Post content & earn content mining yield

placeholder

Trader_X

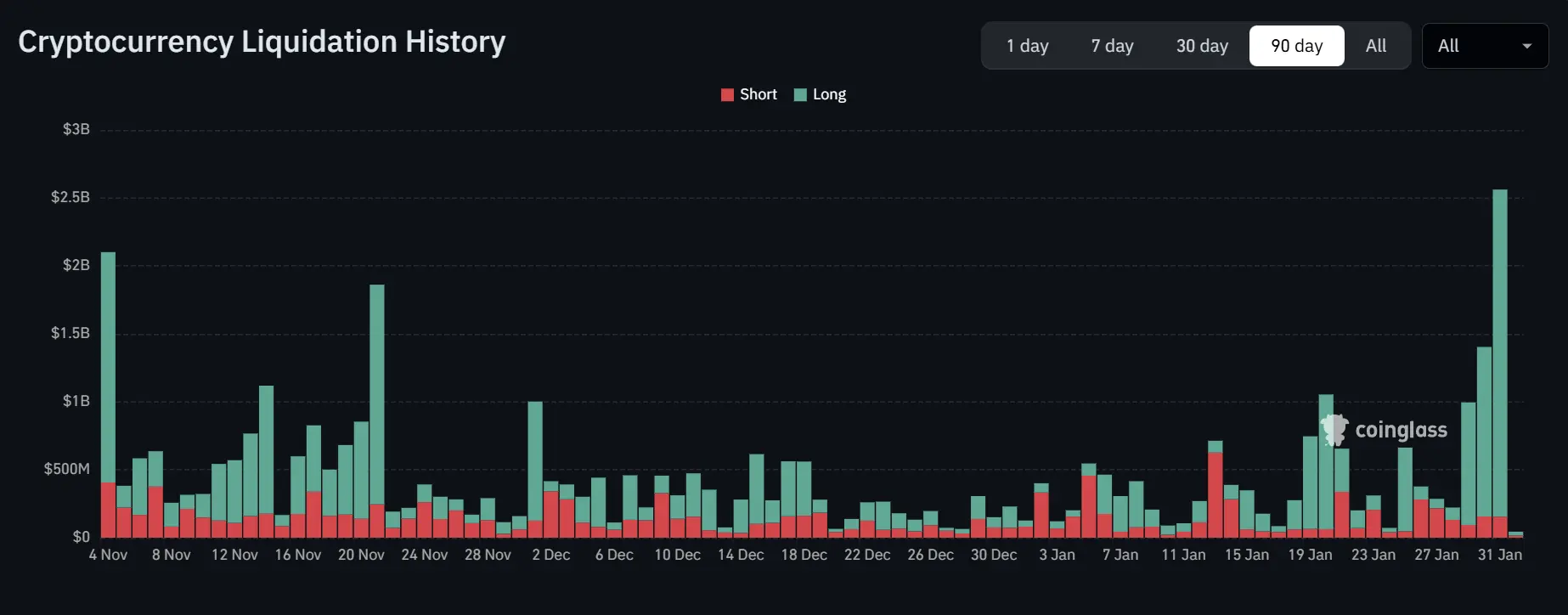

🚨 Crypto Liquidation Check• Oct 10 crash: $19.1B liquidated• COVID crash: $1.2B liquidated• FTX collapse: $1.6B liquidated• Today: $2.51B liquidated👉 This ranks as the 10th largest liquidation event in crypto history.Volatility is back.Risk management matters more than narratives.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

黄金币

黄金币

Created By@交易员668

Subscription Progress

0.00%

MC:

$0

Create My Token

#GateLunarNewYearOn-ChainGala 🧧🚀

This isn’t just a celebration.

It’s strategy wrapped in culture.

Gate’s Lunar New Year On-Chain Gala is more than red envelopes and festive vibes — it’s a live showcase of how Web3 ecosystems drive real on-chain activity during peak global attention.

While markets fluctuate, builders keep building. And this event proves one thing: engagement is the new utility.

Why this matters 👇

🔗 Real on-chain participation — not just marketing noise

🎯 Interactive tasks that convert users into active ecosystem players

💰 Reward mechanics that incentivize sustainable acti

This isn’t just a celebration.

It’s strategy wrapped in culture.

Gate’s Lunar New Year On-Chain Gala is more than red envelopes and festive vibes — it’s a live showcase of how Web3 ecosystems drive real on-chain activity during peak global attention.

While markets fluctuate, builders keep building. And this event proves one thing: engagement is the new utility.

Why this matters 👇

🔗 Real on-chain participation — not just marketing noise

🎯 Interactive tasks that convert users into active ecosystem players

💰 Reward mechanics that incentivize sustainable acti

- Reward

- 1

- Comment

- Repost

- Share

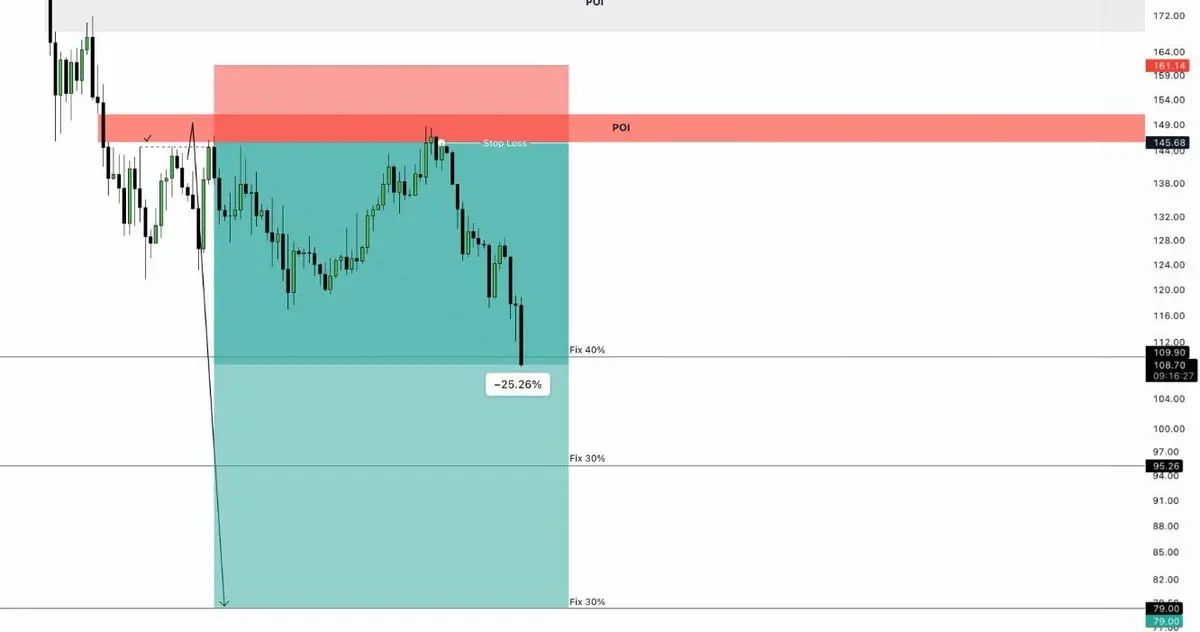

【$THETA Signal】Empty position, waiting for selling pressure to be confirmed as exhausted

$THETA After a volume-driven decline, the market enters a cooling phase. The price action shows continuous selling pressure release without effective buying absorption. Combined with changes in open interest, caution is needed to determine whether this is the main force continuing to unload after a long squeeze. The current structure is relatively weak, with no clear signs of a bottoming or reversal.

🎯Direction: Short (NoPosition)

Waiting for the price to show clear buying absorption and rejection signals

View Original$THETA After a volume-driven decline, the market enters a cooling phase. The price action shows continuous selling pressure release without effective buying absorption. Combined with changes in open interest, caution is needed to determine whether this is the main force continuing to unload after a long squeeze. The current structure is relatively weak, with no clear signs of a bottoming or reversal.

🎯Direction: Short (NoPosition)

Waiting for the price to show clear buying absorption and rejection signals

- Reward

- like

- Comment

- Repost

- Share

Sentiment tone:Caution dominates, but fear fails to accelerate selling

- Reward

- like

- Comment

- Repost

- Share

#MiddleEastTensionsEscalate

Rising tensions in the Middle East are once again drawing the attention of global markets, reminding investors how closely geopolitics and financial stability are connected. As developments unfold, uncertainty has begun to creep back into sentiment, influencing risk appetite across equities, commodities, and digital assets. These moments often arrive quietly at first, but their impact can expand far beyond headlines, shaping capital flows and investor behavior worldwide.

Historically, escalations in this region have acted as a catalyst for defensive positioning. En

Rising tensions in the Middle East are once again drawing the attention of global markets, reminding investors how closely geopolitics and financial stability are connected. As developments unfold, uncertainty has begun to creep back into sentiment, influencing risk appetite across equities, commodities, and digital assets. These moments often arrive quietly at first, but their impact can expand far beyond headlines, shaping capital flows and investor behavior worldwide.

Historically, escalations in this region have acted as a catalyst for defensive positioning. En

- Reward

- like

- Comment

- Repost

- Share

A good start to the year for good dealsThe only decision I made on the advice of a friend

- Reward

- like

- Comment

- Repost

- Share

#MyWeekendTradingPlan

Weekend markets move differently—slower liquidity, sudden spikes, and lots of traps. So this weekend, the plan is simple: trade smart, not fast.

📌 Step 1: Read the Bigger Picture

Before touching any trade, I’m analyzing daily and 4H charts to understand the trend. If the market is ranging, I trade the range. If it’s unclear, I wait.

📌 Step 2: Respect the Levels

Support and resistance are my best friends. I’m only interested in trades where price reacts with confirmation—no FOMO, no impulse entries.

📌 Step 3: Choose Quality Over Quantity

Not every coin deserves attentio

Weekend markets move differently—slower liquidity, sudden spikes, and lots of traps. So this weekend, the plan is simple: trade smart, not fast.

📌 Step 1: Read the Bigger Picture

Before touching any trade, I’m analyzing daily and 4H charts to understand the trend. If the market is ranging, I trade the range. If it’s unclear, I wait.

📌 Step 2: Respect the Levels

Support and resistance are my best friends. I’m only interested in trades where price reacts with confirmation—no FOMO, no impulse entries.

📌 Step 3: Choose Quality Over Quantity

Not every coin deserves attentio

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

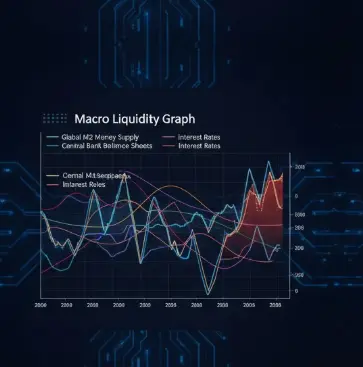

Dragon Fly Official insight: Market divergence — bullish or cautious? ⚡🐉

Recent crypto volatility has heightened the tug-of-war between bulls and bears. The structure of price action, on-chain flows, and macro liquidity signals are all pointing to a critical decision zone.

🔍 Market Analysis & Signals

BTC & ETH structure: BTC has held key accumulation zones, but short-term oscillators show overextension on lower timeframes, signaling potential pullbacks. ETH mirrors similar patterns, with smart money accumulation suggesting selective conviction.

On-chain metrics: Whale inflows and exchange ba

Recent crypto volatility has heightened the tug-of-war between bulls and bears. The structure of price action, on-chain flows, and macro liquidity signals are all pointing to a critical decision zone.

🔍 Market Analysis & Signals

BTC & ETH structure: BTC has held key accumulation zones, but short-term oscillators show overextension on lower timeframes, signaling potential pullbacks. ETH mirrors similar patterns, with smart money accumulation suggesting selective conviction.

On-chain metrics: Whale inflows and exchange ba

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

RECOMMENDATION (RIVER):

The current price zone appears suitable for gradual accumulation. Although there is short-term volatility, the risk-reward ratio is attractive for the medium and long term.

It is recommended to hold a certain amount in your spot wallet (HOLD) and stay away from leverage.

Strategy: buy in increments, hold patiently, diversify your risk.

No short trades, planned spot approach…

#$RIVER #River #RIVER一個月暴漲50倍 #btc

The current price zone appears suitable for gradual accumulation. Although there is short-term volatility, the risk-reward ratio is attractive for the medium and long term.

It is recommended to hold a certain amount in your spot wallet (HOLD) and stay away from leverage.

Strategy: buy in increments, hold patiently, diversify your risk.

No short trades, planned spot approach…

#$RIVER #River #RIVER一個月暴漲50倍 #btc

BTC-4,89%

- Reward

- 1

- Comment

- Repost

- Share

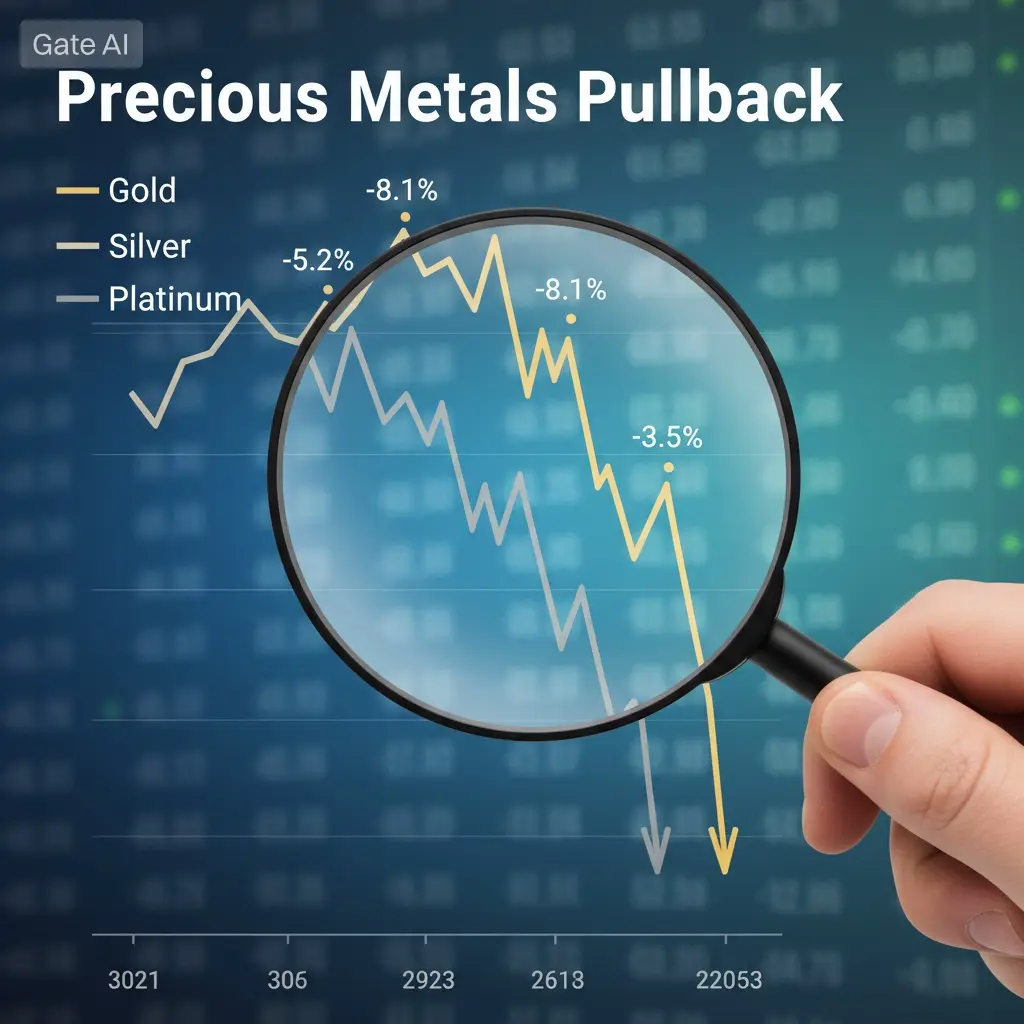

#PreciousMetalsPullBack 📉🟡

After a blistering run, precious metals are finally taking a breather — and markets are noticing. Gold and silver, which had been driven higher by safe-haven demand and macro uncertainty, are now showing a meaningful pullback as short-term profit-taking kicks in.

This pullback isn’t a breakdown — it’s a reset.

When metals surge rapidly, corrections are healthy and expected. Traders booked profits, liquidity shifted, and risk assets felt the impact.

Here’s what to watch now:

🔹 Gold: Pulling back from recent highs, testing support near key structural zones

🔹 Silver

After a blistering run, precious metals are finally taking a breather — and markets are noticing. Gold and silver, which had been driven higher by safe-haven demand and macro uncertainty, are now showing a meaningful pullback as short-term profit-taking kicks in.

This pullback isn’t a breakdown — it’s a reset.

When metals surge rapidly, corrections are healthy and expected. Traders booked profits, liquidity shifted, and risk assets felt the impact.

Here’s what to watch now:

🔹 Gold: Pulling back from recent highs, testing support near key structural zones

🔹 Silver

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

PBB

PB

Created By@ComeWealth,ComeWealth

Listing Progress

0.00%

MC:

$2.91K

Create My Token

📊 MARKET: Yesterday saw the highest single-day liquidations since October 10th.

- Reward

- like

- Comment

- Repost

- Share

Got it from the group before BTC touched 77K $

BTC / USD, as seen on the 1W time frame according to the admin's analysis yesterday, BTC reached the 94k$ area, and currently, BTC shows potential for 85k$ and also the deepest potential at the 77k$ area because there is a demand zone and a strong support zone. After that, there is a potential increase up to 107k$ following the Head and Shoulders pattern. RSI Indicator: although it shows the potential for a Golden Cross, currently RSI is still not in the Oversold area. Conclusion: BTC has the potential to decrease to 85k$ and the deepest at the 77

BTC / USD, as seen on the 1W time frame according to the admin's analysis yesterday, BTC reached the 94k$ area, and currently, BTC shows potential for 85k$ and also the deepest potential at the 77k$ area because there is a demand zone and a strong support zone. After that, there is a potential increase up to 107k$ following the Head and Shoulders pattern. RSI Indicator: although it shows the potential for a Golden Cross, currently RSI is still not in the Oversold area. Conclusion: BTC has the potential to decrease to 85k$ and the deepest at the 77

BTC-4,89%

- Reward

- 1

- Comment

- Repost

- Share

#Others #Total3 #usdt.d Let's finalize it. If someone writes privately, I'll try to respond eventually. Wishing everyone a good Sunday 🫶🏼

View Original

- Reward

- like

- Comment

- Repost

- Share

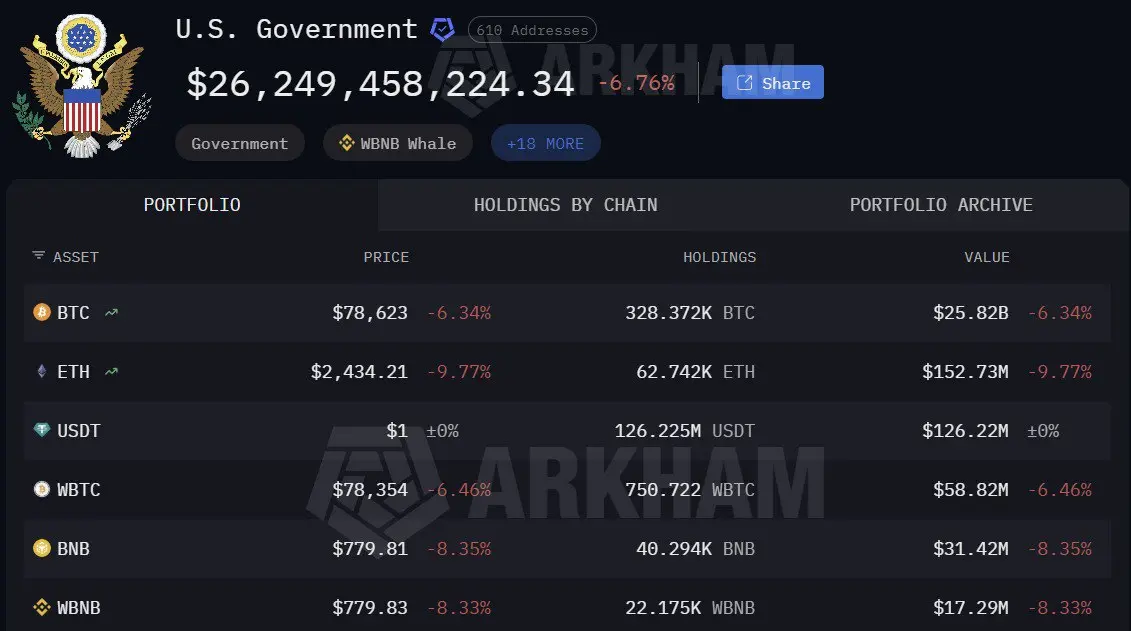

#CryptoMarketWatch

The cryptocurrency market remains volatile and sentiment‑driven as major assets fluctuate with macroeconomic pressure, investor caution, and ongoing liquidity concerns. This report breaks down current market conditions across Bitcoin (BTC), Ethereum (ETH), and major altcoins, highlighting trends, sentiment, and strategic insights.

📊 Market Snapshot

Approx. Price (USDT)

BTC (Bitcoin)

~$78,700–$79,000

ETH (Ethereum)

~$2,420–$2,440

XRP (Ripple)

~$1.60–$1.70

SOL (Solana)

~$100–$105

ADA (Cardano)

~$0.25–$0.30

DOT (Polkadot)

~$1.40–$1.60

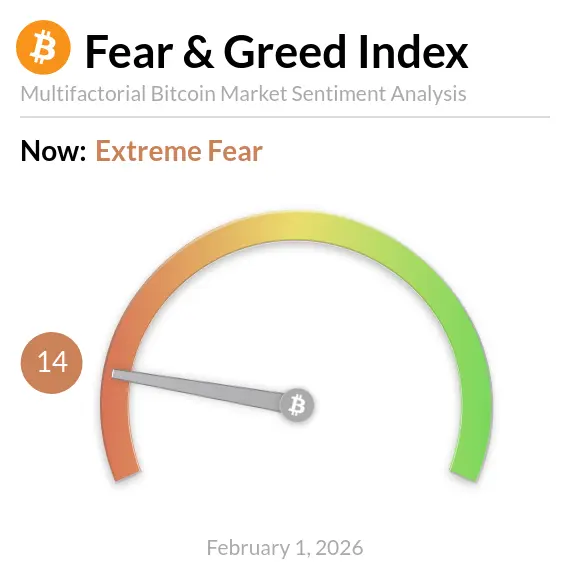

Crypto Fear & Greed Index: Extreme fear

The cryptocurrency market remains volatile and sentiment‑driven as major assets fluctuate with macroeconomic pressure, investor caution, and ongoing liquidity concerns. This report breaks down current market conditions across Bitcoin (BTC), Ethereum (ETH), and major altcoins, highlighting trends, sentiment, and strategic insights.

📊 Market Snapshot

Approx. Price (USDT)

BTC (Bitcoin)

~$78,700–$79,000

ETH (Ethereum)

~$2,420–$2,440

XRP (Ripple)

~$1.60–$1.70

SOL (Solana)

~$100–$105

ADA (Cardano)

~$0.25–$0.30

DOT (Polkadot)

~$1.40–$1.60

Crypto Fear & Greed Index: Extreme fear

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

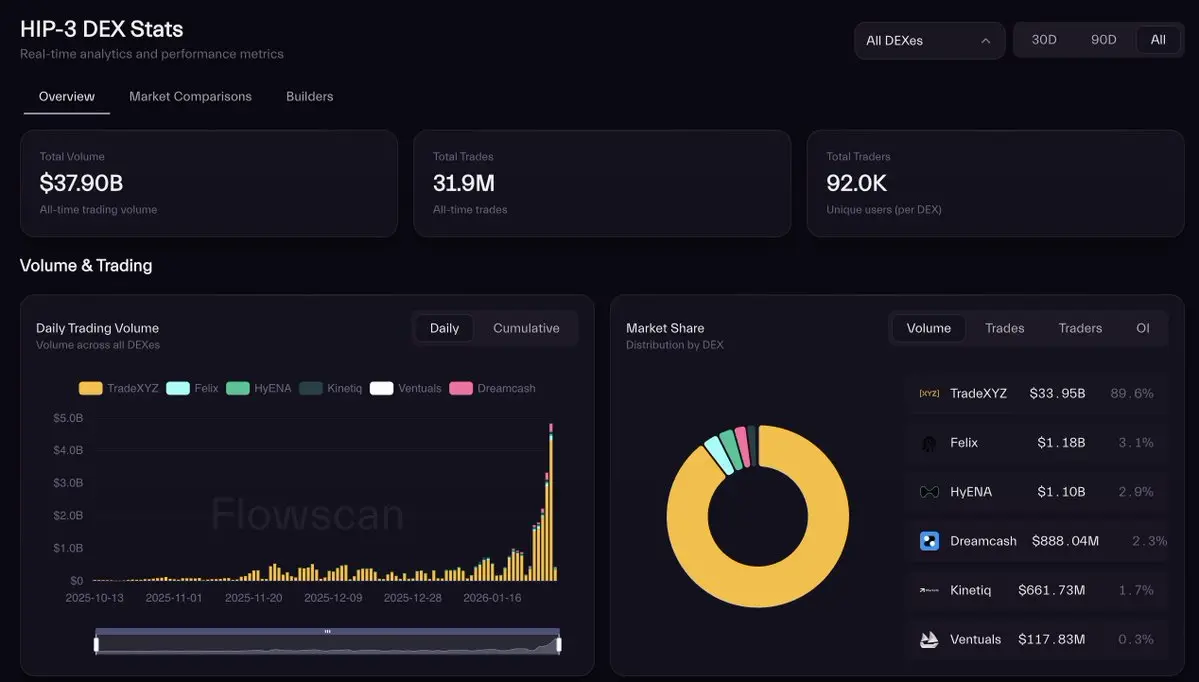

HIP3 Stats are up only.

- Reward

- like

- Comment

- Repost

- Share

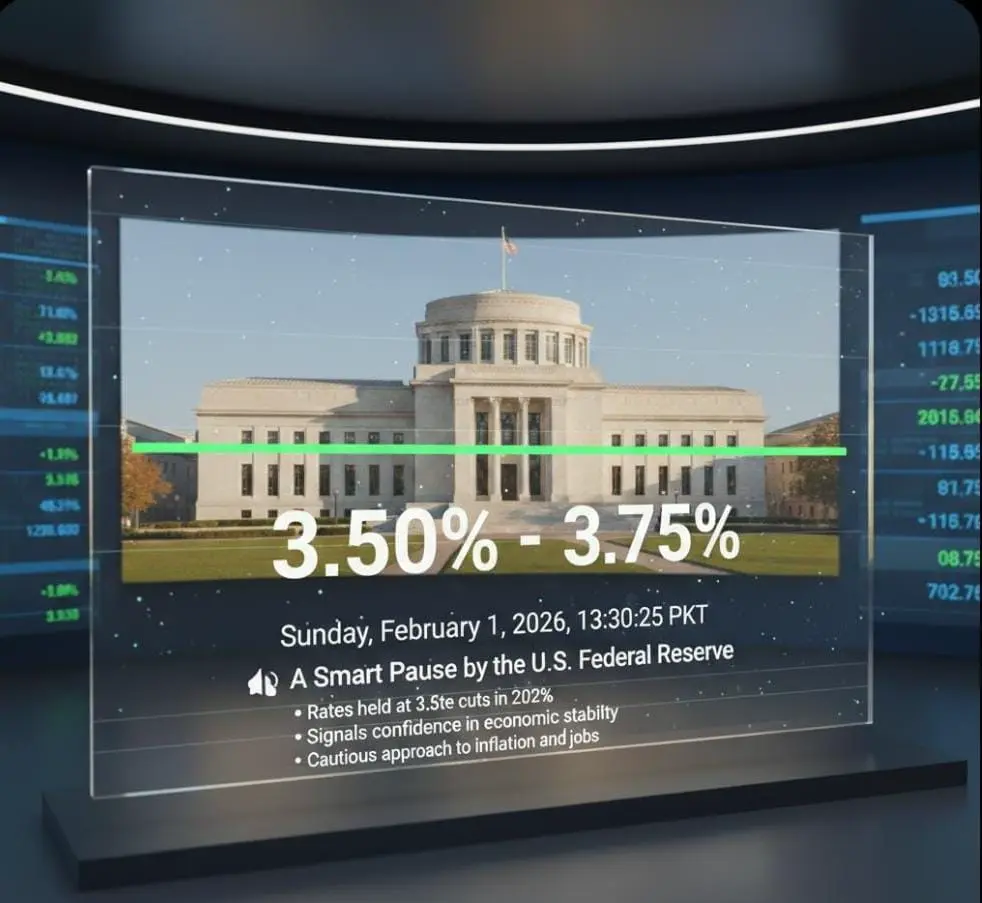

#FedKeepsRatesUnchanged

📢 A Smart Pause by the U.S. Federal Reserve

The U.S. Federal Reserve has just announced a major decision: it is keeping interest rates unchanged at the **current range of 3.50% to 3.75%. This decision comes after a series of three rate cuts in 2025 and marks a pause in rate changes for now a move that has crucial implications for global markets, businesses, and everyday borrowers.

🔍 What does this mean?

Instead of cutting or raising rates, the Fed chose to hold rates steady. The benchmark interest rate known as the federal funds rate influences many key borrowing cos

📢 A Smart Pause by the U.S. Federal Reserve

The U.S. Federal Reserve has just announced a major decision: it is keeping interest rates unchanged at the **current range of 3.50% to 3.75%. This decision comes after a series of three rate cuts in 2025 and marks a pause in rate changes for now a move that has crucial implications for global markets, businesses, and everyday borrowers.

🔍 What does this mean?

Instead of cutting or raising rates, the Fed chose to hold rates steady. The benchmark interest rate known as the federal funds rate influences many key borrowing cos

- Reward

- 4

- 6

- Repost

- Share

AnnaCryptoWriter :

:

Hold tight 💪View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More26.53K Popularity

62.49K Popularity

367.83K Popularity

46.23K Popularity

65.56K Popularity

Hot Gate Fun

View More- MC:$2.91KHolders:00.00%

- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.9KHolders:10.00%

News

View MoreData: If BTC breaks through $82,861, the total liquidation strength of mainstream CEX short positions will reach $2.053 billion.

8 m

Data: If ETH breaks through $2,548, the total liquidation strength of long positions on mainstream CEXs will reach $910 million.

9 m

Jupiter will integrate Polymarket, enabling users to directly access Polymarket through Jupiter.

28 m

Jensen Huang: OpenAI has invited us to invest up to $100 billion

34 m

A whale holding a Bitcoin long position for 112 days is facing liquidation, with an estimated loss of $6.84 million.

54 m

Pin