Post content & earn content mining yield

placeholder

vanabin

BTC Market Structure: Support, Resistance & Liquidity Zones (Educational Analysis)”

- Reward

- like

- Comment

- Repost

- Share

Ice racing done, now up to a mountain pass at 3,000 meters to ski down on this beautiful Sunday not my car but I’m driving [friends and family perks]

- Reward

- like

- Comment

- Repost

- Share

Participation level:Trading activity remains moderate, no panic moves yet

- Reward

- like

- Comment

- Repost

- Share

msyq

马上有钱

Created By@ComeWealth,ComeWealth

Listing Progress

0.00%

MC:

$2.9K

Create My Token

#TokenizedSilverTrend 🪙⚡

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

$SOSO /USDT is currently trading at $0.5457. Key levels to watch include support and resistance zones (to be determined based on chart analysis). A strategic entry zone can help optimize risk/reward, while defined targets 1, 2, and 3 guide profit-taking. Always set a stop loss to protect your capital and manage exposure. Proper risk management ensures positions are sized correctly relative to your portfolio. Stay disciplined and monitor market moves closely before acting.

SOSO-0,47%

- Reward

- like

- Comment

- Repost

- Share

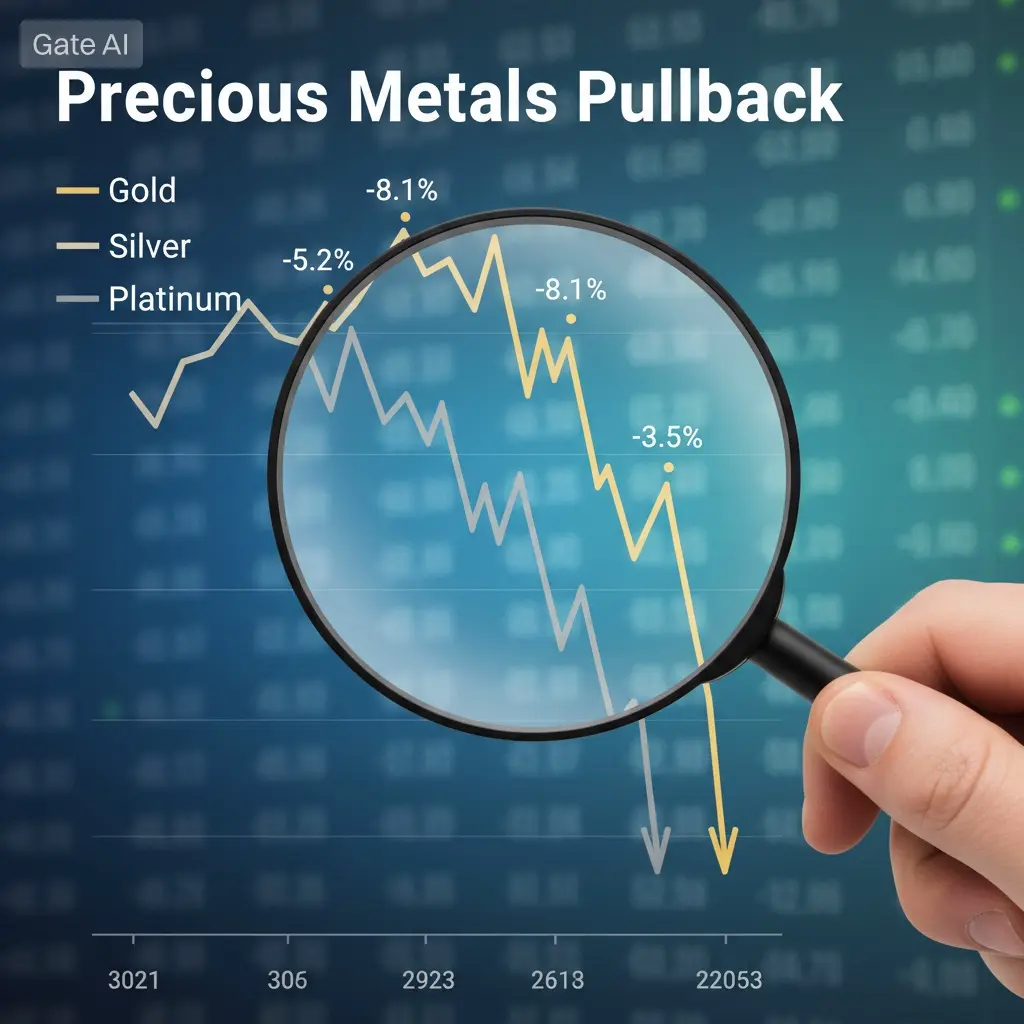

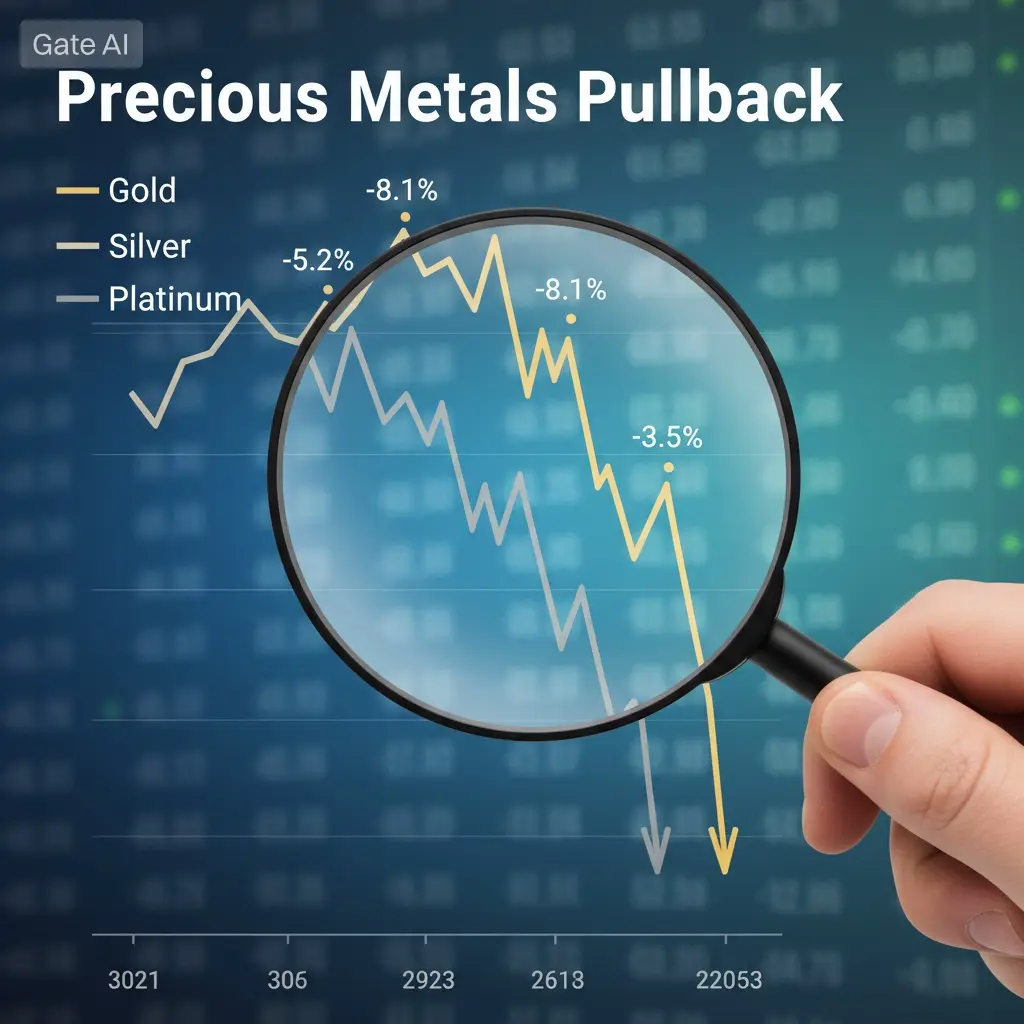

#PreciousMetalsPullBack 📉🟡

After a blistering run, precious metals are finally taking a breather — and markets are noticing. Gold and silver, which had been driven higher by safe-haven demand and macro uncertainty, are now showing a meaningful pullback as short-term profit-taking kicks in.

This pullback isn’t a breakdown — it’s a reset.

When metals surge rapidly, corrections are healthy and expected. Traders booked profits, liquidity shifted, and risk assets felt the impact.

Here’s what to watch now:

🔹 Gold: Pulling back from recent highs, testing support near key structural zones

🔹 Silver

After a blistering run, precious metals are finally taking a breather — and markets are noticing. Gold and silver, which had been driven higher by safe-haven demand and macro uncertainty, are now showing a meaningful pullback as short-term profit-taking kicks in.

This pullback isn’t a breakdown — it’s a reset.

When metals surge rapidly, corrections are healthy and expected. Traders booked profits, liquidity shifted, and risk assets felt the impact.

Here’s what to watch now:

🔹 Gold: Pulling back from recent highs, testing support near key structural zones

🔹 Silver

- Reward

- 4

- 4

- Repost

- Share

Yusfirah :

:

Happy New Year! 🤑View More

#CryptoRegulationNewProgress

The cryptocurrency regulatory landscape has seen substantial progress in recent months, particularly as 2025 transitioned into 2026.

Across the globe, regulators are moving toward clearer frameworks, reduced enforcement-heavy approaches, and greater support for innovation, especially in stablecoins, market structure, compliance, and tokenization.

United States: The US has shifted dramatically toward pro-crypto regulation. The GENIUS Act (enacted July 2025) establishes the first federal framework for payment stablecoins, allowing banking integration and everyday u

The cryptocurrency regulatory landscape has seen substantial progress in recent months, particularly as 2025 transitioned into 2026.

Across the globe, regulators are moving toward clearer frameworks, reduced enforcement-heavy approaches, and greater support for innovation, especially in stablecoins, market structure, compliance, and tokenization.

United States: The US has shifted dramatically toward pro-crypto regulation. The GENIUS Act (enacted July 2025) establishes the first federal framework for payment stablecoins, allowing banking integration and everyday u

LINK-5,6%

- Reward

- 1

- Comment

- Repost

- Share

Alcaraz - Djokovic Australian Open Final 🎾

View Original- Reward

- like

- Comment

- Repost

- Share

$ETH

📌 Update on EGY Token – Gate Fun

In light of the ongoing fluctuations in the digital asset market, some emerging projects continue to record various movements that reflect the diversity of asset behaviors on decentralized platforms.

The EGY token has demonstrated relative stability in its performance on Gate Fun recently, with the community actively monitoring price movements and its ranking among other listed projects.

These movements highlight the importance of analyzing each project individually, following its data and development without relying solely on the overall market trend.

📊

📌 Update on EGY Token – Gate Fun

In light of the ongoing fluctuations in the digital asset market, some emerging projects continue to record various movements that reflect the diversity of asset behaviors on decentralized platforms.

The EGY token has demonstrated relative stability in its performance on Gate Fun recently, with the community actively monitoring price movements and its ranking among other listed projects.

These movements highlight the importance of analyzing each project individually, following its data and development without relying solely on the overall market trend.

📊

ETH-8,5%

- Reward

- 2

- 2

- Repost

- Share

GateUser-c845622b :

:

Hold tight to 💪View More

#MyWeekendTradingPlan Weekends are for clarity, discipline, and smart execution.

My focus is simple: observe the market structure, respect key levels, and stay patient.

✔️ Prioritizing strong setups over overtrading

✔️ Managing risk carefully in low-volume conditions

✔️ Staying flexible and letting the market lead the way

✔️ Protecting capital while aiming for steady progress

A calm mindset and a clear plan make all the difference.

No rush, no emotions—just strategy, consistency, and learning with every move.

Wishing everyone a focused and productive trading weekend 🚀

Trade smart. Stay discip

My focus is simple: observe the market structure, respect key levels, and stay patient.

✔️ Prioritizing strong setups over overtrading

✔️ Managing risk carefully in low-volume conditions

✔️ Staying flexible and letting the market lead the way

✔️ Protecting capital while aiming for steady progress

A calm mindset and a clear plan make all the difference.

No rush, no emotions—just strategy, consistency, and learning with every move.

Wishing everyone a focused and productive trading weekend 🚀

Trade smart. Stay discip

- Reward

- 5

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Welcome back to work diamond hand, how was the moon?

- Reward

- like

- Comment

- Repost

- Share

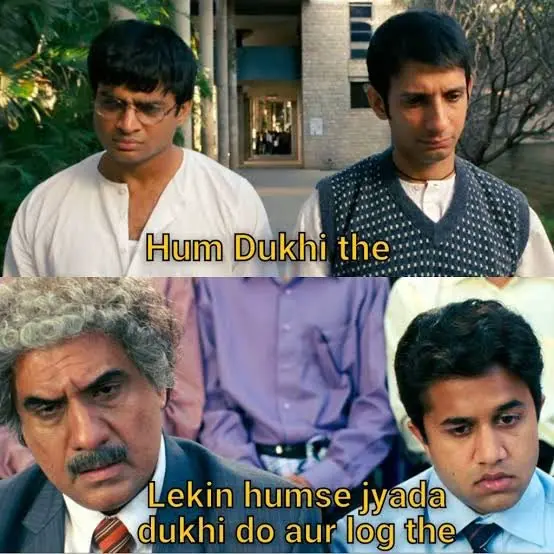

🇮🇳 crypto bros after #BudgetSession2026 😆

- Reward

- like

- Comment

- Repost

- Share

001

数字货币1号

Created By@Experience

Subscription Progress

0.00%

MC:

$0

Create My Token

🔥CZ: Capital always flows into "safe haven" assets first before moving into Crypto

When global tensions escalate, according to CZ, the usual scenario unfolds as follows:

🖤Funds pour into Gold/Silver because they are considered “absolutely safe”

🖤Then the market realizes: safe havens also have volatility, not as stable as expected

This is the best time to “spread awareness” about Crypto, as the flow of money typically shifts from traditional assets to digital assets during times of uncertainty.

In times of crisis, investors tend to seek refuge in assets they perceive as secure, but they shou

View OriginalWhen global tensions escalate, according to CZ, the usual scenario unfolds as follows:

🖤Funds pour into Gold/Silver because they are considered “absolutely safe”

🖤Then the market realizes: safe havens also have volatility, not as stable as expected

This is the best time to “spread awareness” about Crypto, as the flow of money typically shifts from traditional assets to digital assets during times of uncertainty.

In times of crisis, investors tend to seek refuge in assets they perceive as secure, but they shou

- Reward

- 1

- 4

- Repost

- Share

PTDpro28 :

:

Bull Run 🐂View More

#USGovernmentShutdownRisk, written in a professional, premium tone suitable for crypto, finance, or macro-economic audiences:

USGovernmentShutdownRisk: Why Markets Are Watching Washington So Closely

The risk of a US government shutdown has once again moved to the forefront of global market discussions, raising concerns across equities, bonds, commodities, and the crypto space.

While government shutdowns are not new in American politics, the current environment of high interest rates, fragile economic growth, and geopolitical uncertainty makes this situation particularly sensitive. Investors a

USGovernmentShutdownRisk: Why Markets Are Watching Washington So Closely

The risk of a US government shutdown has once again moved to the forefront of global market discussions, raising concerns across equities, bonds, commodities, and the crypto space.

While government shutdowns are not new in American politics, the current environment of high interest rates, fragile economic growth, and geopolitical uncertainty makes this situation particularly sensitive. Investors a

BTC-5,04%

- Reward

- 1

- Comment

- Repost

- Share

#MyWeekendTradingPlan

$ZEC/USDT Bullish Analysis

#Zcash remains in a broader bullish structure on the weekly timeframe, but it is currently in a corrective phase. The 1W 50 EMA, marked in yellow, is acting as the first dynamic support zone. Price is approaching this level and is likely to test it, making this area a key decision point for the next move.

The 1W 99 EMA, marked in green, is the secondary support. This EMA aligns closely with the major demand zone and serves as the last strong support for maintaining the bullish market structure.

Key support lies between $233 and $155. This zone

$ZEC/USDT Bullish Analysis

#Zcash remains in a broader bullish structure on the weekly timeframe, but it is currently in a corrective phase. The 1W 50 EMA, marked in yellow, is acting as the first dynamic support zone. Price is approaching this level and is likely to test it, making this area a key decision point for the next move.

The 1W 99 EMA, marked in green, is the secondary support. This EMA aligns closely with the major demand zone and serves as the last strong support for maintaining the bullish market structure.

Key support lies between $233 and $155. This zone

ZEC-8,65%

- Reward

- 4

- 5

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

It's worth it. Take the jade and carve it into a chain pattern.

View Original

- Reward

- like

- Comment

- Repost

- Share

Dragon Fly Official insight: VanEck U.S. Spot AVAX ETF — institutional gateway or hype play? 🚀🦾

VanEck’s launch of the first U.S. spot AVAX ETF marks a structural milestone. By providing direct exposure plus staking rewards, it bridges traditional finance with Avalanche’s ecosystem in a compliant, institution-friendly format.

🔍 Market & Structural Analysis

Institutional access: Previously, institutions had limited avenues for direct AVAX exposure. Spot ETFs reduce custody friction and regulatory hurdles, enabling larger capital inflows.

Staking incentives: Layering staking rewards on a spot

VanEck’s launch of the first U.S. spot AVAX ETF marks a structural milestone. By providing direct exposure plus staking rewards, it bridges traditional finance with Avalanche’s ecosystem in a compliant, institution-friendly format.

🔍 Market & Structural Analysis

Institutional access: Previously, institutions had limited avenues for direct AVAX exposure. Spot ETFs reduce custody friction and regulatory hurdles, enabling larger capital inflows.

Staking incentives: Layering staking rewards on a spot

- Reward

- 5

- 3

- Repost

- Share

DragonFlyOfficial :

:

Do you see the VanEck AVAX ETF as a game-changer for institutional adoption, or will retail and market hype dominate the near-term trend? How are you positioning?View More

#PreciousMetalsPullBack 📉🟡

After a blistering run, precious metals are finally taking a breather — and markets are noticing. Gold and silver, which had been driven higher by safe-haven demand and macro uncertainty, are now showing a meaningful pullback as short-term profit-taking kicks in.

This pullback isn’t a breakdown — it’s a reset.

When metals surge rapidly, corrections are healthy and expected. Traders booked profits, liquidity shifted, and risk assets felt the impact.

Here’s what to watch now:

🔹 Gold: Pulling back from recent highs, testing support near key structural zones

🔹 Silver

After a blistering run, precious metals are finally taking a breather — and markets are noticing. Gold and silver, which had been driven higher by safe-haven demand and macro uncertainty, are now showing a meaningful pullback as short-term profit-taking kicks in.

This pullback isn’t a breakdown — it’s a reset.

When metals surge rapidly, corrections are healthy and expected. Traders booked profits, liquidity shifted, and risk assets felt the impact.

Here’s what to watch now:

🔹 Gold: Pulling back from recent highs, testing support near key structural zones

🔹 Silver

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

Those who understand, understand. Only those who get it will understand this 😂😊😇

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More25.66K Popularity

62.68K Popularity

367.55K Popularity

45.75K Popularity

61.85K Popularity

Hot Gate Fun

View More- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.9KHolders:10.00%

- MC:$2.92KHolders:10.00%

- MC:$2.9KHolders:10.00%

News

View More“1011 Insider Whale” ranks first in the loss amount among Hyperliquid's top whales.

2 m

Cathie Wood: BTC, ETH, SOL, HYPE can be used as diversified investment options

8 m

Whale Deposits $3M USDC to Hyperliquid, Sets Buy Orders for HYPE

10 m

Ethereum's return rate for January 2026 is -17.52%, compared to Bitcoin's return rate of -10.17%.

11 m

Bitcoin has been surpassed by Tesla and has fallen to the 14th position in the global asset market capitalization ranking.

19 m

Pin