2025 BLUR Fiyat Tahmini: NFT Pazar Yeri Token’ı Yeni Zirvelere Yükselecek mi?

Giriş: BLUR’un Piyasadaki Konumu ve Yatırım Potansiyeli

Blur (BLUR), merkeziyetsiz NFT pazar yeri ve toplayıcı olarak 2023’te faaliyete geçtiğinden bu yana dikkate değer bir gelişim gösterdi. 2025 itibarıyla Blur’un piyasa değeri 134.008.788 dolar seviyesinde, dolaşımdaki arzı ise yaklaşık 2.563.780.154 token olup, fiyatı 0,05227 dolar civarında seyrediyor. “NFT ticaretinin güç merkezi” olarak anılan bu varlık, NFT ve merkeziyetsiz finans alanlarında giderek daha stratejik bir konuma sahip.

Bu makalede, Blur’un 2025-2030 yılları arasındaki fiyat trendleri, geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler bir arada ele alınarak profesyonel fiyat tahminleri ve yatırımcılar için kapsamlı yatırım stratejileri sunulmaktadır.

I. BLUR Fiyat Geçmişi ve Güncel Piyasa Durumu

BLUR Tarihsel Fiyat Değişimi

- 2023: BLUR piyasaya sürüldü, 14 Şubat’ta 5,4146 dolar ile rekor seviyeye ulaştı

- 2024: Piyasadaki dalgalanmalar fiyat oynaklığına neden oldu

- 2025: Ayı döngüsünde fiyat, önceki zirvelerden 10 Ekim’de 0,02379 dolara kadar geriledi

BLUR Güncel Piyasa Durumu

20 Ekim 2025’te BLUR, 0,05227 dolardan işlem görüyor; 24 saatlik işlem hacmi 244.471 dolar. Token, son 24 saatte yüzde 1,12 artış gösterdi ancak hâlâ zirve seviyesinin oldukça gerisinde. BLUR’un piyasa değeri 134.008.788 dolar ile kripto para piyasasında 354. sırada yer alıyor. Dolaşımdaki arzı 2.563.780.154 BLUR token olup, toplam 3 milyar token arzının yüzde 85,46’sına karşılık geliyor. Son dönemdeki yükselişe rağmen, BLUR uzun vadede ciddi değer kayıpları yaşadı; son 30 günde yüzde 38,36, son bir yılda ise yüzde 78,5 oranında azaldı. VIX endeksinin 29 olması genel kripto piyasasında “Korku” durumunu gösteriyor.

Güncel BLUR piyasa fiyatını görüntüleyin

BLUR Piyasa Duyarlılığı Göstergesi

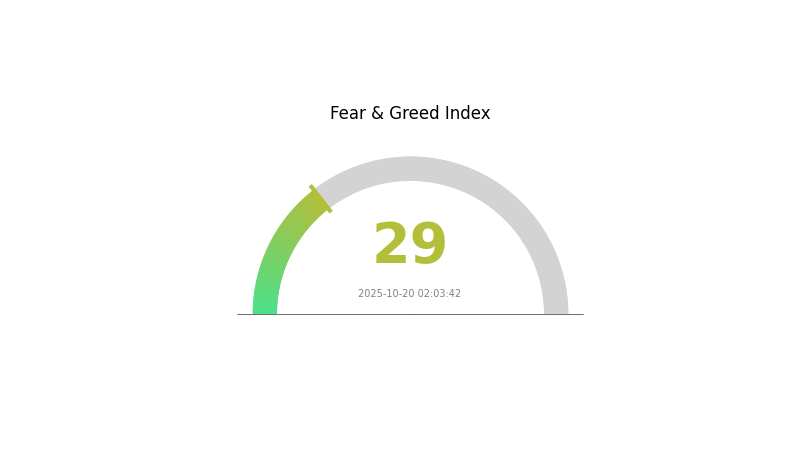

2025-10-20 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntüleyin

Kripto piyasasında Korku ve Açgözlülük Endeksi’nin 29 seviyesinde olması, yatırımcıların temkinli hareket ettiğini ve BLUR piyasasında cesur adımlar atmaktan çekindiklerini gösteriyor. Bu tür dönemlerde, işlem yapanların risk yönetimi konusunda dikkatli olmaları gerekir. Ancak bazı yatırımcılar, bu ortamı BLUR’u düşük fiyatlardan toplama fırsatı olarak değerlendirebilir ve “başkaları açgözlü olduğunda kork, başkaları korktuğunda açgözlü ol” stratejisini uygulayabilir.

BLUR Varlık Dağılımı

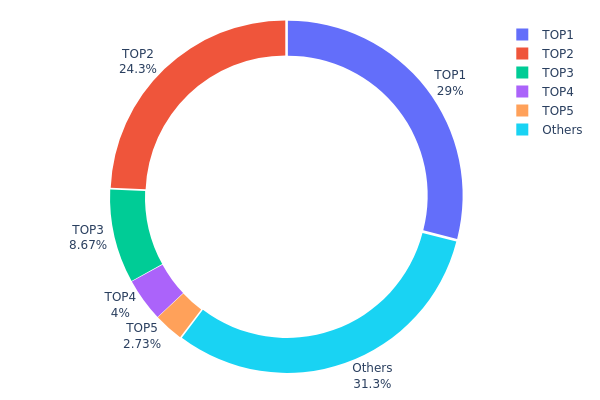

BLUR adres varlık dağılımı, sahipliğin son derece yoğunlaşmış olduğunu gösteriyor. En büyük 5 adres toplam BLUR arzının yüzde 68,7’sini elinde tutarken, en büyük sahip yüzde 29’luk paya sahip. İkinci sıradaki sahip ise arzın yüzde 24,31’ine sahip olarak bu yoğunlaşmayı daha da belirginleştiriyor.

Böyle bir yoğunlaşma, piyasa istikrarı ve fiyat manipülasyonu açısından risk oluşturuyor. Tokenlerin yüzde 70’e yakını sadece beş adreste toplandığı için, büyük çaplı satışlar veya koordineli piyasa hareketleri BLUR’un fiyatını ciddi şekilde etkileyebilir. Bu merkezileşme, kripto projelerinin temel merkeziyetsizlik ilkesiyle de çelişiyor.

Mevcut dağılım, BLUR için zincir üstü yapısal istikrarın düşük olduğunu gösteriyor. Tokenin dolaşımdaki arzı ve piyasa dinamikleri, az sayıdaki büyük sahibin etkisiyle şekilleniyor ve bu da volatiliteyi ve balina hareketlerine karşı hassasiyeti artırıyor. Yatırımcı ve işlemciler, BLUR’u portföylerine eklerken bu yoğunlaşma risklerini göz önünde bulundurmalıdır.

Güncel BLUR Varlık Dağılımını inceleyin

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x581e...f3fb26 | 870.000,00K | 29,00% |

| 2 | 0x04b5...aeed1c | 729.473,03K | 24,31% |

| 3 | 0x3f1b...7db647 | 260.037,96K | 8,66% |

| 4 | 0xf977...41acec | 120.000,00K | 4,00% |

| 5 | 0x70c9...529f29 | 81.978,13K | 2,73% |

| - | Diğerleri | 938.510,87K | 31,3% |

II. BLUR’un Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Token Dağıtımı: BLUR tokenleri, Blur pazarında NFT ticareti yapan kullanıcılara dağıtılarak platformun kullanımını ve likiditeyi teşvik ediyor.

- Tarihsel Model: Geçmişteki dağıtımlar, kullanıcıların ödüllerini alıp satmasıyla kısa vadeli fiyat dalgalanmalarına neden oldu.

- Güncel Etki: Devam eden token dağıtımı satış baskısı yaratabilir ancak platformun benimsenmesi ve ekosistem büyümesini de hızlandırır.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: Bazı risk sermayesi şirketlerinin BLUR’a ilgisi, projeye duyulan uzun vadeli güveni gösteriyor.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özelliği: NFT piyasasıyla bağlantılı bir kripto para olarak BLUR, geleneksel piyasa enflasyonuna karşı kısmi koruma sağlayabilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Platform Güncellemeleri: Blur pazarındaki sürekli iyileştirmeler, gelişmiş işlem özellikleri ve kullanıcı deneyimi ile benimsenme oranını artırabilir.

- Ekosistem Uygulamaları: BLUR ekosisteminin ana uygulaması olan Blur pazarı, NFT ticaretini kolaylaştırıyor ve potansiyel olarak başka NFT tabanlı hizmetlere genişleyebilir.

III. BLUR 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,03909 - 0,05212 dolar

- Nötr tahmin: 0,05212 - 0,06489 dolar

- İyimser tahmin: 0,06489 - 0,07766 dolar (daha fazla NFT piyasa faaliyetiyle)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Artan oynaklıkla büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,05804 - 0,08571 dolar

- 2028: 0,05591 - 0,10417 dolar

- Ana katalizörler: NFT piyasasının büyümesi, BLUR tokeninin kullanım alanlarının genişlemesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,08044 - 0,09671 dolar (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,09671 - 0,10831 dolar (NFT’nin yaygın benimsenmesiyle)

- Dönüştürücü senaryo: 0,10831+ dolar (NFT ekosisteminde aşırı olumlu şartlar)

- 2030-12-31: BLUR 0,10831 dolar (iyimser tahminlere göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,07766 | 0,05212 | 0,03909 | 0 |

| 2026 | 0,07008 | 0,06489 | 0,05516 | 24 |

| 2027 | 0,08571 | 0,06748 | 0,05804 | 29 |

| 2028 | 0,10417 | 0,0766 | 0,05591 | 46 |

| 2029 | 0,10304 | 0,09038 | 0,08044 | 72 |

| 2030 | 0,10831 | 0,09671 | 0,0706 | 85 |

IV. BLUR için Yatırım Stratejileri ve Risk Yönetimi

BLUR Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde BLUR token biriktirin

- Fiyat hedefleri belirleyin ve varlıklarınızı düzenli aralıklarla gözden geçirin

- Tokenleri donanım cüzdanında güvenli şekilde saklayın

(2) Aktif Ticaret Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası giriş/çıkış noktalarını belirlemek için

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izlemek için

- Dalgalı işlem için önemli noktalar:

- NFT piyasa trendlerini yakından takip edin

- Zarar durdur emirleriyle riskinizi kontrol altında tutun

BLUR Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara dağıtın

- Opsiyon stratejileri: Düşüşe karşı put opsiyonlarını kullanın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı: Gate Web3 cüzdan önerilir

- Soğuk saklama: Uzun vadeli varlıklar için çevrimdışı depolama

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, özel anahtarlarınızı güvenli şekilde yedekleyin

V. BLUR için Potansiyel Riskler ve Zorluklar

BLUR Piyasa Riskleri

- Yüksek volatilite: BLUR fiyatı sert dalgalanmalara açıktır

- NFT piyasasına bağımlılık: Performans NFT ekosisteminin genel sağlığına bağlıdır

- Rekabet: Diğer NFT platformları pazar payı kazanabilir

BLUR Düzenleyici Riskler

- Belirsiz düzenleyici ortam: NFT’ler için daha sıkı düzenlemeler gelebilir

- Vergi etkileri: NFT tabanlı tokenlerde değişen vergi uygulamaları

- Sınır ötesi kısıtlamalar: Uluslararası işlemlerde olası sınırlamalar

BLUR Teknik Riskler

- Akıllı sözleşme açıkları: Güvenlik açıkları ve yazılım hataları riski

- Ölçeklenebilirlik sorunları: Yüksek işlem hacminde performans sorunları yaşanabilir

- Blokzincir ağ yoğunluğu: Ethereum ağındaki tıkanıklık performansı olumsuz etkileyebilir

VI. Sonuç ve Eylem Önerileri

BLUR Yatırım Potansiyeli Değerlendirmesi

BLUR, NFT pazar yeri alanında özgün bir fırsat sunuyor; ancak yüksek volatilite ve düzenleyici belirsizlikler nedeniyle ciddi riskler barındırıyor. Platform yenilikçi gelişimini sürdürüp pazar payı kazanırsa uzun vadede önemli potansiyel taşıyor.

BLUR Yatırım Tavsiyeleri

✅ Yeni başlayanlar: NFT piyasasını anlamak için küçük ve deneme amaçlı pozisyonlar açın

✅ Tecrübeli yatırımcılar: Sıkı risk yönetimiyle birlikte düzenli maliyet ortalaması stratejisi uygulayın

✅ Kurumsal yatırımcılar: Kapsamlı analizle BLUR’u çeşitlendirilmiş kripto portföyüne dahil etmeyi değerlendirin

BLUR İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden BLUR token satın alın

- Staking: Ek ödüller için staking programlarına katılın

- NFT ticareti: Tokenin kullanımını ve ekosistemi anlamak için Blur platformunda işlem yapın

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi niteliği taşımamaktadır. Her yatırımcı, kendi risk profiline göre karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Blur Kripto’nun geleceği var mı?

Evet, Blur kripto gelecek vaat ediyor. Yenilikçi özellikleri ve NFT piyasasında artan benimsenmesi, önümüzdeki yıllarda başarı ve değer artışı potansiyeline işaret ediyor.

Blur iyi bir yatırım mı?

Evet, Blur yatırım için potansiyel taşıyor. Yenilikçi özellikleri ve NFT alanında artan kullanımı, 2025 için cazip bir seçenek sunuyor.

BLUR’un tüm zamanların en yüksek fiyatı nedir?

BLUR’un tüm zamanların en yüksek fiyatı, lansmanından kısa bir süre sonra, 14 Şubat 2023’te 2,47 dolar olarak kaydedildi.

2025’te 1 Bitcoin ne kadar olacak?

Mevcut trendler ve uzman tahminlerine göre, 2025’te 1 Bitcoin’in değeri yaklaşık 100.000 ila 150.000 dolar arasında olabilir ve bu, kripto piyasasında önemli bir büyümeye işaret ediyor.

2025 BLUR Fiyat Tahmini: NFT Pazar Yeri Tokeni İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

2025 AURA Fiyat Tahmini: Bu DeFi Token Boğa Piyasasında Yeni Zirvelere Çıkabilir mi?

ARTEM ve KAVA: DeFi ile zincirler arası çözümler sunan iki yenilikçi blockchain platformunun karşılaştırılması

ZORA ve LINK: Dijital İçeriğin Geleceğinde Blockchain Protokollerinin Rekabeti

FLOW ve ZIL: dApp Geliştirme Amaçlı İki Lider Blockchain Platformunun Karşılaştırmalı Analizi

2025 SUPER Fiyat Tahmini: Kripto Para Birimi İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

Kripto Para Piyasasında Short Squeeze: İşleyişi Nasıl Gerçekleşir Açıklandı

Short Squeeze Fenomenini Anlamak: Kapsamlı Bir Açıklama