#AltcoinDivergence

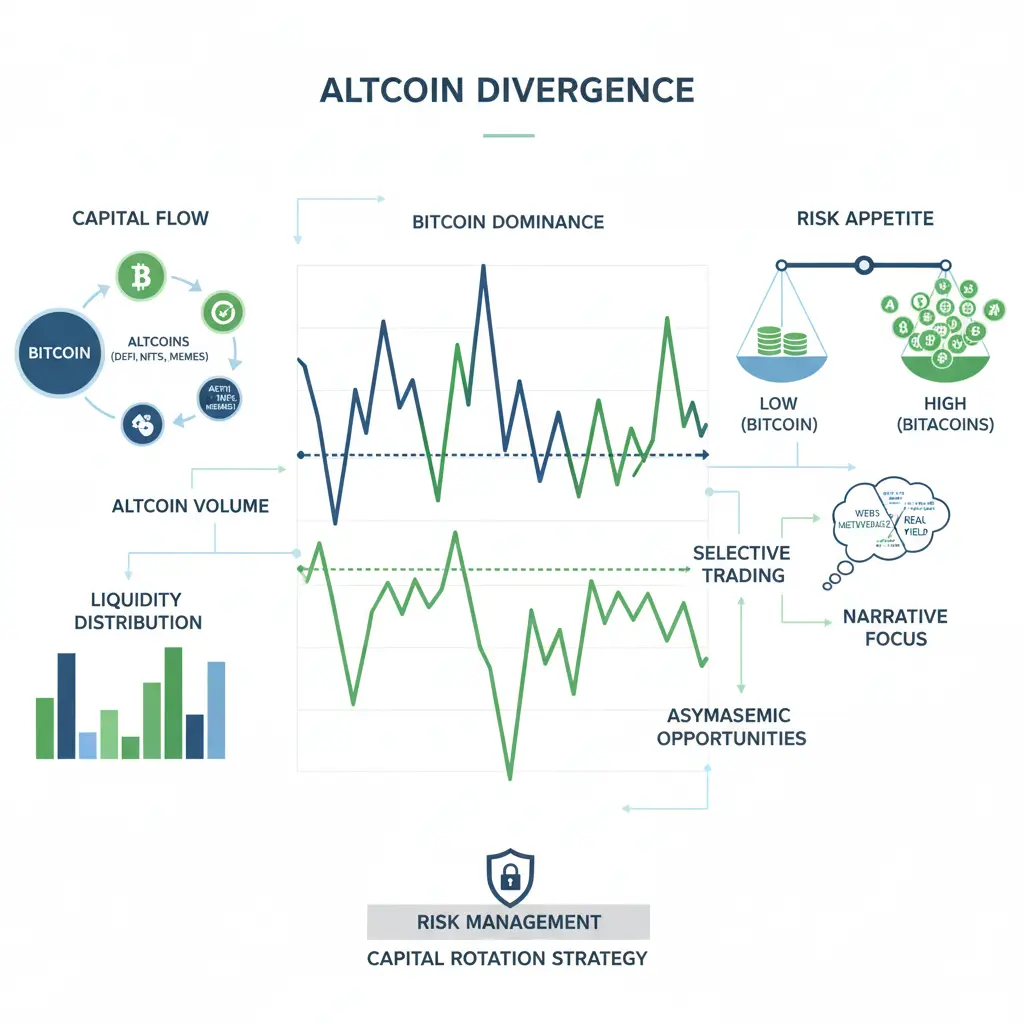

在加密货币市场中,价格并不总是以统一的力量移动。虽然比特币通常引领整体市场方向,但在许多时期,山寨币的表现截然不同——要么表现不佳,要么大幅跑赢BTC。这种行为被称为山寨币背离,它在理解市场周期、资金轮动、流动性流动和风险动态中起着关键作用。识别山寨币背离有助于交易者和投资者了解资金流向、关注的板块以及市场底层条件何时发生变化。

山寨币背离:完整的市场层面分析

山寨币背离不仅仅是短期交易信号——它是一种反映资本、风险偏好、叙事和流动性在加密生态系统中相互作用的结构性市场行为。正确理解后,它可以解释为何某些币种爆发50–300%,而其他币种几乎没有变化,即使比特币占据头条新闻。

这一现象在BTC后期上涨、周期中期暂停和山寨币季节前夕尤为重要。

1. 价格行动背离 (核心概念)

本质上,山寨币背离发生在山寨币的价格表现偏离比特币的趋势时。

常见的价格背离场景:

BTC +5% | 山寨币 −5% 到 −15%

→ 资金集中到比特币 (避险行为)

BTC持平 (±1%) | 山寨币 +10% 到 +60%

→ 早期山寨币轮动

BTC −5% | 强势山寨币 +15% 到 +40%

→ 叙事驱动的背离 (罕见但强大)

BTC +20% | 山寨币 +0–5%

→ 比特币主导扩张阶段

价格背离是相对衡量的,而非绝对的。在一次BTC下跌4%的行情中,山寨币上涨3%是强烈的背离。

2. 百分比表现差距 (BTC与山寨币)

专业交易者关注表现差距,而非原始涨幅。

14天内的示例:

比特币:+18%

ETH:+6%

中型山寨币:−8%

低市值叙事:+40% 到 +120%

这告诉我们:

大量资金留在BTC

选择性投机转向利基板块

广泛的山寨币市场仍然受到抑制

这就是背离。

差距越大,市场越碎片化。

3. 比特币主导地位 (BTC.D) 动态

比特币主导地位是山寨币背离的基础指标。

关键主导区域:

BTC.D 上升 (↑):

山寨币表现不佳

流动性退出小市值

比特币被视为资金锚

BTC.D 持平:

选择性山寨币背离

板块性涨幅 (AI、RWA、梗)

BTC.D 下降 (↓):

广泛的山寨币参与

山寨币季节开始

各币对波动性增加

即使是1–2%的BTC.D变动,也可能因流动性稀薄引发双位数的山寨币涨幅。

4. 流动性结构与市场深度

流动性是背离变得危险或盈利的关键。

比特币:

深厚的订单簿

紧密的价差

能吸收大量买卖订单

山寨币:

订单薄薄

价差宽广

易滑点

在背离期间:

BTC可能平稳移动2–3%

山寨币可能在几分钟内飙升20–50%

但也可能迅速回撤

低流动性放大背离——无论上涨还是下跌。

5. 交易量分析 (聪明资金线索)

交易量告诉你谁在推动背离。

健康的背离交易量:

逐步增加的交易量

交易量的低点逐步升高

价格保持涨幅

危险的背离交易量:

突发的交易量激增

一两根蜡烛占据主导

价格快速消退

常见模式:

BTC交易量下降 → 资金暂停

山寨币交易量上升 → 投机轮动

如果BTC交易量突然回升 → 山寨币反转风险增加

交易量背离常常预示价格背离。

6. 资金轮动机制

山寨币背离由轮动驱动,而非新资金。

典型流程:

稳定币 → 比特币

比特币盈利 → ETH

ETH盈利 → 大盘山寨币

大盘山寨币 → 中小盘

周期重回BTC

如果轮动在步骤1或2停滞,山寨币会出现负面背离。

如果轮动达到步骤3–4,背离偏向山寨币。

7. 叙事驱动背离

并非所有山寨币都同时背离。

示例:

AI代币上涨,而DeFi停滞

梗币飞涨,而Layer-2项目流血

RWA项目表现优异

这形成了内部的山寨币背离,其中:

80%的山寨币是红色

10%持平

10%上涨三位数

短期背离中,叙事优于基本面。

8. 相关性断裂

通常:

山寨币与BTC的相关性在0.7–0.9之间

背离期间:

相关性降至0.2–0.4

一些币对变得完全独立

低相关性 =

更高的机会

更高的风险

更快的反转

相关性回升通常结束背离。

9. 波动率扩张

山寨币背离几乎总是增加波动性:

日内波动范围从5%扩大到15–30%

影线变大

止损追击频繁

超越表现带来的,是情绪压力和执行风险。

10. 山寨币背离期间的风险因素

假突破

低流动性陷阱

过度扩张的百分比变动

快速的情绪反转

依赖BTC的稳定性

山寨币通常:

上涨速度快于BTC

下跌幅度大于BTC

背离放大了这两种结果。

11. 战略要点

山寨币背离不是买入一切的信号。

它是一个信号,提示:

要有选择性

关注主导地位和交易量

尊重流动性

管理仓位规模

最佳机会出现在:

BTC稳定时

主导地位停止上升

山寨币交易量悄然增加

最后的思考

山寨币背离是在告诉你,资金在选择偏爱。

并非每个币都会上涨,也不是每次涨势都能持续。

理解价格百分比差距、流动性深度、交易行为和轮动时机的人,才能生存并超越那些追逐噪音。

在加密货币中,背离不是混乱。

它是信息。

在加密货币市场中,价格并不总是以统一的力量移动。虽然比特币通常引领整体市场方向,但在许多时期,山寨币的表现截然不同——要么表现不佳,要么大幅跑赢BTC。这种行为被称为山寨币背离,它在理解市场周期、资金轮动、流动性流动和风险动态中起着关键作用。识别山寨币背离有助于交易者和投资者了解资金流向、关注的板块以及市场底层条件何时发生变化。

山寨币背离:完整的市场层面分析

山寨币背离不仅仅是短期交易信号——它是一种反映资本、风险偏好、叙事和流动性在加密生态系统中相互作用的结构性市场行为。正确理解后,它可以解释为何某些币种爆发50–300%,而其他币种几乎没有变化,即使比特币占据头条新闻。

这一现象在BTC后期上涨、周期中期暂停和山寨币季节前夕尤为重要。

1. 价格行动背离 (核心概念)

本质上,山寨币背离发生在山寨币的价格表现偏离比特币的趋势时。

常见的价格背离场景:

BTC +5% | 山寨币 −5% 到 −15%

→ 资金集中到比特币 (避险行为)

BTC持平 (±1%) | 山寨币 +10% 到 +60%

→ 早期山寨币轮动

BTC −5% | 强势山寨币 +15% 到 +40%

→ 叙事驱动的背离 (罕见但强大)

BTC +20% | 山寨币 +0–5%

→ 比特币主导扩张阶段

价格背离是相对衡量的,而非绝对的。在一次BTC下跌4%的行情中,山寨币上涨3%是强烈的背离。

2. 百分比表现差距 (BTC与山寨币)

专业交易者关注表现差距,而非原始涨幅。

14天内的示例:

比特币:+18%

ETH:+6%

中型山寨币:−8%

低市值叙事:+40% 到 +120%

这告诉我们:

大量资金留在BTC

选择性投机转向利基板块

广泛的山寨币市场仍然受到抑制

这就是背离。

差距越大,市场越碎片化。

3. 比特币主导地位 (BTC.D) 动态

比特币主导地位是山寨币背离的基础指标。

关键主导区域:

BTC.D 上升 (↑):

山寨币表现不佳

流动性退出小市值

比特币被视为资金锚

BTC.D 持平:

选择性山寨币背离

板块性涨幅 (AI、RWA、梗)

BTC.D 下降 (↓):

广泛的山寨币参与

山寨币季节开始

各币对波动性增加

即使是1–2%的BTC.D变动,也可能因流动性稀薄引发双位数的山寨币涨幅。

4. 流动性结构与市场深度

流动性是背离变得危险或盈利的关键。

比特币:

深厚的订单簿

紧密的价差

能吸收大量买卖订单

山寨币:

订单薄薄

价差宽广

易滑点

在背离期间:

BTC可能平稳移动2–3%

山寨币可能在几分钟内飙升20–50%

但也可能迅速回撤

低流动性放大背离——无论上涨还是下跌。

5. 交易量分析 (聪明资金线索)

交易量告诉你谁在推动背离。

健康的背离交易量:

逐步增加的交易量

交易量的低点逐步升高

价格保持涨幅

危险的背离交易量:

突发的交易量激增

一两根蜡烛占据主导

价格快速消退

常见模式:

BTC交易量下降 → 资金暂停

山寨币交易量上升 → 投机轮动

如果BTC交易量突然回升 → 山寨币反转风险增加

交易量背离常常预示价格背离。

6. 资金轮动机制

山寨币背离由轮动驱动,而非新资金。

典型流程:

稳定币 → 比特币

比特币盈利 → ETH

ETH盈利 → 大盘山寨币

大盘山寨币 → 中小盘

周期重回BTC

如果轮动在步骤1或2停滞,山寨币会出现负面背离。

如果轮动达到步骤3–4,背离偏向山寨币。

7. 叙事驱动背离

并非所有山寨币都同时背离。

示例:

AI代币上涨,而DeFi停滞

梗币飞涨,而Layer-2项目流血

RWA项目表现优异

这形成了内部的山寨币背离,其中:

80%的山寨币是红色

10%持平

10%上涨三位数

短期背离中,叙事优于基本面。

8. 相关性断裂

通常:

山寨币与BTC的相关性在0.7–0.9之间

背离期间:

相关性降至0.2–0.4

一些币对变得完全独立

低相关性 =

更高的机会

更高的风险

更快的反转

相关性回升通常结束背离。

9. 波动率扩张

山寨币背离几乎总是增加波动性:

日内波动范围从5%扩大到15–30%

影线变大

止损追击频繁

超越表现带来的,是情绪压力和执行风险。

10. 山寨币背离期间的风险因素

假突破

低流动性陷阱

过度扩张的百分比变动

快速的情绪反转

依赖BTC的稳定性

山寨币通常:

上涨速度快于BTC

下跌幅度大于BTC

背离放大了这两种结果。

11. 战略要点

山寨币背离不是买入一切的信号。

它是一个信号,提示:

要有选择性

关注主导地位和交易量

尊重流动性

管理仓位规模

最佳机会出现在:

BTC稳定时

主导地位停止上升

山寨币交易量悄然增加

最后的思考

山寨币背离是在告诉你,资金在选择偏爱。

并非每个币都会上涨,也不是每次涨势都能持续。

理解价格百分比差距、流动性深度、交易行为和轮动时机的人,才能生存并超越那些追逐噪音。

在加密货币中,背离不是混乱。

它是信息。