What is Crepe Coin (CRE)?

What Is Crepe?

(Source: CREPENEWS)

Crepe is a decentralized asset management system built on the Polygon Network, introducing the PaaM™ (Planetary Augmented Asset Makerspace System) concept. This framework allows users to combine on-chain and off-chain assets—including traditional assets outside the blockchain ecosystem—to create diversified investment portfolios. More than just a platform, Crepe functions as a financial collaboration ecosystem where professional fund managers, algorithmic trading experts, and everyday users can all find their niche and unique opportunities.

PaaM™: The Decentralized Asset Management Engine

PaaM™ is the core of the Crepe ecosystem, functioning as an asset management makerspace. Users can use this makerspace to construct asset baskets—a customizable collection of assets forming individualized investment frameworks. These baskets can consist of on-chain tokens, off-chain assets, and verified data sources, considerably expanding the range of investable opportunities. Users can use each basket as a foundational investment portfolio to create innovative financial products. PaaM™ makes asset management accessible beyond traditional financial institutions, allowing every user to participate, create, and market their own investment products.

Algo Products and DAO Certification

Crepe introduces Algo investment products—algorithmic trading strategies created by DAO-certified professional managers. These experts codify their investment knowledge into algorithms, which are then listed on the marketplace, allowing users to buy and sell directly.

- Algo Tokens: Each algorithmic strategy issues its own token, enabling investors to participate in and profit from these strategies through token purchases.

- Performance Example: The pilot Algo product, Manur System 1, achieved a 60% return in just three months, generating significant market anticipation for a full-scale launch.

Crepe is more than an asset management platform—it’s a decentralized marketplace for algorithmic investment products.

CrD™: Decentralized Direct Indexing

Direct indexing, a traditional financial strategy for tracking specific indices, is now available on-chain through Crepe’s CrD™:

- Unlike CrW™, which can only be established by authorized managers, CrD™ is open to all users. With a modest deposit and token issuance fee, anyone can create a customized index.

- Investing is no longer a passive act—it becomes a user-driven process of financial innovation.

- Through CrD™, every participant has the potential to operate as an independent fund manager, launching their own investment index and earning potential returns.

Lagrangian Protocol: Strategies for Consistent Returns

In the volatile crypto markets, Crepe incorporates the Lagrangian Protocol, an investment infrastructure oriented around delta-neutral strategies.

- Objective: Identify arbitrage opportunities in basis and funding rate fluctuations across crypto markets, aiming for stable, risk-adjusted returns.

- Methodology: Advanced algorithms and mathematical models continuously monitor market liquidity and automatically execute trades. This ensures minimal slippage and optimized execution quality.

- Risk Management: Orders are decomposed into smaller tranches for entry and exit, minimizing market impact and maintaining net delta exposure below 1% to ensure steady capital growth.

Backtesting reveals that this approach produces a stable long-term return curve, focusing on low-risk yield for investors.

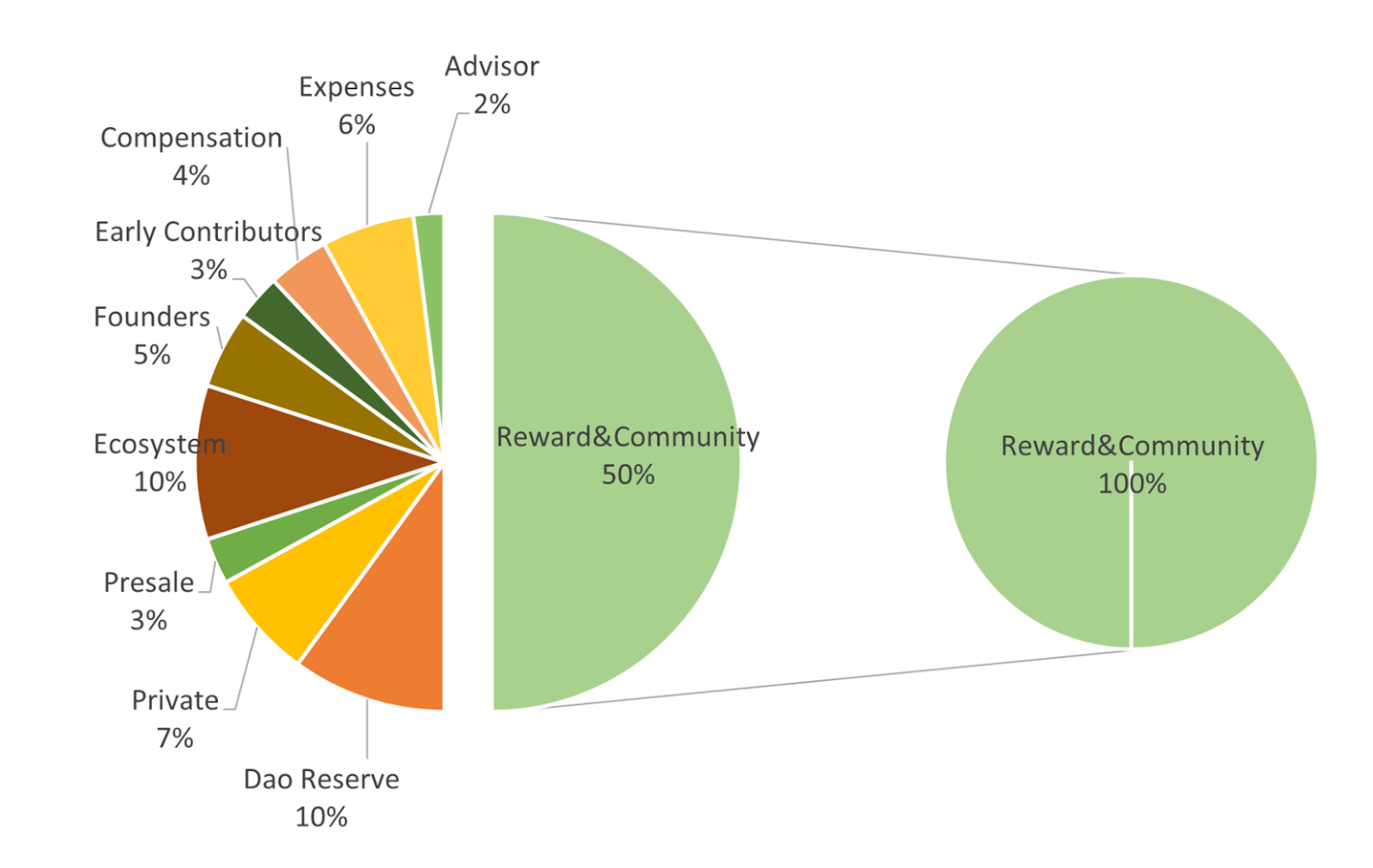

Crepe Tokenomics

The total supply of the CRE token is capped at 1 billion, ensuring both scarcity and controlled inflation. The distribution is structured to support long-term project development and foster active community participation:

Half the supply (50%) is dedicated to Rewards & Community, incentivizing ecosystem growth and user engagement. DAO Reserve and Ecosystem allocations each make up 10%, guaranteeing resources for future governance and sustained project operation. Private allocation is 7%, with Presale and Early Contributors each receiving 3%. Founders receive 5% to incentivize the core team’s long-term commitment. The remainder is allocated as follows: Advisors 2%, Compensation 4%, and Operating Expenses 6%. This allocation strategy secures project advancement, aligns investor and community interests, and supports sustainable CRE ecosystem growth.

(Source: crepe.gitbook)

Token Utility

The Crepe ecosystem features multiple token types, each fulfilling distinct roles and functions:

- CREPE Token (CRE)

This is the primary governance and value-storage token. It can be used to pay for platform products and services, participate in governance, and its value is driven by ecosystem growth, increased utility, and higher transaction volume. Users can earn CRE by staking, providing liquidity, and participating in community activities such as marketing, research, or submitting proposals. - Soulbound Tokens (SBTs)

SBTs serve as decentralized identity (DID) tokens and are non-transferable and non-tradable. They record attributes such as user reputation, credit score, and ranking. Individuals can maintain multiple SBT profiles for distinct use cases. - Product Tokens

Issued by the makerspace, these tokens represent asset management products (e.g., CrW™, CrD™) and are fully asset-backed, only tradable within the platform. They may be redeemed for CREPE Tokens to exit an investment position.

This layered token architecture positions Crepe as a comprehensive decentralized finance (DeFi) infrastructure, rather than just an asset management platform.

Incentive and Penalty Systems

Crepe’s architecture is designed around the principle that participation creates value:

- Users who stake CRE tokens earn rewards based on the amount and duration of their staked tokens.

- All user participation is recorded as NFT credentials, establishing a verifiable record of community contribution.

- Early unstaking before reaching the minimum required period results in penalties, discouraging short-term speculation.

This incentive structure is engineered to support sustainable, long-term ecosystem growth.

Future Outlook

Crepe aims to serve as the central hub for asset management in the Web3 era. Whether you’re a professional investor, retail participant, or independent creator, PaaM™ and its suite of financial tools support the creation and participation in novel investment portfolios.

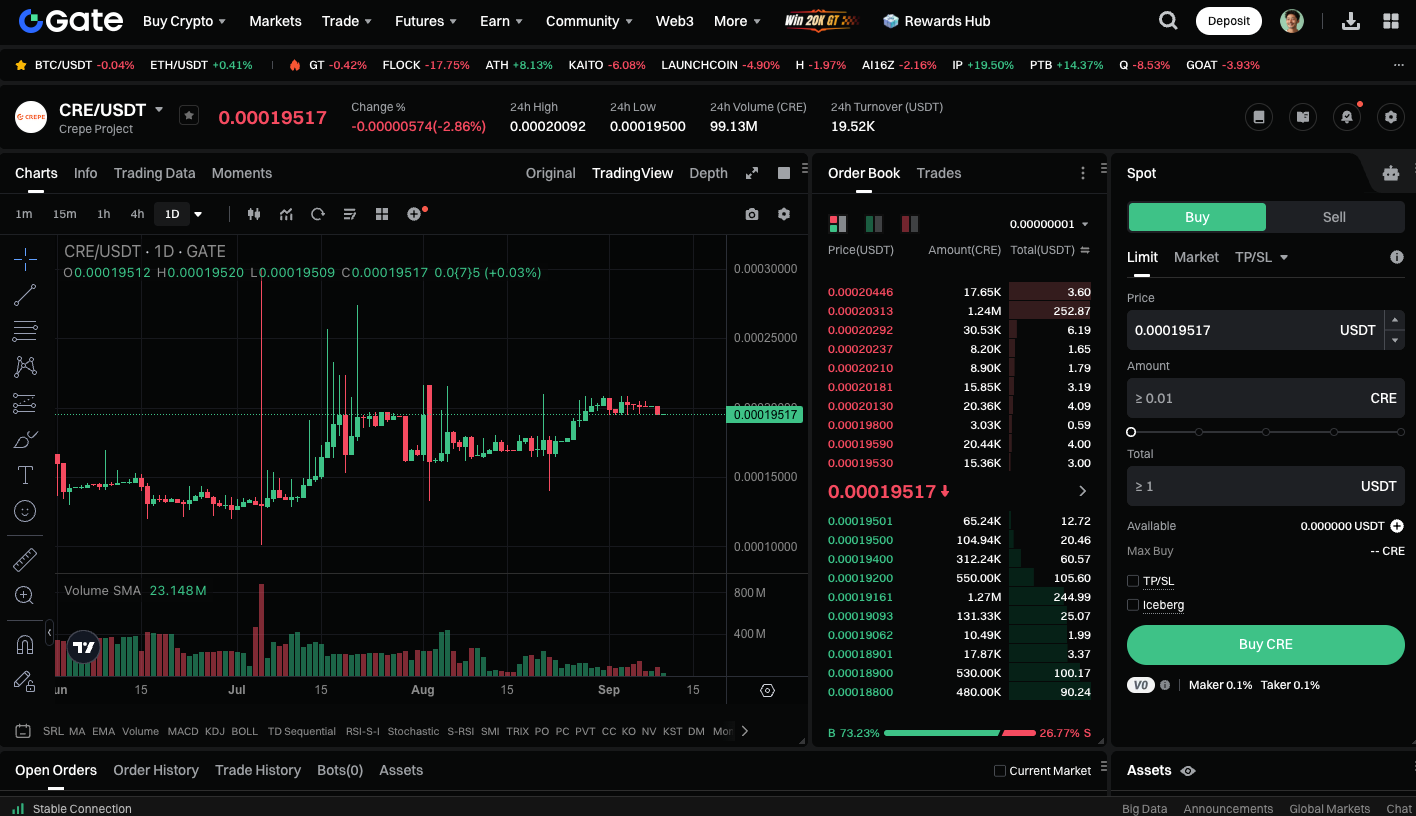

You can begin trading CRE spot: https://www.gate.com/trade/CRE_USDT

Conclusion

At the intersection of traditional finance and Web3, Crepe demonstrates a new approach to asset management. It is a foundational layer for decentralized asset management infrastructure. With PaaM™, Algo products, CrD™, and the Lagrangian Protocol, Crepe provides an ecosystem for portfolio creation, algorithmic trading, decentralized identity, and incentive systems. As the CRE token economy matures, this platform may become a significant part of Web3 financial infrastructure and help define the future of asset management.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

What is N2: An AI-Driven Layer 2 Solution

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article