2025 CFG Fiyat Tahmini: Centrifuge Token’ın piyasa trendleri ile potansiyel büyüme faktörlerinin incelenmesi

Giriş: CFG'nin Piyasa Konumu ve Yatırım Potansiyeli

Centrifuge (CFG), merkeziyetsiz bir varlık finansmanı protokolü olarak, 2021’den beri gerçek dünya varlıklarını DeFi ile entegre etmektedir. 2025 yılı itibarıyla Centrifuge’un piyasa değeri 117.131.245 $’a ulaşmış, dolaşımdaki token sayısı yaklaşık 566.563.054 ve fiyatı 0,20674 $ civarındadır. "Gerçek dünya varlıkları için DeFi köprüsü" olarak tanımlanan CFG, KOBİ’ler için sermaye maliyetini azaltırken DeFi yatırımcılarına istikrarlı getiri sunma konusunda giderek daha önemli bir rol üstlenmektedir.

Bu makalede, Centrifuge’un 2025–2030 yılları arasındaki fiyat trendleri; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik göstergelerle birlikte bütüncül olarak incelenmekte, yatırımcılar için profesyonel fiyat tahminleri ve uygulamaya yönelik yatırım stratejileri sunulmaktadır.

I. CFG Fiyat Geçmişi ve Güncel Piyasa Durumu

CFG Tarihsel Fiyat Seyri

- 2021: CFG, 15 Ekim 2021’de 2,19 $ ile tarihinin en yüksek fiyatına ulaşarak önemli bir kilometre taşı kaydetti.

- 2022-2024: Kripto piyasasında uzun süren bir ayı trendi yaşandı ve CFG fiyatı kademeli olarak düştü.

- 2025: CFG, 7 Nisan 2025’te 0,09996 $ ile en düşük seviyesini gördü; bu, genel piyasa gerilemesinin bir göstergesidir.

CFG Güncel Piyasa Görünümü

20 Ekim 2025 itibarıyla CFG, 0,20674 $ seviyesinden işlem görmektedir ve son 24 saatte %3,24 oranında değer kazanmıştır. Token'ın piyasa değeri 117.131.245 $ olup kripto para piyasasında 377. sıradadır. Son 24 saatteki CFG işlem hacmi ise 477.392 $ ile orta düzeyde bir piyasa faaliyeti sergilemektedir.

Son 24 saatteki yükselişe rağmen, CFG uzun vadeli periyotlarda kayıplar yaşamıştır. Son bir haftada %17,76, son bir ayda ise %27,52 oranında gerilemiştir. Yıllık performansa bakıldığında CFG, %37,81’lik bir düşüşle zorlu piyasa koşullarını yansıtmaktadır.

CFG'nin mevcut fiyatı, zirve fiyatının yaklaşık %90,56 altında olsa da; yıl başındaki dip seviyesine göre %106,82 oranında toparlanma göstermiştir. Bu toparlanma, tokene yönelik belirli bir ilgi artışını gösterse de, önceki seviyelere ulaşmak için hâlâ önemli engeller bulunmaktadır.

Güncel CFG piyasa fiyatını incelemek için tıklayın

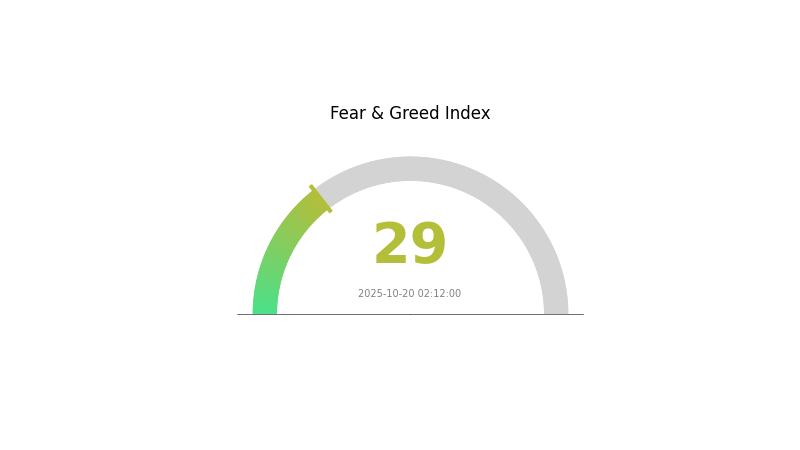

CFG Piyasa Duyarlılık Endeksi

2025-10-20 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık hâlâ temkinli seyrediyor; Korku ve Açgözlülük Endeksi 29 seviyesinde ve piyasanın korku halinde olduğunu gösteriyor. Yatırımcılar temkinli ve riskten kaçınan bir yaklaşım sergilerken, karşıt işlem yapanlar için alım fırsatları doğabilir. Yine de, kapsamlı araştırma yapmak ve risk yönetimini ön planda tutmak kritik önem taşır. Gate.com, bu koşullarda yatırımcılara yardımcı olacak çeşitli araçlar ve özellikler sunmaktadır. Piyasa duyarlılığının hızla değişebileceğini unutmayın; güncel kalın ve stratejinizi buna göre şekillendirin.

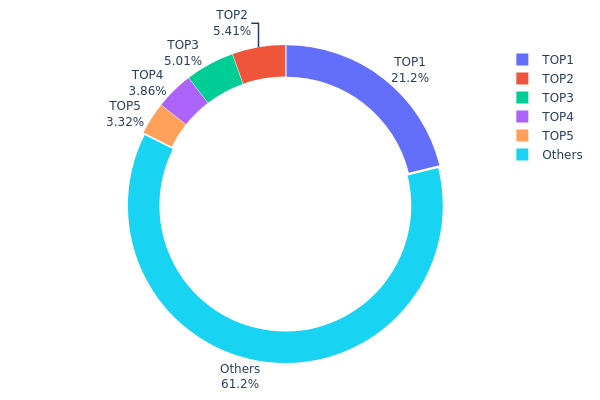

CFG Varlık Dağılımı

CFG adres varlık dağılımı verileri, en büyük sahiplerde yüksek bir yoğunlaşma olduğunu ortaya koymaktadır. En büyük adres toplam arzın %21,17’sini, ilk 5 adres ise CFG tokenlarının %38,75’ini elinde bulunduruyor. Bu seviyedeki yoğunlaşma, görece merkezi bir dağılım örneğidir.

Böyle bir yoğunlaşma, piyasa dinamiklerini etkileyebilir. Büyük sahiplerin satış yapması fiyat üzerinde aşağı yönlü baskı yaratabilir; tersine, birikim hareketleri fiyatı yukarı taşıyabilir. Toplu hareketler ise fiyat manipülasyonu riskini artırır; zira üst düzey sahiplerin koordineli işlemleri token değerlemesini ciddi şekilde yönlendirebilir.

Üst segmentteki yoğunlaşmaya rağmen, CFG tokenlarının %61,25’i diğer adreslere dağılmıştır; bu da piyasada daha geniş bir katılım olduğunu gösterir. Bu dağılım, merkezi kontrol ile piyasa çeşitliliği arasında denge oluşturarak fiyat istikrarını ve farklı katılımcılarla fiyat keşfini destekler.

Güncel CFG Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd052...f293cb | 102.470,93K | 21,17% |

| 2 | 0x495d...2e0d01 | 26.194,19K | 5,41% |

| 3 | 0xc882...84f071 | 24.255,51K | 5,01% |

| 4 | 0xf89d...5eaa40 | 18.668,43K | 3,85% |

| 5 | 0x4cd9...0ffeca | 16.044,47K | 3,31% |

| - | Others | 296.328,06K | 61,25% |

II. CFG’nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Teknik Gelişim ve Ekosistem Oluşumu

-

Yönetim Güncellemeleri: Centrifuge, ekosistemde merkeziyetsiz karar alma süreçlerini güçlendirmek için yönetim güncellemeleri uygulamaktadır.

-

Ekosistem Uygulamaları: Centrifuge; Tinlake ve gerçek dünya varlıklarına yönelik merkeziyetsiz kredi protokolü gibi birçok DApp ve ekosistem projesi geliştirmiştir.

III. 2025–2030 CFG Fiyat Öngörüleri

2025 Görünümü

- Temkinli tahmin: 0,12347 $ – 0,20579 $

- Tarafsız tahmin: 0,20579 $ – 0,22843 $

- İyimser tahmin: 0,22843 $ – 0,25106 $ (piyasa toparlanması ve benimsenme artışı gerektirir)

2027–2028 Görünümü

- Piyasa aşaması öngörüsü: Konsolidasyon sonrası kademeli büyüme

- Fiyat aralığı tahminleri:

- 2027: 0,17338 $ – 0,28633 $

- 2028: 0,16196 $ – 0,37059 $

- Kilit katalizörler: Teknolojik ilerlemeler, kullanım alanlarının genişlemesi ve genel kripto piyasasının toparlanması

2029–2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,32255 $ – 0,37739 $ (istikrarlı büyüme ve benimseme ile)

- İyimser senaryo: 0,37739 $ – 0,43399 $ (güçlü piyasa performansı ve artan fayda ile)

- Dönüştürücü senaryo: 0,43399 $+ (oldukça elverişli koşullar ve yaygın benimsenmede)

- 2030-12-31: CFG 0,37739 $ (yıl sonu ortalama fiyat potansiyeli)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,25106 | 0,20579 | 0,12347 | 0 |

| 2026 | 0,29695 | 0,22843 | 0,21472 | 10 |

| 2027 | 0,28633 | 0,26269 | 0,17338 | 27 |

| 2028 | 0,37059 | 0,27451 | 0,16196 | 32 |

| 2029 | 0,43222 | 0,32255 | 0,27417 | 56 |

| 2030 | 0,43399 | 0,37739 | 0,19247 | 82 |

IV. CFG için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CFG Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli değer yatırımcıları

- Uygulama önerileri:

- Piyasa düşüşlerinde CFG biriktirin

- Kısmi kâr almak için fiyat hedefleri belirleyin

- Tokenları güvenli, gözetimsiz cüzdanlarda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Trend ve destek/direnç seviyelerini belirlemek için kullanılır

- Göreceli Güç Endeksi (RSI): Aşırı alım/aşırı satım durumlarını tespit etmek için kullanılır

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- CFG’nin genel kripto piyasasıyla korelasyonunu izleyin

- Zarar durdur emirleriyle aşağı yönlü riskleri yönetin

CFG Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1–3’ü

- Orta derecede risk alanlar: Kripto portföyünün %3–5’i

- Agresif yatırımcılar: Kripto portföyünün %5–10’u

(2) Riskten Korunma Çözümleri

- Diversifikasyon: CFG’yi diğer kripto varlıkları ve geleneksel yatırımlarla dengeleyin

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için devreye alın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanı

- Güvenlik önlemleri: İki aşamalı kimlik doğrulama etkinleştirin, güçlü şifreler kullanın ve yazılımı düzenli olarak güncelleyin

V. CFG için Potansiyel Riskler ve Zorluklar

CFG Piyasa Riskleri

- Volatilite: CFG fiyatı belirgin dalgalanmalara açık olabilir

- Likidite: Düşük işlem hacmi, büyük işlemlerde kaymalara sebep olabilir

- Rekabet: Diğer DeFi protokolleri, CFG’nin pazar payını etkileyebilir

CFG Regülasyon Riskleri

- Belirsiz düzenlemeler: Değişen regülasyon ortamı CFG’nin faaliyetlerini etkileyebilir

- Sınır ötesi uyum: Farklı bölgelerdeki mevzuatlar benimsenmeyi sınırlayabilir

- Vergilendirme belirsizliği: CFG içeren DeFi işlemlerinin vergisel statüsü net değildir

CFG Teknik Riskleri

- Akıllı kontrat açıkları: Centrifuge protokolünde suistimal riski bulunabilir

- Ölçeklenebilirlik sorunları: Ağ kullanımı arttıkça işlem ücretleri yükselebilir

- İşbirliği sorunları: Diğer blokzincir ağlarıyla uyum problemleri yaşanabilir

VI. Sonuç ve Eylem Önerileri

CFG Yatırım Değeri Analizi

Centrifuge (CFG), gerçek dünya varlıklarını blokzincir finansmanına bağlayarak DeFi alanında uzun vadeli potansiyel sunmaktadır. Ancak, kısa vadede volatilite ve regülasyon belirsizliği önemli riskler teşkil etmektedir.

CFG Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp Centrifuge ekosistemini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Risk toleransına göre dengeli portföy yaklaşımı değerlendirin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapıp CFG’yi çeşitlendirilmiş bir DeFi portföyüne dahil edin

CFG’ye Katılım Yöntemleri

- Spot alım-satım: Gate.com’da CFG token alıp satabilirsiniz

- Staking: Centrifuge yönetimine katılarak ödül kazanabilirsiniz

- DeFi entegrasyonu: CFG’yi çeşitli DeFi protokollerinde getiri veya likidite sağlamak amacıyla kullanın

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi içermemektedir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

Sıkça Sorulan Sorular

CorgiAI 1 dolara ulaşabilir mi?

İddialı olmakla birlikte, piyasa koşulları ve projenin gelişimine bağlı olarak CorgiAI’nin gelecekte 1 $’a ulaşması mümkündür. Ancak bu, önemli ölçüde büyüme ve benimsenme gerektirir.

CFG hissesi için fiyat tahmini nedir?

CFG hissesinin 2025 sonunda 2,50 $’a ulaşması bekleniyor; 2026 yılında ise artan benimsenme ve piyasa genişlemesi ile daha fazla büyüme potansiyeli mevcut.

Fetch AI 5 dolara ulaşacak mı?

Evet, Fetch AI güçlü teknolojisi ve AI ile blokzincir alanında artan benimsenmesiyle 2025’e kadar 5 $ seviyesine ulaşma potansiyeline sahiptir.

Filecoin bugün 1.000 dolara ulaşabilir mi?

Hayır; Filecoin’in bugün 1.000 $’a ulaşması mevcut piyasa koşullarında son derece olası değildir. Filecoin’in büyüme potansiyeli olsa da, bir gün içinde bu kadar ani ve yüksek bir fiyat artışı gerçekçi değildir.

Soil (SOIL) yatırım açısından avantajlı mı?: Dijital varlık ekosisteminde bu tarım odaklı kripto paranın potansiyelini değerlendirmek

Avantis (AVNT) iyi bir yatırım mı?: Bu çeşitlendirilmiş ETF sağlayıcısının olası riskleri ve getirileri üzerine analiz

Spark (SPK) iyi bir yatırım mı?: Bu Yeni Kripto Paranın Potansiyeli ve Riskleri Üzerine Analiz

2025 HDRO Fiyat Tahmini: Piyasa Eğilimleri ve Olası Büyüme Faktörlerinin Analizi

CBL vs SNX: Merkeziyetsiz Sentetik Varlık Ticareti İçin İki Farklı Yaklaşımın Karşılaştırılması

Web3 Platformlarında Yenilikçi Sosyal Deneyimi Keşfetmek