ETH Is this wave worth jumping in?

Recently, breakup pain has been suffocating, and I haven't posted for a few days. Today is the first day I fully let go. Sitting back in front of 💻 and opening the ETH candlestick chart, I suddenly see through everything. Emotional internal struggles are pointless; only the real gold and silver on the chart never lie.

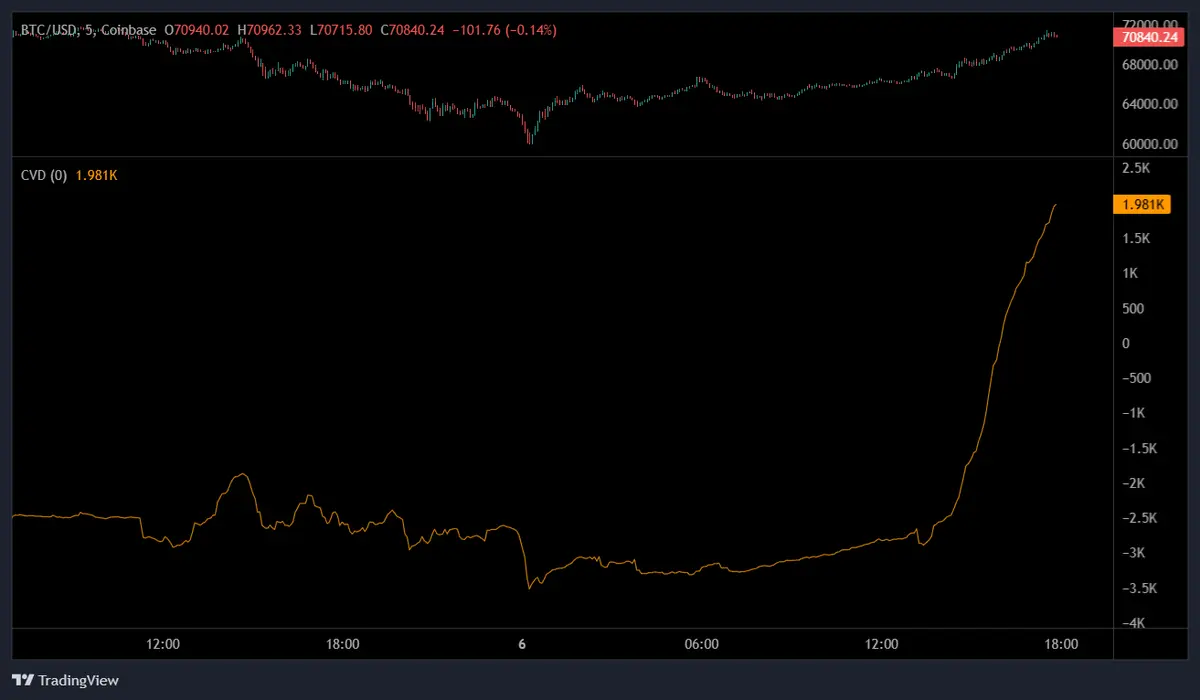

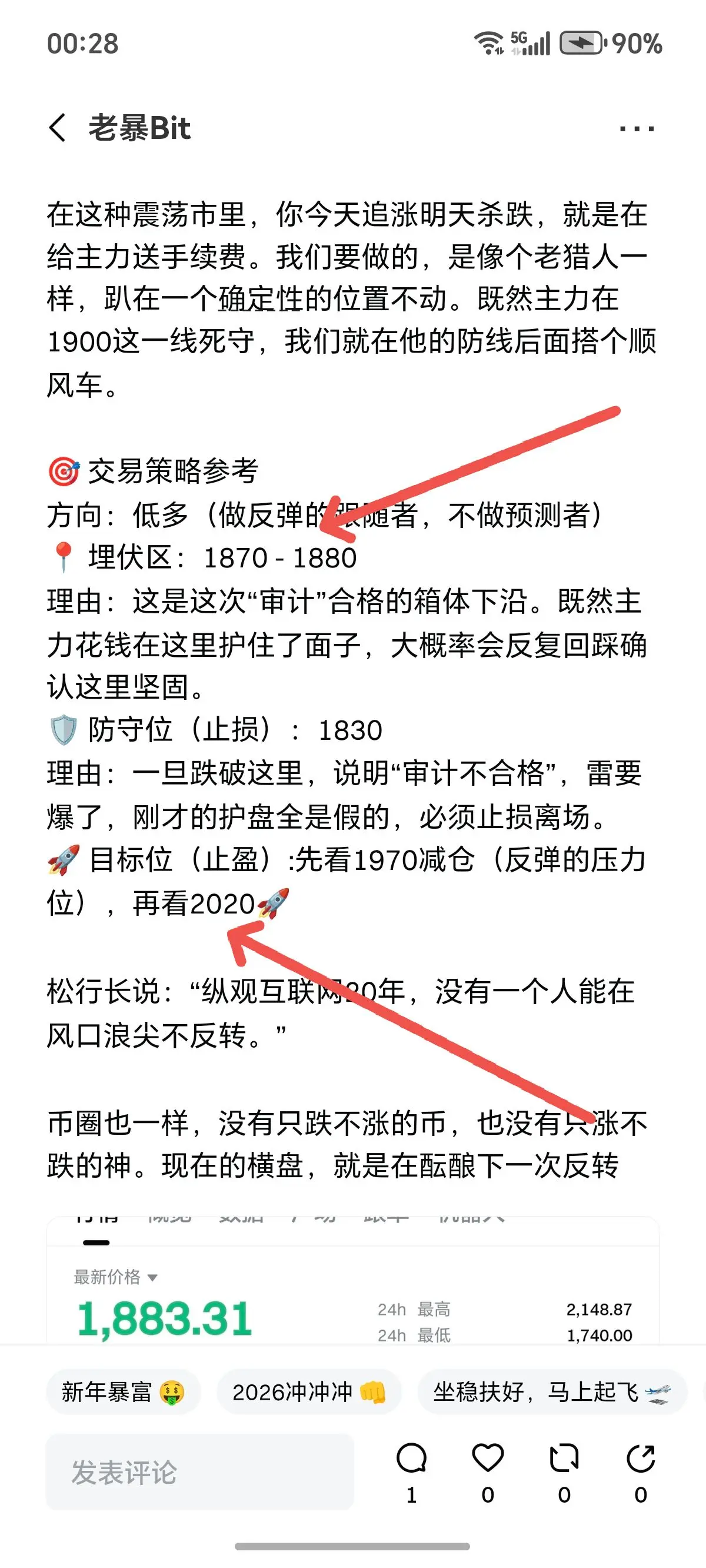

The current ETH is not stagnant; rather, the main force is conducting an extreme pressure audit. Every sideways candlestick is an audit hammer, clearing out panic and floating positions, solidifying the bottom defense.

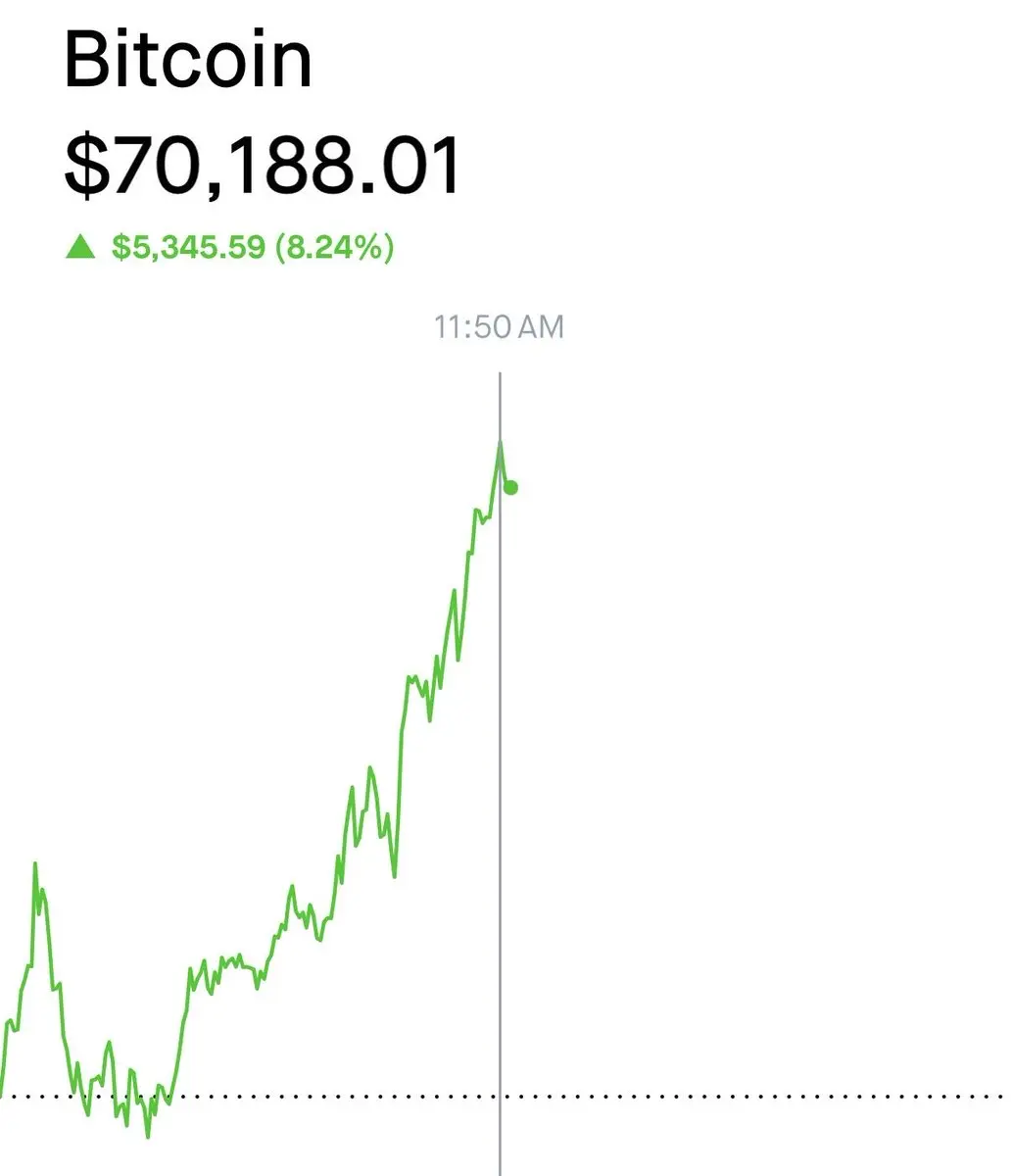

The core resistance level at 1736 is critical. The sharp drop from over 3000 indicates a systemic collapse of market sentiment. If it bottoms out at this level, it will stabilize immediately and rebound, with no secondary breakdown—hardcore support from real gold and silver. This is ETH's first life-and-death line after the decline!

Looking at the sideways consolidation around 1900 with decreasing volume, retail traders complain about the frustration, blindly holding cash, and some even engage in high-frequency trading, buying high and selling low, causing their capital to shrink far beyond the crash.

Honestly, this is the main force testing the waters, not a stagnant rally. After a sharp drop, the market's selling pressure is overwhelming. Being able to pin the price at around 1900 shows that the bulls' main force has done its best to absorb the sell-off. If there were no support, the price would have already collapsed. The calm you see is just the main force building a bottom fortress with their funds.

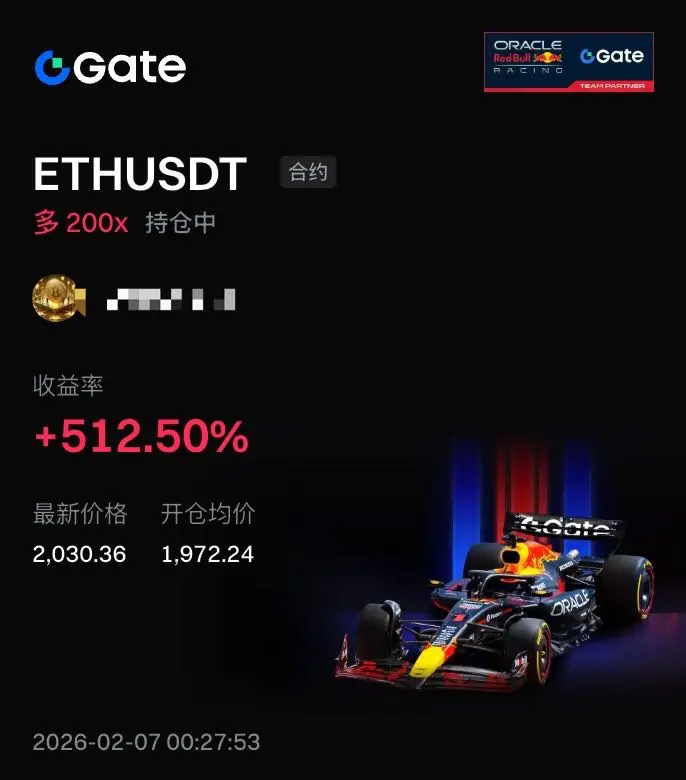

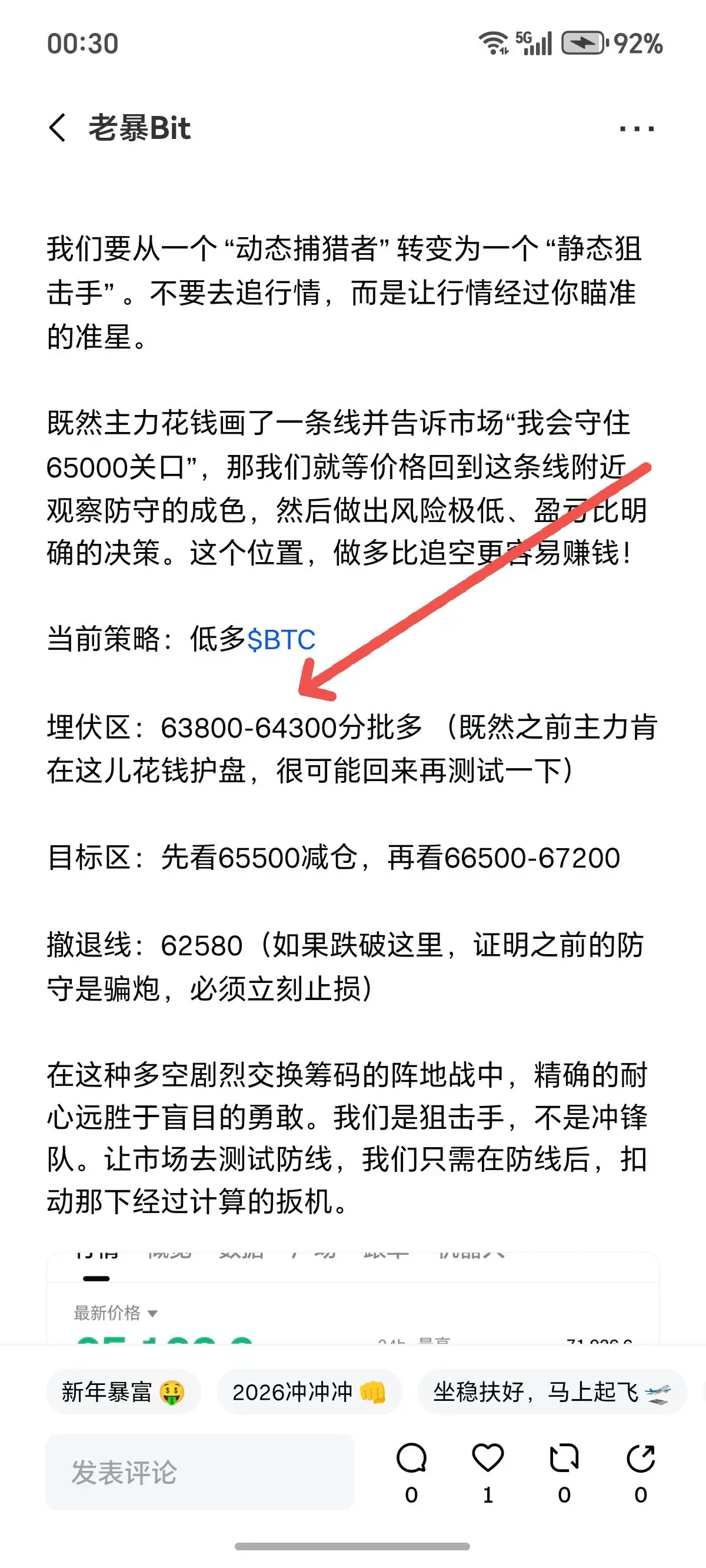

My strategy is straightforward—no ambiguity: "坚定看多,跟随反弹" (Confidently bullish, follow the rebound)

▪️ Trap point: Hidden in the 1860-1880 range, clear signs of main force defending the price

▪️ Defense line: Stop-loss strictly set at 1830; breaking below means failure—exit decisively, no holding

▪️ Hunting targets: First target at 1920 resistance, second at 2020 psychological level, take profits in batches and secure gains.

Let go of past regrets in emotional matters; the clear trading opportunities are right in front of us.

$ETH

Are you brave enough to follow this wave?

Recently, breakup pain has been suffocating, and I haven't posted for a few days. Today is the first day I fully let go. Sitting back in front of 💻 and opening the ETH candlestick chart, I suddenly see through everything. Emotional internal struggles are pointless; only the real gold and silver on the chart never lie.

The current ETH is not stagnant; rather, the main force is conducting an extreme pressure audit. Every sideways candlestick is an audit hammer, clearing out panic and floating positions, solidifying the bottom defense.

The core resistance level at 1736 is critical. The sharp drop from over 3000 indicates a systemic collapse of market sentiment. If it bottoms out at this level, it will stabilize immediately and rebound, with no secondary breakdown—hardcore support from real gold and silver. This is ETH's first life-and-death line after the decline!

Looking at the sideways consolidation around 1900 with decreasing volume, retail traders complain about the frustration, blindly holding cash, and some even engage in high-frequency trading, buying high and selling low, causing their capital to shrink far beyond the crash.

Honestly, this is the main force testing the waters, not a stagnant rally. After a sharp drop, the market's selling pressure is overwhelming. Being able to pin the price at around 1900 shows that the bulls' main force has done its best to absorb the sell-off. If there were no support, the price would have already collapsed. The calm you see is just the main force building a bottom fortress with their funds.

My strategy is straightforward—no ambiguity: "坚定看多,跟随反弹" (Confidently bullish, follow the rebound)

▪️ Trap point: Hidden in the 1860-1880 range, clear signs of main force defending the price

▪️ Defense line: Stop-loss strictly set at 1830; breaking below means failure—exit decisively, no holding

▪️ Hunting targets: First target at 1920 resistance, second at 2020 psychological level, take profits in batches and secure gains.

Let go of past regrets in emotional matters; the clear trading opportunities are right in front of us.

$ETH

Are you brave enough to follow this wave?