Unveiling the trillion-dollar feast of stablecoins: Who's making money?

In the dynamic crypto landscape, Bitcoin and Ethereum steal the spotlight, but stablecoins like USDT and USDC are the true lifeblood, fuel, and currency of the entire ecosystem. They connect every facet of the market, offering traders a haven from volatility and acting as the fundamental settlement layer for DeFi (Decentralized Finance).

You probably use stablecoins every day, but have you ever stopped to ask a basic question:

You give $1 to the issuer (such as Circle) and receive 1 USDC token. Holding that token earns you no interest, and when you redeem it, you get back exactly $1.

Yet, the issuers are making billions. In 2024, Circle generated $1.7 billion in revenue, while Tether posted an astounding $13 billion profit.

Where does all that money come from? Let’s break down how stablecoin systems work—and reveal who the real winners are.

The Core Money Printer

The business model for stablecoin issuers is almost boringly simple, but its scale makes it incredibly powerful. At its core, it’s an age-old financial play: exploiting float.

It’s similar to banks taking in demand deposits or operating a money market fund (MMF), but with one key difference—they don’t pay any interest on these deposits (the stablecoins users hold).

During the zero interest rate era (pre-2022), this model barely made money. But as the Federal Reserve aggressively raised rates, yields on U.S. Treasuries soared. Circle and Tether’s profits took off in tandem.

Simply put, these stablecoin giants’ multi-billion-dollar valuations are a leveraged wager on the Fed’s “higher-for-longer” interest rate policy. Every rate hike from the Fed acts as a direct subsidy for the industry. If the Fed returns to zero rates, the issuers’ core revenue would vanish overnight.

Beyond interest, issuers have a second revenue stream: institutional fees.

- Circle (USDC): To attract major clients like Coinbase, Circle offers free minting (depositing). Fees are only charged symbolically when daily institutional redemptions (withdrawals) exceed $2 million. Circle’s approach is to maximize the size of its reserves (grow the float pool).

- Tether (USDT): Tether takes a more opportunistic approach. Institutional clients pay a 0.1% fee (minimum $100,000) for both minting and redeeming. Tether’s strategy is to maximize revenue from every transaction—capturing both interest and fees.

Circle vs. Tether: A Strategic Face-Off

While the business foundations are similar, Circle and Tether manage their multi-billion-dollar reserves in radically different ways—leading to stark contrasts in risk, transparency, and profitability.

Circle (USDC): Compliance and Transparency

Circle positions itself as a trustworthy, regulation-embracing model of compliance. Its strategy isn’t “trust me,” but rather “trust BlackRock.”

Circle’s reserve structure is extremely conservative and transparent. Instead of managing billions internally, it outsources that responsibility to BlackRock—the world’s largest asset manager.

The bulk of Circle’s reserves are parked in the “Circle Reserve Fund” (ticker: USDXX), a government money market fund registered with the SEC and managed entirely by BlackRock. As of November 2025, the fund’s portfolio is exceptionally conservative: 55.8% U.S. Treasury repos and 44.2% U.S. Treasuries.

- Circle’s implicit message: “Institutions and regulators—concerned about reserve safety? We’ve solved it. Our funds aren’t tucked away in some obscure bank account; BlackRock manages them in a SEC-regulated fund, invested in the safest U.S. Treasuries.”

This is a savvy defensive strategy. Circle gives up some potential earnings (paying BlackRock management fees) in exchange for lasting institutional and regulatory trust.

Tether (USDT): Aggressive and Highly Profitable

If Circle is a meticulous accountant, Tether is a bold hedge fund manager.

Tether has long been criticized for its lack of transparency (relying on BDO’s attestation reports rather than full audits), but its investment strategy is far more aggressive and diversified—yielding massive profits.

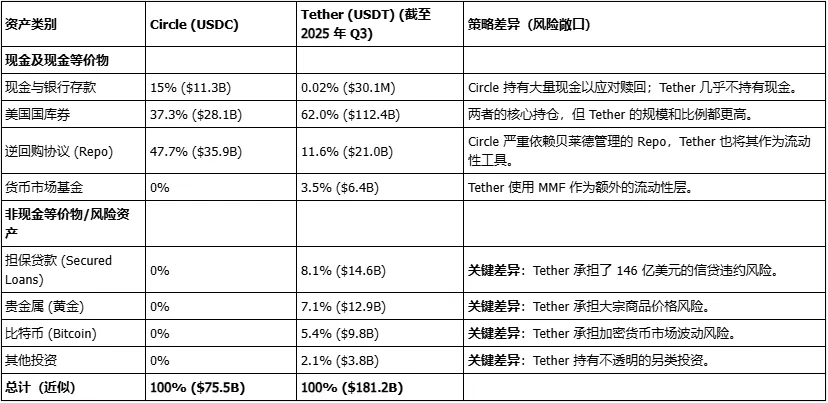

Here’s Tether’s reserve breakdown as of Q3 2025:

- Conventional assets (similar to Circle): U.S. Treasury bills ($112.4B), overnight reverse repos ($18B), money market funds ($6.4B).

- Aggressive assets (Circle would never touch):

Precious metals (gold): $12.9B

Bitcoin: $9.8B

Secured loans: $14.6B

Other investments: $3.8B

This means Tether earns Treasury interest and assumes commodity, crypto volatility, and credit default risks.

Tether operates similarly to a hedge fund, powered by the interest-free USDT held by users worldwide.

This approach contributes to Tether’s $13 billion profit in 2024. It earns interest, bets on capital gains in bitcoin and gold, and boosts returns through riskier lending.

This also explains Tether’s emphasis on excess reserves (or Net Assets)—$11.9B as of August 2024. This isn’t freely distributable profit; it’s a capital cushion reserved to absorb potential losses from risk assets (bitcoin, loans) and prevent USDT from de-pegging.

Tether must maintain high profits to sustain its high-risk asset allocation.

Circle vs. Tether Reserve Asset Composition (Data as of Q3/Q4 2025)

Where Do the Profits Go?

How are these billions in profits distributed? This is where the two companies diverge dramatically.

Circle (USDC): Shackled by a Costly Coinbase Revenue Split

Circle’s revenue is substantial, but its net profit is consistently dragged down by one major cost: its revenue-sharing agreement with Coinbase.

Circle and Coinbase (joint founders of USDC) agreed back in 2018 to split the interest income generated from USDC reserves. Coinbase gets 50% of the residual payment base.

The deal is based on the amount of USDC held on Coinbase. By 2024, Coinbase’s share had dropped to around 20% of total USDC in circulation, but the legacy agreement still entitles it to roughly 50–55% of total reserve income.

This distribution cost eats up most of Circle’s profit. The percentage Circle pays Coinbase jumped from 32% in 2022 to 54% in 2024. In Q2 2025, Circle earned $658 million in revenue, but distribution, trading, and other costs totaled $407 million.

This makes Coinbase not just Circle’s partner, but essentially a de facto equity holder in USDC’s core revenue stream. Coinbase is both Circle’s biggest distributor and its largest cost burden.

Tether (USDT): Opaque Structure

Tether’s profit allocation is a completely opaque structure.

Tether (USDT) is owned by iFinex, a privately held company registered in the British Virgin Islands (BVI), which also owns Bitfinex, a major crypto exchange.

All $13 billion of Tether’s reported profit goes directly to iFinex.

As a private firm, iFinex isn’t required to disclose detailed costs or dividend information like the publicly traded Circle. Based on public data and history, these profits go three ways:

- Shareholder dividends: iFinex (Bitfinex) has a history of paying massive dividends to private shareholders (e.g., executives like Giancarlo Devasini—$246M in 2017).

- Retained as capital buffer: As noted, Tether keeps huge profits (e.g., $11.9B) as Net Assets to hedge against risk assets like bitcoin and loans.

- Strategic investments (or internal transfers): Tether/iFinex uses profits to diversify into AI, renewable energy, and bitcoin mining. Tether and Bitfinex also have a long-standing pattern of complex internal fund flows (such as the infamous Crypto Capital incident).

In short, Circle’s profit distribution is public, costly, and locked (by Coinbase), while Tether’s is opaque, discretionary, and controlled by a handful of insiders at iFinex—fueling their next business empire.

How Can Regular Users Participate in Profits?

Since issuers pocket all the Treasury interest, how do stablecoin holders (crypto users) make money in the ecosystem?

The money we earn doesn’t come from issuers—it comes from other crypto users’ needs, by offering services (liquidity, lending) and taking on-chain risks for yield.

Three main strategies stand out:

Strategy 1: Lending

- Mechanism: Deposit your USDC or USDT into algorithmic money markets like Aave or Compound.

- Who pays you? Borrowers—usually leveraged traders or long-term holders (hodlers) who need cash but don’t want to sell their Bitcoin or Ethereum.

- How it works: Protocols like Aave and Compound automatically match lenders and borrowers, adjusting rates in real time based on supply and demand. You (the lender) earn the majority of the interest; the protocol takes a small cut.

Strategy 2: Providing Liquidity

- Mechanism: Deposit your stablecoins (typically USDC/USDT or USDC/DAI pairs) into liquidity pools on decentralized exchanges (DEXs).

- Top platform: Curve Finance

Curve is specifically designed for swapping between stablecoins (like USDC and USDT), using algorithms to minimize slippage.

Who pays you? Traders. Each swap on Curve incurs a small fee (e.g., 0.04%), which is distributed to liquidity providers.

Extra rewards: Curve offers additional airdrop incentives in the form of its governance token (CRV).

- Why it’s popular: Because pools are composed of stablecoins pegged to $1, there’s almost no impermanent loss, making it an ideal yield strategy.

Strategy 3: Yield Farming

- Mechanism: More complex stacked strategies to maximize returns.

- Example: You could

1) Deposit USDC into Aave;

2) Use USDC as collateral to borrow ETH;

3) Invest the borrowed ETH in other high-yield pools.

- Risk: This is the most aggressive approach, exposing you to smart contract hacks, collateral (ETH) price drops and liquidation risk, and the possibility of protocol rewards drying up.

Summary

At its core, the stablecoin story describes two economies.

The first is a private, off-chain system: issuers (Tether/Circle) invest our idle reserves in U.S. Treasuries and split the billions in interest with shareholders and business partners (like Coinbase), while token holders get nothing.

The second is the vibrant, on-chain DeFi economy we’ve built—where users earn yield from fees and interest paid by other users through lending and liquidity provision.

This exposes a central irony: a decentralized ecosystem whose lifeblood is supplied by highly centralized, profit-driven banks. The future of this vast empire depends on two pillars: the high-rate macro environment issuers rely on, and DeFi users’ continued appetite for speculation and leverage.

The longevity of these pillars remains a critical question for the industry.

Statement:

- This article is reprinted from [Baihua Blockchain], with copyright belonging to the original author [Cole]. If you object to this reprint, please contact the Gate Learn team, who will address your request promptly according to established procedures.

- Disclaimer: The views and opinions expressed here are solely those of the author and do not constitute investment advice.

- Other language versions of this article were translated by the Gate Learn team. No copying, dissemination, or plagiarism of translated articles is permitted unless Gate is clearly mentioned.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.