ASK vs GMX: Comparing Two Leading Email Providers for Business Communication

Introduction: Investment Comparison between ASK and GMX

In the cryptocurrency market, the comparison between ASK vs GMX has always been a topic that investors can't avoid. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

ASK (ASK): Since its launch, it has gained market recognition for its role in the film and television entertainment industry.

GMX (GMX): Since its inception, it has been hailed as a decentralized perpetual exchange, and is one of the cryptocurrencies with significant trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between ASK vs GMX, focusing on historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, and attempt to answer the question that investors are most concerned about:

"Which is the better buy right now?"

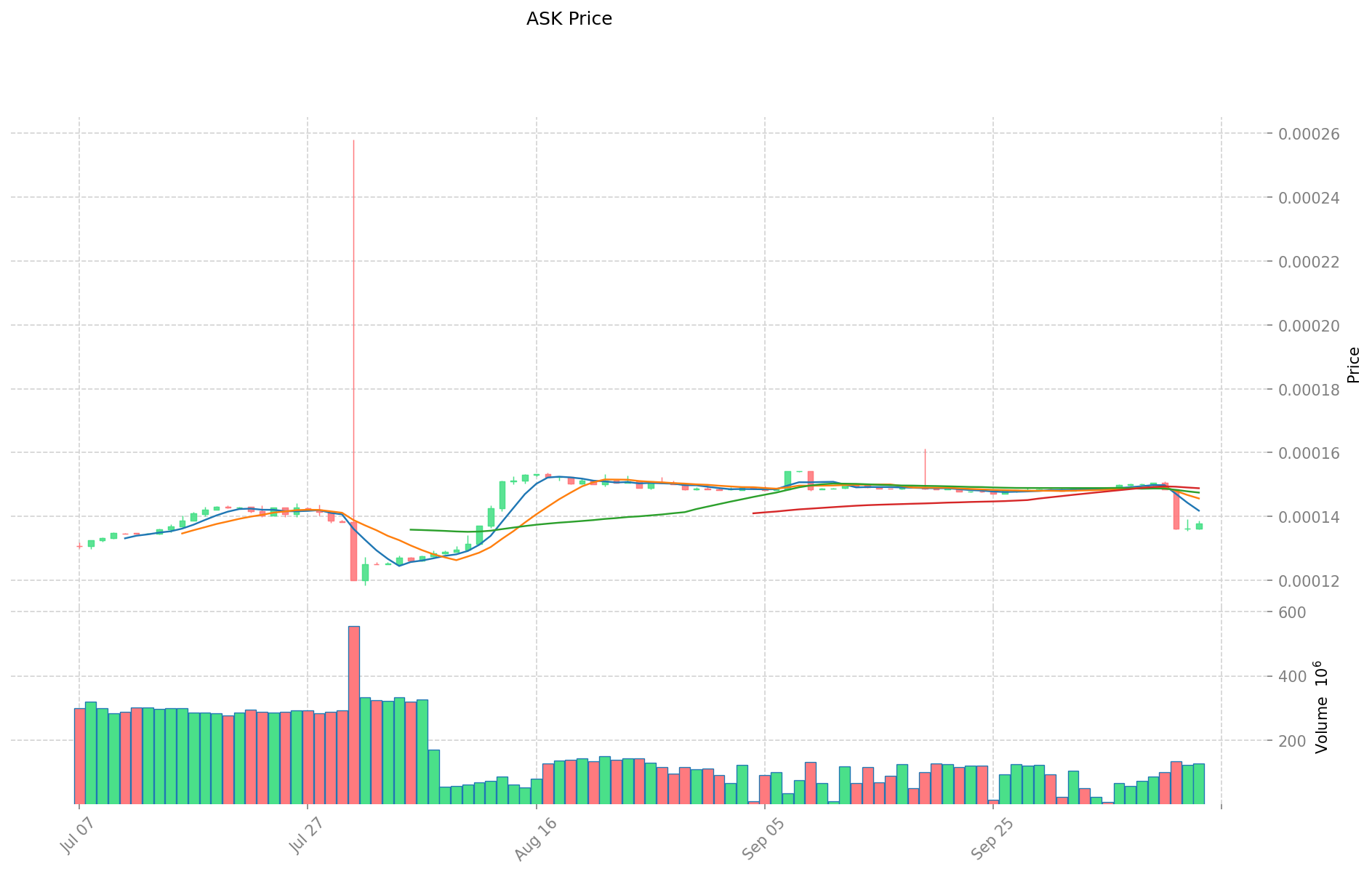

I. Price History Comparison and Current Market Status

ASK (Coin A) and GMX (Coin B) Historical Price Trends

- 2024: ASK reached its all-time low of $0.00005915 on October 27, 2024.

- 2023: GMX hit its all-time high of $91.07 on April 18, 2023.

- Comparative Analysis: During the market cycle, ASK dropped from its all-time high of $0.00845153 to its all-time low of $0.00005915, while GMX declined from its peak of $91.07 to its current price of $11.87.

Current Market Situation (2025-10-14)

- ASK current price: $0.00013778

- GMX current price: $11.87

- 24-hour trading volume: ASK $17,542.17 vs GMX $233,840.73

- Market Sentiment Index (Fear & Greed Index): 38 (Fear)

Click to view real-time prices:

- View ASK current price Market Price

- View GMX current price Market Price

II. Core Factors Affecting ASK vs GMX Investment Value

Supply Mechanism Comparison (Tokenomics)

- ASK: Maximum supply cap of 1 billion tokens, with a significant portion (24%) allocated to airdrops and token burns to create deflationary pressure

- GMX: Fixed maximum supply of 13.25 million tokens with emissions schedule that decreases over time, creating natural scarcity

- 📌 Historical pattern: Deflationary tokens like ASK tend to see price appreciation during bull markets, while GMX's limited supply has historically supported its value during market fluctuations

Institutional Adoption and Market Applications

- Institutional holdings: GMX has attracted more institutional attention with its established revenue model and derivatives ecosystem

- Enterprise adoption: GMX offers more mature cross-chain infrastructure for institutional trading and settlement, while ASK remains more retail-focused

- Regulatory attitudes: Both face regulatory scrutiny, but GMX's established position in the derivatives market places it under more immediate regulatory attention

Technical Development and Ecosystem Building

- ASK technical upgrades: AI-powered features in development for personalized trading recommendations and risk management

- GMX technical development: Implementation of GMX V2 with improved capital efficiency and sophisticated trading features like range limit orders

- Ecosystem comparison: GMX has a more established DeFi infrastructure with proven revenue generation, while ASK is building a newer ecosystem focused on AI integration and user-friendly trading experiences

Macroeconomic and Market Cycles

- Performance in inflationary environments: GMX has demonstrated stronger resilience during market downturns with its fee-sharing model

- Macroeconomic monetary policy: Interest rate hikes have historically had a stronger negative impact on newer tokens like ASK compared to established protocols like GMX

- Geopolitical factors: Cross-border trading demand benefits both platforms, with GMX currently having wider global market penetration

III. 2025-2030 Price Prediction: ASK vs GMX

Short-term Prediction (2025)

- ASK: Conservative $0.00008265 - $0.00013775 | Optimistic $0.00013775 - $0.0001473925

- GMX: Conservative $9.877 - $11.9 | Optimistic $11.9 - $14.518

Mid-term Prediction (2027)

- ASK may enter a growth phase, with prices expected in the range of $0.000108240093 - $0.000155687805

- GMX may enter a bullish market, with prices expected in the range of $11.7916743 - $21.9414699

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- ASK: Base scenario $0.000128136242914 - $0.000180473581569 | Optimistic scenario $0.000180473581569 - $0.000220177769515

- GMX: Base scenario $19.588675727592562 - $23.04550085599125 | Optimistic scenario $23.04550085599125 - $31.111426155588187

Disclaimer: These predictions are based on historical data and current market trends. Cryptocurrency markets are highly volatile and subject to rapid changes. This information should not be considered as financial advice. Always conduct your own research before making any investment decisions.

ASK:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0001473925 | 0.00013775 | 0.00008265 | 0 |

| 2026 | 0.00015397695 | 0.00014257125 | 0.000082691325 | 3 |

| 2027 | 0.000155687805 | 0.0001482741 | 0.000108240093 | 7 |

| 2028 | 0.000171738476325 | 0.0001519809525 | 0.0001459017144 | 10 |

| 2029 | 0.000199087448727 | 0.000161859714412 | 0.000135962160106 | 17 |

| 2030 | 0.000220177769515 | 0.000180473581569 | 0.000128136242914 | 30 |

GMX:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 14.518 | 11.9 | 9.877 | 0 |

| 2026 | 16.64334 | 13.209 | 7.52913 | 11 |

| 2027 | 21.9414699 | 14.92617 | 11.7916743 | 25 |

| 2028 | 20.4615401445 | 18.43381995 | 15.484408758 | 55 |

| 2029 | 26.6433216647325 | 19.44768004725 | 10.3072704250425 | 63 |

| 2030 | 31.111426155588187 | 23.04550085599125 | 19.588675727592562 | 94 |

IV. Investment Strategy Comparison: ASK vs GMX

Long-term vs Short-term Investment Strategies

- ASK: Suitable for investors focused on AI integration and potential growth in the film and television entertainment industry

- GMX: Suitable for investors seeking established DeFi infrastructure and proven revenue generation

Risk Management and Asset Allocation

- Conservative investors: ASK: 20% vs GMX: 80%

- Aggressive investors: ASK: 40% vs GMX: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- ASK: Higher volatility due to lower market cap and trading volume

- GMX: Exposure to broader DeFi market fluctuations and derivatives trading risks

Technical Risks

- ASK: Scalability, network stability, and AI integration challenges

- GMX: Smart contract vulnerabilities, cross-chain risks

Regulatory Risks

- Global regulatory policies may have a more immediate impact on GMX due to its established position in the derivatives market

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ASK advantages: Potential for growth in AI-powered trading, deflationary tokenomics

- GMX advantages: Established revenue model, strong institutional adoption, proven resilience in market downturns

✅ Investment Recommendations:

- New investors: Consider a small allocation to ASK for potential growth, with a larger position in GMX for stability

- Experienced investors: Balance portfolio with both ASK and GMX, adjusting based on risk tolerance and market conditions

- Institutional investors: Focus on GMX for its established infrastructure and institutional-grade trading features

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

FAQ

Q1: What are the key differences between ASK and GMX? A: ASK is focused on the film and television entertainment industry with AI integration, while GMX is a decentralized perpetual exchange with an established DeFi infrastructure. ASK has a maximum supply of 1 billion tokens with deflationary mechanisms, while GMX has a fixed supply of 13.25 million tokens. GMX currently has higher trading volume, market capitalization, and institutional adoption.

Q2: Which coin has performed better historically? A: GMX has shown better historical performance. It reached its all-time high of $91.07 in April 2023, while ASK hit its all-time low of $0.00005915 in October 2024. GMX has also demonstrated stronger resilience during market downturns.

Q3: What are the current prices and market conditions for ASK and GMX? A: As of October 14, 2025, ASK is priced at $0.00013778, while GMX is at $11.87. The 24-hour trading volume for ASK is $17,542.17, compared to GMX's $233,840.73. The current market sentiment index is at 38, indicating fear.

Q4: How do the supply mechanisms of ASK and GMX compare? A: ASK has a maximum supply of 1 billion tokens with 24% allocated to airdrops and token burns, creating deflationary pressure. GMX has a fixed maximum supply of 13.25 million tokens with a decreasing emissions schedule, naturally creating scarcity over time.

Q5: What are the predictions for ASK and GMX prices in 2030? A: For ASK, the base scenario predicts a range of $0.000128136242914 - $0.000180473581569, with an optimistic scenario of $0.000180473581569 - $0.000220177769515. For GMX, the base scenario predicts $19.588675727592562 - $23.04550085599125, with an optimistic scenario of $23.04550085599125 - $31.111426155588187.

Q6: How should investors allocate their portfolio between ASK and GMX? A: Conservative investors might consider allocating 20% to ASK and 80% to GMX, while more aggressive investors could opt for 40% ASK and 60% GMX. New investors may want to have a smaller allocation to ASK for potential growth, with a larger position in GMX for stability.

Q7: What are the main risks associated with investing in ASK and GMX? A: ASK faces higher volatility due to lower market cap and trading volume, as well as technical challenges related to AI integration. GMX is exposed to broader DeFi market fluctuations, derivatives trading risks, and potential smart contract vulnerabilities. Both face regulatory risks, with GMX potentially more impacted due to its established position in the derivatives market.

2025 JOEPrice Prediction: Analyzing Market Trends and Growth Potential for Trader Joe's Native Token

Is Aark (AARK) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

BLZ vs GMX: A Comprehensive Analysis of Two Leading Cloud Service Providers

DIAM vs GMX: Comparing Two Leading Decentralized Exchange Protocols for Enhanced Liquidity and Trading Efficiency

How Does ASTER's Capital Flow Indicate Its Market Trend in 2025?

2025 WOO Price Prediction: Analyzing Market Trends and Expert Forecasts for WOO Network's Future Value

2025 POWER Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 CELO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 SNEK Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

2025 VTHO Price Prediction: Expert Analysis and Market Forecast for VeThor Token's Future Growth

Is Peanut the Squirrel (PNUT) a good investment?: Analyzing the Viral Token's Market Potential, Risks, and Long-Term Viability in the Crypto Landscape