Post content & earn content mining yield

placeholder

GateUser-62cada74

GM yall 💔🫠When everything crashesPatience becomes power

- Reward

- like

- Comment

- Repost

- Share

GM friends, the crypto market is ready for some big moves💥🚀🌛!What #100x #Altcoin 💎 is a must buy these days?Shill me yours below 👇👇

- Reward

- like

- Comment

- Repost

- Share

Short-Term Market Trend Analysis (No Signals)

- Reward

- like

- Comment

- Repost

- Share

永恒熊市

永恒熊市

Created By@KKYE

Listing Progress

0.00%

MC:

$2.31K

Create My Token

Recent sharp declines in cryptocurrency assets are mainly due to threefold pressures:

Macro tightening: The Federal Reserve has paused interest rate cuts, the new chair nominee is hawkish, liquidity easing expectations have faded, and funds are withdrawing from high-risk assets.

Leverage collapse: High-leverage long positions are being liquidated in succession, ETF fund outflows continue, and the market is caught in a "decline - liquidation" negative feedback loop.

Narrative shake-up: Bitcoin and risk assets are declining in tandem, the "digital gold" safe-haven attribute is being questioned,

View OriginalMacro tightening: The Federal Reserve has paused interest rate cuts, the new chair nominee is hawkish, liquidity easing expectations have faded, and funds are withdrawing from high-risk assets.

Leverage collapse: High-leverage long positions are being liquidated in succession, ETF fund outflows continue, and the market is caught in a "decline - liquidation" negative feedback loop.

Narrative shake-up: Bitcoin and risk assets are declining in tandem, the "digital gold" safe-haven attribute is being questioned,

- Reward

- like

- 1

- Repost

- Share

ZhanDongqi :

:

New Year Wealth Explosion 🤑YO ITS MIDNIGHT MADNESS!!! I AM PICKING A COUPLE REPLY GUYS TO WIN A SHARE OF $10K FROM MY WALLET!!

- Reward

- like

- 1

- Repost

- Share

CanIGetSomeCapitalBack? :

:

New Year Wealth Explosion 🤑Crypto Technical Analysis for Live Streams (Educational)

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

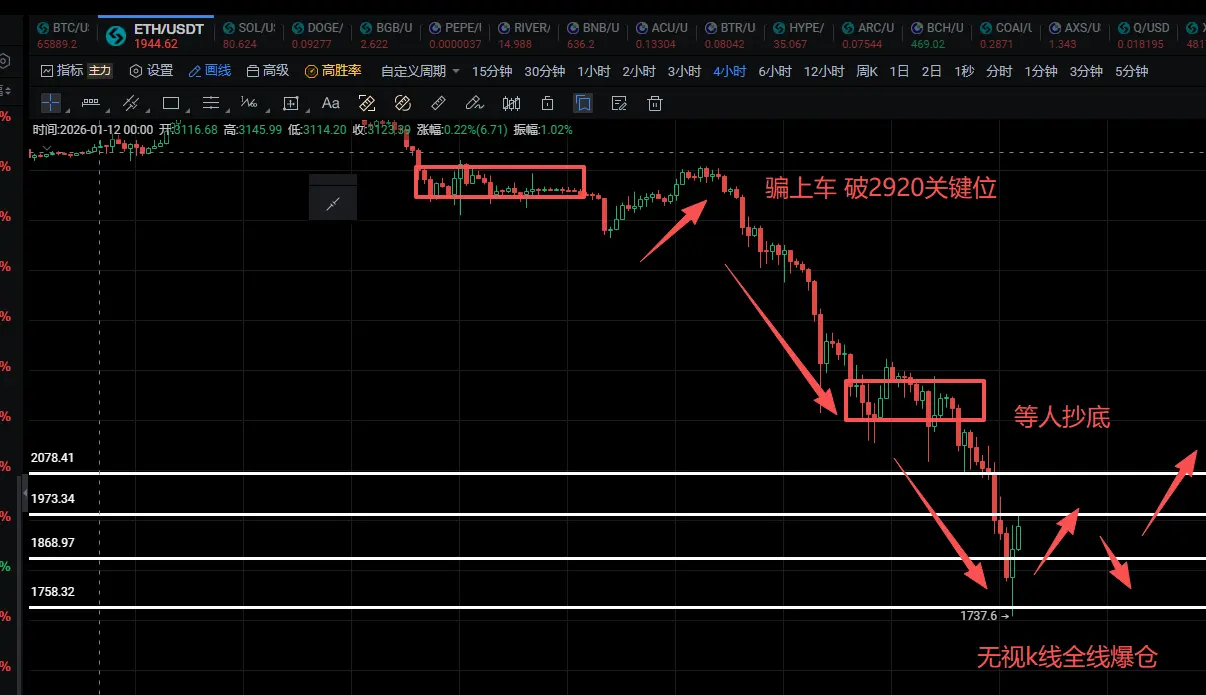

$BTC $ETH Afternoon Market Analysis: Published at 14:53 on February 6th

Last night, all my short positions on gold at 4880 and AXS at 1.58 were fully profitable. My wife wanted to take a position again but got stopped out. Currently, in this market, Ethereum can only see the immediate profit; pending orders can't be used for basis point scalping for now. That said, congratulations to the followers who are on the same page. Here at Ying Ge's, we always review our take profits and stop losses, learning to respect the market. Summarizing and reviewing makes you stronger. For friends who choose t

View OriginalLast night, all my short positions on gold at 4880 and AXS at 1.58 were fully profitable. My wife wanted to take a position again but got stopped out. Currently, in this market, Ethereum can only see the immediate profit; pending orders can't be used for basis point scalping for now. That said, congratulations to the followers who are on the same page. Here at Ying Ge's, we always review our take profits and stop losses, learning to respect the market. Summarizing and reviewing makes you stronger. For friends who choose t

- Reward

- 2

- 2

- Repost

- Share

JustSimpleNo.2 :

:

AXS is eating meatView More

Stop fighting for 1% profit in 99% noise.

If you’re feeling tired:

Tired of chasing every hot topic that’s hard to tell real from fake,

Tired of exhausting your emotions through wild swings,

Tired of those “get rich quick” myths repeated a thousand times with no results.

Then, this is your mental harbor.

I don’t offer codes for tomorrow’s skyrocketing prices.

What I provide is an operating system that helps you survive in any market and keep making profits.

▫️ When everyone FOMO—I give you the “Emotional Breakpoint” tool to identify danger signals in collective frenzy.

▫️ When information over

View OriginalIf you’re feeling tired:

Tired of chasing every hot topic that’s hard to tell real from fake,

Tired of exhausting your emotions through wild swings,

Tired of those “get rich quick” myths repeated a thousand times with no results.

Then, this is your mental harbor.

I don’t offer codes for tomorrow’s skyrocketing prices.

What I provide is an operating system that helps you survive in any market and keep making profits.

▫️ When everyone FOMO—I give you the “Emotional Breakpoint” tool to identify danger signals in collective frenzy.

▫️ When information over

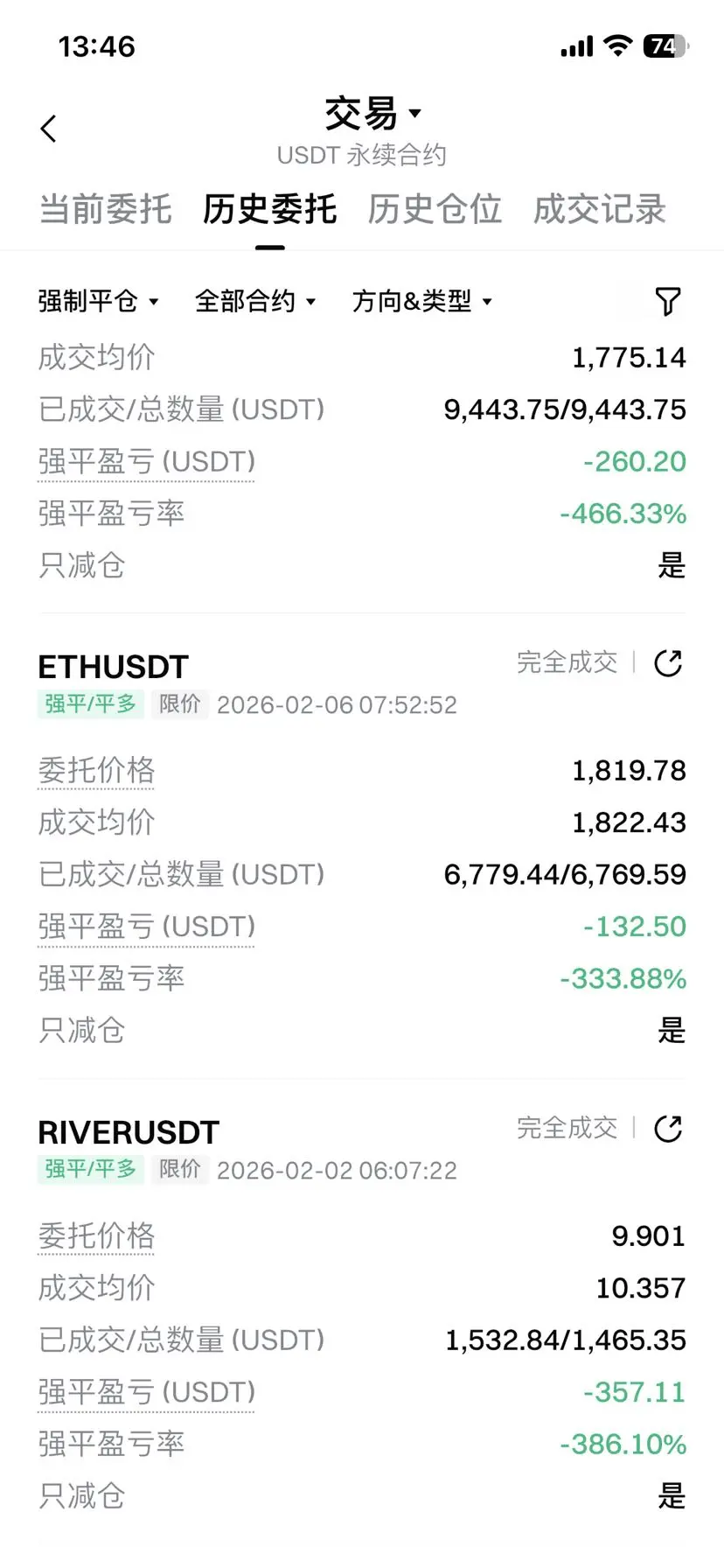

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3994?ref=VLIXXFKJAQ&ref_type=132

- Reward

- 4

- 4

- Repost

- Share

HeavenSlayerSupporter :

:

Stay strong and HODL💎View More

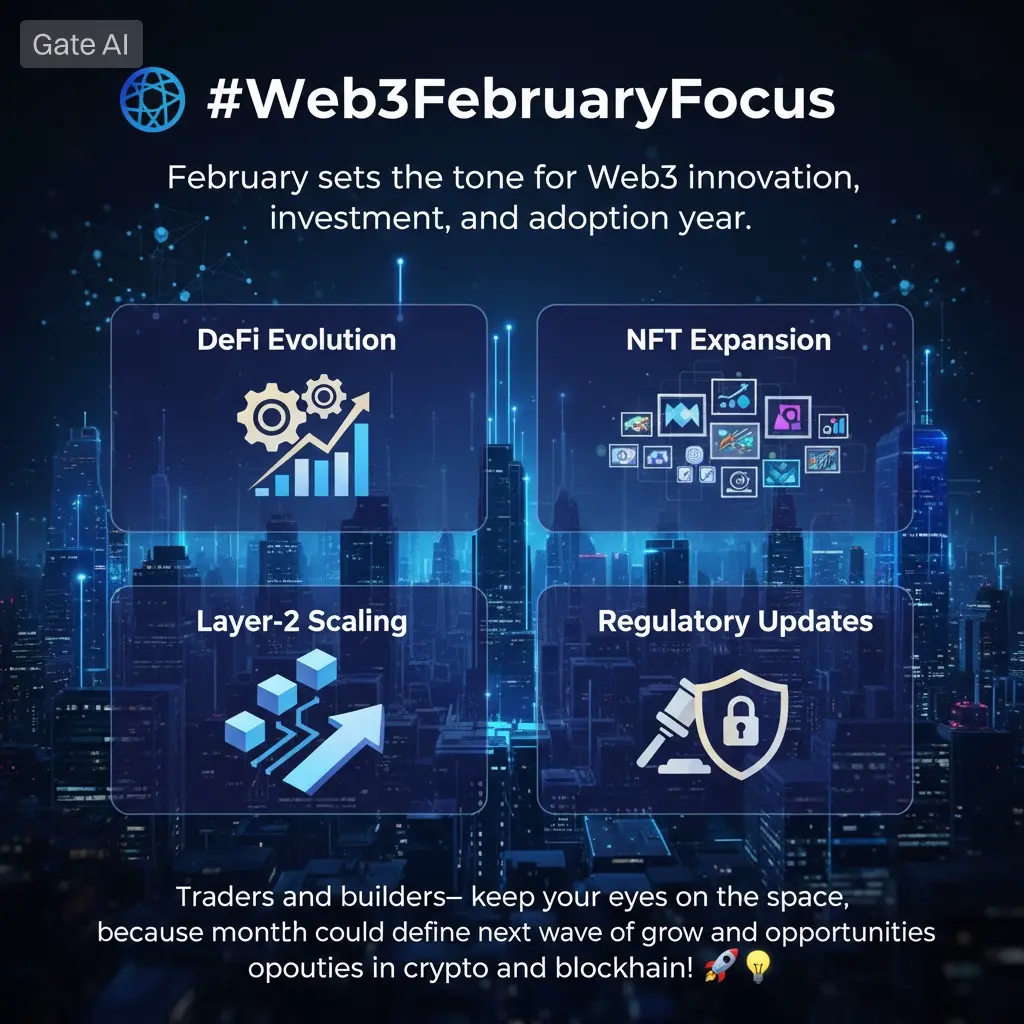

#Web3FebruaryFocus

#Web3FebruaryFocus is here! February sets the tone for Web3 innovation, investment, and adoption this year. Key trends include DeFi evolution, NFT expansion, layer-2 scaling, and regulatory updates.

Traders and builders—keep your eyes on the space, because this month could define the next wave of growth and opportunities in crypto and blockchain!

#Web3FebruaryFocus is here! February sets the tone for Web3 innovation, investment, and adoption this year. Key trends include DeFi evolution, NFT expansion, layer-2 scaling, and regulatory updates.

Traders and builders—keep your eyes on the space, because this month could define the next wave of growth and opportunities in crypto and blockchain!

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

New year Wealth Explosion- Reward

- like

- 10

- Repost

- Share

EverythingWillBeOkay. :

:

New Year Wealth Explosion 🤑View More

大饼4万

大饼4万

Created By@KKYE

Listing Progress

0.00%

MC:

$2.32K

Create My Token

🚨🇺🇸BREAKING:Bitcoin ETFs sold $434,100,000 on Feb 05BlackRock $IBIT sold $175,300,000 worth of Bitcoin alone.

BTC-8.7%

- Reward

- like

- Comment

- Repost

- Share

#当前行情抄底还是观望?

February 6th, Coinglass data shows that the Bitcoin Ahr999 indicator dropped to 0.27, significantly below the 0.45 "bottom-fishing line." Historically, this level has appeared during extreme events, such as the 2020 "316 Crash," the 2022 LUNA and FTX crises. This indicator is often used to assess the deviation of BTC from its long-term valuation.

Does this currently signal a high-value entry window, or are the risks yet to be fully realized? Amid the tug-of-war between sentiment and fundamentals, would you choose dollar-cost averaging, hold, or cut losses? Welcome to discuss.

February 6th, Coinglass data shows that the Bitcoin Ahr999 indicator dropped to 0.27, significantly below the 0.45 "bottom-fishing line." Historically, this level has appeared during extreme events, such as the 2020 "316 Crash," the 2022 LUNA and FTX crises. This indicator is often used to assess the deviation of BTC from its long-term valuation.

Does this currently signal a high-value entry window, or are the risks yet to be fully realized? Amid the tug-of-war between sentiment and fundamentals, would you choose dollar-cost averaging, hold, or cut losses? Welcome to discuss.

BTC-8.7%

- Reward

- 1

- 2

- Repost

- Share

HaonanChen :

:

Hold on tight, we're about to take off 🛫View More

Is the lowest shutdown price range for BTC still $46,354? Are you panicking? Bitcoin has now dropped below $60,000, already reaching the middle-lower part of the entire network's mining shutdown threshold. The most powerful machines can still hold on for a while (it really hurts at $46,000), but most ordinary mining rigs can no longer withstand the electricity costs and are losing money. As a result, hash rate is plummeting, and difficulty will need to be adjusted downward significantly.

BTC-8.7%

- Reward

- like

- Comment

- Repost

- Share

New user rewards are fully upgraded. During the event, newly registered users can join the token draw, with a variety of popular token airdrops available and rewards credited instantly upon winning. https://www.gate.com/campaigns/4005?ref=VGCSVFPYCQ&ref_type=132&utm_cmp=WFOFomoo

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionThe FCA Launches Major Study on AI in Financial Services - #fca #ia #pib

View Original

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? Global markets are once again under pressure, and today’s price action is sending a clear warning. Bitcoin is struggling near key support, U.S. futures are slipping, and both gold and silver are seeing heavy selling. This is not isolated weakness — this is synchronized risk reduction across major asset classes.

When crypto, equities, and precious metals fall together, it usually points to tightening liquidity. Institutions begin reducing exposure, leveraged traders are forced to unwind positions, and capital moves into safety. In these moments, price is not driven by senti

When crypto, equities, and precious metals fall together, it usually points to tightening liquidity. Institutions begin reducing exposure, leveraged traders are forced to unwind positions, and capital moves into safety. In these moments, price is not driven by senti

BTC-8.7%

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

The market overview you described accurately captures the current complex environment of high volatility and multi-asset synchronized pressure. This cross-asset decline is indeed not an isolated event but a clear signal of tightening global liquidity and a sharp contraction in risk appetite🌼🌹Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More98.01K Popularity

14.8K Popularity

386.42K Popularity

2.9K Popularity

1.2K Popularity

News

View MoreThe MGBX platform will host a Chinese New Year themed limited-time event from February 12 to March 4, 2026, with a total prize pool of $1,000,000.

2 m

CYS (Cysic) has increased by 18.62% over the past 24 hours, currently trading at $0.34.

3 m

Greeks.live: The sharp downward trend of Bitcoin and Ethereum continues, with put options dominating the market.

6 m

Data: 72 BTC transferred out from Cumberland DRW, worth approximately $4.67 million

16 m

ETH drops below 1900 USDT

28 m