2025 ASTR Fiyat Tahmini: Astar Network için Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: ASTR'nin Piyasadaki Konumu ve Yatırım Potansiyeli

Astar Token (ASTR), Japonya merkezli topluluk tarafından yönlendirilen Web3 benimsemesini hızlandıran bir varlık olarak, kurulduğu günden bu yana Astar Network ve Soneium ekosistemlerini sorunsuz şekilde birbirine bağlamaktadır. 2025 yılı itibarıyla ASTR'nin piyasa değeri 145.017.904 $'a ulaşmış, dolaşımdaki arzı yaklaşık 8.193.101.963 tokena ve fiyatı yaklaşık 0,0177 $ seviyesine yükselmiştir. "Japon Web3 Öncüsü" olarak bilinen bu varlık, kullanıcı dostu uygulamalar, ödeme çözümleri ve merkeziyetsiz finans ile Web3'ün ana akımda benimsenmesinde giderek daha kritik bir rol üstlenmektedir.

Bu makalede, ASTR'nin 2025-2030 yılları arasındaki fiyat hareketleri; geçmiş eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler bütününde analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. ASTR Fiyat Geçmişi ve Güncel Piyasa Durumu

ASTR Fiyatının Tarihsel Gelişimi

- 2022: ASTR, 17 Ocak'ta 0,421574 $ ile tüm zamanların en yüksek seviyesini gördü ve proje için önemli bir kilometre taşı oldu

- 2023-2024: Token, genel kripto piyasasındaki zorluklar nedeniyle uzun süreli bir düşüş trendine girdi

- 2025: ASTR, 11 Ekim'de 0,01201883 $ ile en düşük seviyesine ulaşarak zirveden ciddi bir gerileme yaşadı

ASTR'nin Güncel Piyasa Durumu

19 Ekim 2025 itibarıyla ASTR, 0,0177 $ seviyesinden işlem görmekte ve yakın zamanda kaydedilen en düşük seviyeden hafif bir toparlanma sergilemektedir. Token, kısa vadede karmaşık bir performans gösterdi; son bir saatte %0,62 artış, son 24 saatte ise %1,06 azalış yaşadı. Haftalık ve aylık eğilimler sırasıyla %2,58 ve %28,48 düşüş ile aşağı yönlü baskının sürdüğünü göstermektedir. Yıllık bazda ise %70,46 azalmayla uzun vadeli performans oldukça zorlu bir görünüm sergilemektedir.

ASTR'nin piyasa değeri şu anda 145.017.904,74 $ olup, küresel kripto para piyasasında 332. sıradadır. Tokenın 24 saatlik işlem hacmi 167.791,60 $ ile orta düzeyde bir likiditeye işaret etmektedir. 8.193.101.963 ASTR dolaşımdaki arz ve 8.533.244.493 ASTR toplam arz ile dolaşım oranı %117,04 gibi yüksek bir seviyededir.

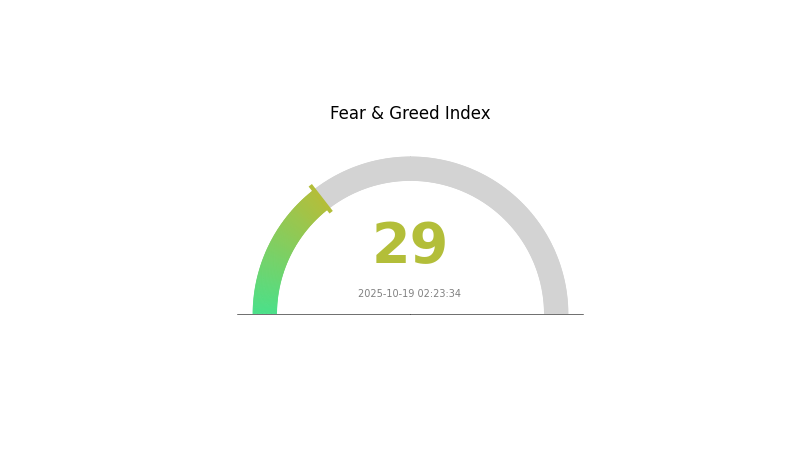

ASTR için mevcut piyasa hissiyatı, 29 değerindeki VIX endeksi ile "Korku" olarak nitelendirilmektedir; bu durum piyasadaki genel temkinli yaklaşımı yansıtmaktadır.

Güncel ASTR piyasa fiyatını görmek için tıklayın

ASTR Piyasa Hissiyatı Göstergesi

2025-10-19 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni görmek için tıklayın

Kripto piyasasında şu anda korku dönemi yaşanıyor ve Korku ve Açgözlülük Endeksi 29 seviyesinde bulunuyor. Bu, yatırımcılar arasında temkinli bir hava olduğunu ve yüksek risk toleransına sahip yatırımcılar için alım fırsatları doğurabileceğini göstermektedir. Ancak yatırım kararı almadan önce mutlaka kapsamlı araştırma yapmalı ve kişisel finansal durumunuzu göz önünde bulundurmalısınız. Unutmayın, piyasa hissiyatı hızla değişebilir ve geçmiş performans gelecekteki sonuçları garanti etmez.

ASTR Varlık Dağılımı

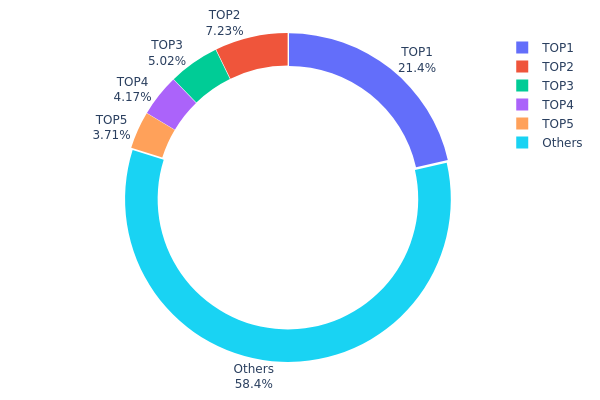

Adres bazlı varlık dağılımı, ASTR tokenlarının farklı cüzdanlar arasında ne ölçüde yoğunlaştığını gösteren önemli bir veridir. Analizler, orta derecede yoğunlaşmış bir dağılım olduğunu ortaya koymaktadır. En büyük adres toplam arzın %21,42'sini elinde tutarken, ilk beş adres birlikte ASTR tokenlarının %41,53'ünü kontrol etmektedir.

Bu yoğunlaşma, büyük sahiplerin piyasayı etkileme potansiyelini artırırken; tokenların %58,47'sinin "Diğerleri" arasında dağılmış olması, üst düzey sahipler dışında anlamlı bir merkeziyetsizliği göstermektedir. Bu dağılım, hiçbir tekil varlığın mutlak kontrol sağlamamasını ve dolayısıyla piyasa istikrarına katkı sağlamasını mümkün kılar. Yine de büyük adreslerin varlıklarını topluca elden çıkarması halinde anlamlı fiyat hareketleri yaşanabilir.

Genel olarak ASTR varlık dağılımı, merkezi etkiler ile yaygın piyasa katılımı arasında denge sunmaktadır. Büyük sahipler önemli piyasa gücüne sahipken, daha geniş dağılım ekosistemin büyümesini ve çeşitli paydaşların katılımını işaret etmekte olup, uzun vadeli piyasa sağlığı ve manipülasyona karşı direnç açısından olumlu bir yapı sergilemektedir.

Güncel ASTR Varlık Dağılımı'nı görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | YDFuxC...pzHGgA | 1.828.011,87K | 21,42% |

| 2 | aRXcHQ...pPX5ve | 616.894,22K | 7,22% |

| 3 | Yc66s2...sZxSVM | 428.445,85K | 5,02% |

| 4 | agF2sH...jDVgae | 356.159,82K | 4,17% |

| 5 | YQnbw3...N8fXhd | 316.173,40K | 3,70% |

| - | Diğerleri | 4.987.434,34K | 58,47% |

II. ASTR'nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Teknik Gelişim ve Ekosistem Genişlemesi

- Ekosistem Uygulamaları: Astar Network, farklı DApp ve projelerle ekosistemini büyütmektedir. Ağın hem Ethereum Virtual Machine (EVM) hem de WebAssembly (WASM) desteği sayesinde, geliştiriciler çok çeşitli uygulamalar geliştirebilmektedir.

III. 2025-2030 Dönemi İçin ASTR Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,01257 $ - 0,0177 $

- Tarafsız tahmin: 0,0177 $ - 0,02 $

- İyimser tahmin: 0,02 $ - 0,02301 $ (olumlu piyasa hissiyatı ve proje ilerlemesi gerektirir)

2027 Orta Vadeli Görünüm

- Piyasa fazı beklentisi: Benimsemenin artışıyla potansiyel bir büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,01832 $ - 0,02748 $

- 2027: 0,02105 $ - 0,02583 $

- Temel katalizörler: Ekosistem genişlemesi, teknolojik ilerlemeler ve piyasanın genel toparlanması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,0253 $ - 0,03373 $ (istikrarlı büyüme ve piyasa dengesi varsayımıyla)

- İyimser senaryo: 0,03373 $ - 0,03744 $ (ekosistemin güçlü şekilde benimsenmesi ve olumlu piyasa koşulları ile)

- Dönüştürücü senaryo: 0,03744 $ - 0,04 $ (çığır açan yenilikler ve ana akım kabul ile)

- 2030-12-31: ASTR 0,03744 $ (iyimser projeksiyona göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,02301 | 0,0177 | 0,01257 | 0 |

| 2026 | 0,02748 | 0,02036 | 0,01832 | 15 |

| 2027 | 0,02583 | 0,02392 | 0,02105 | 35 |

| 2028 | 0,03134 | 0,02487 | 0,01492 | 40 |

| 2029 | 0,03935 | 0,02811 | 0,02445 | 58 |

| 2030 | 0,03744 | 0,03373 | 0,0253 | 90 |

IV. ASTR İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ASTR Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde ASTR biriktirmek

- ASTR stake ederek ödüller kazanmak ve yönetime katılmak

- Tokenları güvenli donanım cüzdanında veya Gate Web3 cüzdanında muhafaza etmek

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemek için

- Relative Strength Index (RSI): Aşırı alım ve aşırı satım durumlarını saptamak için

- Swing trade için önemli noktalar:

- Astar ekosistemindeki haber ve gelişmeleri yakından takip etmek

- Zarar durdur emirleriyle aşağı yönlü riski kontrol altında tutmak

ASTR Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Aggresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %15'i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla kripto varlıkla yatırım portföyünü genişletmek

- Stablecoin kullanımı: Yüksek volatilite dönemlerinde ASTR'nin bir kısmını stablecoin'e çevirmek

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk cüzdan çözümü: Uzun vadeli saklama için donanım cüzdan kullanmak

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifreler ve özel anahtarları çevrimdışı tutmak

V. ASTR İçin Potansiyel Riskler ve Zorluklar

ASTR Piyasa Riskleri

- Yüksek volatilite: ASTR fiyatında önemli dalgalanmalar yaşanabilir

- Sınırlı likidite: Büyük işlemlerin hızlıca gerçekleştirilmesi zor olabilir

- Rekabet: Diğer Layer 1 ve Layer 2 projeleri ASTR'nin piyasa payını etkileyebilir

ASTR Düzenleyici Riskler

- Belirsiz regülasyon ortamı: ASTR'yi etkileyebilecek yeni düzenlemeler olabilir

- Sınır ötesi uyum: Farklı bölgelerde değişen regülasyonlar

- Vergi belirsizlikleri: Kripto varlıklarla ilgili değişen vergi yasaları

ASTR Teknik Riskler

- Akıllı sözleşme açıkları: Astar Network'te olası istismar riskleri

- Ölçeklenebilirlik sorunları: Yoğun talepte ağ tıkanıklığı yaşanabilir

- Birlikte çalışabilirlik problemleri: Zincirler arası işlemlerde karşılaşılabilecek riskler

VI. Sonuç ve Eylem Önerileri

ASTR Yatırım Potansiyeli Değerlendirmesi

ASTR, Astar topluluğunun bir parçası olarak, Astar Network ve Soneium ekosistemlerini birbirine bağlayan özgün bir değer sunar. Web3 alanında uzun vadeli büyüme potansiyeli taşırken, kısa vadeli volatilite ve piyasa riskleri göz önünde bulundurulmalıdır.

ASTR Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın ve Astar ekosistemi hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Stake ve aktif al-sat işlemlerini bir arada kullanarak dengeli bir strateji uygulayın ✅ Kurumsal yatırımcılar: Yönetime katılım için stratejik işbirlikleri ve büyük pozisyonları değerlendirin

ASTR Alım-Satım Yöntemleri

- Spot işlem: Gate.com'da ASTR alıp satmak

- Stake etme: Pasif gelir için ASTR stake programlarına katılmak

- DeFi katılımı: Astar Network'ün merkeziyetsiz uygulamalarında (dApps) yer almak

Kripto para yatırımları çok yüksek risk içerir ve bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

ACH 1 $'a ulaşır mı?

ACH'nin potansiyeli olsa da 1 $ seviyesine ulaşmak iddialı bir beklentidir. 2025-2026 yıllarında piyasa koşulları olumlu olursa ve benimseme güçlü şekilde artarsa bu seviyeye yaklaşabilir.

Aster token yatırım için uygun mu?

Evet, Aster token Web3 ekosisteminde büyüme potansiyeli taşıyor. Yenilikçi özellikleri ve artan benimsenme oranı, onu 2025 ve sonrası için cazip bir yatırım alternatifi haline getiriyor.

Alchemy Pay 2025'te ne kadar olur?

Piyasa eğilimleri ve potansiyel büyüme dikkate alındığında, Alchemy Pay (ACH) 2025'te yaklaşık 0,15 $ - 0,20 $ aralığında değer kazanabilir ve mevcut seviyesinden önemli artış gösterebilir.

Aave 100 bin $'a çıkar mı?

Aave'nin 100 bin $ seviyesine ulaşması oldukça düşük bir ihtimaldir. Mevcut fiyat ve piyasa değeri göz önüne alındığında, kripto piyasasında bu kadar yüksek bir artış emsalsiz olurdu.

Hedera Nedir: 2025'teki Blok Zinciri teknolojisi ve uygulama durumlarını Anlamak

Sei Network 2025 Gelişim Durumu ve Yatırım Fırsatı Analizi

2025'te SEI Ekosisteminin Gelişim Durumu ve Yatırım Fırsatlarının Analizi

2025 Haziran için Chainlink Fiyatı Üzerine Son Analiz ve Yatırım Beklentisi

GT Token 2025'te: Yatırımcılar için Alım, Staking ve Kullanım Alanları

MileVerse (MVC) Proje Analizi: White Paper'ının DeFi Mileage Exchange Yeniliğini Nasıl Sürdüğüne Dair

Meme Finansını Keşfetmek: Yenilikçi Web3 Platformlarına Kapsamlı Bir Rehber

Bitcoin Layer 2 Akıllı Sözleşmeler ve DeFi’ye Yaklaşım: Temel Bir Kılavuz

Web3 cüzdanlarında unutulan PIN kodlarının kurtarılması: PIN yenileme sürecini etkin şekilde yönetmek

Fuel ağı ve FUEL tokenı: Tanıtım ve nasıl çalışır?

ZKFair Launchpool: FairStake Fırsatları İçin Kapsamlı Kılavuz