#BitcoinFallsBehindGold

When Markets Choose Memory Over Momentum: Bitcoin, Gold, and the Psychology of Capital

Financial markets are not driven solely by numbers, yields, or charts. At critical moments, they are shaped by something far more human: memory. When uncertainty rises, investors do not search for the most innovative asset — they search for the one that has survived before.

Today’s global environment is a textbook example of this instinct at work.

Across currencies, commodities, and digital assets, capital is reorganizing itself not around growth narratives, but around endurance. And in that reorganization, Gold and Bitcoin are being judged by very different standards.

Gold: The Asset That Requires No Explanation

Gold’s current strength does not come from excitement. It comes from familiarity.

In times of stress, markets favor assets that require no belief system, no onboarding process, and no future promise. Gold does not need to explain its value proposition. It does not rely on network effects, adoption curves, or regulatory clarity. Its appeal is immediate and universal.

Central banks accumulating Gold are not making speculative bets — they are making statements about trust. In a world where sovereign debt expands faster than productivity and monetary policy credibility is questioned, Gold acts as a neutral reserve of confidence. It performs best not when optimism is high, but when doubt becomes systemic.

Gold is not a trade. It is a default setting.

Bitcoin: Still Powerful, Still Early — But Not Neutral Yet

Bitcoin occupies a very different psychological space.

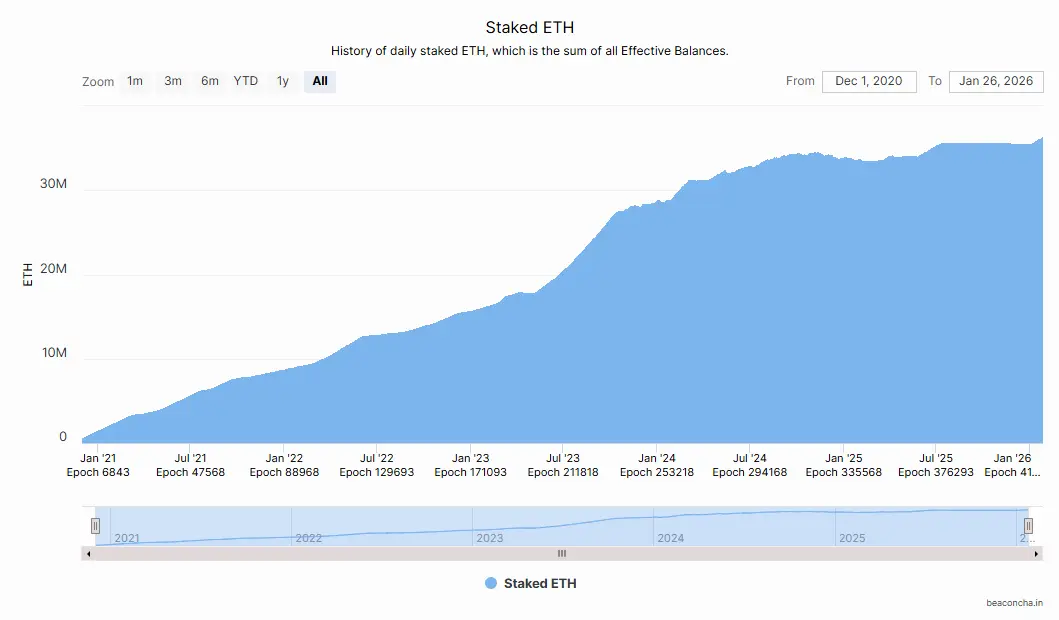

Despite its fixed supply and decentralized design, Bitcoin still requires interpretation. It demands an understanding of technology, custody, regulation, and market structure. In stable times, that complexity is acceptable — even attractive. In unstable times, it becomes friction.

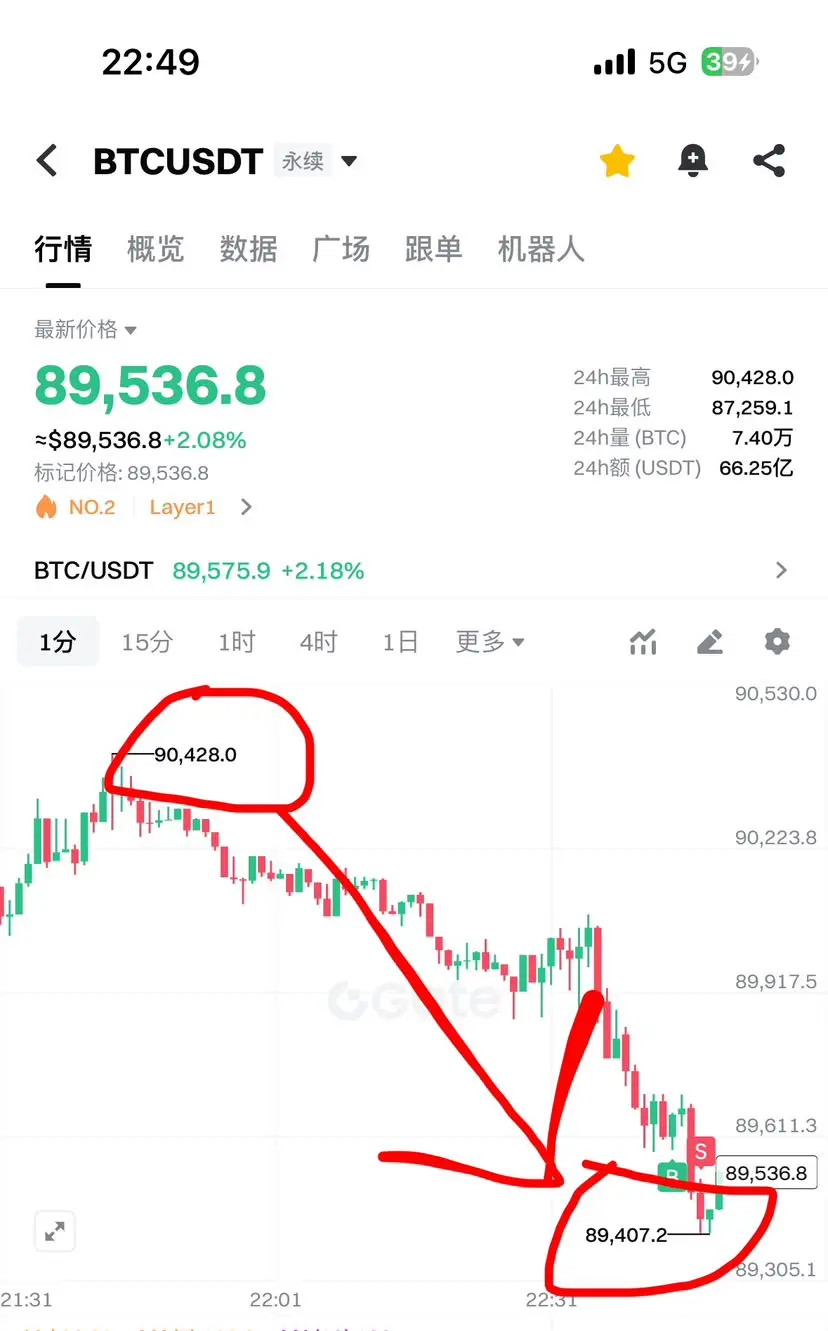

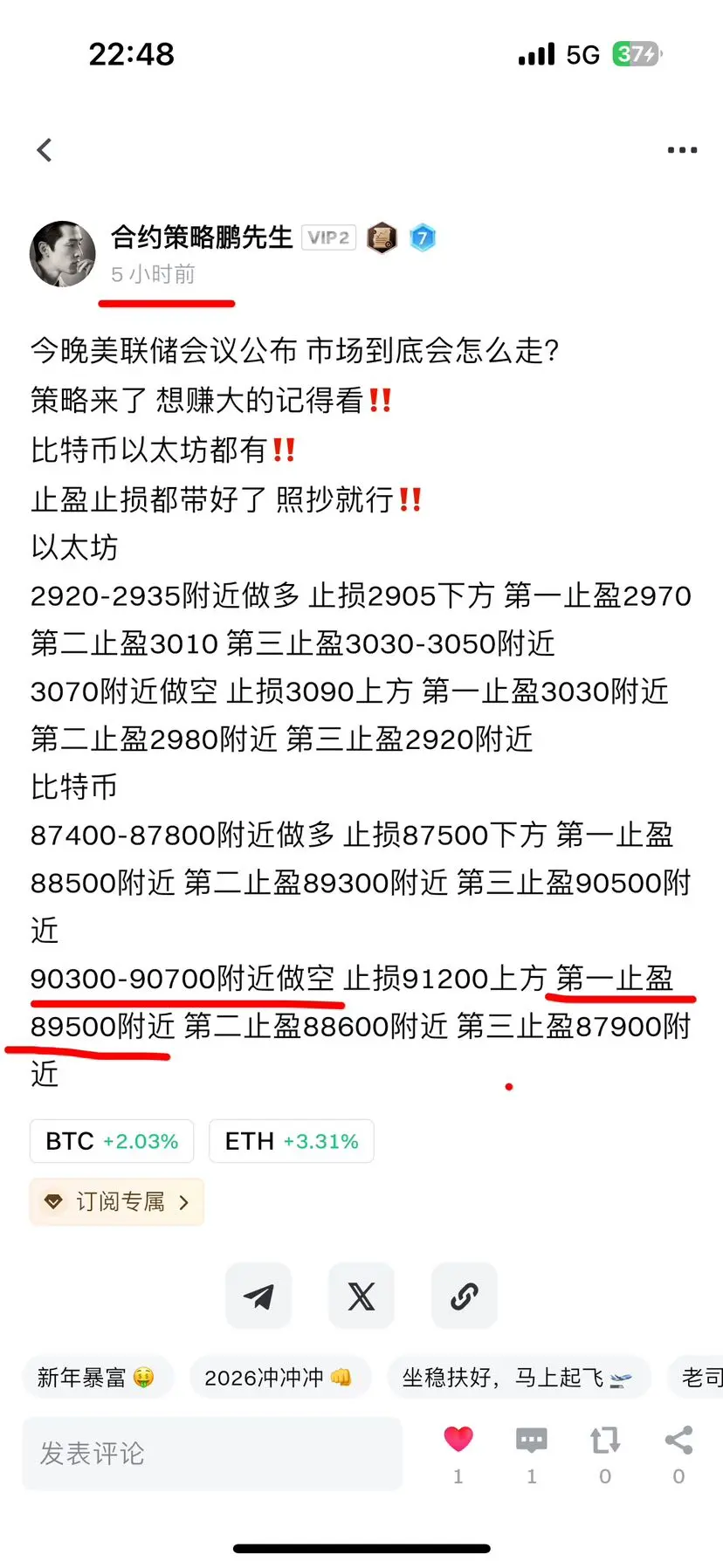

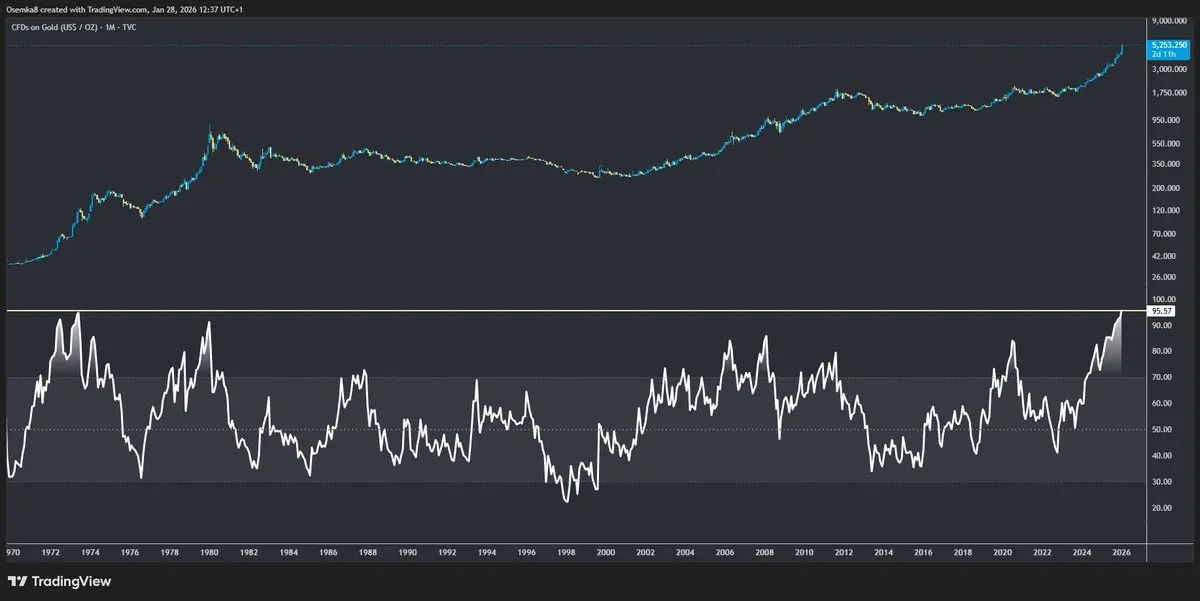

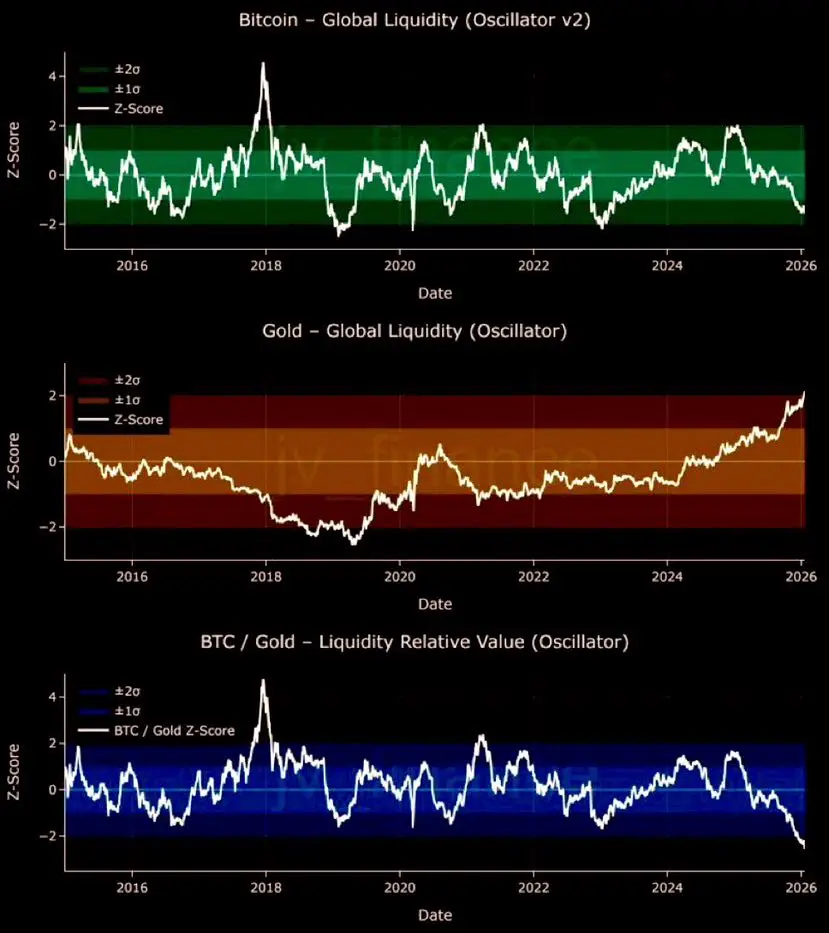

Current price behavior reflects this reality. Bitcoin continues to respond to liquidity conditions, interest rate expectations, and broader risk sentiment. When capital tightens, Bitcoin behaves less like a monetary anchor and more like a high-beta macro asset.

This does not diminish Bitcoin’s long-term relevance. It simply highlights where it currently sits in the hierarchy of trust.

Gold is remembered. Bitcoin is still being evaluated.

The Bitcoin–Gold Relationship Is About Time Horizons

Comparisons between Bitcoin and Gold often miss a critical variable: time.

Gold represents accumulated credibility across centuries. Bitcoin represents potential credibility across decades.

During periods of monetary expansion, markets are willing to price the future aggressively. In those environments, Bitcoin thrives. Its upside is asymmetric, its narrative compelling, and its innovation rewarded.

But when markets shift into preservation mode, upside becomes secondary. The priority becomes minimizing regret, not maximizing return. In that phase, Gold naturally regains dominance — not because it grows faster, but because it disappoints less.

This is why the Bitcoin-to-Gold ratio weakens during restrictive cycles. It is not a rejection of Bitcoin, but a rebalancing of expectations.

Cycles Don’t Kill Assets — They Reassign Roles

Every macro regime reshuffles leadership.

Expansion rewards innovation

Tightening rewards durability

Crisis rewards simplicity

Bitcoin has already proven it can survive volatility. What it has not fully proven — yet — is neutrality under stress. That neutrality is what transforms an asset from an opportunity into a refuge.

Gold crossed that threshold long ago.

Bitcoin is still approaching it.

And that distinction matters for how capital behaves today.

What This Means for Strategic Investors

The mistake many investors make is treating asset identity as fixed. In reality, asset roles are conditional.

Bitcoin is not failing because it is consolidating. Gold is not “winning” because it is rising.

They are responding to the same environment — in different ways.

The intelligent response is not to choose sides, but to recognize phases:

When certainty is scarce, capital defends.

When confidence returns, capital expands.

Those who understand this do not panic during rotations. They prepare for them.

Final Thought

Markets are not emotional — but investors are. And in moments of stress, investors choose what they trust most.

Right now, the world is choosing memory over momentum. History over possibility. Silence over innovation.

That does not mean the future is cancelled. It means it is temporarily postponed.

Gold leads when the past feels safer than the future. Bitcoin leads when the future feels investable again.

Cycles change. Roles rotate. But assets that survive every phase eventually define the next one.

And that is where the real story is being written.

When Markets Choose Memory Over Momentum: Bitcoin, Gold, and the Psychology of Capital

Financial markets are not driven solely by numbers, yields, or charts. At critical moments, they are shaped by something far more human: memory. When uncertainty rises, investors do not search for the most innovative asset — they search for the one that has survived before.

Today’s global environment is a textbook example of this instinct at work.

Across currencies, commodities, and digital assets, capital is reorganizing itself not around growth narratives, but around endurance. And in that reorganization, Gold and Bitcoin are being judged by very different standards.

Gold: The Asset That Requires No Explanation

Gold’s current strength does not come from excitement. It comes from familiarity.

In times of stress, markets favor assets that require no belief system, no onboarding process, and no future promise. Gold does not need to explain its value proposition. It does not rely on network effects, adoption curves, or regulatory clarity. Its appeal is immediate and universal.

Central banks accumulating Gold are not making speculative bets — they are making statements about trust. In a world where sovereign debt expands faster than productivity and monetary policy credibility is questioned, Gold acts as a neutral reserve of confidence. It performs best not when optimism is high, but when doubt becomes systemic.

Gold is not a trade. It is a default setting.

Bitcoin: Still Powerful, Still Early — But Not Neutral Yet

Bitcoin occupies a very different psychological space.

Despite its fixed supply and decentralized design, Bitcoin still requires interpretation. It demands an understanding of technology, custody, regulation, and market structure. In stable times, that complexity is acceptable — even attractive. In unstable times, it becomes friction.

Current price behavior reflects this reality. Bitcoin continues to respond to liquidity conditions, interest rate expectations, and broader risk sentiment. When capital tightens, Bitcoin behaves less like a monetary anchor and more like a high-beta macro asset.

This does not diminish Bitcoin’s long-term relevance. It simply highlights where it currently sits in the hierarchy of trust.

Gold is remembered. Bitcoin is still being evaluated.

The Bitcoin–Gold Relationship Is About Time Horizons

Comparisons between Bitcoin and Gold often miss a critical variable: time.

Gold represents accumulated credibility across centuries. Bitcoin represents potential credibility across decades.

During periods of monetary expansion, markets are willing to price the future aggressively. In those environments, Bitcoin thrives. Its upside is asymmetric, its narrative compelling, and its innovation rewarded.

But when markets shift into preservation mode, upside becomes secondary. The priority becomes minimizing regret, not maximizing return. In that phase, Gold naturally regains dominance — not because it grows faster, but because it disappoints less.

This is why the Bitcoin-to-Gold ratio weakens during restrictive cycles. It is not a rejection of Bitcoin, but a rebalancing of expectations.

Cycles Don’t Kill Assets — They Reassign Roles

Every macro regime reshuffles leadership.

Expansion rewards innovation

Tightening rewards durability

Crisis rewards simplicity

Bitcoin has already proven it can survive volatility. What it has not fully proven — yet — is neutrality under stress. That neutrality is what transforms an asset from an opportunity into a refuge.

Gold crossed that threshold long ago.

Bitcoin is still approaching it.

And that distinction matters for how capital behaves today.

What This Means for Strategic Investors

The mistake many investors make is treating asset identity as fixed. In reality, asset roles are conditional.

Bitcoin is not failing because it is consolidating. Gold is not “winning” because it is rising.

They are responding to the same environment — in different ways.

The intelligent response is not to choose sides, but to recognize phases:

When certainty is scarce, capital defends.

When confidence returns, capital expands.

Those who understand this do not panic during rotations. They prepare for them.

Final Thought

Markets are not emotional — but investors are. And in moments of stress, investors choose what they trust most.

Right now, the world is choosing memory over momentum. History over possibility. Silence over innovation.

That does not mean the future is cancelled. It means it is temporarily postponed.

Gold leads when the past feels safer than the future. Bitcoin leads when the future feels investable again.

Cycles change. Roles rotate. But assets that survive every phase eventually define the next one.

And that is where the real story is being written.