2025 CELO Fiyat Tahmini: Boğa Koşusu mu, Ayı Piyasası mı? CELO'nun Gelecekteki Değerini Belirleyen Temel Faktörlerin Analizi

Giriş: CELO'nun Piyasa Konumu ve Yatırım Değeri

CELO (CELO), finansal araçları cep telefonu kullanıcılarına erişilebilir kılmayı hedefleyen bir platform olarak, 2020'deki çıkışından bu yana kayda değer ilerleme gösterdi. 2025 yılı itibarıyla CELO'nun piyasa değeri 148.595.200 $ seviyesine ulaştı; dolaşımdaki token miktarı yaklaşık 584.100.629 ve fiyatı da 0,2544 $ civarında seyrediyor. Sıklıkla "finansal kapsayıcılık için mobil odaklı blokzincir" olarak anılan bu varlık, bankacılık hizmetlerine erişimi olmayan kesimlerin finansal hizmetlere ulaşmasını sağlama konusunda giderek daha belirleyici bir rol üstleniyor.

Bu makalede, 2025-2030 döneminde CELO'nun fiyat eğilimleri kapsamlı şekilde analiz edilmekte; tarihsel desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler bir arada değerlendirilerek profesyonel fiyat tahminleri ve yatırımcılar için uygulamaya dönük stratejiler sunulmaktadır.

I. CELO Fiyat Geçmişi ve Güncel Piyasa Durumu

CELO Tarihsel Fiyat Seyri

- 2020: CELO 1 $ ile piyasaya sürülerek kripto para piyasasına girdi

- 2021: 30 Ağustos'ta 9,82 $ ile zirve yaptı ve güçlü bir boğa koşusu yaşadı

- 2025: Uzun süreli ayı piyasasında fiyat 11 Ekim'de 0,199457 $ ile taban yaptı

CELO Güncel Piyasa Görünümü

19 Ekim 2025 itibarıyla CELO 0,2544 $ seviyesinden işlem görüyor ve piyasa değeri 148.595.200 $ düzeyinde. Token son bir saatte %2,29 yükselirken, son 24 saatte %2,26 geriledi. 7 ve 30 günlük değişimlerde ise sırasıyla %7,59 ve %20,89 düşüş gözleniyor; bu da kısa vadede aşağı yönlü bir eğilime işaret ediyor. Yıl başından bu yana performans ise oldukça negatif; %70,23 değer kaybı yaşandı. CELO'nun mevcut fiyatı, en yüksek seviyesinin oldukça altında ve token için zorlu bir piyasa ortamına işaret ediyor.

Güncel CELO piyasa fiyatı için tıklayın

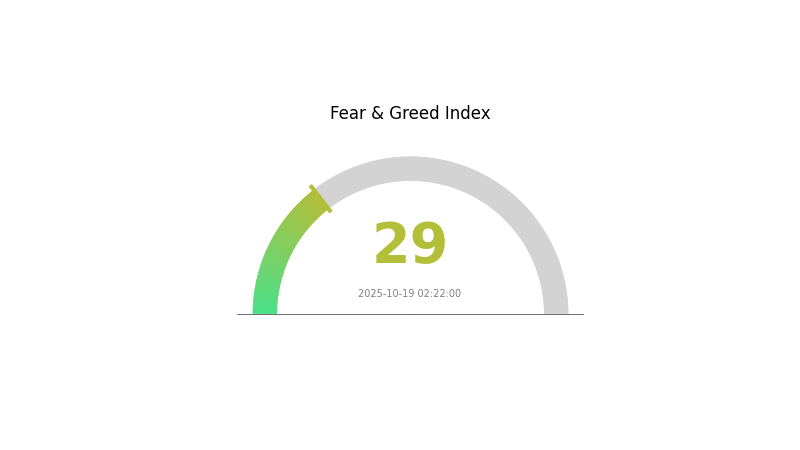

CELO Piyasa Duyarlılığı Göstergesi

19 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında CELO için duyarlılık şu an "Korku" bölgesinde; endeks değeri 29. Bu, yatırımcıların temkinli davrandığını ve karşıt stratejilere sahip olanlar için potansiyel alım fırsatı oluşabileceğini gösteriyor. Ancak yatırım kararı almadan önce detaylı araştırma yapmak ve çok yönlü etkenleri göz önünde bulundurmak gerekir. Gate.com, yatırımcıların bu belirsiz ortamda CELO piyasasında bilinçli adımlar atabilmeleri için kapsamlı piyasa verileri sunmaktadır.

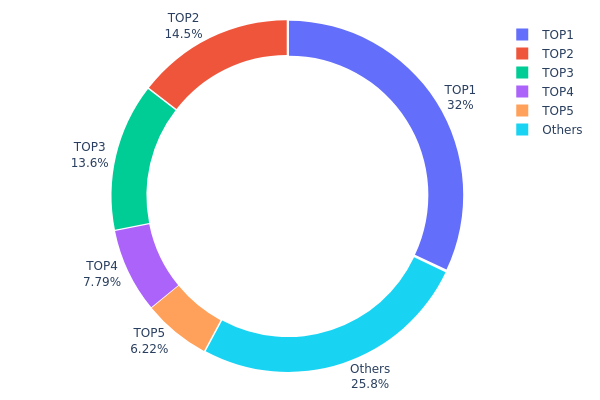

CELO Varlık Dağılımı

CELO'nun adres varlık dağılımı, oldukça yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük adres toplam arzın %32,03’ünü elinde bulundururken, ilk beş adresin payı %74,18'e ulaşıyor. Bu düzeydeki yoğunlaşma, ağın merkeziyetsizliği ve piyasa manipülasyonu riskleri açısından endişeye neden oluyor.

Böyle bir dağılım, fiyatlarda oynaklık ve piyasa istikrarında bozulmalara yol açabilir. "Balina" olarak bilinen büyük sahipler, alım-satım işlemleriyle CELO fiyatını ciddi şekilde etkileyebilir. Ayrıca, bu yoğunlaşma ağ yönetişiminde az sayıda varlığın etkili oy hakkına sahip olduğu anlamına gelir; bu da merkeziyetsizliğin temel ilkelerinin zedelenmesine yol açabilir.

Tüm bu endişelere rağmen, CELO tokenlerinin %25,82'sinin ilk beş adres dışında kaldığını belirtmek gerekir. Bu, daha küçük sahipler arasında belirli bir dağılımın olduğunu ve zamanla ağın dayanıklılığı ile merkeziyetsizliğine katkı sağlanabileceğini gösteriyor. Ancak mevcut durum, CELO'nun zincir üstü yapısının ve piyasa dinamiklerinin büyük ölçüde az sayıda büyük paydaş tarafından şekillendirildiğini ortaya koyuyor.

Güncel CELO Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x7A8c...8A434f | 291.905,70K | 32,03% |

| 2 | 0x6cC0...03349E | 132.285,83K | 14,51% |

| 3 | 0xA5c4...0a87fe | 124.208,56K | 13,63% |

| 4 | 0xef26...036Ef1 | 71.032,65K | 7,79% |

| 5 | 0x9d65...50a400 | 56.687,16K | 6,22% |

| - | Diğerleri | 235.150,72K | 25,82% |

II. CELO'nun Gelecek Fiyatını Etkileyecek Temel Faktörler

Teknik Gelişim ve Ekosistem Genişlemesi

- Ekosistem Uygulamaları: Celo ekosistemi, finansal kapsayıcılık ve mobil odaklı çözümlere yönelik çeşitli DApp ve projeleri içeriyor. Bu uygulamalar ağın kullanımı ve benimsenmesini artırarak CELO fiyatının uzun vadede şekillenmesinde etkili olabilir.

III. 2025-2030 CELO Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,24453 $ - 0,2574 $

- Tarafsız tahmin: 0,2574 $ - 0,30 $

- İyimser tahmin: 0,30 $ - 0,32432 $ (olumlu piyasa duyarlılığı ve artan benimsenme gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Artan benimsenmeyle büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,21477 $ - 0,32065 $

- 2028: 0,21498 $ - 0,3365 $

- Temel katalizörler: Kullanım alanlarının genişlemesi, teknolojik iyileştirmeler ve piyasa toparlanması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,32403 $ - 0,35158 $ (istikrarlı büyüme ve benimsenme varsayımıyla)

- İyimser senaryo: 0,35158 $ - 0,4676 $ (hızlanan benimsenme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,4676 $ üzeri (çığır açan teknolojik gelişmeler veya büyük iş birlikleri durumunda)

- 31 Aralık 2030: CELO 0,35158 $ (2025 seviyelerine göre kayda değer büyüme potansiyeli)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,32432 | 0,2574 | 0,24453 | 1 |

| 2026 | 0,31413 | 0,29086 | 0,26759 | 14 |

| 2027 | 0,32065 | 0,3025 | 0,21477 | 18 |

| 2028 | 0,3365 | 0,31157 | 0,21498 | 22 |

| 2029 | 0,37912 | 0,32403 | 0,23979 | 27 |

| 2030 | 0,4676 | 0,35158 | 0,18634 | 38 |

IV. CELO Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CELO Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun kitle: Uzun vadeli yatırımcılar ve finansal kapsayıcılığa inananlar

- İşlem önerileri:

- Piyasa düşüşlerinde CELO token biriktirin

- Staking ile ödüller kazanın

- Tokenlerinizi güvenli Gate Web3 cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirleyin

- RSI: Aşırı alım ve satım durumlarını tespit edin

- Swing trade için kritik noktalar:

- CELO'nun genel kripto piyasasıyla olan korelasyonunu izleyin

- Proje gelişmeleri ve iş birliklerini takip edin

CELO Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı kripto varlıklarla ve geleneksel yatırımlarla dağıtım yapın

- Zarar durdurma emirleri: Kaybı sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, düzenli güvenlik denetimleri

V. CELO için Potansiyel Riskler ve Zorluklar

CELO Piyasa Riskleri

- Oynaklık: Kripto piyasasında sıkça görülen yüksek fiyat dalgalanmaları

- Likidite: Büyük hacimli işlemlerde yaşanabilecek zorluklar

- Rekabet: Finansal kapsayıcılığı hedefleyen diğer blockchain projeleri

CELO Düzenleyici Riskler

- Küresel düzenleyici belirsizlik: Farklı ülkelerde kriptoya yönelik değişken yaklaşımlar

- Uyum zorlukları: Sürekli değişen yasal gerekliliklere uyum sağlama güçlüğü

- Hukuki statü: CELO tokenlerinin farklı yargı alanlarında belirsiz sınıflandırılması

CELO Teknik Riskler

- Akıllı kontrat açıkları: Protokolde istismar riski

- Ağ tıkanıklığı: Yoğun talep sırasında ölçeklenebilirlik sorunları

- Teknolojik eskime: Daha yeni blokzincir teknolojileri karşısında geri kalma riski

VI. Sonuç ve Eylem Önerileri

CELO Yatırım Değeri Analizi

CELO, finansal kapsayıcılığı ilerletmede benzersiz bir değer sunuyor; ancak kısa vadede piyasa oynaklığı ve düzenleyici belirsizliklerle karşı karşıya. Uzun vadeli büyüme potansiyeli, başarılı benimsenme ve teknolojik gelişmelere bağlı olarak umut vadediyor.

CELO Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini anlamak için küçük ve düzenli yatırımlar yapın

✅ Deneyimli yatırımcılar: Hem tutma hem alım-satım stratejilerini birleştiren dengeli bir yaklaşım benimseyin

✅ Kurumsal yatırımcılar: CELO ekosistemine yönelik ortaklık ve büyük ölçekli katılımı değerlendirin

CELO Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden CELO alıp satabilirsiniz

- Staking: Ağ doğrulamasına katılarak ödül kazanın

- DeFi uygulamaları: CELO tabanlı merkeziyetsiz finans uygulamalarını keşfedin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, risk toleranslarına göre dikkatli karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

Sıkça Sorulan Sorular

Celo uzun vadeli yatırım açısından iyi bir seçenek mi?

Evet, Celo uzun vadede umut vaat ediyor. Mobil odaklı finansal çözümler ve sürdürülebilirlik girişimleri sayesinde değişen kripto piyasasında gelecekte büyüme için güçlü bir konuma sahip.

Celo ne kadar yükselebilir?

Celo, ekosistemde büyüme ve artan benimsenmeyle 2025 yılına kadar potansiyel olarak 10-15 $ seviyelerine ulaşabilir.

2030 Celr fiyat tahmini nedir?

Piyasa trendlerine ve olası büyümeye göre, Celr 2030’da blokzincir alanında artan benimsenme ve teknolojik ilerlemeler sayesinde 5 ila 7 $ seviyelerine ulaşabilir.

Celo'da neler oluyor?

Celo, ekosistemde kayda değer bir büyüme yaşıyor; blokzinciri, merkeziyetsiz finans ve mobil odaklı uygulamalar için daha fazla benimseniyor. Platform, ortaklıklarını genişletip teknolojisini geliştirerek CELO tokenine olan ilgiyi artırıyor.

2025 COTI Fiyat Tahmini: Gelişen kripto para ekosisteminde piyasa trendleri ve geleceğe yönelik potansiyelin değerlendirilmesi

2025 ROSE Fiyat Tahmini: Oasis Network’in yerel token’ı için piyasa trendleri ve olası büyümenin analizi

2025 NEWT Fiyat Tahmini: Gelişen DeFi Ekosisteminde Newt Finance İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 CERE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 RADAR Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 REACT Fiyat Tahmini: Merkeziyetsiz Finans Ekosisteminde Büyüme Potansiyelinin Analizi

XPR vs ICP: İki Önde Gelen Blockchain Platformunun Kapsamlı Karşılaştırılması

POWER nedir: Bilim ve toplumda enerji, kuvvet ve etkinin temellerini kavramak

Bilgisayar Bilimlerinde CFG Nedir: Bağlamdan Bağımsız Gramerlere Kapsamlı Rehber

REQ nedir: Gereksinim Mühendisliği ve Yönetimi Hakkında Kapsamlı Bir Rehber

XPR Nedir: Ripple’ın Yerel Kripto Parası ve Blokzincir Ekosistemindeki Rolüne Kapsamlı Bir Rehber