2025 NS Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of NS

SuiNS (NS) serves as a decentralized identity solution within the Sui blockchain ecosystem, enabling users to effortlessly transfer, update, and secure their digital identities while maintaining privacy and control. Since its launch in November 2024, SuiNS has established itself as an indispensable tool for developers, businesses, and individuals seeking to simplify their interactions with blockchain technology. As of December 24, 2025, NS has achieved a market capitalization of approximately $4.23 million USD, with a circulating supply of approximately 155.3 million tokens trading at around $0.02725 per token.

This digital identity asset is playing an increasingly crucial role in fostering interoperability and innovation across various blockchain ecosystems, earning recognition as an essential infrastructure component for secure blockchain interactions.

This article provides a comprehensive analysis of NS price trends through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors and market participants.

SuiNS (NS) Market Analysis Report

I. NS Price History Review and Current Market Status

NS Historical Price Evolution

- November 14, 2024: NS reached its all-time high of $1.1936, marking the peak of its market performance since launch.

- December 19, 2025: NS hit its all-time low of $0.02558, reflecting a significant decline from historical peaks.

- December 24, 2025 (Current): NS is trading at $0.02725, representing a correction phase in its price trajectory.

NS Current Market Dynamics

As of December 24, 2025, SuiNS (NS) is trading at $0.02725 with a 24-hour trading volume of approximately 62,779 NS tokens. The token has experienced a -1.19% decline over the past 24 hours, while showing a marginal gain of +0.80% in the last hour, suggesting some short-term price stabilization.

Over a broader timeframe, NS exhibits significant downward pressure, declining -7.77% over the past 7 days and -31.31% over the past 30 days. The year-to-date performance reveals an even steeper decline of -87.19%, indicating substantial depreciation from its peak valuation earlier in 2024.

The fully diluted market capitalization stands at $13,625,000, with a circulating market cap of approximately $4,231,981.82. Currently, 155,302,085.08 NS tokens are in circulation out of a total supply of 500,000,000, representing approximately 31.06% of the maximum supply. The token maintains a relatively modest market dominance of 0.00042%.

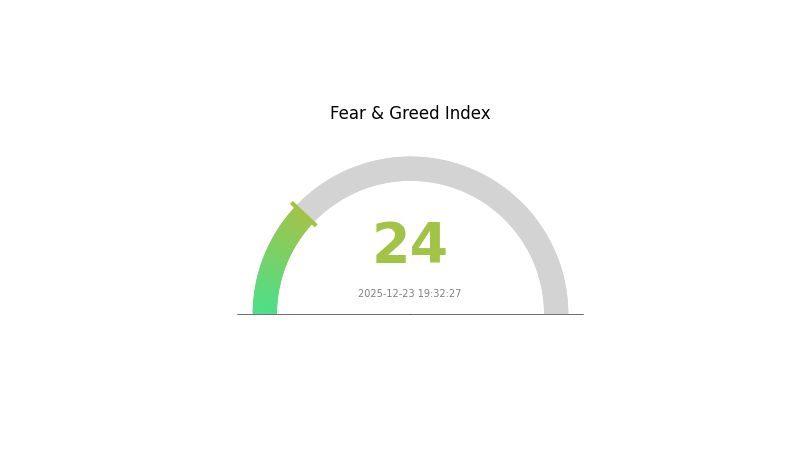

NS is listed on 10 exchanges, with an active holder base of 66,907 addresses. Market sentiment remains cautious, with the broader market experiencing extreme fear conditions (VIX: 24).

Click to view current NS market price

NS Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and investor anxiety. During such periods, market participants tend to adopt cautious strategies, often leading to increased selling pressure. However, extreme fear historically presents contrarian opportunities for long-term investors seeking entry points. It is advisable to monitor market developments closely and consider your risk tolerance before making trading decisions on Gate.com or other platforms.

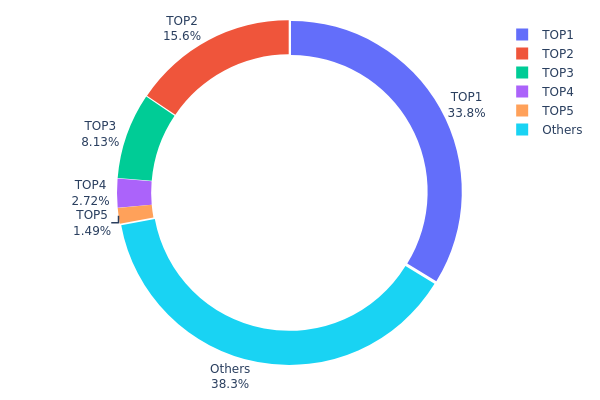

NS Holdings Distribution

Address holdings distribution refers to the allocation of tokens across blockchain addresses, serving as a critical metric for assessing token concentration risk and market structure health. By analyzing the distribution patterns of top holders versus the broader holder base, analysts can evaluate the degree of decentralization and identify potential vulnerabilities related to market manipulation or sudden price movements.

The current NS holdings data reveals a pronounced concentration pattern. The top address commands 33.79% of total holdings, while the combined top five addresses account for 61.67% of the supply. This concentration level indicates moderate centralization risk, as a relatively small number of entities control the majority of circulating tokens. The second-largest holder maintains a substantial 15.57% position, further emphasizing the uneven distribution. However, the "Others" category representing 38.33% of holdings provides some counterbalance, suggesting that a significant portion of tokens remains distributed across numerous smaller addresses. This mixed structure indicates that while major holders retain considerable influence, the token ecosystem has not reached extreme concentration levels.

From a market dynamics perspective, such holdings concentration creates both risks and market characteristics worth monitoring. Large holders possess significant price impact potential, as substantial liquidation or accumulation by top addresses could drive material price movements independent of fundamental developments. The current distribution suggests moderate vulnerability to whale-driven volatility, particularly during periods of low trading volume. Simultaneously, the presence of distributed holdings across smaller addresses implies some organic demand base and reduces the risk of total supply collapse scenarios. This structure reflects a market maturation phase where institutional or early investor concentration coexists with emerging retail participation, creating a market structure characterized by both centralization risks and emerging decentralization elements.

For detailed NS holdings analysis, visit NS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2ba3...7206fe | 168996.41K | 33.79% |

| 2 | 0x2893...2c6d07 | 77857.74K | 15.57% |

| 3 | 0xe0d5...0a4d28 | 40626.54K | 8.12% |

| 4 | 0x60dd...b0984d | 13592.79K | 2.71% |

| 5 | 0x45dc...ced046 | 7432.68K | 1.48% |

| - | Others | 191493.84K | 38.33% |

II. Core Factors Influencing NS Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Major central banks, particularly the Federal Reserve, have direct impact on NS price. Market participants closely monitor interest rate reduction expectations, with potential restart anticipated as early as September 2025.

-

Inflation Hedge Properties: In inflationary environments, NS demonstrates potential value preservation characteristics, particularly relevant given current economic conditions focused on debt management and currency system transitions.

Market Trends and Investor Strategy

-

Market Sentiment: Market trends and investor strategies play crucial roles in determining NS price movements. Professional analysis indicates that market participants' positioning and tactical allocation decisions significantly influence short-term price dynamics.

-

Technical Progress: Technological advancement within the ecosystem contributes to long-term price sustainability, with improvements in network efficiency and user adoption driving fundamental value.

III. 2025-2030 NS Price Forecast

2025 Outlook

- Conservative Forecast: $0.02612–$0.02721

- Neutral Forecast: $0.02721–$0.02843

- Optimistic Forecast: $0.02843–$0.02966 (requires sustained market stability and positive ecosystem developments)

Mid-term Outlook (2026-2028)

- Market Stage Expectations: Gradual recovery and accumulation phase with increasing institutional interest and adoption growth

- Price Range Predictions:

- 2026: $0.02019–$0.03526

- 2027: $0.02643–$0.04459

- 2028: $0.03478–$0.05312

- Key Catalysts: Enhanced protocol upgrades, expanding DeFi ecosystem integration, increasing mainstream adoption, strategic partnerships, and improved market liquidity on platforms such as Gate.com

Long-term Outlook (2029-2030)

- Base Case Scenario: $0.04567–$0.05183 (assumes moderate regulatory clarity and steady ecosystem growth)

- Optimistic Scenario: $0.05183–$0.06450 (assumes accelerated blockchain adoption and positive macroeconomic conditions)

- Transformative Scenario: $0.06450–$0.07101 (extreme favorable conditions including breakthrough technological innovations, major institutional adoption waves, and significant expansion of use cases)

- December 24, 2030: NS projects potential upside of 90% from current levels (reflecting multi-year accumulation and maturation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02966 | 0.02721 | 0.02612 | 0 |

| 2026 | 0.03526 | 0.02843 | 0.02019 | 4 |

| 2027 | 0.04459 | 0.03185 | 0.02643 | 16 |

| 2028 | 0.05312 | 0.03822 | 0.03478 | 40 |

| 2029 | 0.058 | 0.04567 | 0.02375 | 67 |

| 2030 | 0.07101 | 0.05183 | 0.04354 | 90 |

SuiNS (NS) Professional Investment Strategy and Risk Management Report

IV. NS Professional Investment Strategy and Risk Management

NS Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Believers in Sui ecosystem development and digital identity infrastructure; long-term crypto portfolio allocators; institutional investors seeking exposure to blockchain identity solutions.

-

Operational Recommendations:

- Accumulate NS tokens during market downturns, particularly when prices show strong rejection from support levels below $0.03.

- Set multi-year holding targets aligned with Sui ecosystem adoption milestones and mainstream adoption of blockchain-based identity solutions.

- Reinvest any staking rewards or protocol incentives to compound returns over extended periods.

-

Storage Solution:

- Utilize Gate.com's Web3 wallet for secure, convenient token management with built-in staking and protocol interaction capabilities.

- For large holdings, consider cold storage solutions with regular security audits and multi-signature verification protocols.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Volume Profile Analysis: Monitor the $0.027-$0.028 price zone for accumulation/distribution patterns; significant volume clusters indicate key support and resistance levels.

- Relative Strength Index (RSI): Track oversold conditions (RSI < 30) as potential entry points; watch for RSI divergences signaling trend reversals.

-

Wave Trading Key Points:

- Exploit the recent downtrend from 12-month high of $1.1936 to current levels; identify capitulation signals for contrarian positions.

- Track daily volatility patterns; the token's recent 24-hour range of $0.0266-$0.02803 suggests moderate intraday trading opportunities.

- Position sizing based on daily volume ($62,779 in 24-hour trading); ensure position sizes remain within 5-10% of daily volume to minimize slippage.

V. NS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation in NS tokens; prioritize long-term hold positions with 2-3 year time horizons.

- Aggressive Investors: 5-8% of portfolio allocation; incorporate both core positions and tactical trading allocations.

- Professional Investors: 8-15% of portfolio allocation; utilize hedging derivatives and options strategies to manage downside exposure.

(2) Risk Hedging Solutions

- Diversification Strategy: Maintain NS positions as part of broader Sui ecosystem exposure; balance with diversified Layer-1 and Layer-2 blockchain assets to reduce single-platform risk.

- Dollar-Cost Averaging (DCA): Implement systematic monthly purchase schedules regardless of price to reduce timing risk and average entry costs over extended periods.

(3) Secure Storage Solution

- Custodial Wallet Approach: Gate.com Web3 wallet provides institutional-grade security with multi-factor authentication, transaction verification, and regular security audits.

- Non-Custodial Storage Plan: Users requiring maximum control should utilize Sui ecosystem-compatible wallets with proper seed phrase backup, encryption, and offline verification protocols.

- Security Precautions:

- Never share private keys or recovery phrases with anyone; use only official Sui ecosystem wallets.

- Enable all available security features including 2FA and withdrawal whitelisting.

- Verify all contract addresses before token transfers; phishing attacks frequently target blockchain identity services.

- Maintain separate wallets for trading and long-term storage.

VI. Potential Risks and Challenges

NS Market Risks

- Extreme Volatility: NS has experienced an 87.19% decline over 12 months (from implied $2.33 to current $0.02725), indicating severe price instability and susceptibility to market sentiment shifts. This creates significant risk for unprepared investors.

- Low Trading Liquidity: With 24-hour volume of only $62,779 and a $4.23M market cap, relatively large orders can cause significant price slippage; liquidity constraints may amplify losses during market stress.

- Market Sentiment Deterioration: The token ranks #1630 by market cap with only 66,907 holders, suggesting limited retail adoption and vulnerability to concentrated holder capitulation.

NS Regulatory Risks

- Blockchain Identity Regulation Uncertainty: As digital identity solutions face evolving global regulatory frameworks, changes in data privacy laws (GDPR, CCPA) could impact NS utility and compliance requirements.

- Jurisdictional Compliance Issues: Different nations' approaches to blockchain-based identity systems create uncertain regulatory pathways that could restrict NS adoption in key markets.

- Protocol-Level Restrictions: Future regulatory actions against Sui protocol or token-based identity systems could indirectly impact NS token economics and usage demand.

NS Technical Risks

- Sui Ecosystem Dependency: NS derives all technical and network effects from the Sui blockchain; any Sui protocol vulnerabilities, network congestion, or technical failures directly threaten NS functionality.

- Smart Contract Risk: As a token built on Sui's blockchain, NS faces potential contract vulnerabilities, exploit risks, and upgrade-related technical challenges that could affect token security or transferability.

- Adoption Constraints: Limited integration across blockchain ecosystems restricts NS utility; narrow use cases compared to alternative identity solutions create technical scalability challenges.

VII. Conclusion and Action Recommendations

NS Investment Value Assessment

SuiNS (NS) operates within the emerging blockchain identity infrastructure sector, offering a solution for decentralized digital identity management on the Sui ecosystem. While the project addresses a legitimate market need for privacy-preserving identity solutions with cross-chain interoperability potential, current market metrics reveal substantial challenges. The token's 87% decline over 12 months, severely limited liquidity, and nascent adoption (66,907 holders across 10 exchanges) indicate a high-risk, speculative investment at current valuations.

The $0.02725 price level represents either deep capitulation or continued market repricing of fundamentals. Long-term value depends critically on Sui ecosystem growth, mainstream adoption of blockchain-based identity solutions, and successful protocol integrations—outcomes that remain uncertain.

NS Investment Recommendations

✅ Beginners: Avoid direct NS token positions until market fundamentals stabilize. If interested in Sui ecosystem exposure, consider diversified blockchain infrastructure funds rather than individual tokens. Start with minimal research positions (< 0.5% of portfolio) only after understanding Sui protocol dynamics and identity solution markets.

✅ Experienced Investors: Position NS as a high-risk/high-reward speculative allocation (2-5% maximum) within broader Sui ecosystem bets. Employ strict stop-losses at 30-40% below entry and target 200-300% upside potential from capitulation lows. Use technical analysis to identify reversal patterns rather than fundamental analysis given immature market.

✅ Institutional Investors: Evaluate NS only as part of comprehensive Sui protocol infrastructure strategies. Conduct deep technical due diligence on smart contract security, team capabilities, and protocol governance participation. Consider small positions (1-3% of crypto allocation) only after institutional-grade risk assessment and established entry/exit protocols.

NS Trading Participation Methods

- Gate.com Spot Trading: Execute NS/USDT spot trades directly on Gate.com's platform; utilize limit orders at psychological price levels ($0.025, $0.03, $0.035) to manage execution risk in low-liquidity environments.

- Accumulation Strategy via Gate.com: Implement automated recurring purchases through Gate.com's trading interface during market weakness; DCA removes timing risk and allows systematic exposure building regardless of short-term volatility.

- Portfolio Hedging: For existing NS holders, use Gate.com's advanced trading tools to establish protective positions or trim exposure during strength; active rebalancing can reduce concentration risk from rapid price movements.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate their risk tolerance and make independent decisions. It is strongly recommended to consult professional financial advisors before making substantial investments. Never invest funds you cannot afford to lose completely.

FAQ

What is NS crypto?

NS crypto refers to Sui Name Service, a decentralized naming and identity service on the Sui blockchain. It enables users to create and manage domain names, serving as an essential identity and naming infrastructure within the Sui ecosystem.

What is the price prediction for BNS 2025?

Based on market analysis, BNS is predicted to trade between $72.54 and $75.34 throughout 2025. This forecast reflects current trends and technical analysis of the asset's performance trajectory.

What factors influence NS price predictions?

NS price predictions are influenced by whale activity, market demand, trading volume, and overall cryptocurrency market performance. Large holder movements can cause significant price volatility, while broader market trends and sentiment also play crucial roles in price direction.

What is the current market cap and trading volume of NS?

The current market cap of NS is $7.03 million, with a 24-hour trading amount of $60.23K. The circulating supply is 252.21 million tokens.

How does NS compare to other similar cryptocurrencies in terms of price potential?

NS offers strong price potential driven by its utility in the Sui blockchain ecosystem. With increasing adoption of decentralized AI services and governance participation, NS demonstrates competitive advantages over similar tokens. Its scarcity and ecosystem growth position it for significant appreciation.

2025 RSC Price Prediction: Expert Analysis and Market Forecast for Rise of the Super Coin

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Avalanche (AVAX) 2025 Price Analysis and Market Trends

Latest analysis and investment prospects for Toncoin price in June 2025

Sui Price Market Analysis and Long-term Investment Potential in 2025

Where to Find Alpha in the 2025 Crypto Spot Market

Beginner's Guide: How to Buy Sora Token Safely Online

How does PEPE's $5.2 million net inflow impact exchange holdings and on-chain staking in Q4 2025?

What Are Technical Indicators in Crypto Trading: MACD, RSI, and KDJ Signals Explained

How Active Is Sui's Community and Ecosystem? Developer Growth Up 219% in 2024

How Does Fed Policy and Inflation Impact Cryptocurrency Prices in 2025: The Macro-Economic Effects on SUI and Crypto Markets