat üzerinde ciddi baskı oluşturabilir. Diğer taraftan, bu büyük adresler uzun vadeli yatırımcıysa istikrar sağlayabilir. Ancak yoğunlaşma, piyasa manipülasyonu riskini de artırır; ana sahiplerin koordineli işlemleri, fiyat hareketlerini ciddi biçimde etkileyebilir.

Tokenların %47,48'i diğer adreslere dağıtılmış durumda; bu, katılımın genişlediğini gösterse de genel yapı merkezileşme riskine karşı dikkatli olunması gerektiğini ortaya koyuyor. Dağılım modeli, büyük sahiplerin davranışlarının ve piyasa üzerindeki etkilerinin yakından izlenmesinin önemini vurguluyor.

Güncel COOKIE Varlık Dağılımını görmek için tıklayın

| Üst | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 112.911,32K | 13,86% |

| 2 | 0xb26e...bc1141 | 100.000,00K | 12,27% |

| 3 | 0x458e...ddb992 | 80.000,00K | 9,82% |

| 4 | 0xad43...32429a | 80.000,00K | 9,82% |

| 5 | 0xa880...73b5af | 55.000,00K | 6,75% |

| - | Diğerleri | 386.588,13K | 47,48% |

II. COOKIE'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Opsiyon Vadesi: Opsiyon vadeleri, büyük COOKIE sözleşmeleri etrafında işlem pozisyonlarının değişmesiyle piyasada ciddi oynaklık yaratabilir.

- Tarihsel Eğilim: COOKIE piyasasında üç aylık opsiyon vadeleri, aylık vadelere kıyasla fiyat üzerinde daha büyük etki gösteriyor.

- Güncel Etki: Büyük ölçekli opsiyon vadesi olayları, sözleşmelerin bir kısmı kullanılsa veya hedge edilse dahi fiyat dalgalanmalarını tetikleyebilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: Alım-satım opsiyonu oranı, kurumsal ve bireysel piyasa duyarlılığını gösterir. Oranın 1'in üzerinde olması ayı, altında olması ise boğa beklentisini ifade eder.

- Kurumsal Benimseme: Yok

- Devlet Politikaları: Yok

Makroekonomik Ortam

- Para Politikası Etkisi: Yok

- Enflasyona Karşı Koruma: Yok

- Jeopolitik Faktörler: Yok

Teknik Gelişim ve Ekosistem Oluşumu

- Maksimum Acı Noktası (Max Pain) Teorisi: Maksimum acı noktası teorisi, opsiyon vade fiyatlarının en fazla sözleşmenin değersiz olduğu seviyeye yönelme eğiliminde olduğunu ve bunun piyasa manipülasyonu riskini artırabileceğini belirtir.

- Piyasa Dönüşleri: Vade tarihine yakın aşırı alım-satım opsiyonu oranları, piyasa dönüşlerinin habercisi olabilir; çünkü varlık fiyatları genellikle aşırı alım veya aşırı satım seviyelerine ulaşır.

- Ekosistem Uygulamaları: CoinGlass ve CME Group takvimleri gibi ileri analiz platformları, opsiyon piyasası hakkında gerçek zamanlı veri sunarak yatırımcılara avantaj sağlar.

III. 2025-2030 Dönemi COOKIE Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,07078 $ - 0,10564 $

- Nötr tahmin: 0,10564 $ - 0,1236 $

- İyimser tahmin: 0,1236 $ - 0,14 $ (güçlü piyasa toparlanması ve benimsemenin artması durumunda)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan benimsemeyle büyüme fazına geçiş olası

- Fiyat aralığı tahmini:

- 2027: 0,12619 $ - 0,17953 $

- 2028: 0,10372 $ - 0,21209 $

- Temel katalizörler: Teknolojik ilerleme, kullanım alanlarının artması ve genel kripto piyasası büyümesi

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,18883 $ - 0,20088 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,20088 $ - 0,23905 $ (yaygın benimseme ve olumlu regülasyon ortamı ile)

- Dönüştürücü senaryo: 0,23905 $ - 0,25 $ (çığır açıcı teknolojik gelişmeler ve ana akım entegrasyon ile)

- 2030-12-31: COOKIE 0,23905 $ (olumlu piyasa koşullarına bağlı potansiyel zirve)

| Yıl | Öngörülen En Yüksek Fiyat | Öngörülen Ortalama Fiyat | Öngörülen En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,1236 | 0,10564 | 0,07078 | 0 |

| 2026 | 0,14557 | 0,11462 | 0,05846 | 9 |

| 2027 | 0,17953 | 0,13009 | 0,12619 | 23 |

| 2028 | 0,21209 | 0,15481 | 0,10372 | 47 |

| 2029 | 0,21831 | 0,18345 | 0,14676 | 74 |

| 2030 | 0,23905 | 0,20088 | 0,18883 | 91 |

IV. COOKIE İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

COOKIE Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli yatırımcılar ve AI teknolojisi odaklı yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde COOKIE tokeni biriktirin

- Cookie DAO'nun gelişimini ve AI agent piyasası trendlerini takip edin

- Tokenları güvenli cüzdanlarda, güçlü yedekleme önlemleriyle saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönünü ve muhtemel dönüşleri belirlemeye yardımcı olur

- RSI – Göreli Güç Endeksi: Aşırı alım ve aşırı satım durumlarını izleyin

- Swing ticareti için ipuçları:

- AI agent piyasası duyarlılığını ve benimseme oranlarını takip edin

- Teknik göstergelere göre giriş-çıkış noktalarını net belirleyin

COOKIE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: %5-10 arası

- Profesyonel yatırımcılar: Maksimum %15

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: COOKIE'yi diğer kripto varlıklar ve geleneksel yatırımlarla dengeleyin

- Zarar durdur emri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 cüzdanı

- Donanım cüzdanı: Uzun vadeli tutum için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifreler ve düzenli yazılım güncellemeleri

V. COOKIE İçin Potansiyel Riskler ve Zorluklar

COOKIE Piyasa Riskleri

- Oynaklık: AI agent piyasası duyarlılığı hızlı fiyat dalgalanmalarına sebep olabilir

- Rekabet: Yeni AI agent endekslerinin ortaya çıkması COOKIE'nin pazar payını etkileyebilir

- Benimseme: AI agent teknolojisinin yavaş yayılması talebi azaltabilir

COOKIE Regülasyon Riskleri

- Belirsiz düzenlemeler: Kripto ve AI alanında değişen regülasyonlar faaliyetleri etkileyebilir

- Uluslararası uyum: Farklı ülkelerdeki mevzuatlar küresel büyümeyi sınırlayabilir

- Veri gizliliği: Daha sıkı veri koruma yasaları AI agent veri toplama süreçlerini etkileyebilir

COOKIE Teknik Riskleri

- Akıllı sözleşme açıkları: Temel yazılımda istismar riski mevcut olabilir

- Ölçeklenebilirlik sorunları: Hızlı büyüme platform altyapısını zorlayabilir

- Oracle bağımlılığı: AI agent bilgileri için harici veri kaynaklarına bağımlılık

VI. Sonuç ve Eylem Önerileri

COOKIE Yatırım Değeri Değerlendirmesi

COOKIE, gelişmekte olan AI agent piyasasında uzun vadeli büyüme potansiyeliyle özgün bir fırsat sunuyor. Yatırımcılar kısa vadede yüksek oynaklık ve regülasyon belirsizliklerini göz önünde bulundurmalı.

COOKIE Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın ve AI agent teknolojisini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Kendi risk toleransınıza göre dengeli bir strateji izleyin ✅ Kurumsal yatırımcılar: Stratejik ortaklıkları değerlendirin ve kapsamlı inceleme gerçekleştirin

COOKIE İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden COOKIE tokeni alıp satabilirsiniz

- Staking: Cookie DAO'nun sunduğu staking programlarına katılabilirsiniz

- Yönetim: Token sahipliği hakları tanınıyorsa DAO yönetiminde söz sahibi olabilirsiniz

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profiline uygun karar vermeli ve profesyonel finansal danışmanlardan görüş almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

COOKIE coin iyi bir yatırım mı?

COOKIE coin yatırım için umut vadeder. Teknik analiz son dönemde güçlü performans ve potansiyel yüksek kazançlar göstermektedir, portföyünüze eklemeyi değerlendirebilirsiniz.

COOKIE coin 1 $'a ulaşır mı?

Mevcut tahminlere göre COOKIE coin'in 28 Haziran 2042'de 1 $ seviyesine ulaşması bekleniyor. Bunun için şu anki fiyattan %866,82'lik bir artış gerekmekte; bu da olumlu piyasa koşullarına bağlıdır.

Hangi kripto 1000x yapacak tahmini var?

Bitcoin Hyper ($HYPER), 2025-09-29 itibarıyla piyasa trendleri ve büyüme potansiyeli doğrultusunda 1000x yapması bekleniyor.

COOKIE kripto için gelecek nedir?

COOKIE kripto, 2026'da 0,070 - 0,280 $ aralığında işlem görecek ve ortalama fiyatı 0,142 $ olacak şekilde öngörülüyor. Bu tahmin, önümüzdeki yıllarda COOKIE için büyüme ve piyasa istikrarı anlamına geliyor.

2025 HOLO Fiyat Tahmini: Halving Sonrası Kripto Piyasasında Trendler ve Büyüme Potansiyeli Analizi

2025 SIREN Fiyat Tahmini: Gelecek Perspektifi, Piyasa Analizi ve Bu Gelişen Kripto Varlığı Şekillendiren Temel Dinamikler

2025 AVAAI Fiyat Tahmini: Genişleyen Yapay Zeka Sektöründe AVAAI'nin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 XNY Fiyat Tahmini: Piyasa Trendleri, Teknik Göstergeler ve Kripto Para Yatırımcıları İçin Gelecek Perspektifinin Analizi

2025 ACT Fiyat Tahmini: Gelişen kripto ekosisteminde ACT tokenlarının piyasa trendlerini ve gelecekteki değerlemesini analiz ediyoruz

2025 CLORE Fiyat Tahmini: Kripto Paranın Piyasa Eğilimleri ve Gelecek Beklentilerinin Analizi

Blum Token Dağıtım Programı