2025年PYUSD価格予測:変動の激しい暗号資産市場で、このステーブルコインは米ドルとのペッグを維持できるのか?

はじめに:PYUSDの市場位置と投資価値

PayPal USD(PYUSD)は決済向けに設計されたステーブルコインであり、2023年の登場以来、着実に市場で存在感を高めてきました。2025年時点で、PYUSDの時価総額は26億4,000万米ドルに達し、流通供給量は約2,641,474,136トークン、価格は0.9992ドル前後で推移しています。「PayPal支援のステーブルコイン」として知られる本資産は、デジタル決済や金融取引において重要性を増しています。

本記事では、PYUSDの価格推移を2025年から2030年まで体系的に分析します。過去の価格動向、市場需給、エコシステム成長、マクロ経済要因などを踏まえ、投資家のために専門的な価格予測と実用的な投資戦略を提供します。

I. PYUSDの価格履歴と現状

PYUSD価格推移の概要

- 2023年:PYUSDがローンチ、価格は1ドル付近で安定

- 2024年:利用拡大とともに小幅な変動を伴い安定

- 2025年:市場の変動により、直近24時間価格は0.9984~0.9997ドルの範囲で推移

PYUSDの現時点市場状況

2025年10月15日現在、PYUSDは0.9992ドルで取引され、米ドルとのペッグを維持しています。24時間の取引量は6,952.66ドル、市場活動は中程度です。時価総額は2,639,360,956ドルで、暗号資産ランキング51位。流通供給量は2,641,474,136 PYUSD、総供給量は967,614,865トークンです。PYUSDは24時間で+0.03%の価格変動を示し、現状の市場で安定性を維持しています。

最新のPYUSD 市場価格はこちら

PYUSD市場センチメント指標

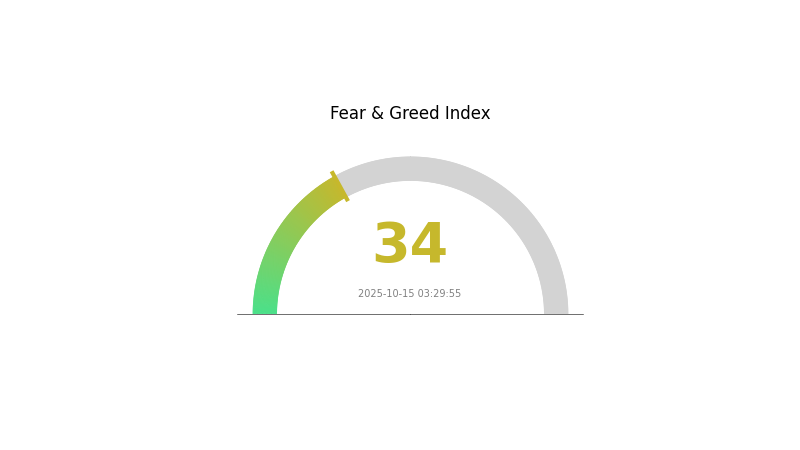

2025年10月15日 フィア&グリード指数:34(恐怖)

最新の フィア&グリード指数はこちら

現在の暗号資産市場は「恐怖」局面にあり、フィア&グリード指数は34です。これは投資家に慎重な心理が広がっていることを示し、直近の市場変動や規制の不透明さが要因となっています。このような局面では、経験豊富なトレーダーが割安で資産を積み増す機会を見出すこともありますが、投資判断には十分な調査と慎重さが欠かせません。市場動向やPYUSDエコシステムの最新情報に常に注意を払いましょう。

PYUSD保有分布

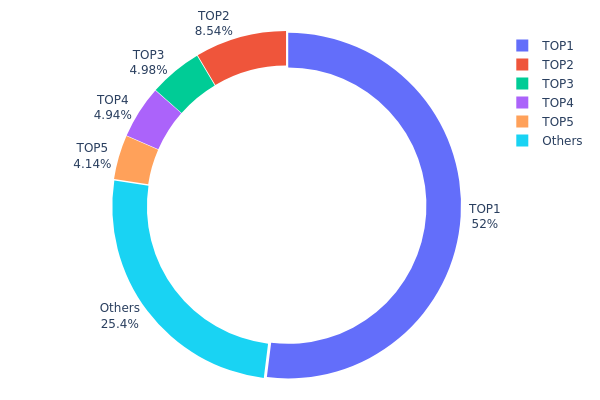

PYUSDのアドレス保有分布は、市場構造の集中度が非常に高いことを示しています。最大保有アドレスは総供給量の51.97%を保有し、著しい中央集権化が認められます。次点の4アドレスの合計保有率は22.58%、残りのアドレスは25.45%を保有しています。

この集中傾向は、市場操作や価格変動への懸念を生じさせます。供給の過半数を単一主体が管理しているため、大口保有者の動向次第で市場が大きく動く可能性があります。上位5アドレス合計で74.55%を保有しており、協調的な市場行動のリスクも高まっています。

この分布状況は、PYUSDの分散度が低いことを示唆しています。市場の安定性や流動性に影響を及ぼす可能性があり、大口保有者が価格形成に強く関与できる点は留意すべきです。PYUSD関連の取引や投資を行う際には、この集中度を十分意識してください。

最新の PYUSD保有分布はこちら

| 上位 | アドレス | 保有数量 | 保有率(%) |

|---|---|---|---|

| 1 | 9DrvZv...yDWpmo | 367,799.53K | 51.97% |

| 2 | 4AK83V...bjdV3m | 60,452.62K | 8.54% |

| 3 | 5SybwT...yPT8ey | 35,225.89K | 4.97% |

| 4 | 5stwKM...vudFde | 34,963.50K | 4.94% |

| 5 | 22Wnk8...h7zkBa | 29,276.99K | 4.13% |

| - | その他 | 179,992.69K | 25.45% |

II. PYUSDの将来価格に影響する主要因

供給メカニズム

- 市場需要:PYUSDの金融システムへの統合・普及が、供給と需要のバランスに大きく影響します。

- 過去の傾向:PYUSDはステーブルコインとして価格安定性を維持しているものの、時価総額や採用率には成長傾向がみられます。

- 現在の影響:Solana等のネットワーク拡大により、PYUSDの利便性や利用用途が増し、供給・需要に影響しています。

機関・大口保有者の動向

- 企業導入:PayPalの支援と決済エコシステムへのPYUSD統合は、機関投資家の利用拡大の基盤となります。

- 政策動向:ステーブルコインに関する規制や政府方針が、PYUSDの今後の展開や普及に大きく影響します。

マクロ経済環境

- 金融政策:米FRBなど中央銀行の政策が暗号資産市場全体、PYUSDにも影響を及ぼします。

- 地政学的要因:国際関係や世界経済の状況が、PYUSDなどデジタルドル代替資産への需要に影響します。

技術開発とエコシステム構築

- ネットワーク拡張:Solana等各種ブロックチェーンへの統合で、PYUSDの多様な利用が可能となります。

- エコシステム応用:PYUSDを活用したDAppsや金融サービスの拡大が、エコシステムの成長と普及を促進します。

III. 2025~2030年PYUSD価格予測

2025年予測

- 保守的予測:0.89928~0.9992ドル

- 中立的予測:0.9992~1.12ドル

- 楽観的予測:1.12~1.249ドル(ステーブルコイン普及拡大が前提)

2027~2028年予測

- 市場局面:成長・統合の可能性

- 価格範囲予測:

- 2027年:0.66727~1.42266ドル

- 2028年:0.79109~1.58218ドル

- 主な要因:DeFiでの普及拡大、従来型金融との統合

2029~2030年 長期予測

- 基本シナリオ:1.4615~1.53458ドル(安定成長前提)

- 楽観シナリオ:1.60765~2.28652ドル(機関投資家導入拡大時)

- 変革シナリオ:2.28652ドル超(規制明確化・一般普及時)

- 2030年12月31日:PYUSD 1.53458ドル(2025年比53%増)

| 年 | 予測最高価格 | 予測平均価格 | 予測最低価格 | 騰落率 |

|---|---|---|---|---|

| 2025 | 1.249 | 0.9992 | 0.89928 | 0 |

| 2026 | 1.39388 | 1.1241 | 0.86556 | 12 |

| 2027 | 1.42266 | 1.25899 | 0.66727 | 26 |

| 2028 | 1.58218 | 1.34083 | 0.79109 | 34 |

| 2029 | 1.60765 | 1.4615 | 1.27151 | 46 |

| 2030 | 2.28652 | 1.53458 | 1.39646 | 53 |

IV. PYUSDの投資戦略・リスク管理

PYUSD投資手法

(1) 長期保有戦略

- 対象:安定したリターンを求める保守型投資家

- 運用ポイント:

- 市場下落時にPYUSDを積み増す

- 定期購入プランの導入

- 多要素認証付きウォレットで安全保管

(2) アクティブトレード戦略

- テクニカル分析ツール:

- 移動平均線:短期・長期トレンド把握

- RSI(相対力指数):過熱感・割安感の判断

- スイングトレード運用:

- 明確なエントリー・イグジット設定

- ストップロス注文でリスク管理

PYUSDリスク管理フレームワーク

(1) 資産配分方針

- 保守型:5~10%

- 積極型:15~20%

- プロ投資家:25~30%

(2) リスクヘッジ策

- 分散投資:複数ステーブルコイン・資産への分散

- ストップロス注文:損失限定に活用

(3) 安全な保管方法

- ホットウォレット推奨:Gate Web3 ウォレット

- コールドストレージ:大口保有はハードウェアウォレット

- セキュリティ対策:二段階認証・強力なパスワード設定

V. PYUSDのリスクと課題

PYUSD市場リスク

- 流動性リスク:大規模償還時の対応難易度

- 競争リスク:他ステーブルコインとの競争激化

- 市場心理:暗号資産市場センチメントの変化

PYUSD規制リスク

- 規制強化:ステーブルコインへの監視強化

- コンプライアンス要求:規制基準変更の可能性

- 越境制限:国・地域ごとに異なる規制対応

PYUSD技術リスク

- スマートコントラクト脆弱性:基盤コードの悪用リスク

- ブロックチェーン混雑:取引遅延リスク

- 統合課題:新規プラットフォーム導入時の問題

VI. 結論・推奨アクション

PYUSD投資価値評価

PYUSDは信頼性の高い企業支援のもと、安定性と着実なリターンの可能性を提供しますが、変動するステーブルコイン市場では規制・市場リスクへの十分な注意が必要です。

PYUSD投資推奨

✅ 初心者:少額・定期購入で市場理解を深める

✅ 経験者:分散型ステーブルコインポートフォリオの一部として検討

✅ 機関投資家:財務管理・低リスク暗号資産エクスポージャーとしてPYUSDの活用を検討

PYUSD取引参加方法

- 現物取引:Gate.comで売買

- 預金型商品:PYUSDを利回りプラットフォームで活用

- 決済ソリューション:PYUSDによる越境取引の活用検討

暗号資産投資は非常に高いリスクを伴います。本記事は投資助言ではありません。投資判断は自身のリスク許容度に基づき慎重に行い、専門金融アドバイザーへの相談を推奨します。無理な投資は絶対に避けてください。

FAQ

PayPal USDの価値は上昇しますか?

はい、PayPal USDは2030年に最大2.1ドルまで上昇する見込みです。現価格比で+112.00%のリターンが期待されます。

PYUSDの本日の価格は?

2025年10月15日時点、PYUSDは0.9998ドルです。24時間取引額は274,400,692ドルで、リアルタイム更新されます。

2030年のPayPal株価予測は?

PayPal株は2030年に14.13~24.75ドルの範囲で推移すると予想されています。現市場動向・分析に基づく予測です。

PYUSDをUSDに交換できますか?

はい、PYUSDはUSDへ交換可能です。通常レートは1:1で、1 PYUSD=1 USDとなります。交換は迅速かつ容易です。

PayPal USD(PYUSD)は投資対象として適切か?進化し続けるデジタル通貨市場でPayPalのステーブルコインが持つ可能性とリスクを検証

Worldwide USD(WUSD)は投資対象として適切か?: 新しいステーブルコインのリスクと将来性を専門的に分析

USDe価格予測:2025 Ethenaステーブルコイン市場分析と投資戦略

イーロン・マスクが最初の百万を稼いだ方法:億万長者を築いた初期の事業

Gate Launchpad: Plasma XPLプロジェクト投資戦略と利益分析

World Liberty Financial USD(USD1)は有望な投資先か?―この暗号資産のリスクおよびリターンの可能性を徹底分析

DRC20トークントレーディングプラットフォーム徹底活用ガイド

HONEYとは何か:自然が生み出す黄金の蜜についての完全ガイドと、その卓越した健康効果

オープンプラットフォームとは何か、その仕組みについて説明します。

主要な暗号資産プラットフォームのグローバル展開:規制と利用可能性

イーサとWrapped Etherの違いを理解する:主要な相違点を詳しく解説