2025 年 MOVE 价格预测:剖析加密货币行业变革中的增长动力与市场走势

简介:MOVE的市场定位与投资价值

Movement Network(MOVE)作为基于Move模块化的区块链生态系统,自成立以来持续推动Move与EVM生态互联互通。到2025年,MOVE市值达到353,237,500美元,流通总量约为2,750,000,000枚,币价稳定在0.12845美元附近。该资产被业内普遍认为是“生态桥梁”,在安全性、高性能和互操作性等区块链应用领域发挥着越来越重要的作用。

本文将从历史价格走势、市场供需、生态发展及宏观经济环境等多个维度,全面分析2025—2030年MOVE价格趋势,助力投资者以专业视角做出价格预判和投资决策。

一、MOVE价格历史回顾与市场现状

MOVE历史价格轨迹

- 2024年:MOVE于12月9日创下历史最高价1.34美元

- 2025年:于6月22日跌至历史最低0.11079美元

- 2025年:市场周期回调,价格由高点回落至当前0.12845美元

MOVE当前市场状况

截至2025年9月21日,MOVE现价为0.12845美元,24小时成交额达274,421.18美元,日内涨幅0.03%。当前市值为353,237,500美元,位列加密货币市场第221名,流通总量2,750,000,000枚,最大发行量100亿枚。

近期价格表现分化,过去一小时上涨0.59%,近30天涨幅1.52%,一周下跌2.83%,年度跌幅最大,同比下降80.65%。

根据市场情绪指数,MOVE当前处于中性区间。尽管近期波动明显,币价仍高于历史低点,短期内展现出一定的稳定性。

点击查看最新MOVE市场价格

MOVE市场情绪指数

2025年9月21日恐慌与贪婪指数:49(中性)

点击查看MOVE恐慌与贪婪指数

加密市场情绪维持平衡。当前恐慌与贪婪指数为49,说明投资者情绪未显极端,市场保持稳定。投资者应持续关注市场变化,理性应对风险,做好充分调研后再作决策。加密市场变动频繁,信息获取与风险防范尤为重要。

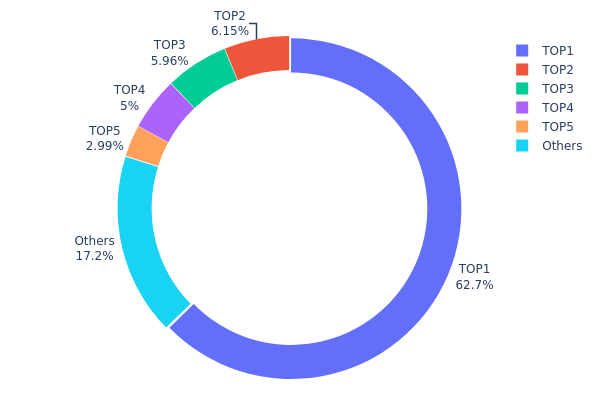

MOVE持币分布

MOVE持币分布高度集中,头号地址占总供应62.66%,体现明显的中心化趋势。后四名大户合计持有20.08%,前五大地址合计占比达82.74%。集中持仓增加市场操控与波动风险。

高度集中可能导致大户交易对价格影响巨大,波动性明显增加,且去中心化程度不足。对于寻求广泛社区治理和生态扩展的项目而言,这种分布或影响其吸引力,令部分中小投资者顾虑市场被大户主导。

点击查看最新MOVE持币分布

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe3e8...5f4f25 | 6,266,721.36K | 62.66% |

| 2 | 0xecb4...d57630 | 614,798.98K | 6.14% |

| 3 | 0x5098...4295eb | 596,333.92K | 5.96% |

| 4 | 0x360f...44df31 | 500,000.00K | 5.00% |

| 5 | 0xf1df...2cbe0f | 298,625.27K | 2.98% |

| - | Others | 1,723,520.46K | 17.26% |

二、影响MOVE未来价格的核心因素

供应机制

- 最大发行量:MOVE最大发行量为100亿枚。

- 历史数据:MOVE自2024年发行,历史数据有限,规律尚在形成中。

- 当前流通影响:流通总量仅占总供应27.5%,未来释放或加剧抛售压力。

机构与大户影响

- 机构持仓:YZi Labs、World Liberty Financial等机构已布局MOVE。

- 企业采纳扩展:Movement Network积极发展以太坊Layer 2扩容应用。

- 政策支持:“美国制造”属性有望获得美方监管利好。

宏观经济环境

- 利率与通胀影响:央行政策将影响包括MOVE在内的加密资产需求。

- 抗通胀潜力:MOVE在高通胀时期或能作为价值对冲载体。

技术升级与生态扩展

- MoveVM集成:MoveVM增强智能合约技术能力,提升网络性能。

- Layer 2方案:专注以太坊Layer 2扩容,解决行业核心痛点。

- 生态应用拓展:Movement Network下dApp创新发展,是MOVE增值关键。

三、2025-2030年MOVE价格展望

2025年预测

- 谨慎区间:0.10407 - 0.12848美元

- 中性预测:0.12848 - 0.14647美元

- 乐观情景:0.14647 - 0.16445美元(依赖市场情绪与应用落地)

2027-2028年预测

- 市场阶段:可能先整理后缓慢增长

- 价格区间:

- 2027年:0.08034 - 0.15614美元

- 2028年:0.13386 - 0.17079美元

- 核心驱动:技术突破、加密货币普及、监管政策逐步明朗

2029-2030年长期预测

- 基础情景:0.16233 - 0.19398美元(市场稳健增长)

- 乐观情景:0.19398 - 0.22564美元(市场利好与生态扩展)

- 突破情景:0.22564 - 0.25000美元(应用创新与主流接纳)

- 2030年12月31日:MOVE预计或达0.19980美元(牛市高点)

| 年份 | 预测最高价 | 预测均价 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.16445 | 0.12848 | 0.10407 | 0 |

| 2026 | 0.15672 | 0.14647 | 0.0747 | 13 |

| 2027 | 0.15614 | 0.15159 | 0.08034 | 17 |

| 2028 | 0.17079 | 0.15387 | 0.13386 | 19 |

| 2029 | 0.22564 | 0.16233 | 0.1461 | 26 |

| 2030 | 0.1998 | 0.19398 | 0.17653 | 50 |

四、MOVE专业投资策略与风控体系

MOVE投资策略

(1) 长线持有型

- 适用对象:风险承受力强的长期投资者

- 执行建议:

- 市场低点逐步加仓MOVE

- 设定目标价定期调整资产配置

- 代币可用硬件钱包或合规托管机构安全存储

(2) 主动交易型

- 关键技术分析工具:

- 移动均线:识别趋势与反转点

- RSI指标:判断超买与超卖状态

- 波段交易要点:

- 关注MOVE与主流币种联动变化

- 紧密跟进项目进展与生态发展

MOVE风险管理机制

(1) 资产配置建议

- 稳健型:加密资产占比1-3%

- 进取型:加密资产占比5-10%

- 专业型:加密资产最高可达15%

(2) 风险对冲措施

- 分散投资:布局多链项目分散风险

- 止损策略:设定止损点控制潜在损失

(3) 安全存储方案

- 热钱包推荐:Gate Web3钱包

- 冷存储:长期持有建议用硬件钱包

- 安全设置:启用双重认证并设置强密码

五、MOVE可能面临的风险与挑战

市场风险

- 高波动性:MOVE价格可能剧烈波动

- 生态落地缓慢:Move技术推广进度影响扩展

- 行业竞争激烈:其他链生态或加速赶超

监管风险

- 政策变动不确定:监管环境随时变化影响项目发展

- 国际合规壁垒:全球政策差异限制扩展

- 证券属性界定:部分市场或认定为证券资产

技术风险

- 智能合约漏洞:底层代码可能被恶意攻击

- 扩容可持续性:网络负载增大或遇性能挑战

- 跨链互操作难题:与其他链集成存在技术壁垒

六、结论与行动建议

MOVE投资价值分析

MOVE在Move与EVM生态互联方面具备独特优势,长期成长潜力突出。但短期波动剧烈,落地难题与风险需高度关注。

MOVE投资建议

✅新手投资者:建议采用小额定投,循序渐进了解市场 ✅经验投资者:根据风险偏好均衡配置资产 ✅机构投资者:深入尽职调查,将MOVE纳入多元化加密资产组合

MOVE交易方式

- 现货交易:可在Gate.com购买MOVE

- 质押服务:如有可参与MOVE相关质押赚取收益

- DeFi应用:探索Movement Network生态内的DeFi投资机会

加密货币投资风险极高,本文内容不构成投资建议。请投资者根据自身风险承受能力谨慎决策,建议先咨询专业财务顾问。切勿投入超过自身承受范围的资金。

常见问题解答

MOVE币最高能涨至多少?

若突破0.52美元关口,结合近期上涨趋势,MOVE有望冲至0.55美元及以上。

MOVE币未来发展前景如何?

预计2035年MOVE价格有望升至40.50至100.00美元,主要依赖区块链行业成熟与投资者信心提升。目前走势显示潜在成长空间较大。

哪种加密货币价格预测最高?

以太坊(ETH)预测价最高,2025年有望达到4,495美元。

XRP在2030年价格预测是多少?

XRP预计2030年价格区间在4.67至26.97美元之间,价格增长受采用率和监管政策驱动,若机构大幅采纳且市场氛围向好,价格可能突破高位。

2025 年 APT 价格预测:推动 Aptos 代币创出新高的关键驱动因素

2025 年 KAS 价格预测:深度解析 Kaspa 未来价值的核心驱动因素

2025 年 SAGA 价格预测:深入解析区块链生态系统演变下的市场趋势与增长前景

Kaspa(KAS)适合投资吗?——深入解析这一高性能区块链项目的潜力

FOXY 与 APT:企业安全环境中现代化威胁检测系统的对比

LOFI 与 APT:解析网络安全威胁情报的多元路径

什么是VTHO:深入解析VeThor Token及其在VeChainThor区块链生态体系中的功能

SC是什么:现代企业供应链管理全面指南

VANA 是什么:去中心化 AI 数据网络的革命性全面解析

2025年SUSHI价格预测:主流DeFi代币的专家解析与市场预测

2025 ALEO价格预测:权威分析与明年市场前景