2025 NAVX Price Prediction: Expert Analysis and Future Market Outlook for Next Year

Introduction: NAVX's Market Position and Investment Value

NAVI Protocol (NAVX), as the first native one-stop liquidity protocol on Sui, has established itself as a key infrastructure solution within the Sui ecosystem since its launch in February 2024. As of December 2025, NAVX has achieved a market capitalization of approximately $16.04 million, with a circulating supply of around 816.17 million tokens, currently trading at $0.01604. This innovative liquidity protocol is increasingly playing a critical role in enabling users to participate as liquidity providers or borrowers within the Sui ecosystem.

This article will comprehensively analyze NAVX's price trends from 2025 through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and practical investment strategies.

NAVX Price History Review and Market Analysis Report

I. NAVX Price History Review and Current Market Status

NAVX Historical Price Evolution

-

March 29, 2024: NAVX reached its all-time high of $0.428, marking the peak of market enthusiasm following the protocol's launch on the Sui ecosystem.

-

June 19, 2024: NAVX declined to its all-time low of $0.01, representing an 97.66% decrease from the previous peak as market conditions corrected.

-

December 21, 2025: NAVX is trading at $0.01604, reflecting a recovery from the lows while remaining significantly below historical highs.

NAVX Current Market Status

As of December 21, 2025, NAVX demonstrates the following market characteristics:

Price Performance:

- Current Price: $0.01604

- 24-Hour Change: +0.06% ($0.000009618)

- 1-Hour Change: +1.45% ($0.000229255)

- 7-Day Change: -11.78%

- 30-Day Change: +8.88%

- Year-to-Date Change: -88.66%

Market Capitalization and Supply:

- Market Cap: $13,091,326.62

- Fully Diluted Valuation (FDV): $16,040,000.00

- Market Cap to FDV Ratio: 81.62%

- Circulating Supply: 816,167,495.24 NAVX (81.62% of total supply)

- Total Supply: 1,000,000,000 NAVX

- 24-Hour Trading Volume: $16,757.85

Market Position:

- Market Ranking: 1,045

- Number of Holders: 96,017

- Listed on 13 exchanges

- Market Dominance: 0.00049%

Price Range (24-Hour):

- High: $0.01633

- Low: $0.01575

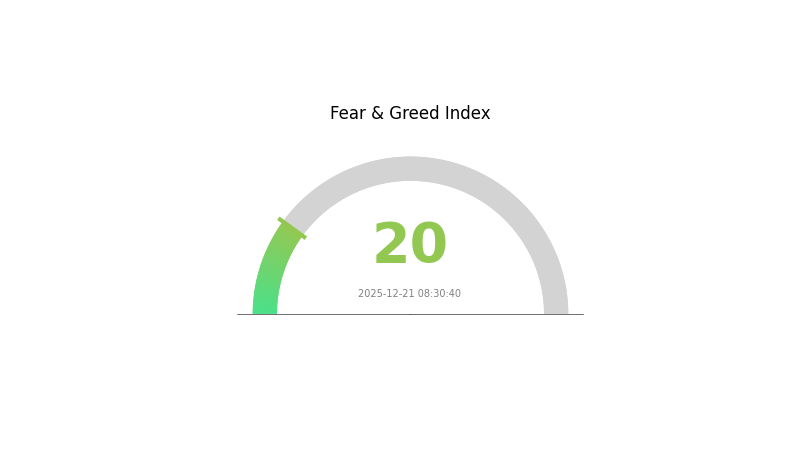

Market Sentiment: Current market sentiment indicates extreme fear (VIX: 20), which may be influencing broader cryptocurrency market dynamics.

Click to view current NAVX market price

NAVX Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with the Fear and Greed Index at 20. This sentiment typically indicates significant market pessimism and potential panic selling among investors. During such periods, altcoins and smaller-cap assets face substantial downward pressure. However, extreme fear historically presents contrarian opportunities for long-term investors, as markets often recover after reaching fear extremes. Traders should exercise caution with leverage and consider dollar-cost averaging strategies. Gate.com provides real-time sentiment data to help you monitor market conditions and make informed trading decisions.

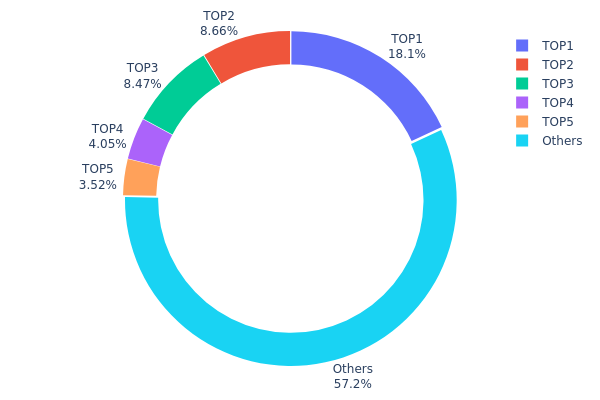

NAVX Holdings Distribution

The address holdings distribution represents the concentration pattern of token ownership across the blockchain network, providing critical insights into the decentralization status and potential market structure risks of an asset. By analyzing the top holder addresses and their proportional stakes, this metric reveals whether token supply is concentrated among a few major stakeholders or distributed more broadly across the network.

NAVX currently exhibits moderate concentration characteristics with notable centralization risk indicators. The top five addresses collectively control approximately 42.74% of the total supply, with the largest holder commanding 18.05% of all tokens. This concentration level warrants attention, as it suggests that major market decisions or liquidation events by these key stakeholders could significantly impact overall market dynamics. However, the substantial 57.26% allocation to "Others" indicates that the remaining token holders collectively represent a meaningful portion of the network, providing a degree of distribution that mitigates extreme centralization scenarios typical of early-stage or highly controlled token ecosystems.

The current distribution structure presents mixed implications for market stability. While the top holder's 18.05% stake is substantial enough to exert influence over significant price movements or governance decisions, the relatively diverse secondary holder base reduces the likelihood of coordinated market manipulation. The distribution suggests NAVX maintains reasonable decentralization standards for a mid-tier asset, though continued monitoring of the top addresses' transaction patterns would be prudent to assess whether these positions represent genuine distributed participation or potential whale accumulation that could increase volatility.

Visit NAVX Holdings Distribution for real-time data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x39c7...c3d9ba | 180542.27K | 18.05% |

| 2 | 0x0d39...d3bfb2 | 86611.11K | 8.66% |

| 3 | 0x0fae...4691b1 | 84744.42K | 8.47% |

| 4 | 0x60dd...b0984d | 40527.12K | 4.05% |

| 5 | 0x18d3...72daf2 | 35173.17K | 3.51% |

| - | Others | 572401.89K | 57.26% |

II. Core Factors Influencing NAVX Future Price

Macro-Economic Environment

-

Market Sentiment: NAVX price is significantly influenced by overall market sentiment and investor confidence in the DeFi ecosystem. The token's value depends on the health of the broader cryptocurrency market and regulatory developments that affect decentralized finance adoption.

-

Geopolitical Factors: Recent trade tensions and policy uncertainties, such as tariff escalations, have triggered systemic financial shocks across cryptocurrency markets. These macroeconomic disruptions can create periods of heightened volatility affecting NAVX valuations alongside broader market corrections.

Technology Development and Ecosystem Building

-

Sui Ecosystem Growth: NAVX operates on the Sui blockchain, which launched mainnet on May 3, 2023. The Sui ecosystem has rapidly expanded its TVL to rank 5th among all public chains and has achieved approximately 1M daily active users as of 2024. The ecosystem encompasses core DeFi infrastructure including lending, liquid staking solutions, and decentralized exchanges.

-

NAVI Protocol Position: NAVI Protocol serves as the largest DeFi project on the Sui ecosystem, providing modular DeFi infrastructure for lending and liquid staking solutions (LSDeFi). As the native governance and utility token, NAVX benefits directly from NAVI Protocol's expansion and user adoption across the Sui network.

-

Cross-Chain Bridge Development: The Sui Bridge launched on mainnet on October 1, 2024, enabling ETH and WETH bridging between Sui and Ethereum networks. This cross-chain functionality enhances liquidity accessibility and ecosystem connectivity, potentially increasing demand for NAVX as NAVI Protocol attracts users from other ecosystems.

Token Utility and Incentive Structure

-

Governance Rights: NAVX holders participate in protocol governance through proposal voting and directional guidance for platform development, creating intrinsic utility and long-term holder value.

-

Fee Sharing Mechanism: A portion of NAVI Protocol's generated fees is distributed to NAVX holders, establishing a revenue-sharing model that ties token value directly to protocol success and transaction volume.

-

Ecosystem Incentives: NAVX serves as the reward mechanism for users providing liquidity, staking assets, and participating in other protocol activities, creating continuous demand drivers as the ecosystem scales.

Three、2025-2030 NAVX Price Forecast

2025 Outlook

- Conservative Forecast: $0.01135 - $0.01622

- Neutral Forecast: $0.01622

- Optimistic Forecast: $0.02238 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation and consolidation phase with emerging recovery signals, marked by increasing institutional interest and protocol adoption.

- Price Range Predictions:

- 2026: $0.01834 - $0.02876

- 2027: $0.01562 - $0.03581

- Key Catalysts: Network upgrades, expanded DeFi integrations, strategic partnerships, and increasing utility adoption within the ecosystem.

2028-2030 Long-term Outlook

- Base Case: $0.02723 - $0.0371 (assumes moderate adoption growth and stable macroeconomic conditions)

- Optimistic Case: $0.03351 - $0.04792 (assumes accelerated mainstream adoption and positive regulatory clarity)

- Transformational Case: $0.04071 - $0.05944 (assumes breakthrough technological innovations and significant market capitalization expansion)

- December 21, 2025: NAVX trading within mid-range accumulation zone with 86% cumulative upside potential by 2028

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02238 | 0.01622 | 0.01135 | 1 |

| 2026 | 0.02876 | 0.0193 | 0.01834 | 20 |

| 2027 | 0.03581 | 0.02403 | 0.01562 | 49 |

| 2028 | 0.0371 | 0.02992 | 0.02723 | 86 |

| 2029 | 0.04792 | 0.03351 | 0.01876 | 108 |

| 2030 | 0.05944 | 0.04071 | 0.02239 | 153 |

NAVI Protocol (NAVX) Professional Investment Strategy and Risk Management Report

I. Executive Summary

NAVI Protocol (NAVX) is the first native one-stop liquidity protocol on the Sui blockchain. As of December 21, 2025, NAVX is trading at $0.01604 with a market capitalization of approximately $13.09 million and a 24-hour trading volume of $16,757.85. The token has experienced significant volatility, declining 88.66% over the past year from its all-time high of $0.428 (March 29, 2024) to its current price level.

II. NAVX Token Overview and Market Position

Token Fundamentals

| Metric | Value |

|---|---|

| Current Price | $0.01604 |

| 24-Hour Change | +0.06% |

| 7-Day Change | -11.78% |

| 30-Day Change | +8.88% |

| 1-Year Change | -88.66% |

| Market Capitalization | $13,091,326.62 |

| Fully Diluted Valuation | $16,040,000 |

| Circulating Supply | 816,167,495.24 NAVX |

| Total Supply | 1,000,000,000 NAVX |

| Market Rank | 1,045 |

| Trading Volume (24H) | $16,757.85 |

| Number of Holders | 96,017 |

| Listed on Exchanges | 13 |

Network and Contract Information

- Blockchain: Sui

- Contract Address: 0xa99b8952d4f7d947ea77fe0ecdcc9e5fc0bcab2841d6e2a5aa00c3044e5544b5::navx::NAVX

- Official Website: https://www.naviprotocol.io/

- Trading Platform: https://app.naviprotocol.io/

III. NAVI Protocol: Technology and Use Cases

Protocol Overview

NAVI Protocol is designed as a comprehensive liquidity solution for the Sui ecosystem. The protocol enables participants to serve as liquidity providers or borrowers within the Sui ecosystem, facilitating capital efficiency and access to novel financial opportunities.

Key Features and Innovations

1. Automatic Leverage Vaults

- Enable users to automatically leverage their assets through vault mechanisms

- Simplify the process of accessing leveraged positions

- Reduce operational complexity for retail users

2. Isolation Mode

- Provides risk compartmentalization for different asset types

- Allows users to maintain separate positions with independent risk parameters

- Protects users from cascading liquidation events across multiple positions

3. Multi-Tier Asset Support

- Supports digital assets across different risk categories

- Flexible collateral acceptance framework

- Accommodates diverse user risk preferences

4. Advanced Security Features

- Protects user funds through sophisticated smart contract architecture

- Implements systemic risk mitigation mechanisms

- Includes safeguards against common DeFi vulnerabilities

Use Cases

- Liquidity Provision: Users can supply capital to liquidity pools and earn yield

- Borrowing: Users can access credit against their collateral for leveraged trading or capital needs

- Yield Farming: Participation in protocol incentive mechanisms

- Risk Management: Isolated positions for strategic asset management

IV. NAVX Professional Investment Strategy and Risk Management

NAVX Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: Growth-oriented investors with high risk tolerance and extended investment horizons (2+ years)

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Allocate capital in regular intervals during market downturns to reduce average entry cost

- Core Position Building: Establish a baseline position at current depressed valuations, targeting accumulation below previous support levels

- Staking and Yield Generation: Participate in protocol governance and liquidity provision mechanisms to generate additional returns during holding periods

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Monitor key levels at $0.01575 (current 24H low) and $0.01633 (current 24H high); historical resistance at $0.428 and support at $0.01

- Volume Analysis: Track trading volume patterns to confirm breakout moves or trend reversals; current 24H volume of $16,757.85 indicates moderate liquidity

Wave Trading Key Points:

- Entry Signals: Accumulate on rebounds toward $0.015-0.016 support zone; consider scaling in on further weakness toward previous lows

- Exit Signals: Take partial profits on rallies toward $0.018-0.020 resistance; establish stop losses below 24H low ($0.01575) to manage downside risk

NAVX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-2% portfolio allocation (suitable for investors prioritizing capital preservation)

- Moderate Investors: 2-5% portfolio allocation (suitable for balanced risk-return objectives)

- Aggressive Investors: 5-15% portfolio allocation (suitable for growth-focused investors with higher risk tolerance)

(2) Risk Hedging Solutions

- Position Sizing: Limit individual NAVX position size to prevent catastrophic losses; use 1-2% portfolio risk per trade as maximum

- Diversification: Maintain exposure to multiple Sui ecosystem protocols and assets to reduce concentration risk; avoid over-weighting in single liquidity protocol tokens

(3) Secure Storage Solutions

- Hot Wallet Management: For active trading and smaller amounts (under 30-day holdings), maintain funds in Gate.com account for convenient access and security

- Cold Storage Strategy: For medium to long-term holdings, transfer NAVX to hardware-backed storage solutions for maximum security protection

- Security Considerations: Enable two-factor authentication on all exchange accounts; use hardware wallet for holdings exceeding 1 million tokens; regularly audit wallet addresses; verify smart contract addresses before transactions; never share private keys or recovery phrases

V. NAVX Potential Risks and Challenges

Market Risks

- Extreme Volatility: NAVX has experienced 88.66% depreciation over one year, indicating high price instability; investors should expect potential further price fluctuations

- Low Trading Liquidity: With only 13 exchange listings and relatively modest daily volume ($16,757.85), NAVX faces liquidity constraints that could amplify price movements during large trades

- Market Capitalization Compression: The fully diluted valuation of only $16.04 million indicates limited institutional capital commitment and increased vulnerability to capital flight

Regulatory Risks

- Sui Ecosystem Regulatory Uncertainty: Changes in regulatory frameworks governing Sui blockchain activities could impact protocol operations and NAVX token utility

- Stablecoin and Lending Regulations: Protocols facilitating borrowing and lending face evolving regulatory scrutiny globally, potentially affecting NAVI's operational model

- Jurisdictional Compliance: Different geographic regions impose varying requirements on liquidity protocols and decentralized finance activities

Technology Risks

- Smart Contract Vulnerabilities: As a liquidity protocol, NAVI depends on sophisticated smart contract architecture; unidentified bugs or exploits could lead to capital losses

- Sui Blockchain Dependency: Protocol viability is entirely dependent on Sui network stability, adoption, and technical developments; network-level issues would directly impact NAVX value

- Competition from Alternative Protocols: Other liquidity protocols on Sui or competing Layer-1 networks may capture market share, reducing NAVI's relevance and NAVX token value

VI. Conclusion and Action Recommendations

NAVX Investment Value Assessment

NAVI Protocol addresses a genuine need within the Sui ecosystem by providing integrated liquidity infrastructure with innovative features like automatic leverage vaults and isolation mode. However, NAVX token faces significant headwinds: extreme year-to-date depreciation, modest market capitalization, limited liquidity, and intense competition within the DeFi liquidity protocol space. The protocol's technical merit does not automatically translate to token appreciation, particularly given the substantial existing losses for early investors. NAVX is primarily suitable for risk-tolerant investors with conviction in the Sui ecosystem's long-term development and a multi-year investment horizon. Current depressed valuations may present accumulation opportunities for selective investors, but substantial downside risks remain.

NAVX Investment Recommendations

✅ For Beginners: Start with micro-allocations (0.5-1% of portfolio) using dollar-cost averaging; prioritize understanding NAVI's protocol mechanics before increasing exposure; consider this a speculative position only

✅ For Experienced Investors: Implement a disciplined entry strategy targeting $0.01-0.015 accumulation zones; combine with position sizing discipline and predetermined exit rules; monitor Sui ecosystem developments and competitive dynamics

✅ For Institutional Investors: Conduct comprehensive due diligence on protocol smart contracts and governance structure; evaluate NAVI's competitive positioning within Sui liquidity infrastructure; establish positions gradually to minimize slippage; structure holdings across multiple secure custody solutions

NAVX Trading and Participation Methods

- Gate.com Trading: Access NAVX spot trading on Gate.com with competitive fees; establish alerts for key technical levels; utilize limit orders to execute predetermined strategies

- Protocol Interaction: Directly participate in NAVI's liquidity pools by visiting https://app.naviprotocol.io/; evaluate current yield rates against opportunity costs and risks

- Community Engagement: Monitor protocol development through official channels (Twitter: @navi_protocol, GitHub, documentation); stay informed on governance proposals and parameter changes

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. It is strongly recommended to consult with professional financial advisors before making investment decisions. Never invest capital that you cannot afford to lose completely.

FAQ

What is navx crypto?

NAVX is a cryptocurrency token of the Navi Protocol, a decentralized liquidity protocol built on the Sui blockchain. It enables users to lend and borrow cryptocurrencies without intermediaries in a fully decentralized manner.

Which coin price prediction 2025?

NAVX is projected to experience significant growth in 2025, driven by increasing adoption and market demand. Based on technical analysis and market trends, analysts forecast NAVX could reach higher price levels as the ecosystem expands. Monitor market developments and trading volume for accurate predictions.

What is navx?

NAVX is a blockchain-based cryptocurrency powering the NAVI Protocol DeFi platform. It focuses on decentralized finance services, enhancing financial efficiency and accessibility through smart contract technology.

Which coin will reach 1 rupee prediction?

Shiba Inu is predicted to reach 1 rupee by end of 2030 based on current market trends and analysis. This projection suggests significant growth potential for SHIB in the coming years.

2025 FISPrice Prediction: Analyzing Market Trends and Future Potential for FIS Token in the Evolving DeFi Landscape

HAEDAL vs GMX: Comparing Next-Generation Trading Protocols in DeFi Ecosystem

Is pSTAKE Finance (PSTAKE) a good investment?: Analyzing the potential returns and risks in the liquid staking sector

2025 VNOPrice Prediction: Analyzing Market Trends and Growth Potential for VNO in the Coming Year

FST vs SNX: A Comparative Analysis of Two Leading Decentralized Finance Protocols

2025 FIS Price Prediction: Analyzing Market Trends and Potential Growth Factors

Giới thiệu Capybara Coin (CAPY) — Liệu Token Meme Tiếp Theo Của Solana Có Xuất Hiện?

OGC Coin: Price Forecast and Market Insights

Exploring Licensed Event Prediction Platforms: Bridging Real-World Events with Blockchain

What is SWEAT: A Comprehensive Guide to the Acronym and Its Applications in Modern Business and Personal Development

What is BLUE: A Comprehensive Guide to Understanding the Color, Science, and Cultural Significance of Blue in Our World