2025 LYX Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: LYX's Market Position and Investment Value

LYX (LYX), a next-generation EVM blockchain token based on Casper PoS, has been revolutionizing how brands, creators, and users interact with blockchain technology in the New Creative Economies since its launch in 2024. As of December 2025, LYX has achieved a market capitalization of $18,727,800, with a circulating supply of approximately 30,535,906.59 tokens, maintaining a price around $0.4459. This innovative asset, characterized by its Universal Profiles and LUKSO Standards Proposals (LSPs), is playing an increasingly crucial role in simplifying Web3 onboarding and enabling verifiable digital identities.

This article will provide a comprehensive analysis of LYX's price trends and market dynamics, incorporating historical patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors considering positions on Gate.com or other supported platforms.

LUKSO (LYX) Market Analysis Report

I. LYX Price History Review and Current Market Status

LYX Historical Price Evolution

-

January 2024: LYX reached its all-time high (ATH) of $11.60 on January 17, 2024, marking the peak of the token's market performance during the bull market cycle.

-

December 2025: LYX declined significantly to its all-time low (ATL) of $0.427764 on December 18, 2025, representing a sharp contraction from previous peaks.

LYX Current Market Conditions

As of December 21, 2025, LYX is trading at $0.4459, with the following market metrics:

Price Performance:

- 1-hour change: -0.27%

- 24-hour change: -0.17%

- 7-day change: -8.94%

- 30-day change: -26.5%

- 1-year change: -82.1%

- 24-hour trading range: $0.4406 - $0.4533

Market Capitalization & Supply:

- Market capitalization: $13,615,960.75

- Fully diluted valuation (FDV): $18,727,800.00

- Circulating supply: 30,535,906.59 LYX

- Total supply: 42,000,000 LYX

- Circulating ratio: 72.70%

- Market dominance: 0.00058%

- Market ranking: #1,030

Trading Activity:

- 24-hour trading volume: $266,383.78

- Active holders: 24,910,155

- Available on 3 exchanges

View the current LYX market price

LYX Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates strong bearish sentiment and significant selling pressure across the market. Investors are highly risk-averse, presenting both challenges and potential opportunities. During periods of extreme fear, asset prices often reach attractive levels for long-term investors. However, market volatility remains elevated, requiring careful risk management. Monitor market developments closely on Gate.com to identify potential entry points while protecting your portfolio from downside risks.

LYX Holdings Distribution

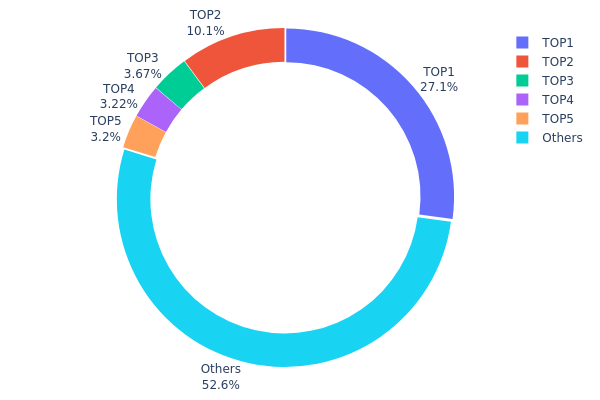

The address holdings distribution chart illustrates how LYX tokens are allocated across different wallet addresses on the blockchain, serving as a critical indicator of token concentration and decentralization. This metric reveals the ownership structure and potential market manipulation risks by displaying the proportion of total token supply held by top addresses and the remaining distributed holders.

Analysis of the current LYX distribution data reveals a moderate concentration pattern. The top holder commands 27.14% of the total supply with approximately 10.27 million tokens, while the second-largest holder controls 10.12%. Combined, the top five addresses account for 47.34% of all LYX tokens in circulation. While this level of concentration warrants attention, the fact that 52.66% of tokens remain distributed among other addresses suggests a reasonably diversified ownership structure. This distribution pattern indicates that while significant holders possess notable influence, the token has not reached extreme centralization levels where a handful of actors could unilaterally determine market dynamics.

The current address distribution landscape presents both opportunities and considerations for market participants. The substantial portion held by major stakeholders could theoretically enable coordinated actions affecting price stability; however, the presence of a substantial dispersed holder base provides a degree of counterbalance. This structure reflects a typical profile for established tokens within the ecosystem, where institutional investors and early participants hold meaningful positions while ongoing adoption maintains a broad base of distributed ownership. The market structure suggests moderate risk of severe price manipulation, though ongoing monitoring of the top addresses' activities remains prudent for comprehensive market assessment.

Click to view current LYX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xCAfe...00CAfe | 10271.26K | 27.14% |

| 2 | 0x2933...fA4625 | 3831.33K | 10.12% |

| 3 | 0xe1A8...1193f1 | 1387.42K | 3.66% |

| 4 | 0xB67e...D9eCaF | 1219.40K | 3.22% |

| 5 | 0x4D28...3C6A66 | 1211.34K | 3.20% |

| - | Others | 19920.90K | 52.66% |

II. Core Factors Affecting LYX Future Price

Supply Mechanism

- Circulating Supply: LYX currently has a circulating supply of 30.536 million tokens.

- Market Impact: Limited supply information may intensify market uncertainty and affect price stability.

Institutional and Whale Dynamics

- Institutional Investment: Institutional participation level is identified as a key factor influencing LYX investment value.

- Mainstream Adoption: Broad adoption and enterprise adoption levels remain important drivers of future price movements.

Macroeconomic Environment

- Overall Economic Conditions: The broader macroeconomic environment significantly impacts LYX investment value and price trajectory.

Technology Development and Ecosystem Building

- LUKSO Ecosystem Technology Upgrades: Technical development within the LUKSO ecosystem serves as a crucial driver for LYX's future valuation and market performance.

- Ecosystem Applications: The evolution and expansion of the LUKSO ecosystem's technical infrastructure directly influences investor confidence and long-term price prospects.

Three、2025-2030 LYX Price Forecast

2025 Outlook

- Conservative Forecast: $0.397-$0.445

- Neutral Forecast: $0.445-$0.468

- Optimistic Forecast: $0.468+ (requires sustained market recovery and increased institutional adoption)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with potential for modest growth as the market stabilizes and protocol developments mature.

- Price Range Forecast:

- 2026: $0.365-$0.571 (expected range with 2% upside potential)

- 2027: $0.463-$0.570 (consolidation with 15% upside potential)

- Key Catalysts: Enhanced network utility, ecosystem expansion, mainstream adoption acceleration, and positive macroeconomic conditions affecting risk assets.

2028-2030 Long-term Outlook

- Base Scenario: $0.423-$0.672 by 2028 (assumes steady adoption and stable regulatory environment)

- Optimistic Scenario: $0.486-$0.826 by 2029 (assuming accelerated institutional interest and breakthrough ecosystem developments)

- Transformational Scenario: $0.466-$1.068 by 2030 (assumes revolutionary use cases, mass adoption, and significant market capitalization expansion)

Market analysts suggest that LYX's long-term trajectory depends heavily on the broader adoption of blockchain infrastructure and the protocol's ability to differentiate itself within the competitive landscape. Investors can monitor real-time price movements and market indicators through Gate.com for informed decision-making.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.46799 | 0.4457 | 0.39667 | 0 |

| 2026 | 0.57105 | 0.45684 | 0.36547 | 2 |

| 2027 | 0.57048 | 0.51395 | 0.46255 | 15 |

| 2028 | 0.67235 | 0.54221 | 0.42293 | 21 |

| 2029 | 0.8259 | 0.60728 | 0.48582 | 36 |

| 2030 | 1.06772 | 0.71659 | 0.46578 | 60 |

LYX Professional Investment Strategy and Risk Management Report

IV. LYX Professional Investment Strategy and Risk Management

LYX Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Web3 enthusiasts, creative economy participants, and believers in LUKSO's Universal Profile ecosystem

- Operation Recommendations:

- Accumulate during market downturns when LYX trades significantly below all-time highs (currently down 82.1% from 1-year peak of $11.6)

- Dollar-cost averaging approach to reduce timing risk given the volatile price movements

- Maintain positions through network development milestones and LSP standard implementations

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price volatility patterns: Recent 24-hour volatility of -0.17% indicates relatively stable intraday movement

- Support levels: Historical low of $0.427764 serves as psychological support

- Resistance assessment: Current price of $0.4459 proximity to recent lows suggests potential recovery levels

-

Trading Operation Points:

- Monitor 7-day and 30-day trends (currently -8.94% and -26.5% respectively) for momentum shifts

- Watch for volume spikes above average 24-hour volume of $266,383.78

- Track ecosystem announcements related to LSP adoption and Universal Profile implementations

LYX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation

- Aggressive Investors: 3-8% portfolio allocation

- Professional Investors: Up to 10% allocation with active rebalancing strategies

(2) Risk Hedging Solutions

- Portfolio diversification: Balance LYX holdings with established Layer-1 blockchain positions

- Position sizing: Implement strict maximum position limits relative to total portfolio value given LYX's market cap of $18.7M (relatively small market capitalization)

(3) Secure Storage Solutions

- Self-custody option: Gate Web3 wallet for secure non-custodial storage with direct control over private keys

- Exchange custody: Maintain trading positions on Gate.com for active trading convenience with institutional-grade security

- Security considerations:

- Always use hardware security measures for long-term holdings

- Enable two-factor authentication across all accounts

- Never share private keys or recovery phrases

- Verify all transactions before confirmation

V. LYX Potential Risks and Challenges

LYX Market Risks

- Market liquidity risk: With 24-hour trading volume of $266,383.78 and a total market cap of $18.7M, LYX exhibits relatively low trading liquidity which can result in significant slippage on large orders

- Price volatility: Demonstrated 82.1% year-over-year decline indicates extreme volatility; investors may experience substantial drawdowns

- Market adoption uncertainty: Success depends on achieving significant adoption of Universal Profiles and LSP standards among brands and creators

LYX Regulatory Risks

- Blockchain regulatory environment: Evolving global regulatory frameworks for Layer-1 blockchains and Web3 platforms may impact network development and token utility

- Geographic compliance: Different jurisdictions may impose varying restrictions on token trading and platform access

- Smart contract regulation: Future regulations on autonomous systems and smart contract standards could affect LSP implementations

LYX Technology Risks

- Network security: As a standalone Layer-1 blockchain, LUKSO faces inherent security responsibilities separate from Ethereum

- Standards adoption risk: LUKSO Standards Proposals (LSP) success depends on developer community adoption and third-party integration support

- Interoperability challenges: Maintaining compatibility across the creative economy ecosystem requires continuous technical development and coordination

VI. Conclusion and Action Recommendations

LYX Investment Value Assessment

LUKSO represents a specialized blockchain focused on the creative economy and Web3 user experience through Universal Profiles and innovative standards. The project addresses legitimate pain points in blockchain adoption—identity management, asset representation, and user-friendly smart contract interaction. However, current market conditions reflect significant uncertainty, with the token trading at approximately 96% below its all-time high. The small market capitalization ($18.7M) and low trading volume present both opportunity and substantial risk. Success heavily depends on ecosystem adoption by content creators, brands, and mainstream users.

LYX Investment Recommendations

✅ Beginners: Start with minimal position sizing (0.5-1% of portfolio) through dollar-cost averaging on Gate.com; focus on understanding LUKSO's Universal Profile ecosystem before committing capital

✅ Experienced Investors: Implement technical analysis-based entries at support levels with defined stop-loss orders; consider this as a high-risk, high-reward speculative position

✅ Institutional Investors: Conduct comprehensive due diligence on LSP adoption metrics and developer activity; structure position sizing according to early-stage blockchain protocols risk frameworks

LYX Trading Participation Methods

- Spot Trading: Trade LYX directly on Gate.com with real-time order execution and transparent pricing

- Dollar-Cost Averaging: Execute recurring purchases on Gate.com to systematically reduce entry price volatility

- Portfolio Rebalancing: Use Gate.com's interface to adjust LYX allocation relative to your total crypto holdings quarterly or semi-annually

Cryptocurrency investment carries extremely high risk and potential for total loss. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the price of LYX?

The current price of LYX is $0.44248 as of December 21, 2025. The price has decreased by 1.47% over the past 24 hours. LYX is trading actively in the market with ongoing price fluctuations based on market conditions.

Is Lukso a buy or sell?

Lukso presents strong buy potential for long-term investors seeking exposure to Web3 fashion and lifestyle innovation. Its unique ecosystem and growing adoption make it attractive for strategic accumulation during market opportunities.

What are the factors that could affect LYX price in the future?

LYX price is influenced by supply and demand dynamics, protocol upgrades and developments, macroeconomic conditions including interest rates, market sentiment, and adoption growth within the ecosystem.

What is Lukso (LYX) and what is its use case?

Lukso (LYX) is a blockchain project designed to bridge digital and physical worlds. Its primary use case focuses on creating and managing digital identities and assets, enabling seamless interaction between the physical and digital realms.

What is the price target for LYX in 2025?

Based on current market analysis, LYX is forecasted to reach approximately $0.4463 by the end of 2025. This prediction assumes favorable market conditions and represents the upper price target estimate based on technical analysis and market trends.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

2025 TIA Price Prediction: Analyzing Market Trends and Growth Potential for the Celestia Token

Elon Musk's Birthday And It's Astrology

Solaxy (SOLX) Overview: Launch Timeline, Future Forecast, and Purchase Guide

Innovative DeFi Lending Platform Built on TON with Enhanced Liquid Staking Options

Comprehensive Lil Pepe Token Presale Overview: Key Insights and Preparation for Listing

Comprehensive Guide to Perpetual Trading for Beginners

Discover MDOGS Token Launch Details, Future Price Insights, and Claiming Instructions