Post content & earn content mining yield

placeholder

#CryptoMarketPullback

Debate – The 21M BTC Cap Narrative Questioned Amid ETF and Futures-Driven Synthetic Supply

Hey friends, big debate heating up: Is Bitcoin's famous 21 million hard cap still meaningful in this ETF/futures world? The core narrative – fixed supply = scarcity = moon – is getting challenged hard right now.

With spot ETFs holding massive BTC equivalents, cash-settled futures, perps, options, prime lending, and wrapped versions everywhere, we're seeing "synthetic" BTC supply explode. One real BTC can back multiple derivatives/ETFs/loans – diluting true scarcity and shifting pri

Debate – The 21M BTC Cap Narrative Questioned Amid ETF and Futures-Driven Synthetic Supply

Hey friends, big debate heating up: Is Bitcoin's famous 21 million hard cap still meaningful in this ETF/futures world? The core narrative – fixed supply = scarcity = moon – is getting challenged hard right now.

With spot ETFs holding massive BTC equivalents, cash-settled futures, perps, options, prime lending, and wrapped versions everywhere, we're seeing "synthetic" BTC supply explode. One real BTC can back multiple derivatives/ETFs/loans – diluting true scarcity and shifting pri

BTC6.81%

- Reward

- 13

- 10

- Repost

- Share

xxx40xxx :

:

Happy New Year! 🤑View More

#CryptoMarketPullback

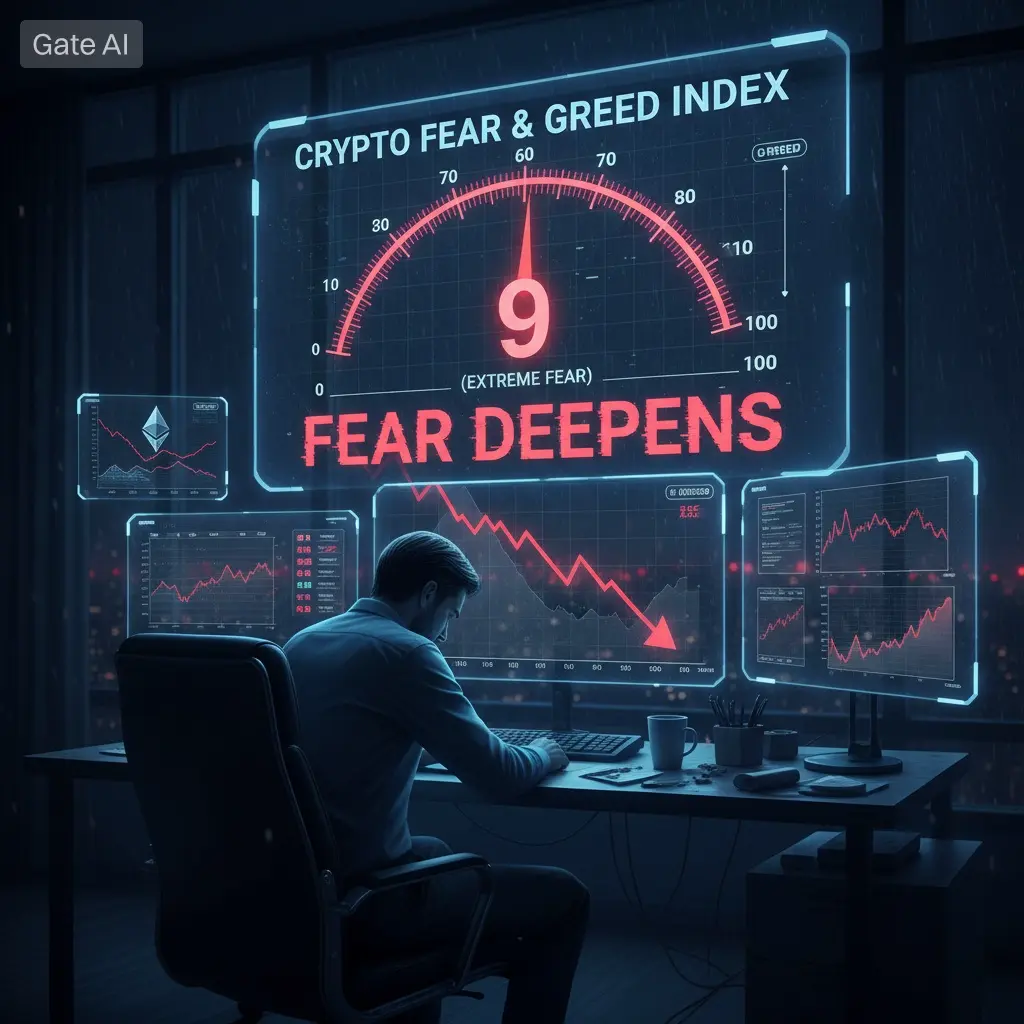

Sentiment – Crypto Fear Deepens as the Fear Index Falls to 9

Hey friends, the fear is real right now! 😱 The Crypto Fear & Greed Index just plunged to 9 – that's Extreme Fear territory, the lowest since the dark days of 2022 FTX collapse. We're talking single-digit panic levels not seen often in Bitcoin's history, with massive liquidations ($2-3B+ in 24h at peaks), ETF outflows, and everyone dumping risk assets.

This isn't just noise – it's capitulation. When sentiment hits rock bottom like this (oversold RSI, record realized losses), history shows violent rebounds follo

Sentiment – Crypto Fear Deepens as the Fear Index Falls to 9

Hey friends, the fear is real right now! 😱 The Crypto Fear & Greed Index just plunged to 9 – that's Extreme Fear territory, the lowest since the dark days of 2022 FTX collapse. We're talking single-digit panic levels not seen often in Bitcoin's history, with massive liquidations ($2-3B+ in 24h at peaks), ETF outflows, and everyone dumping risk assets.

This isn't just noise – it's capitulation. When sentiment hits rock bottom like this (oversold RSI, record realized losses), history shows violent rebounds follo

BTC6.81%

- Reward

- 1

- Comment

- Repost

- Share

ALLBUY

鳌拜

Created By@AllbuyAoBai

Listing Progress

0.00%

MC:

$0.1

Create My Token

#CryptoMarketPullback

Outlook – JPMorgan Sees BTC’s Long-Term Target at $266,000, Gaining Appeal vs Gold

Hey friends, even in this bloodbath, big institutions stay bullish long-term. JPMorgan just reiterated: Bitcoin could hit $266,000 over the long haul, especially as it looks more attractive than gold right now.

Why? Gold crushed it in 2025 (up 60%+ on central bank buying/safe-haven flows), while BTC struggled into 2026 with higher volatility. But JPM sees BTC's lower relative vol (maturing asset), digital properties, and institutional adoption making it a better store-of-value play ahead.

Outlook – JPMorgan Sees BTC’s Long-Term Target at $266,000, Gaining Appeal vs Gold

Hey friends, even in this bloodbath, big institutions stay bullish long-term. JPMorgan just reiterated: Bitcoin could hit $266,000 over the long haul, especially as it looks more attractive than gold right now.

Why? Gold crushed it in 2025 (up 60%+ on central bank buying/safe-haven flows), while BTC struggled into 2026 with higher volatility. But JPM sees BTC's lower relative vol (maturing asset), digital properties, and institutional adoption making it a better store-of-value play ahead.

BTC6.81%

- Reward

- 14

- 10

- Repost

- Share

AbuDharrGhaffari :

:

2026 GOGOGO 👊View More

Wrong.way bet A whale shorted BTC and ETH in early January and is now sitting on 7 million in unrealized losses

- Reward

- 1

- Comment

- Repost

- Share

VLC could’ve made billions if they wanted to, but they chose not to

- Reward

- like

- Comment

- Repost

- Share

$BTC $ETH $SOL $SKR After a volume breakout on the 4H chart, the price is currently undergoing a healthy pullback below the previous high resistance zone. The price is consolidating narrowly around 0.0270, with buy orders significantly deeper than sell orders. The negative funding rate indicates that bearish sentiment still dominates, which is favorable for bulls to squeeze the market.

🎯 Direction: Long

🎯 Entry: 0.02695 - 0.02705

🛑 Stop Loss: 0.02480 ( Rigid stop loss, below the low of the previous 4H candle body )

🚀 Target 1: 0.0300

🚀 Target 2: 0.0330

Hardcore logic: The 4H chart show

View Original🎯 Direction: Long

🎯 Entry: 0.02695 - 0.02705

🛑 Stop Loss: 0.02480 ( Rigid stop loss, below the low of the previous 4H candle body )

🚀 Target 1: 0.0300

🚀 Target 2: 0.0330

Hardcore logic: The 4H chart show

- Reward

- like

- Comment

- Repost

- Share

Market Analysis!! (COMEBACK STREAM)

- Reward

- like

- Comment

- Repost

- Share

JUST IN 🚨$ETH is heating up again. Traders on Kalshi are now forecasting Ethereum to reach $2.36K in February, signaling renewed confidence in the market. After weeks of uncertainty, sentiment is slowly shifting back toward optimism.If this momentum holds, ETH could be setting up for a strong short-term rally. Eyes are now on volume, ETF flows, and macro signals to see if this target becomes reality.Bullish vibes… but stay sharp.

ETH6.07%

- Reward

- like

- Comment

- Repost

- Share

#EthereumL2Outlook

Ethereum’s Layer 2 (L2) ecosystem continues to gain attention as adoption grows and network scalability remains a focus. L2 solutions are designed to improve transaction throughput, reduce fees, and enhance user experience, which is increasingly critical as Ethereum activity expands.

Recent Market Snapshot

Ethereum (ETH): ~$1,950 – $2,000, consolidating near key support levels

L2 Tokens & Projects: Arbitrum, Optimism, and other L2-focused protocols are showing relative strength, benefiting from user adoption and ecosystem growth

Trading activity highlights rotational inter

Ethereum’s Layer 2 (L2) ecosystem continues to gain attention as adoption grows and network scalability remains a focus. L2 solutions are designed to improve transaction throughput, reduce fees, and enhance user experience, which is increasingly critical as Ethereum activity expands.

Recent Market Snapshot

Ethereum (ETH): ~$1,950 – $2,000, consolidating near key support levels

L2 Tokens & Projects: Arbitrum, Optimism, and other L2-focused protocols are showing relative strength, benefiting from user adoption and ecosystem growth

Trading activity highlights rotational inter

- Reward

- like

- Comment

- Repost

- Share

if kellyclaude is a "good dev", then this one is even better

- Reward

- like

- Comment

- Repost

- Share

芝麻传奇

芝麻传奇之路

Created By@gatefunuser_e111

Listing Progress

100.00%

MC:

$2.44K

Create My Token

#BuyTheDipOrWaitNow? #BuyTheDipOrWaitNow? Global markets remain under pressure as risk assets continue to struggle for stability. Bitcoin is hovering near critical support zones, U.S. futures remain weak, and precious metals are failing to provide their usual safety net. This is not a normal pullback — it reflects a broader shift in market behavior driven by tightening liquidity and reduced risk appetite.

What makes this phase different is the synchronized decline across crypto, equities, and commodities. When all major asset classes fall together, it usually signals institutional de-risking a

What makes this phase different is the synchronized decline across crypto, equities, and commodities. When all major asset classes fall together, it usually signals institutional de-risking a

BTC6.81%

- Reward

- like

- Comment

- Repost

- Share

$SHIB just went through a textbook “wash & reset” phase.

After days of bleeding lower, price finally swept the lows and triggered max fear. That’s usually where weak hands exit and stronger hands quietly step in.

What’s interesting now isn’t the bounce, it’s the pause. Price reclaimed an intraday level and is starting to compress instead of instantly dumping again.

When a market stops going down after bad price action, it’s often telling you something.

Not saying moon tomorrow. But this is exactly how short-term reversals and strong relief moves start forming.

Definitely one to keep on the wat

After days of bleeding lower, price finally swept the lows and triggered max fear. That’s usually where weak hands exit and stronger hands quietly step in.

What’s interesting now isn’t the bounce, it’s the pause. Price reclaimed an intraday level and is starting to compress instead of instantly dumping again.

When a market stops going down after bad price action, it’s often telling you something.

Not saying moon tomorrow. But this is exactly how short-term reversals and strong relief moves start forming.

Definitely one to keep on the wat

SHIB6.25%

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

What’s Driving the Sell-Off? Why Are Gold, Stocks, and Crypto Falling Together?

Hey friends, straight to the point—what the hell is driving this synchronized bloodbath? 📉 BTC plunged toward $60k (down 50%+ from Oct '25 peak ~$126k), stocks futures bleeding, gold volatility spiking (hit $4,660 intraday low but now ~$4,930+), silver -9% in a day. Normally gold rises when everything else tanks, so why the co-meltdown?

Key drivers I see:

Broad risk aversion + liquidity crunch: High rates persisting, Fed hawkish vibes, global uncertainty—cash and bonds looking safer. Risk ass

What’s Driving the Sell-Off? Why Are Gold, Stocks, and Crypto Falling Together?

Hey friends, straight to the point—what the hell is driving this synchronized bloodbath? 📉 BTC plunged toward $60k (down 50%+ from Oct '25 peak ~$126k), stocks futures bleeding, gold volatility spiking (hit $4,660 intraday low but now ~$4,930+), silver -9% in a day. Normally gold rises when everything else tanks, so why the co-meltdown?

Key drivers I see:

Broad risk aversion + liquidity crunch: High rates persisting, Fed hawkish vibes, global uncertainty—cash and bonds looking safer. Risk ass

BTC6.81%

- Reward

- 14

- 8

- Repost

- Share

AbuDharrGhaffari :

:

1000x VIbes 🤑View More

Global financial markets experienced severe turbulence last night (February 5, 2026). Cryptocurrencies, primarily Bitcoin (BTC), as well as traditional assets like gold and silver, were heavily impacted as investors fled risky positions. BTC fell by as much as 12% during the day, dropping below $64,000 and reaching its lowest levels since October 2024. The total cryptocurrency market capitalization eroded by more than $1.2 trillion, gold prices fell by 1%, while silver experienced a sharp drop of 6.6%. This movement is interpreted as part of a broad wave of risk aversion; however, while gold m

BTC6.81%

- Reward

- 1

- 1

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊#USIranNuclearTalksTurmoil

Global markets are reacting to renewed tensions surrounding US-Iran nuclear talks, creating uncertainty that extends across equities, commodities, and cryptocurrencies. Political and geopolitical turmoil often drives risk-off sentiment, leading investors to reassess positions in both traditional and digital assets.

Market Context

Bitcoin (BTC): ~$67,000 – $68,000, experiencing volatility amid risk-off flows

Gold and precious metals: Prices have risen slightly as investors seek safe havens, but gold stocks are under pressure due to equity correlations

Equities: Globa

Global markets are reacting to renewed tensions surrounding US-Iran nuclear talks, creating uncertainty that extends across equities, commodities, and cryptocurrencies. Political and geopolitical turmoil often drives risk-off sentiment, leading investors to reassess positions in both traditional and digital assets.

Market Context

Bitcoin (BTC): ~$67,000 – $68,000, experiencing volatility amid risk-off flows

Gold and precious metals: Prices have risen slightly as investors seek safe havens, but gold stocks are under pressure due to equity correlations

Equities: Globa

- Reward

- 2

- 3

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

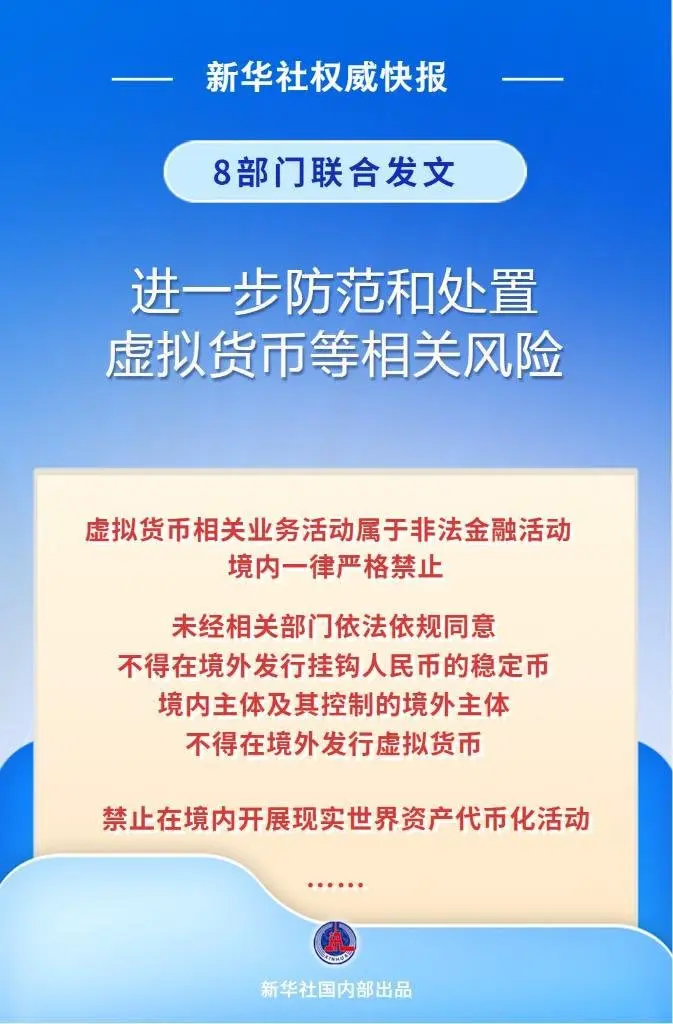

The People's Bank of China and seven other ministries have issued a new notice, replacing the previous 2021 announcement. The main differences are: 1. Recently, the so-called "compliant" RWA has also been explicitly prohibited. 2. Domestic entities issuing tokens overseas based on domestic assets must file with the China Securities Regulatory Commission! 3. Strengthen "local implementation"—cases in each province should be handled by that province, reducing the difficulty of cross-provincial profit-seeking enforcement and clarifying regional responsibilities!

View Original

- Reward

- like

- 1

- Repost

- Share

6_sToDaMoon :

:

What does it really mean?$ZRO is showing classic textbook action 📈

After breaking out from the falling wedge on the Macro-chart, we’re seeing a healthy retracement perfect for accumulation.

Smart move? Use this dip to position yourself before the next big breakout 🚀.

Eyes locked 👀

$ZRO could be gearing up for some serious momentum.

After breaking out from the falling wedge on the Macro-chart, we’re seeing a healthy retracement perfect for accumulation.

Smart move? Use this dip to position yourself before the next big breakout 🚀.

Eyes locked 👀

$ZRO could be gearing up for some serious momentum.

ZRO-0.63%

- Reward

- like

- Comment

- Repost

- Share

BREAKING:$340,000,000,000 has been added to the crypto market today.

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More109.79K Popularity

20.56K Popularity

388.6K Popularity

7.61K Popularity

5.28K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:00.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.74KHolders:32.33%

- MC:$2.45KHolders:10.00%

News

View MoreThe Dow Jones Industrial Average rises above 50,000 points, hitting an intraday record high

32 m

Data: If BTC drops below $66,105, the total long liquidation strength on mainstream CEXs will reach $1.325 billion.

1 h

Data: If ETH drops below $1,935, the total long liquidation strength on major CEXs will reach $720 million.

1 h

Data: 454.08 BTC transferred out from Cumberland DRW, valued at approximately $28.55 million.

1 h

BTC drops below 70,000 USDT

1 h