Crypto 的下一步,只有一条路,即成为主流世界本身

对 Crypto 而言,前方只有一条路——不再游离于主流之外,而是成为主流世界本身。

10 月 29 日,当英伟达市值破 5 万亿美元,成为全球首家市值突破 5 万亿美元的上市公司之时,加密从业者们集体「破防」。这不仅是因为英伟达仅以一家公司的市值,便超过了加密货币的总市值( 4 万亿美元)。也是因为英伟达和它所代表的 AI 赛道,正在努力拓宽这个世界的边界,在努力寻找增量,而 Crypto 给人们的印象总是不断陷入到零和博弈之中。许多人不仅没有挣得财富,也失去了未来。

AI 行业从业者每天谈论的热点是:无人驾驶、机器人、生命医药、太空驾驶……AI 如何深度的改变和重塑这些行业的价值。而正如一名加密 KOL 所说,加密行业从业者每天讨论的热点是:猫、狗、青蛙、中文 Meme、谁上币安 Alpha 了、哪个名人点赞转发了……热闹过后,一地鸡毛。

山寨币与 Meme 浪潮的一次次破碎,或许会让加密从业者们逐渐认清方向。只有结合科技与实体,Crypto 才有更具持续与长久的未来。让 Crypto 成为科技的载体,而不是赌徒的乐园。

更为现实的问题是:当美元稳定币的市值达到 2500 亿美元( 美元的流通量约为 25000 亿美元 ),比特币的市值超过 2.2 万亿美元( 黄金的市值为 27 万亿美元),币安的现货与合约的日交易量达到 1000 亿美元(纳斯达克的日交易量约为 5000 亿美元),Crypto 前方已经无路可走,只有成为主流本身。

一:用区块链技术,把全球金融系统全部更换一遍。

稳定币,正在逐步替代法定货币原有的操作系统;加密货币交易所,正在分食纳斯达克等传统证券交易所的市场份额;比特币,正在成为继黄金之后新的全球价值锚;以太坊等公共区块链,正在尝试取代 Swift,构建新的国际价值流通网络……从货币市场、证券市场、黄金市场、国际贸易市场、再到支付体系,加密货币正在重塑整个金融世界。

而在这一过程中,加密行业本身也在不断进化中。

稳定币在向「去中心化稳定币」演进,USDT 和 USDC 之后,还有 Ethena 等去中心化的稳定币尝试;加密货币交易所在朝着「去中心化交易所」发展,币安和 Coinbase 等中心化加密交易所蓬勃发展之后,还诞生了 Uniswap、Phantom 和 Hyperliquid 等去中心化加密交易所;比特币已经接近黄金市值的十分之一;越来越多的国家将以太坊视作新的国际贸易结算网络。

这里的每一个领域的每一次演进,都是科技对现实世界的改变与重构。

互联网曾让全球金融体系经历了一次彻底的重构。而区块链,正在推动第二次,而且这一次是更加系统性的重构。

加密货币已经逐渐走出了边缘金融系统,融入甚至有望反超主流金融系统,它在多个领域的开创性进展已经占据了主流金融系统的十分之一份额。

比如美元稳定币恰好占流通中的美元的十分之一,前者市值约 2400 亿美元,后者为 2.4 万亿美元;比如比特币的市值恰好占黄金市值的十分之一,前者市值为 2.2 万亿美元,后者为 27 万亿美元;比如币安的每日交易量约占纳斯达克的每日交易量的十分之一,前者的每日现货交易量约为 300 亿美元,现货与合约交易量为 1000 亿美元左右,后者的每日交易量约为 5000 亿美元。

二:像早期的纳斯达克一样,逐渐成为边缘科技公司的载体。

早期的纳斯达克,也像如今的币安等加密货币交易所一样,是「垃圾股」最为盛行的平台。

一开始的纳斯达克并非像纽交所一样是交易蓝筹股的主流交易所,它主要专注于:中小型股票、科技股和未上市公司股票,它提供的是报价透明化和电子撮合交易。而当时作为主流交易所的纽交所,依然依靠人工喊价和交易大厅系统。

早期的纳斯达克也并非像今天一样「高大上」,在 1970 年–1980 年期间,纳斯达克市场充满了各种骗局,几乎和《华尔街之狼》里描写的「粉单股票市场」一样,遍地都是「垃圾股」和被操纵的便士股。

小李子饰演的 Jordan Belfort 便是那个混乱时期的一名基金销售经理,十分擅长卖垃圾股,他从粉单市场上挑一只没人听过的股票,比如电影中提到的那家:「Aerotyne International」 —— 实际上是个根本不存在的航空公司。 Jordan Belfort 的原话是:

「先生,我这有一家公司正在研发革命性航天技术,

投资者名单里有波音的人,NASA 都在关注。

您不想错过这样的机会吧?」

大量的纳斯达克股民买入这种粉单股票,就像现在的加密市场里的媒体和 KOL:

「先生,这是极具革命性的 x402 协议代币,

关注这个协议的公司包括 Google、Visa 等,Coinbase 都在躬身入局。

您不想错过这样的机会吧?」

然而很多代币背后,实际上根本不存在有这样的公司。

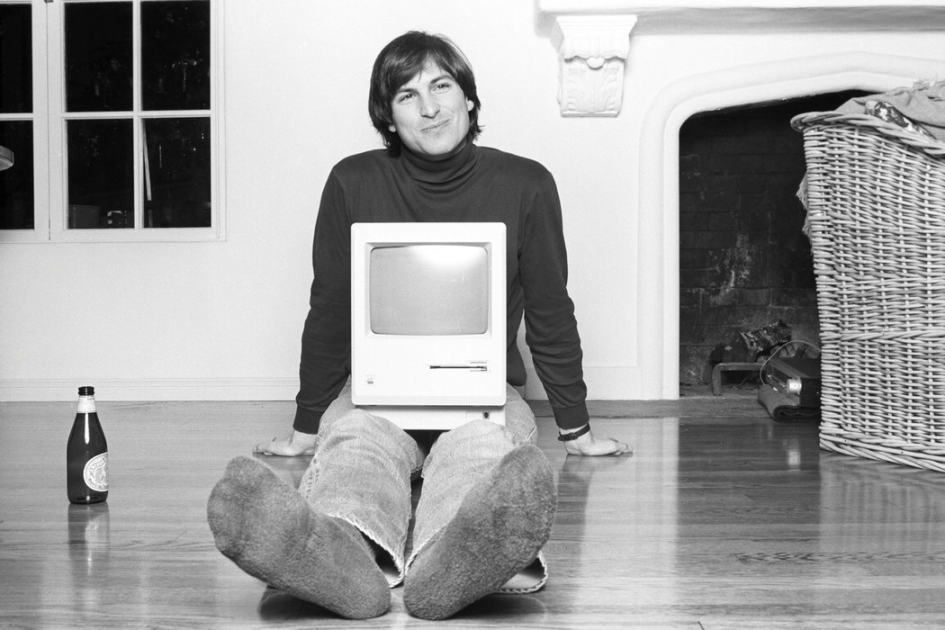

直到 1980 年代末和 1990 年代科技股热潮后,随着吸引微软、苹果、英特尔等大型科技公司上市,纳斯达克才逐渐成为主流交易所之一,才有了现在的主流地位。

2004 年,纳斯达克的股票日均成交量首次与纽约证券交易所(NYSE)相当,从 1971 年成立,1980 年苹果公司在纳斯达克上市,再到 2004 年,纳斯达克才第一次超越纽交所。纳斯达克整整用了 33 年时间。

而这个漫长的过程中,纳斯达克也曾迷失,但它最终等待到了苹果、微软、英特尔、英伟达等互联网与高科技公司的成长,最终成为如今最为主流的股票资本交易市场。

纳斯达克的成长路程,或许可以给加密从业者们一些启示,要专注于 Crypto 交易市场自身独有的优势(公平发射、全球流通、早期用户空投持股),正如纳斯达克一开始的优势(报价透明化和电子撮合交易),不要害怕早期市场的乱象,正如纳斯达克早期的垃圾股盛行,正如早期加密货币市场的垃圾山寨币与 meme 盛行。

Crypto 的未来永远在那些可以给人类带来重大影响的公司身上。正如纳斯达克依赖苹果、微软、英特尔、英伟达一样,加密货币市场则将依赖 Tether、Ethereum、Polymarket、Hyperliquid、Farcaster、Chainlink 等公司和组织。而绝大多数的山寨币与 meme 将消失在历史长河之中。

纳斯达克的日交易量为数千亿美元,而全球最大的加密货币交易所币安的日交易量也达到了数百亿美元。从交易量看,加密货币交易所想要超越纳斯达克,成为新的全球最大的资本市场,并非天方夜谭。

一个交易市场之所以成为传奇,是因为它汇聚了全球绝大多数科技创新公司。这里不仅有资本的流动,更有科技进步的脉动;它承载着世界最新的生产力,也承载着全球最大的投资热情。

三:Crypto 终将摆脱「 meme 时代」,进入「 Iphone 时刻 」

币安的日交易量已经达到纳斯达克的十分之一,美元稳定币已经达到流通中的美元的十分之一,比特币的市值也已接近黄金市值的十分之一…….Crypto 的下一步,只有一条路,即成为主流世界本身。

幸运的是,纳斯达克早期也只是一个不入流的交易市场,苹果电脑的前二十年都只是一个为边缘爱好者和发烧友们而生的产品。当时,没有人想到他们会成为当今世界的主流。

1980 年苹果诞生,而直到 20 年后互联网革命的浪潮才正式掀起。纳斯达克,也是在 2004 年才第一次超越纽交所,成为全球最重要的资本交易市场,真正的融入主流世界。

如果没有苹果、微软等底层基础设施公司的成立与完善,互联网公司与 AI 公司根本无法大量的拔地而起。正如当前的以太坊、Tether、Solana、币安、Hyperliquid 等公司一样,他们作为底层基础设计的成长与完善仍需要时间,而只有等待他们完全成熟的那一刻,Web3 革命才会真正的到来,像亚马逊、Facebook、抖音等 Mass Adoption 产品才会井喷式的出现。

互联网,是一个庞大的概念,它覆盖的不仅是互联网公司,互联网金融公司,还有电脑、手机等基础设施公司,还包含了纳斯达克等应用最新技术的资本市场,最终影响的是所有实体企业。同样,Crypto 也是一个庞大的概念,它所涉及的不仅仅只是加密货币公司,还涉及到底层技术设施协议和公司,涉及的是 Hyperliquid、Binance 等应用最新技术的资本市场,也终将会大规模的诞生新的应用型公司甚至影响到广泛的实体企业。

科技,是推动人类生活质量持续跃升的终极法宝。而 Crypto 的未来,注定将与科技深度融合,甚至成为下一代科技的载体与代名词。

声明:

- 本文转载自 [Foresight News],著作权归属原作者 [周舟,Foresight News],如对转载有异议,请联系 Gate Learn 团队,团队会根据相关流程尽速处理。

- 免责声明:本文所表达的观点和意见仅代表作者个人观点,不构成任何投资建议。

- 文章其他语言版本 由Gate Learn 团队翻译, 在未提及 Gate 的情况下不得复制、传播或抄袭经翻译文章。

相关文章

Gate 研究院:ORE 单日收入突破百万美元|x402 协议生态交易量暴跌 90%

Gate 研究院:BTC 突破 10 万美元大关,11 月加密货币交易量首次突破 10 万亿美元

Gate 研究院:2025 年 Q1 加密货币市场回顾

Gate 研究院:加密货币市场 2024 年发展回顾与 2025 年趋势预测