2025 OKB Price Prediction: Analyzing Market Trends and Future Potential of OKB Token in the Crypto Ecosystem

Introduction: OKB's Market Position and Investment Value

OKB (OKB), as a global utility token in the cryptocurrency ecosystem, has achieved significant milestones since its inception in 2019. As of 2025, OKB's market capitalization has reached $4,012,470,000, with a circulating supply of approximately 21,000,000 tokens, and a price hovering around $191.07. This asset, often referred to as the "ecosystem backbone," is playing an increasingly crucial role in platform governance and user incentives.

This article will comprehensively analyze OKB's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

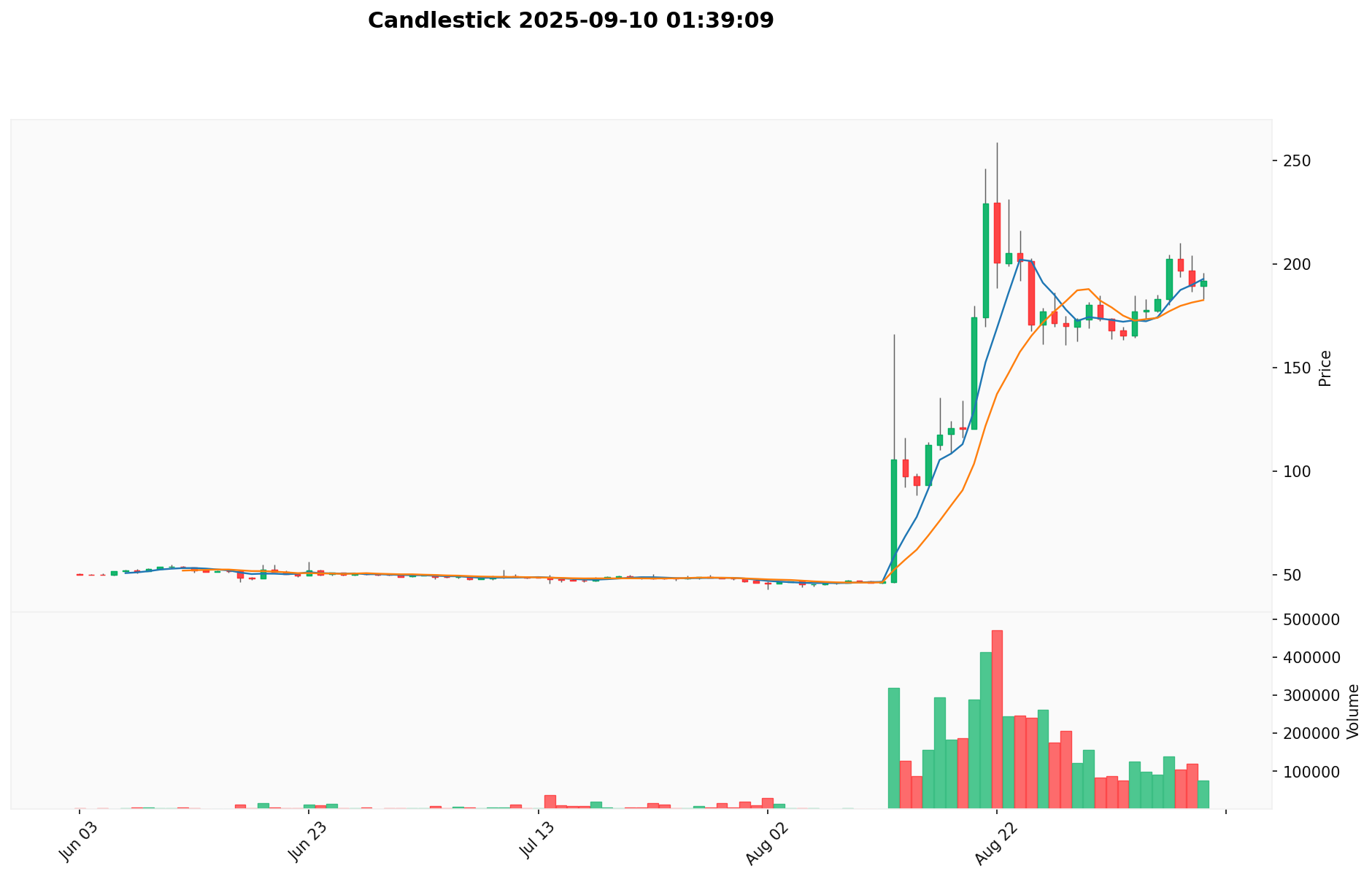

I. OKB Price History Review and Current Market Status

OKB Historical Price Evolution

- 2019: Initial launch, price dropped to all-time low of $0.580608 on January 14

- 2022: Significant growth phase, price surpassed $30

- 2025: Reached all-time high of $255.5 on August 22

OKB Current Market Situation

As of September 10, 2025, OKB is trading at $191.07, ranking 43rd in the cryptocurrency market. The token has experienced substantial growth over the past year, with a 410.09% increase. In the last 24 hours, OKB has shown a 3% price increase, while its 7-day performance indicates a 15.50% gain. The 30-day chart reveals an impressive 309.92% surge, reflecting strong bullish momentum.

OKB's market capitalization stands at $4,012,470,000, representing 0.097% of the total cryptocurrency market. The circulating supply is 21,000,000 OKB, which is also the maximum supply, indicating no future inflation. The 24-hour trading volume is $14,286,049.1981, suggesting moderate liquidity in the market.

Click to view the current OKB market price

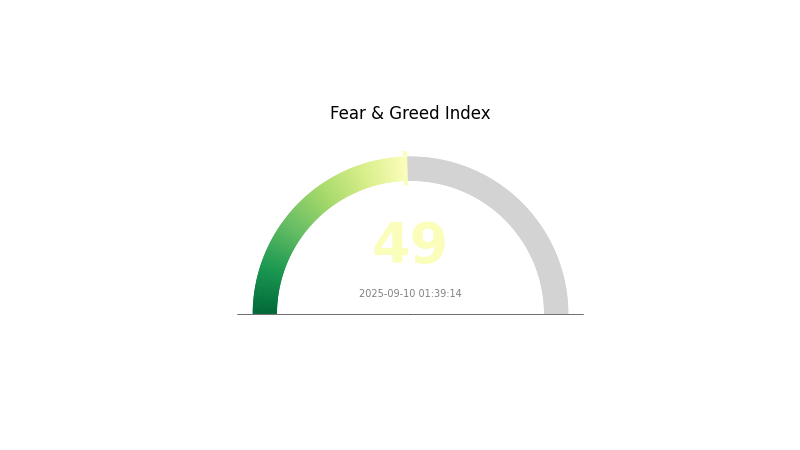

OKB Market Sentiment Indicator

2025-09-10 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment for OKB remains balanced today, with the Fear and Greed Index at 49, indicating a neutral outlook. This suggests that investors are neither overly pessimistic nor optimistic about OKB's current market conditions. While caution is still advised, the neutral sentiment may present opportunities for both buyers and sellers. Traders should continue to monitor market trends and conduct thorough research before making any investment decisions.

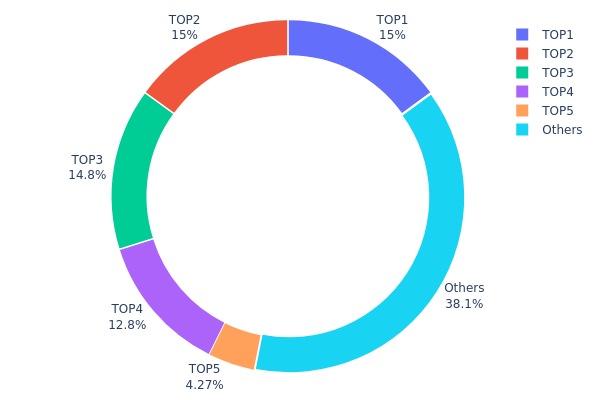

OKB Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of OKB tokens among different wallet addresses. Analysis of this data reveals a highly centralized distribution pattern for OKB. The top five addresses collectively hold 61.91% of the total supply, with the top three addresses each controlling approximately 15% of the tokens. This concentration level raises concerns about potential market manipulation and price volatility.

Such a concentrated distribution structure could have significant implications for OKB's market dynamics. With a small number of addresses holding substantial portions of the supply, there's an increased risk of large-scale sell-offs or accumulations that could dramatically impact price movements. Moreover, this centralization may undermine the token's perceived decentralization and could potentially deter some investors who prioritize more distributed ownership structures.

From a market perspective, this high concentration suggests that OKB's on-chain structure may be less stable than desired for a widely adopted cryptocurrency. It indicates a lower level of decentralization, which could be viewed as a point of concern for long-term sustainability and resistance to centralized control or influence.

Click to view the current OKB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9e76...680fd2 | 100.10K | 15.01% |

| 2 | 0xe5f3...1cc293 | 100.00K | 15.00% |

| 3 | 0x91d4...c8debe | 98.92K | 14.83% |

| 4 | 0x2c8f...d5a161 | 85.33K | 12.80% |

| 5 | 0xc0bf...c49c9e | 28.49K | 4.27% |

| - | Others | 253.76K | 38.09% |

II. Key Factors Affecting OKB's Future Price

Supply Mechanism

- Burn Events: OKB implements periodic token burns to reduce supply

- Historical Pattern: Previous burns have positively impacted OKB price

- Current Impact: Recent large-scale burn of 5% circulating supply drove significant price increase

Institutional and Whale Activity

- Institutional Holdings: Major institutions are showing increased interest in OKB

- Enterprise Adoption: Companies are exploring OKB integration for various use cases

- Government Policies: Regulatory clarity in some jurisdictions has been favorable for OKB

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies influence crypto market sentiment, affecting OKB

- Inflation Hedge Properties: OKB has shown some potential as an inflation hedge

- Geopolitical Factors: Global economic uncertainties drive interest in cryptocurrencies like OKB

Technical Development and Ecosystem Growth

- X Layer Upgrade: Enhances OKB utility and network capabilities

- Ecosystem Expansion: Growing number of DApps and projects built on OKB ecosystem

- Ecosystem Applications: Increasing use cases in DeFi, NFTs, and governance within the OKB network

III. OKB Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $133.64 - $180.00

- Neutral prediction: $180.00 - $190.91

- Optimistic prediction: $190.91 - $200.46 (requires sustained market growth)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range forecast:

- 2027: $149.15 - $255.97

- 2028: $132.68 - $256.21

- Key catalysts: Increasing adoption of blockchain technology, favorable regulatory developments

2029-2030 Long-term Outlook

- Base scenario: $242.49 - $281.29 (assuming steady market growth)

- Optimistic scenario: $281.29 - $320.09 (assuming widespread crypto adoption)

- Transformative scenario: $320.09 - $350.00 (assuming revolutionary blockchain applications)

- 2030-12-31: OKB $306.60 (potential peak before year-end correction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 200.46 | 190.91 | 133.64 | 0 |

| 2026 | 207.42 | 195.68 | 99.7982 | 2 |

| 2027 | 255.97 | 201.55 | 149.15 | 5 |

| 2028 | 256.21 | 228.76 | 132.68 | 19 |

| 2029 | 320.09 | 242.49 | 189.14 | 26 |

| 2030 | 306.6 | 281.29 | 171.58 | 47 |

IV. Professional Investment Strategies and Risk Management for OKB

OKB Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate OKB during market dips

- Set price targets for partial profit-taking

- Store in secure hardware wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- RSI (Relative Strength Index): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor OKB's correlation with overall crypto market trends

- Set strict stop-loss orders to manage risk

OKB Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for OKB

OKB Market Risks

- Volatility: Significant price fluctuations common in crypto markets

- Liquidity: Potential challenges during extreme market conditions

- Competition: Emerging exchange tokens may impact OKB's market position

OKB Regulatory Risks

- Regulatory uncertainty: Changing global cryptocurrency regulations

- Compliance requirements: Potential impact on OKB's utility and value

- Cross-border restrictions: Possible limitations on OKB's global accessibility

OKB Technical Risks

- Smart contract vulnerabilities: Potential security issues in the token contract

- Blockchain scalability: Limitations of the underlying network

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

OKB Investment Value Assessment

OKB presents a high-risk, high-reward investment opportunity tied to the success of its associated platform. Long-term value depends on ecosystem growth, while short-term volatility remains a significant risk factor.

OKB Investment Recommendations

✅ Beginners: Consider small, long-term positions as part of a diversified crypto portfolio ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider OKB as part of a broader crypto investment strategy

OKB Trading Participation Methods

- Spot trading: Direct OKB purchases on Gate.com

- Staking: Participate in OKB staking programs for potential passive income

- OKB-based products: Explore OKB-linked investment products as they become available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of the OKB coin?

OKB's future looks promising, with a projected price of around $278 by 2026. This growth potential reflects increasing adoption and utility in the crypto ecosystem.

Why is OKB pumping?

OKB is pumping due to a massive token burn, migration of OKT tokens, launch of a new blockchain, and IPO speculation.

Is OKB a cryptocurrency?

Yes, OKB is a cryptocurrency. It's an ERC-20 utility token used on the OKX platform for transaction fees and passive income features.

What is the all time low for OKB?

The all-time low for OKB is $1.95, which occurred on June 12, 2021. However, prices may have changed since then.

pi price prediction

SYS vs ICP: A Comparative Analysis of Network Security Systems and Infrastructure Control Protocols

ATA vs QNT: Comparing Two Leading Blockchain Protocols for Enterprise Solutions

GRND vs CRO: Comparing Ground-Based and Conversion Rate Optimization Strategies for Digital Marketing Success

NS vs FLOW: A Comparative Analysis of Network Simulation Tools for Modern Traffic Management Systems

TSTBSC vs XTZ: A Comparative Analysis of Two Emerging Cryptocurrencies in the Digital Asset Market

Xenea Daily Quiz Answer December 14, 2025

Beginner's Guide to Understanding Crypto Terminology

Understanding Soulbound Tokens: A New Frontier in NFTs

Understanding Tendermint's Consensus Mechanism in Blockchain Technology

How to Purchase and Manage Ethereum Name Service Domains